With the help of the online PDF editor by FormsPal, you'll be able to fill out or change form cms 838 here and now. Our editor is continually evolving to present the very best user experience achievable, and that is because of our resolve for constant development and listening closely to testimonials. With just several basic steps, you may begin your PDF editing:

Step 1: Firstly, open the editor by clicking the "Get Form Button" above on this webpage.

Step 2: The tool provides the ability to customize your PDF file in a variety of ways. Change it by writing customized text, correct original content, and add a signature - all doable within minutes!

Completing this document requires attentiveness. Ensure all required areas are completed accurately.

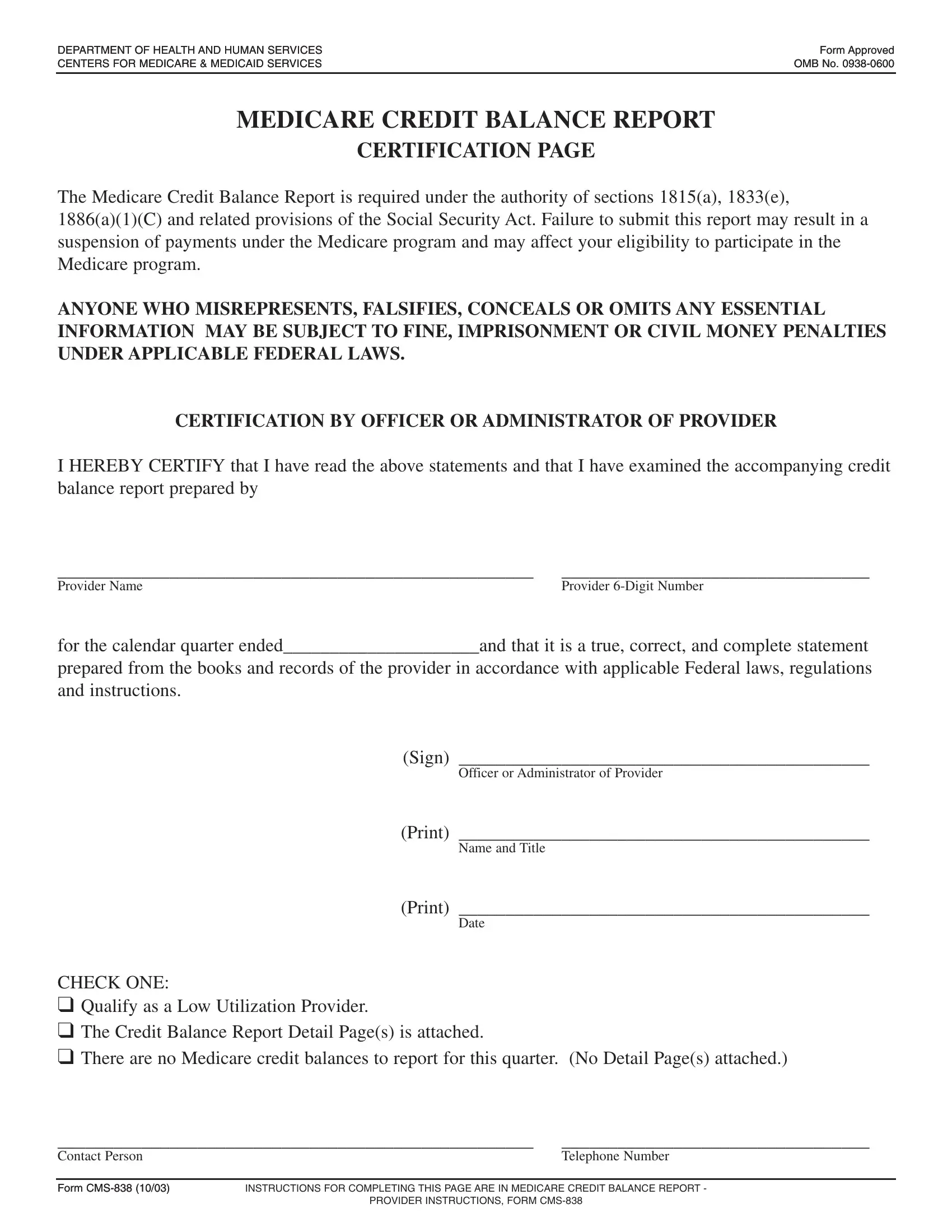

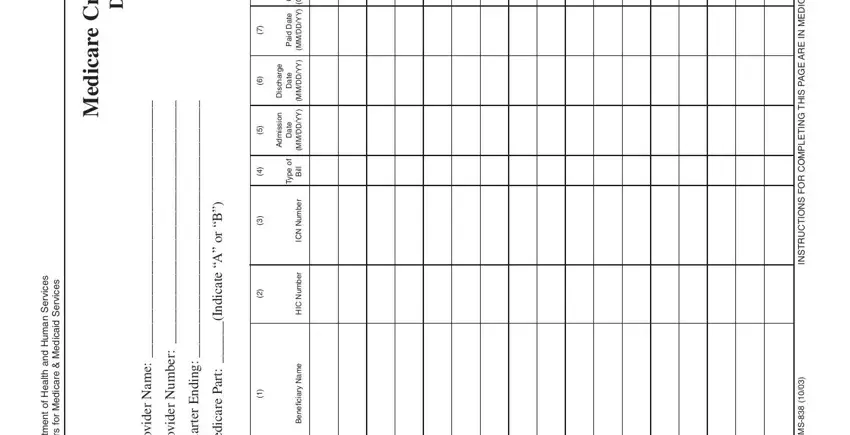

1. To get started, when filling in the form cms 838, start in the page that features the subsequent fields:

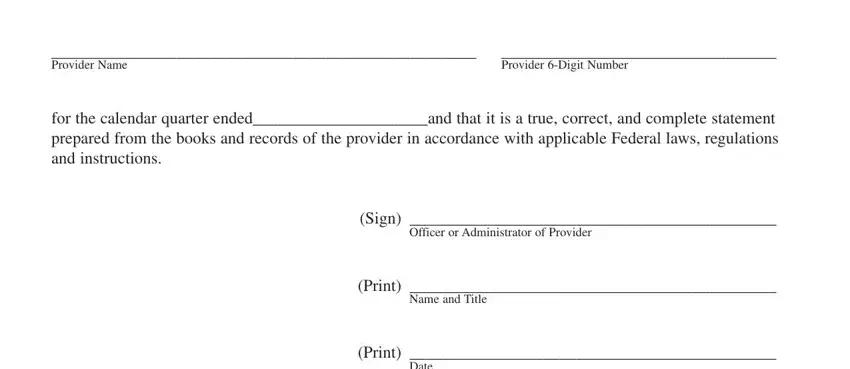

2. Once your current task is complete, take the next step – fill out all of these fields - CHECK ONE Qualify as a Low, Contact Person, Telephone Number, Form CMS Form CMS, INSTRUCTIONS FOR COMPLETING THIS, and PROVIDER INSTRUCTIONS FORM CMS with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

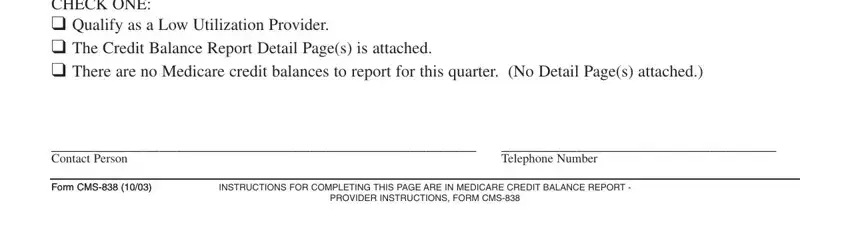

3. The following section will be about d e v o r p p A m r o F, o N B M O, t r o p e R e c n a l a B, t i d e r C e r a c i d e M, e g a P, l i a t e D, n o s r e P, t c a t n o C, r e b m u N e n o, f o e g a P, r o, n o s a e R, n u o m A, n u o m A, and n u o m A - complete these fields.

4. To go forward, this form section requires completing a few empty form fields. These comprise of s e c v r e S n a m u H d n a, t l, a e H, n e m, t r a p e D, s e c v r e S d a c d e M e r a c, r o, f s r e n e C, t i d e r C e r a c i d e M, l i a t e D, e m a N, r e d i v o r P, r e b m u N, r e d i v o r P, and B r o, which you'll find key to moving forward with this process.

5. Now, the following final subsection is precisely what you'll have to wrap up before finalizing the PDF. The fields in question include the next: According to the Paperwork, Form CMS, and Page.

People generally make errors when filling in Page in this part. Don't forget to go over what you enter right here.

Step 3: Go through the information you have entered into the form fields and click the "Done" button. After getting a7-day free trial account at FormsPal, it will be possible to download form cms 838 or email it right off. The PDF document will also be easily accessible in your personal account with your every change. FormsPal is dedicated to the personal privacy of all our users; we make certain that all personal information used in our system is kept confidential.