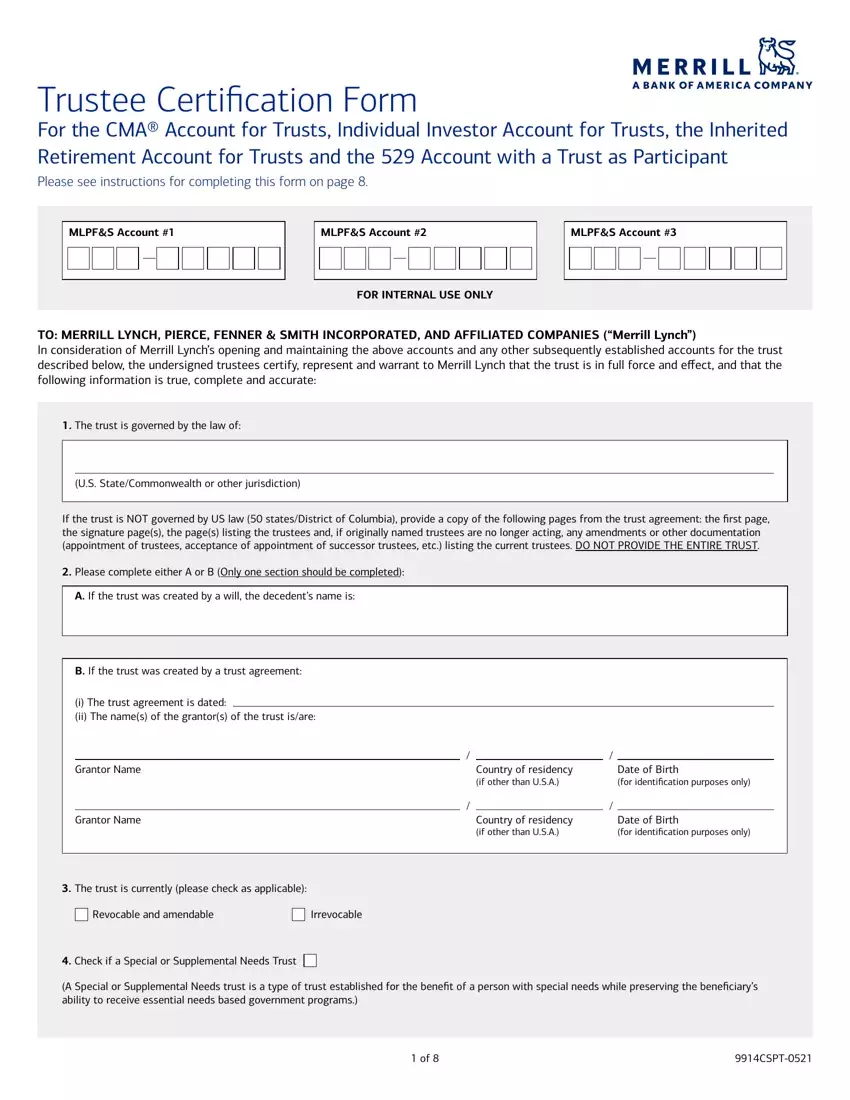

Trustee Certification Form

For the CMA® Account for Trusts and Individual Investor Account for Trusts

Please see instructions for completing this form on page 4.

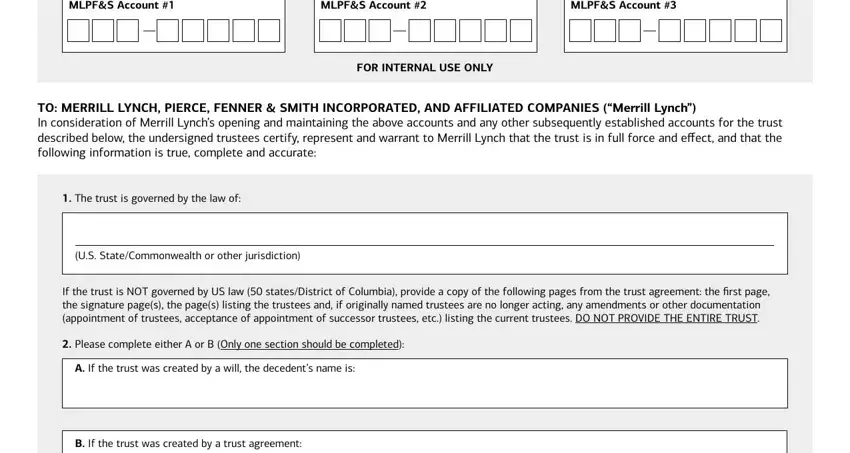

TO: MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED, AND AFFILIATED COMPANIES (“Merrill Lynch”)

In consideration of Merrill Lynch’s opening and maintaining the above accounts and any other subsequently established accounts for the trust described below, the undersigned trustees certify, represent and warrant to Merrill Lynch that the trust is in full force and effect, and that the following information is true and complete:

1.The trust is governed by the law of the state (or U.S. jurisdiction) of:

2.Please complete either A or B:

A.If the trust was created under a will, the decedent’s name is:

B.If the trust was created and funded during the grantor’s life:

(i)The trust agreement is dated: __________________________________________________________________________________________________

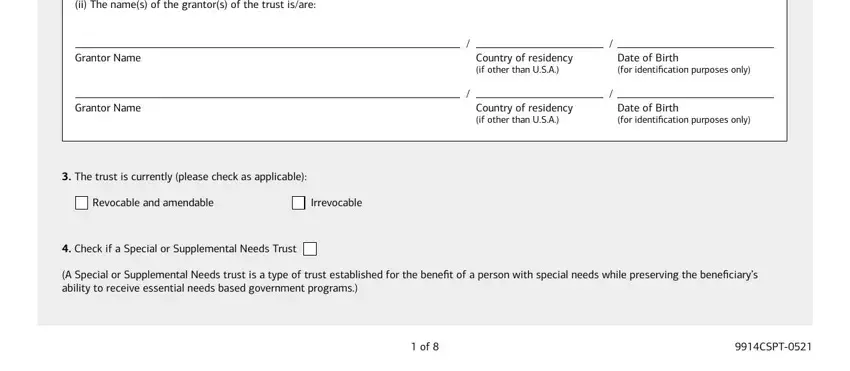

(ii)The name(s) of the grantor(s) of the trust is/are:

______________________________________________________________________________________ |

/ _______________________________________ |

Grantor Name |

Date of Birth (for identification purposes only) |

______________________________________________________________________________________ |

/ _______________________________________ |

Grantor Name |

Date of Birth (for identification purposes only) |

|

|

3. The trust is currently (please check as applicable): |

|

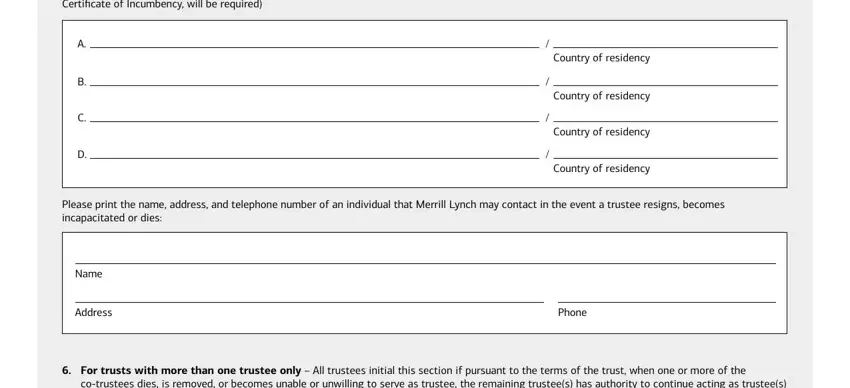

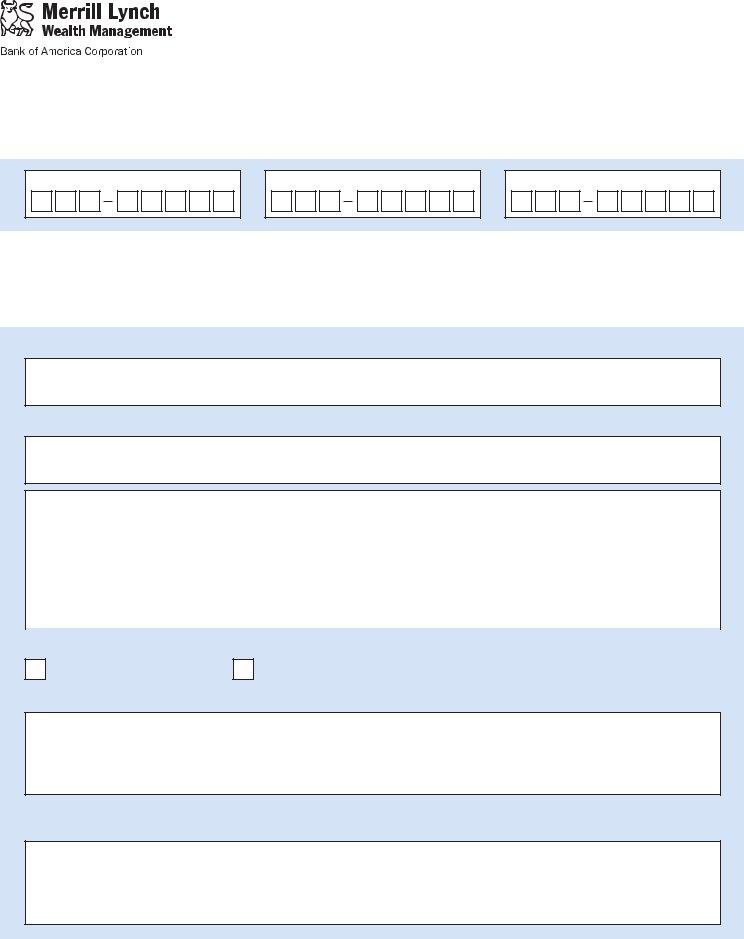

4.The names of all current trustees are:

A._____________________________________________________________________________________________________________________________

B._____________________________________________________________________________________________________________________________

C._____________________________________________________________________________________________________________________________

Please print the name, address, and telephone number of an individual that Merrill Lynch may contact in the event a trustee resigns, becomes incapacitated or dies:

________________________________________________________________________________________________________________________________

Name |

|

___________________________________________________________________________________________ |

___________________________________ |

Address |

Phone |

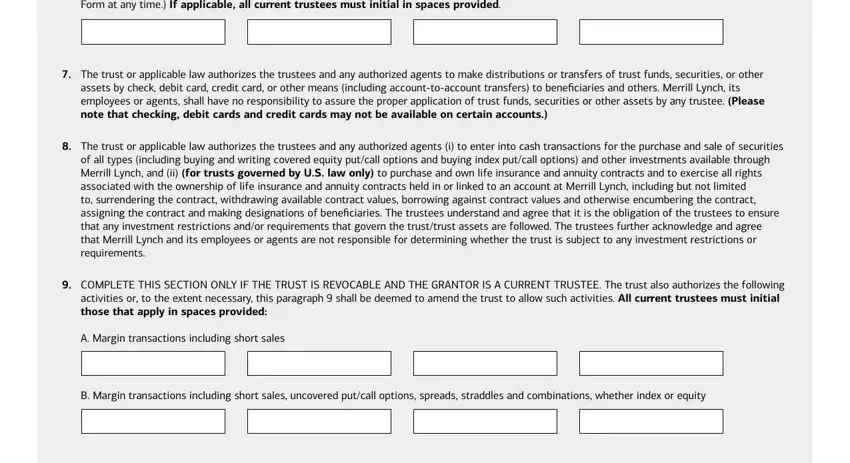

5.The trust or applicable law authorizes the trustees and any authorized agents to make distributions or transfers of trust funds, securities, or other assets by check, debit card, credit card, or other means (including account-to-account transfers) to beneficiaries and others. Merrill Lynch shall have no responsibility to assure the proper application of trust funds, securities or other assets by any trustee. (Please note that checking, debit cards and credit cards may not be available to accounts using certain services.)

6.The trust or applicable law authorizes the trustees and any authorized agents (i) to enter into cash transactions for the purchase and sale of securities of all types (including buying and writing covered equity put/call options and buying index put/call options) and other investments available through Merrill Lynch, and (ii) to purchase and own life insurance and annuity contracts and to exercise all rights associated with the ownership of life insurance and annuity contracts held in or linked to an account at Merrill Lynch, including but not limited to, surrendering the contract, withdrawing available contract values, borrowing against contract values and otherwise encumbering the contract, assigning the contract and making designations of beneficiaries.

7.COMPLETE THIS SECTION ONLY IF THE TRUST IS REVOCABLE AND THE GRANTOR IS A CURRENT TRUSTEE. The trust also authorizes the following activities or, to the extent necessary, this paragraph 7 shall be deemed to amend the trust to allow such activities. All current trustees must initial those that apply in spaces provided:

A.Margin transactions including short sales

B.Margin transactions including short sales, uncovered put/call options, spreads, straddles and combinations, whether index or equity

8.The trust or applicable law authorizes the trustees to delegate the performance of discretionary investment management duties to investment advisors or other agents, as provided under any applicable investment management contracts or powers of attorney, and where applicable, to charge the compensation of such advisors or other agents against the trust, including any other related expenses. Where required under applicable law, the trustees have filed necessary statements or elections with governmental authorities, and have provided timely written notice to all beneficiaries eligible to receive income from the trust of this delegation. No person other than the trustees has any investment authority over the trust’s assets. The consent of no party other than the trustees is required to vest investment discretion in investment advisors or other agents engaged by the trustees.

If, at any time, an investment advisor or other agent not affiliated with Merrill Lynch’s programs or services, is granted discretionary authority over the trust, Merrill Lynch is authorized to act upon the instructions of such investment advisor or other agent to the extent authorized in a properly executed power of attorney. (Please attach power of attorney.)

9.The trustees represent, warrant and agree that Merrill Lynch is authorized for all purposes regarding the trust’s accounts to follow the instructions of any one trustee. If there is more than one trustee, the trustees agree that it is their responsibility to agree among themselves before giving any instructions to Merrill Lynch for the trust’s accounts, if required by the trust instrument or applicable law, and that Merrill Lynch may conclusively presume that any one trustee who provides instructions to Merrill Lynch has obtained such agreement. Merrill Lynch shall be entitled to assume the existence of a trust power and the proper exercise of a trust power by any trustee without inquiry. Merrill Lynch shall have no responsibility to assure the proper application of trust funds, securities or other assets by any trustee. In the event Merrill Lynch receives inconsistent instructions from two or more trustees, reasonably believes instructions received from one trustee are not mutually agreeable to all trustees, or receives a court order with respect to the account, Merrill Lynch may, but is not obligated to, restrict activity in the trust account, require that all instructions be in writing signed by all trustees, suspend or terminate the account and/or file an interpleader action in an appropriate court at the expense of the trust.

10.The trustees represent and warrant that none of the beneficiaries of the trust are business organizations operating for profit such as corporations, partnerships, limited liability companies, associations or business trusts.

11.The trustees agree, jointly and severally, to indemnify Merrill Lynch, its employees and directors, and hold them harmless from any liabilities and expenses that arise from following the instructions of any trustee, or of any authorized investment advisors or agents, or that otherwise arise from Merrill Lynch’s reliance on the representations, warranties and agreements included in this Trustee Certification Form. This agreement to indemnify Merrill Lynch shall survive termination of the trust or of the accounts.

12.The trustees also agree to provide a new Trustee Certification Form to Merrill Lynch in the event that any of these representations, warranties, agreements, or certifications change, or if they may no longer be relied upon by Merrill Lynch.

13.The trustees agree that Merrill Lynch may rely upon this Trustee Certification Form (and any copies thereof) until Merrill Lynch and any investment advisors or other agents receive a new Trustee Certification Form, executed by all then-serving trustees, notifying Merrill Lynch of any changes involving the trust, in which case the new Trustee Certification Form will supercede this Trustee Certification Form in all respects, except as otherwise provided in Paragraph 11. The trustees also agree that this Trustee Certification Form supercedes any prior Trustee Certification Forms, documents, or information provided to Merrill Lynch regarding the trust, and that the INSTRUCTIONS printed on page 4 are an integral part of the Trustee Certification Form, and are specifically incorporated herein.

Merrill Lynch may, but need not, require current Letters of Trusteeship.

Except where it would be inconsistent to do so, words and phrases used in this document should be interpreted so the singular includes the plural and the plural includes the singular.

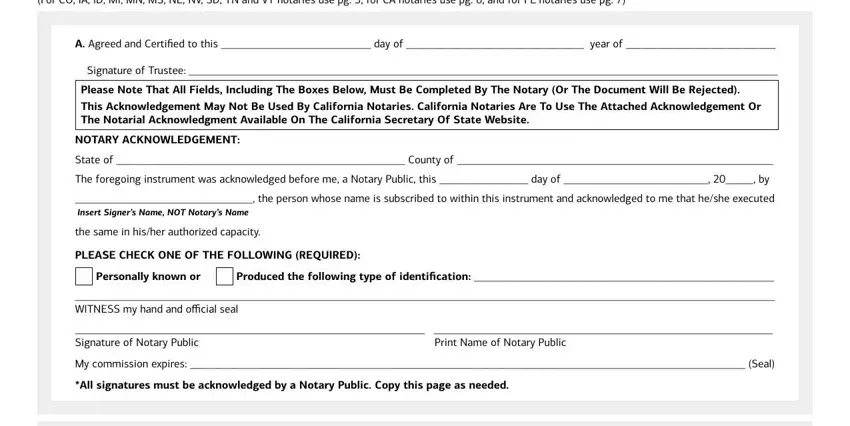

Signatures of Trustees (All current trustees must sign and all signatures must be notarized.)

A.Agreed and Certified to this __________________________ day of _______________________________________ year of ___________________

Signature of Trustee: _________________________________________________________________________________________________________

State of ___________________________________________ County of ____________________________________ On ______________________ .

before me,__________________________________________, personally appeared, ___________________________________________________ .

Personally known to me, OR

Proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same in his/her authorized capacity, and that by his/her signature on the instrument the person or entity upon which the person acted, executed the instrument.

WITNESS my hand and official seal.

Signature of Notary: ______________________________________________________

B.Agreed and Certified to this __________________________ day of _______________________________________ year of ___________________

Signature of Trustee: _________________________________________________________________________________________________________

State of ___________________________________________ County of ____________________________________ On ______________________ .

before me,__________________________________________, personally appeared, ___________________________________________________ .

Personally known to me, OR

Proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same in his/her authorized capacity, and that by his/her signature on the instrument the person or entity upon which the person acted, executed the instrument.

WITNESS my hand and official seal.

Signature of Notary: ______________________________________________________

C.Agreed and Certified to this __________________________ day of _______________________________________ year of ___________________

Signature of Trustee: _________________________________________________________________________________________________________

State of ___________________________________________ County of ____________________________________ On ______________________ .

before me,__________________________________________, personally appeared, ___________________________________________________ .

Personally known to me, OR

Proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same in his/her authorized capacity, and that by his/her signature on the instrument the person or entity upon which the person acted, executed the instrument.

WITNESS my hand and official seal.

Signature of Notary: ______________________________________________________

Instructions

This Trustee Certification Form is for use by trustees of any domestic revocable trust or irrevocable trust to maintain one or more cash securities accounts and by trustees of any grantor revocable living trusts to maintain a margin account or engage in other investment activity. It is not to be used by employee benefit trusts, nominees or business trusts, any trust governed under the laws of any foreign jurisdiction, nor for any trust for which the beneficiaries are business organizations operating for profit such as corporations, partnerships, limited liability companies, associations or business trusts. The Trustee Certification Form is also for use by trustees of revocable or irrevocable trusts for which the trustees delegate the performance of their discretionary duties to an investment advisor(s) or other agent(s).

NAMES OF TRUSTEES – The names of all current trustees must be included. If only one trustee is named, it shall be a representation that the trust has a single trustee. If a change of trustees occurs by death or otherwise, a new Trustee Certification Form must be provided. If there are more than three trustees, use an additional form.

POWER TO MAKE DISTRIBUTIONS/TRANSFERS – The authority of the trustees (and if applicable, the authority of any authorized agents)

to make distributions/transfers shall (be understood to) include the power for the trustees and any authorized agents to draw upon the funds, securities or other assets in the account of the trust by check, debit card, credit card, or other means (including account-to-account transfers). If the trustees apply to participate in Merrill Lynch programs or services that include extensions of credit to the trust, the trustees hereby represent that the trust or applicable law authorizes the trustees to incur indebtedness to the extent required to qualify for such programs

or services.

INVESTMENT POWERS – The authority of the trustees of any trust to purchase and sell securities and other investments including options

to the extent described in paragraph 6 shall be unrestricted. The authority of the grantor/trustee of a grantor revocable living trust to maintain a margin account and to engage in other activities described in paragraph 7 shall be understood to be unrestricted. Merrill Lynch shall be entitled to assume the existence of a trust power and the proper exercise of a trust power by any trustee (and by any investment advisor or agent appointed by the trustees for the trust) without inquiry. Merrill Lynch shall have no responsibility to assure the proper application of trust funds, securities or other assets by any trustee (or by an agent appointed by the trustees for the trust).

GRANTOR REVOCABLE LIVING TRUSTS – By signing this certification, the trustee of a grantor revocable living trust represent and warrant that they have full power and authority to direct the transfer of trust assets, and that the grantor has full power and authority to revoke and amend the trust.

SIGNATURES OF TRUSTEES – All trustees must sign this Trustee Certification Form. If there are more than three trustees, use an additional form. If only one trustee signs, it shall be a representation that the trust has a single trustee. All trustees are required to sign any account opening documents.

INVESTMENT ADVISORS AND AGENTS – If the trustees have designated an investment advisor(s) or other agent outside of Merrill Lynch’s programs or services with discretionary authority over the trust’s funds, securities or other assets, a copy of the investment management contract(s) or power(s) of attorney signed by all of the trustees must also be provided (refer to paragraph 8).

NOTARIZATION – Notarization of all trustees’ signatures by a notary public is required.

Merrill Lynch reserves the right to request a complete copy of the trust agreement or will at any time. Merrill Lynch may require written authorization of all co-trustees in some circumstances even though the trust instrument may allow a trustee to act individually and without the consent of other co-trustees for all purposes.

L-05-10

Merrill Lynch Wealth Management makes available products and services offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S) and other subsidiaries of Bank of America Corporation.

Trust and fiduciary services are provided by the Merrill Lynch Trust Company division of Bank of America, N.A., Member FDIC.

Bank of America, N.A. and MLPF&S, a registered broker-dealer and Member SIPC, are wholly owned subsidiaries of Bank of America Corporation.

Investment products:

Are Not FDIC Insured |

Are Not Bank Guaranteed |

May Lose Value |

|

|

|

MLPF&S and Bank of America, N.A. make available investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation or in which Bank of America Corporation has a substantial economic interest, including BofA™ Global Capital Management, BlackRock and Nuveen Investments.

Unless otherwise noted, registered trademarks and trademarks are the property of Merrill Lynch & Co. Inc.

© 2010 Bank of America Corporation. All rights reserved.