You'll be able to fill in Insureds effectively in our online PDF tool. The tool is continually upgraded by our team, getting powerful functions and turning out to be much more versatile. All it takes is several simple steps:

Step 1: First, open the editor by pressing the "Get Form Button" in the top section of this page.

Step 2: With our advanced PDF editor, it is easy to do more than simply complete blank form fields. Try each of the features and make your forms seem faultless with customized text added, or tweak the file's original input to excellence - all comes along with the capability to insert any pictures and sign the file off.

This form will require some specific information; to guarantee consistency, don't hesitate to pay attention to the following tips:

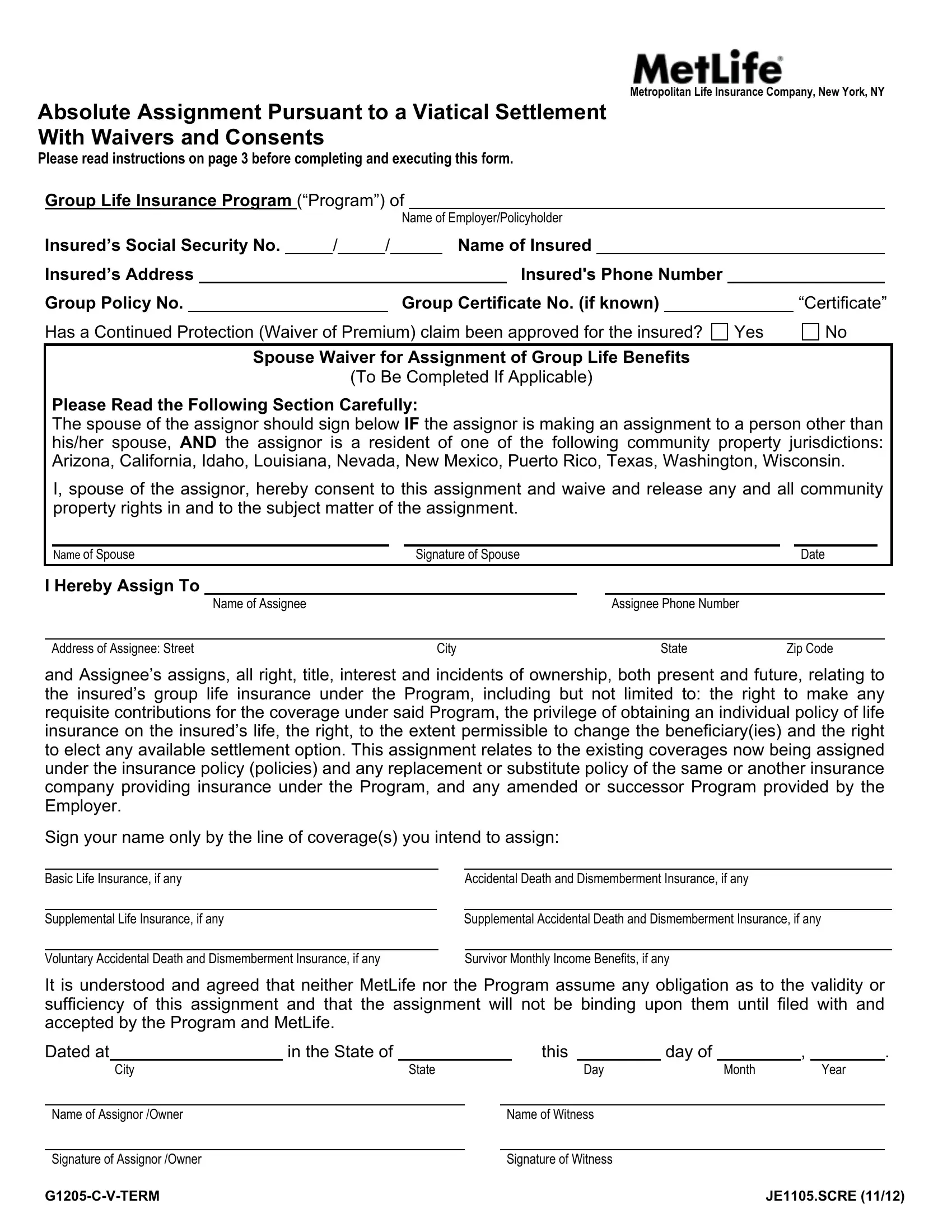

1. You have to complete the Insureds properly, so pay close attention while working with the segments containing all of these blanks:

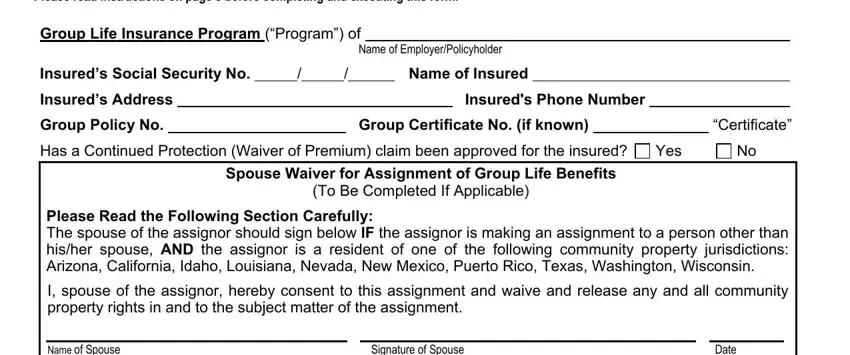

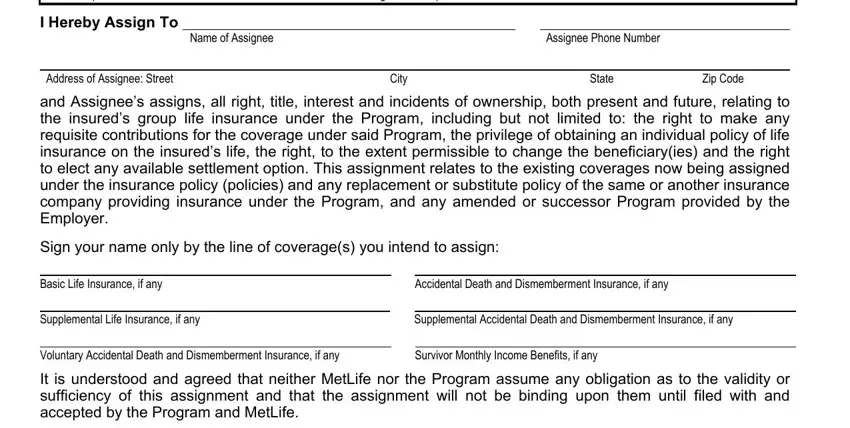

2. Given that the last part is done, you're ready to include the required details in Name of Spouse, Signature of Spouse, Date, I Hereby Assign To, Name of Assignee, Address of Assignee Street, Assignee Phone Number, City, State, Zip Code, and Assignees assigns all right, Basic Life Insurance if any, Supplemental Life Insurance if any, Voluntary Accidental Death and, and Accidental Death and Dismemberment so that you can proceed to the next step.

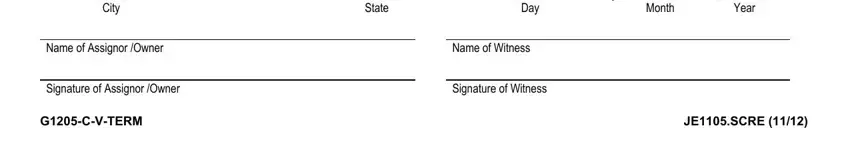

3. This subsequent step should also be relatively straightforward, Dated at, City, Name of Assignor Owner, Signature of Assignor Owner, GCVTERM, in the State of, this, day of, State, Day, Month, Year, Name of Witness, Signature of Witness, and JESCRE - every one of these form fields has to be filled in here.

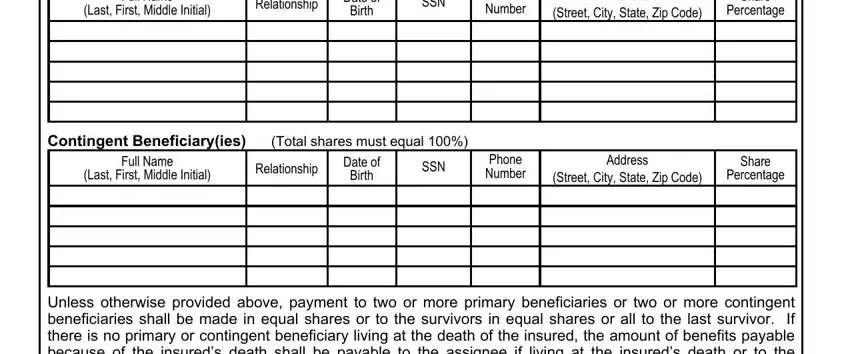

4. The form's fourth subsection arrives with all of the following form blanks to type in your information in: Full Name, Last First Middle Initial, Relationship, Date of, Birth, SSN, Phone Number, Address, Street City State Zip Code, Share, Percentage, Contingent Beneficiaryies, Total shares must equal, Full Name, and Last First Middle Initial.

People often get some things incorrect when filling in SSN in this area. You should go over what you type in right here.

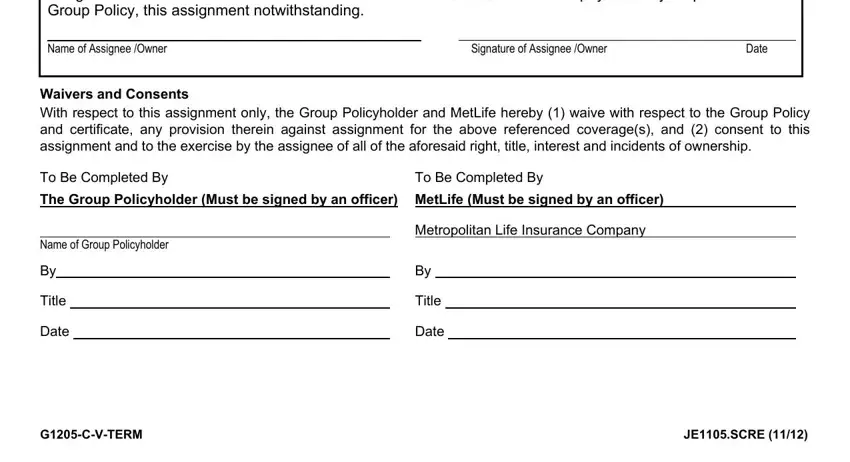

5. To finish your form, the final part incorporates several extra fields. Filling out It is understood and agreed that, Name of Assignee Owner, Signature of Assignee Owner, Date, Waivers and Consents With respect, To Be Completed By, To Be Completed By, The Group Policyholder Must be, Name of Group Policyholder, Metropolitan Life Insurance Company, Title, Date, Title, Date, and GCVTERM is going to finalize the process and you'll surely be done before you know it!

Step 3: Right after double-checking the entries, click "Done" and you are all set! Right after creating afree trial account here, it will be possible to download Insureds or email it directly. The form will also be accessible via your personal cabinet with all your adjustments. Here at FormsPal.com, we endeavor to make sure that all your details are kept secure.