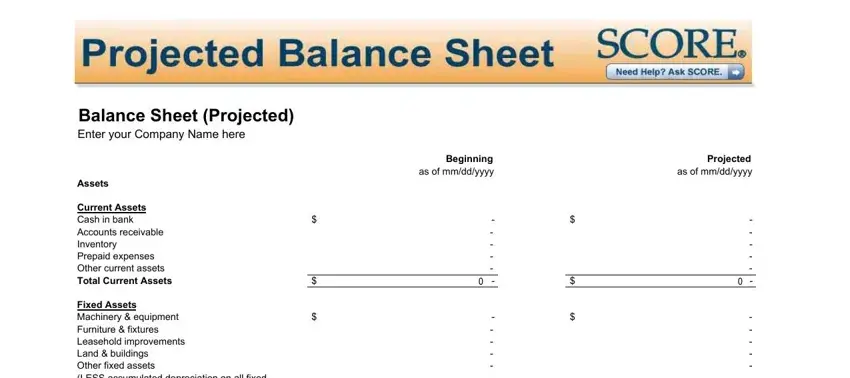

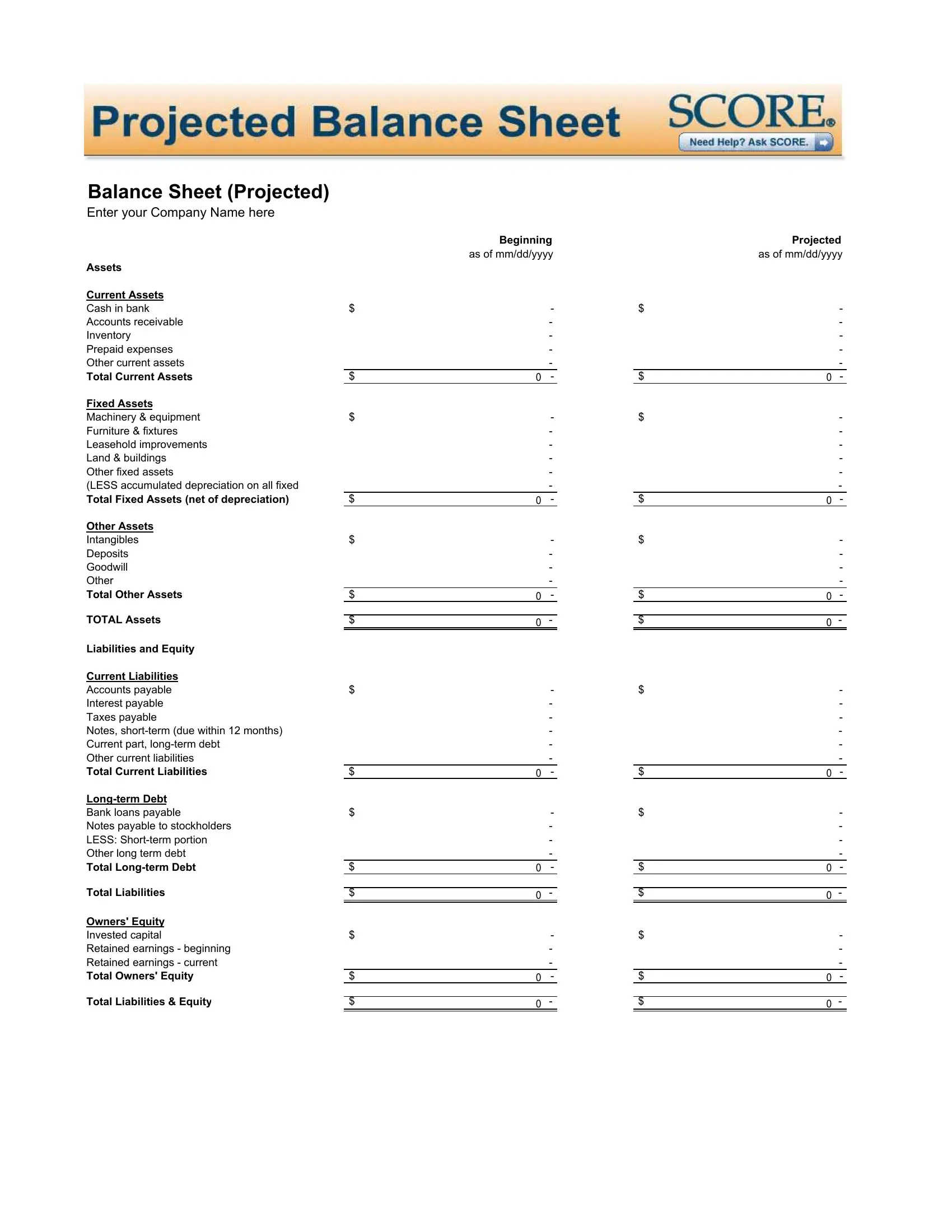

Balance Sheet (Projected)

Enter your Company Name here

|

|

Beginning |

|

|

Projected |

|

|

as of mm/dd/yyyy |

|

|

as of mm/dd/yyyy |

Assets |

|

|

|

|

|

Current Assets |

|

|

|

|

|

Cash in bank |

$ |

- |

$ |

- |

Accounts receivable |

|

- |

|

|

- |

Inventory |

|

- |

|

|

- |

Prepaid expenses |

|

- |

|

|

- |

Other current assets |

|

- |

|

|

- |

Total Current Assets |

$ |

- |

$ |

- |

Fixed Assets |

|

|

|

|

|

Machinery & equipment |

$ |

- |

$ |

- |

Furniture & fixtures |

|

- |

|

|

- |

Leasehold improvements |

|

- |

|

|

- |

Land & buildings |

|

- |

|

|

- |

Other fixed assets |

|

- |

|

|

- |

(LESS accumulated depreciation on all fixed |

|

- |

|

|

- |

Total Fixed Assets (net of depreciation) |

$ |

- |

$ |

- |

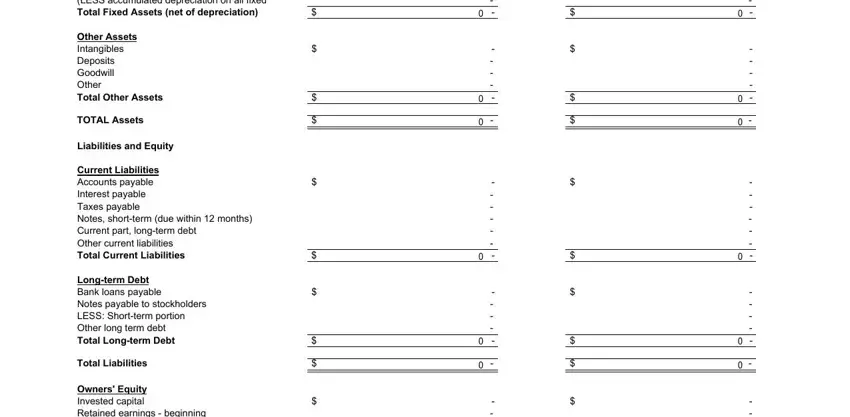

Other Assets |

|

|

|

|

|

Intangibles |

$ |

- |

$ |

- |

Deposits |

|

- |

|

|

- |

Goodwill |

|

- |

|

|

- |

Other |

|

- |

|

|

- |

Total Other Assets |

$ |

- |

$ |

- |

|

|

|

|

|

|

TOTAL Assets |

$ |

- |

|

$ |

- |

Liabilities and Equity |

|

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

Accounts payable |

$ |

- |

$ |

- |

Interest payable |

|

- |

|

|

- |

Taxes payable |

|

- |

|

|

- |

Notes, short-term (due within 12 months) |

|

- |

|

|

- |

Current part, long-term debt |

|

- |

|

|

- |

Other current liabilities |

|

- |

|

|

- |

Total Current Liabilities |

$ |

- |

$ |

- |

Long-term Debt |

|

|

|

|

|

Bank loans payable |

$ |

- |

$ |

- |

Notes payable to stockholders |

|

- |

|

|

- |

LESS: Short-term portion |

|

- |

|

|

- |

Other long term debt |

|

- |

|

|

- |

Total Long-term Debt |

$ |

- |

$ |

- |

|

|

|

|

|

|

Total Liabilities |

$ |

- |

|

$ |

- |

Owners' Equity |

|

|

|

|

|

|

|

|

|

|

Invested capital |

$ |

- |

$ |

- |

Retained earnings - beginning |

|

- |

|

|

- |

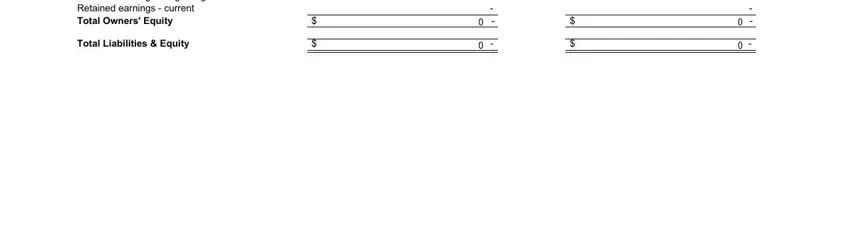

Retained earnings - current |

|

- |

|

|

- |

Total Owners' Equity |

$ |

- |

$ |

- |

|

|

|

|

|

|

Total Liabilities & Equity |

$ |

- |

|

$ |

- |

|

|

|

|

|

|

Notes on Preparation

You may want to print this information to use as reference later. To delete these instructions, click the border of this text box and then press the DELETE key.

Projecting your balance sheet can be quite a complex accounting problem, but that does not mean you need to be a professional accountant to do it or to benefit from the exercise. The desired result is not a perfect forecast, but rather a thoughtful plan detailing what additional resources will be needed by the company, where they will be needed, and how they will be financed. Using your last historical balance sheet as a starting point, project what your balance sheet will look like at the end of the 12 month period covered in your Profit & Loss and Cash Flow forecasts. How will the year's operations affect assets, debts and owners’ equity? For example, if you are planning significant sales growth in the coming year, go through the balance sheet item by item and think about the probably effects of assets.

Ex. ASSETS: Inventory and Accounts Receivable will have to grow. New equipment may be needed for increased production. You may draw down on cash to finance some of this.

Now, since a balance must balance, you need to consider the effects on the other half of the statement, liabilities and equity.

Ex. LIABILITIES & EQUITY: Some of the growth may be financed by profits retained in the business as Retained Earnings. Your Profit & Loss Projection will tell you how much might be available from that source. Funds may be contributed by the owners through contributions of more Invested Capital or loans to the company (Notes Payable to Stockholders). Suppliers may provide some of the financing via increased Accounts Payable. The rest will have to be financed by borrowing, which can be: Short term loans (due within 12 months) such as a line of credit or by Long Term Debt (maturity greater than 12 months).

Technical Tips:

1.Your firm's balance sheet no doubt has more lines than this template. For clarity and ease of analysis, we recommend you combine categories to fit into this compressed format.

2.As always for projections, we recommend that you condense your numbers. Most people find it useful to express the values in thousands, rounding to the nearest hundred dollars; for example, $11,459 would be entered as 11.5.

3.In the Fixed Assets section, the "LESS accumulated depreciation"

figure is the total of all depreciation accrued over the years on all fixed assets still owned by the company. Be sure to enter it as a negative number so the spreadsheet will subtract it from Total Fixed Assets.

4.In Owners' Equity, "Retained Earnings-Beginning" is retained earnings as of the last historical balance sheet or the end of the last fiscal year. "Retained Earnings-Current" is net profit for the period of the projections, less any owner's draw (for partnerships and proprietorships) or dividends paid (for corporations).