It is really very easy to fill out the nj prevailing wage form empty blanks. Our PDF tool can make it practically effortless to fill out almost any PDF. Below are the only four steps you should follow:

Step 1: You should select the orange "Get Form Now" button at the top of this page.

Step 2: Now, you can start modifying the nj prevailing wage form. Our multifunctional toolbar is readily available - add, remove, transform, highlight, and carry out various other commands with the text in the file.

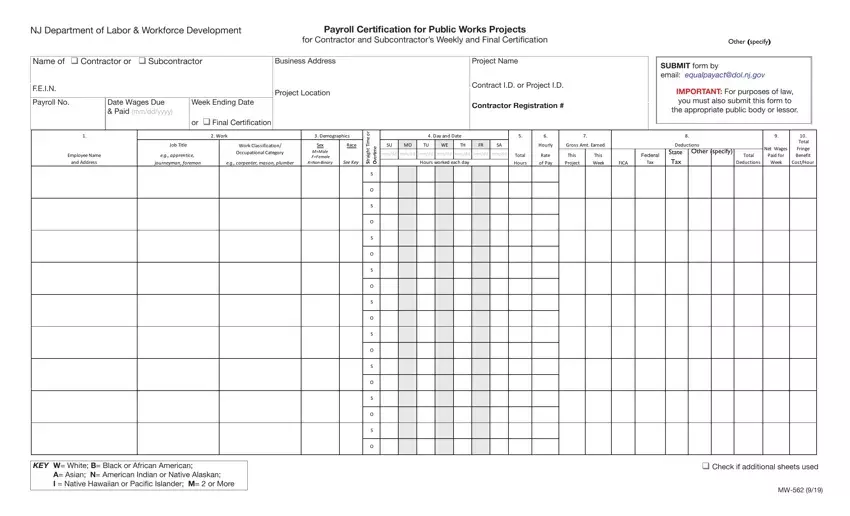

The next segments are contained in the PDF file you will be filling in.

Enter the demanded details in the space KEY W White B Black or African, A Asian N American Indian or, and Check if additional sheets used.

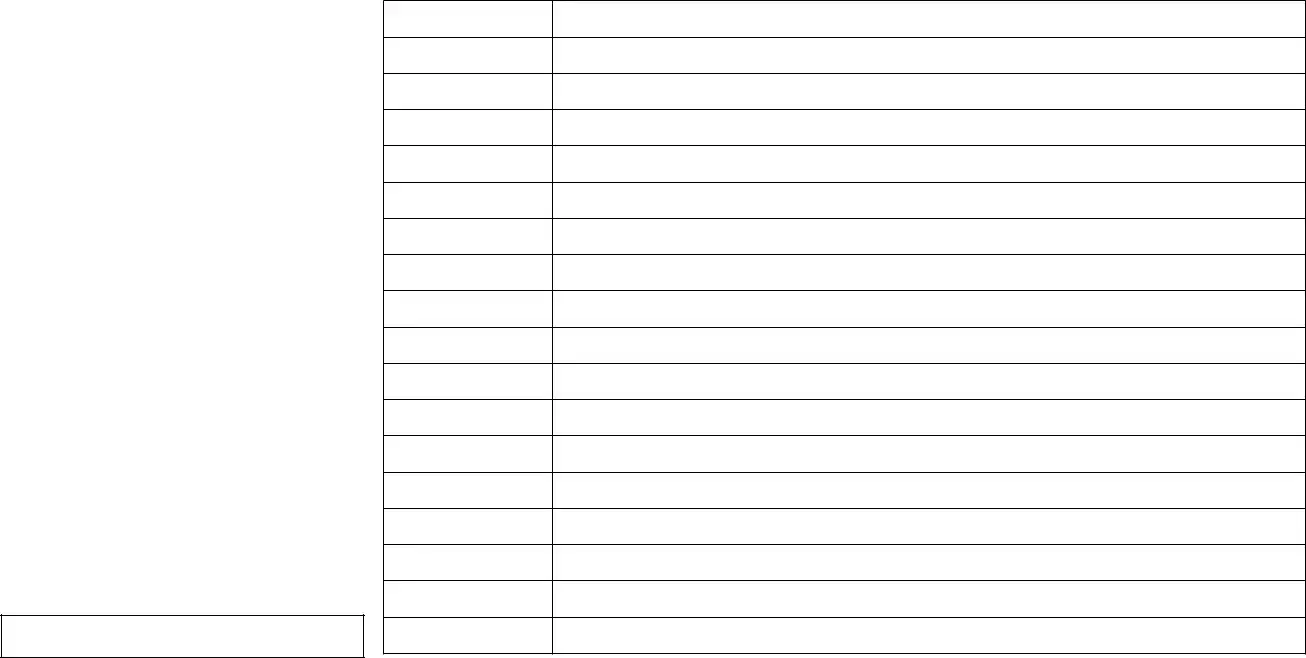

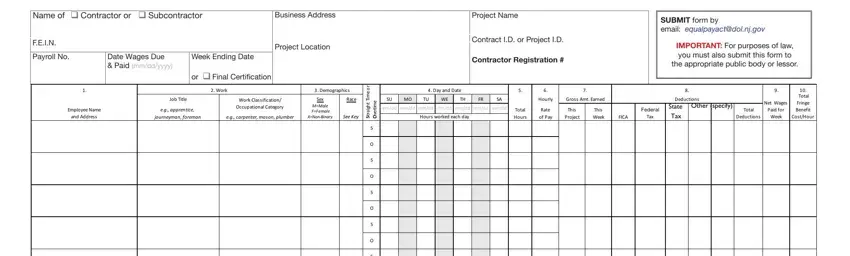

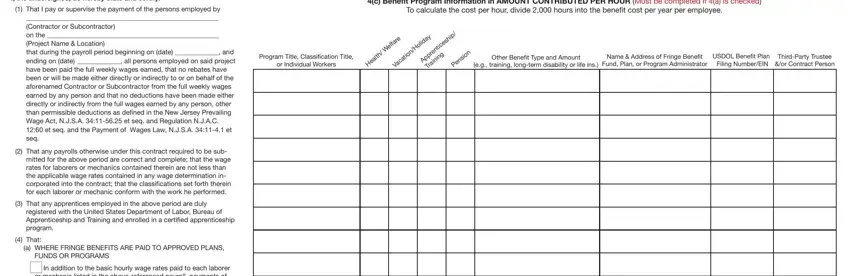

You'll have to provide particular data within the section c Benefit Program Information in, Program Title Classification Title, H e alth W elfare, A p pre ntic e s hip V a c atio n, Other Benefit Type and Amount eg, Name Address of Fringe Benefit, USDOL Benefit Plan Filing NumberEIN, ThirdParty Trustee or Contract, I the undersigned do hereby state, That I pay or supervise the, That any payrolls otherwise under, mitted for the above period are, That any apprentices employed in, registered with the United States, and That.

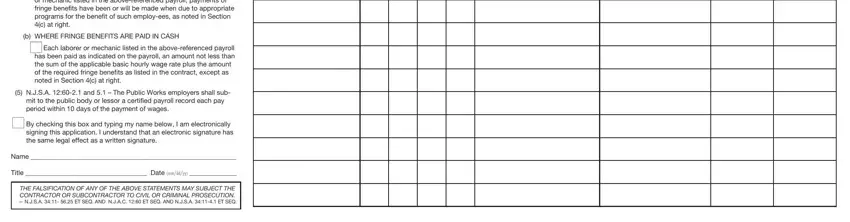

Identify the rights and responsibilities of the parties in the space FUNDS OR PROGRAMS q In addition to, b WHERE FRINGE BENEFITS ARE PAID, q Each laborer or mechanic listed, NJSA and The Public Works, By checking this box and typing, Name, Title Date mmddyy, and THE FALSIFICATION OF ANY OF THE.

Step 3: Press the "Done" button. It's now possible to transfer the PDF file to your device. Besides, you can easily send it through electronic mail.

Step 4: It will be easier to keep duplicates of your form. You can rest easy that we are not going to publish or see your details.