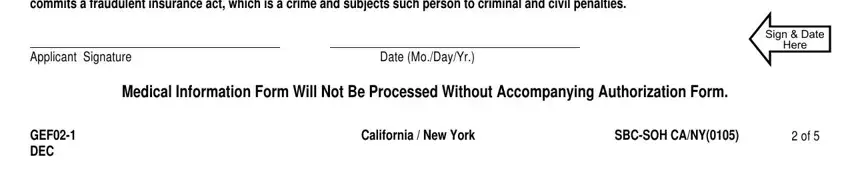

Send directly to MetLife,

not to Liazon.Metropolitan Life Insurance Company, New York, NY

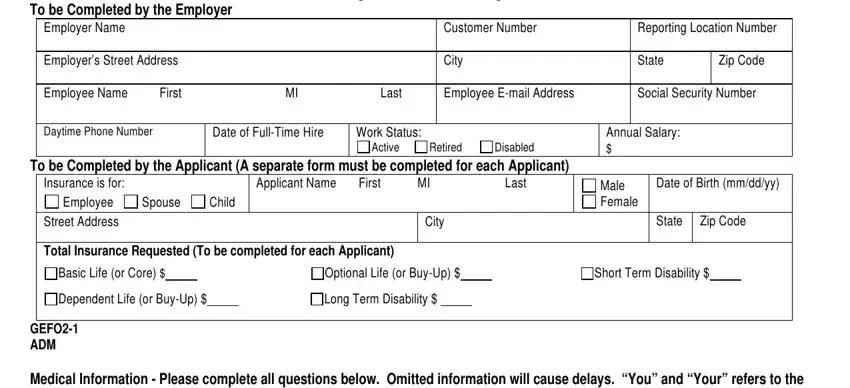

SBC Medical Underwriting, PO Box 14593, Lexington, KY 40512-4593 To be Completed by the Employer

Employer Name |

|

|

|

Customer Number |

Reporting Location Number |

|

|

|

|

|

|

Employer’s Street Address |

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

Employee Name |

First |

MI |

Last |

Employee E-mail Address |

Social Security Number |

|

|

|

|

|

|

|

To be Completed by the Applicant (A separate form must be completed for each Applicant)

Insurance is for: |

|

|

Applicant Name |

First |

MI |

Last |

Male |

Date of Birth (mm/dd/yy) |

Employee |

Spouse |

Child |

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Total Insurance Requested (To be completed for each Applicant)

Basic Life (or Core) $ |

|

|

|

Optional Life (or Buy-Up) $ |

|

|

Short Term Disability $ |

Dependent Life (or Buy-Up) $ |

|

Long Term Disability $ |

|

|

|

|

GEFO2-1

ADM

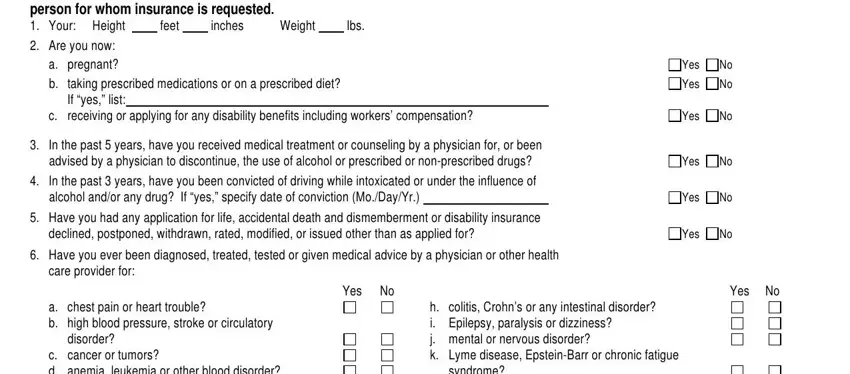

Medical Information - Please complete all questions below. Omitted information will cause delays. “You” and “Your” refers to the person for whom insurance is requested.

1. Your: Height |

|

feet |

|

inches |

Weight |

|

lbs. |

2.Are you now:

a.pregnant?

b.taking prescribed medications or on a prescribed diet? If “yes,” list:

c.receiving or applying for any disability benefits including workers’ compensation?

3.In the past 5 years, have you received medical treatment or counseling by a physician for, or been advised by a physician to discontinue, the use of alcohol or prescribed or non-prescribed drugs?

4.In the past 3 years, have you been convicted of driving while intoxicated or under the influence of alcohol and/or any drug? If “yes,” specify date of conviction (Mo./Day/Yr.)

5.Have you had any application for life, accidental death and dismemberment or disability insurance declined, postponed, withdrawn, rated, modified, or issued other than as applied for?

6.Have you ever been diagnosed, treated, tested or given medical advice by a physician or other health care provider for:

a.chest pain or heart trouble?

b.high blood pressure, stroke or circulatory disorder?

c.cancer or tumors?

d.anemia, leukemia or other blood disorder?

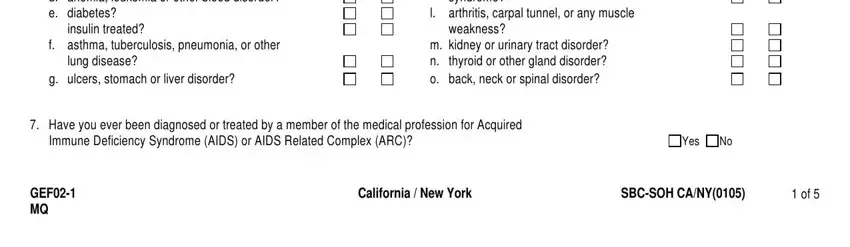

e.diabetes? insulin treated?

f.asthma, tuberculosis, pneumonia, or other lung disease?

g.ulcers, stomach or liver disorder?

Yes No |

Yes No |

h. |

colitis, Crohn’s or any intestinal disorder? |

i. |

Epilepsy, paralysis or dizziness? |

j. |

mental or nervous disorder? |

k. |

Lyme disease, Epstein-Barr or chronic fatigue |

|

syndrome? |

l. |

arthritis, carpal tunnel, or any muscle |

|

weakness? |

m. kidney or urinary tract disorder? |

n. |

thyroid or other gland disorder? |

o. |

back, neck or spinal disorder? |

7. Have you ever been diagnosed or treated by a member of the medical profession for Acquired |

|

|

Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)? |

Yes |

No |

GEF02-1 |

California / New York |

SBC-SOH CA/NY(0105) |

1 of 5 |

MQ |

|

|

|

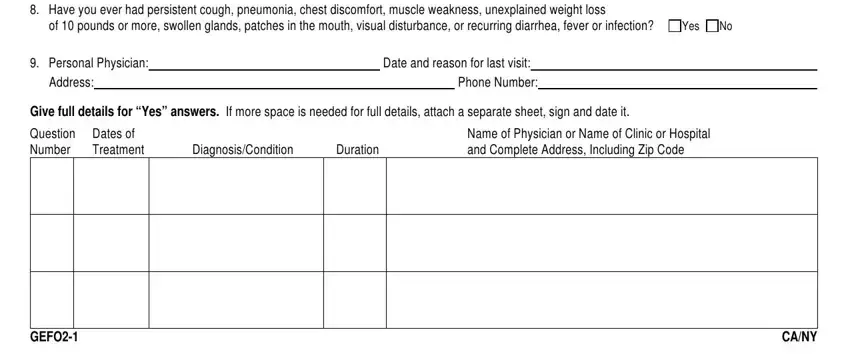

8.Have you ever had persistent cough, pneumonia, chest discomfort, muscle weakness, unexplained weight loss

of 10 pounds or more, swollen glands, patches in the mouth, visual disturbance, or recurring diarrhea, fever or infection?

9. Personal Physician: |

|

Date and reason for last visit: |

Give full details for “Yes” answers. If more space is needed for full details, attach a separate sheet, sign and date it.

Question |

Dates of |

|

|

Name of Physician or Name of Clinic or Hospital |

Number |

Treatment |

Diagnosis/Condition |

Duration |

and Complete Address, Including Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MQ

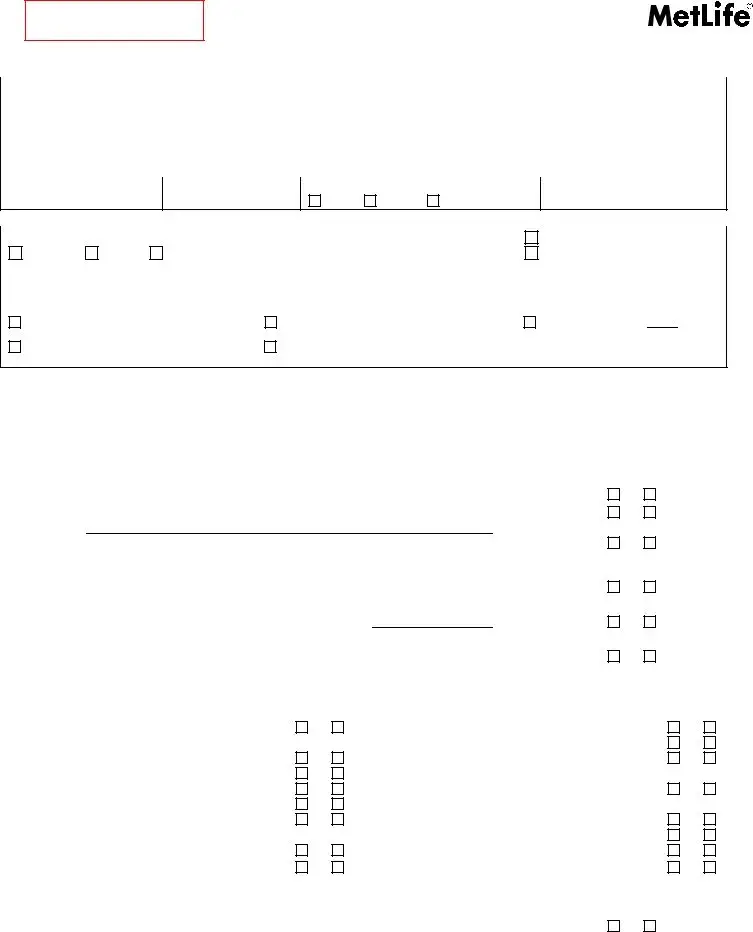

Declaration — I have read this Statement of Health and declare that all information given above is true and complete to the best of my knowledge and belief. I understand that this information will be used by MetLife to determine my insurability.

Fraud Warning:

If you reside in or are applying for insurance under a policy issued in one of the following states, please read the applicable warning.

New York [only applies to Accident and Health Benefits (AD&D/Disability/Dental)]: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Massachusetts: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, and may subject such person to criminal and civil penalties.

New Jersey: Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

Oklahoma: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Kansas and Oregon: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto may be guilty of insurance fraud, and may be subject to criminal and civil penalties.

Virginia: Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application containing a false or deceptive statement may have violated state law.

In any other case, read the following warning.

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

|

|

|

|

|

Sign & Date |

|

|

|

|

|

Here |

Applicant |

Signature |

|

Date (Mo./Day/Yr.) |

|

|

|

|

|

Medical Information Form Will Not Be Processed Without Accompanying Authorization Form. |

|

GEF02-1 |

|

|

California / New York |

SBC-SOH CA/NY(0105) |

2 of 5 |

DEC |

|

|

|

|

|

AUTHORIZATION

In connection with an enrollment for group insurance, for underwriting and claim purposes regarding the proposed insureds (the proposed insureds are the employee, spouse, and any other person(s) named below), notwithstanding any prior restriction placed on information, records or data by a proposed insured, each proposed insured authorizes:

•Any medical practitioner, facility or related entity; any insurer; the Medical Information Bureau, Inc. (MIB); any employer; any group policyholder, contract holder or benefit plan administrator; or any government agency to give Metropolitan Life Insurance Company (“MetLife”) or any third party acting on MetLife's behalf in this regard:

•personal information and data about the proposed insured;

•medical information, records and data about the proposed insured including information, records and data about drugs prescribed, medical test results and sexually transmitted diseases;

•information, records and data about the proposed insured related to alcohol and drug abuse and treatment, including information and data records and data related to alcohol and drug abuse protected by Federal Regulations 42 CFR part 2;

•information, records and data about the proposed insured relating to Acquired Immune Deficiency Syndrome (AIDS) or AIDS related conditions including, where permitted by applicable law, Human Immune deficiency Virus (HIV) test results; and

•information, records and data about the proposed insured relating to mental illness, except psychotherapy notes.

Expiration, Revocation and Refusal to Sign: This authorization will expire 24 months from the date on this form or sooner if prescribed by

law. Unless permitted by applicable law, the proposed insured cannot revoke this authorization: (1) to the extent that MetLife has taken action relying on the authorization; or (2) if MetLife obtained the authorization as a condition to the proposed insured obtaining insurance coverage. In all other cases, the proposed insured may revoke this authorization at any time. To revoke the authorization, the proposed insured must write to MetLife at SBC Administration, P.O. Box 14593, Lexington, KY 40512-4593 and inform MetLife that this Authorization is revoked. Any action taken before MetLife receives the proposed insured's revocation will be valid. Revocation may be the basis for denying coverage or benefits. If the proposed insured does not sign this Authorization, that person's enrollment for group insurance cannot be processed.

By signing below, each proposed insured acknowledges his or her understanding that:

•All or part of the information, records and data that MetLife receives pursuant to this authorization may be disclosed to MIB. Such information may also be disclosed to and used by any reinsurer, employee, affiliate or independent contractor who performs a business service for MetLife on the insurance applied for or on existing insurance with MetLife, or disclosed as otherwise required or permitted by applicable laws.

•Medical information, records and data that may have been subject to federal and state laws or regulations, including federal rules issued by Health and Human Services, setting forth standards for the use, maintenance and disclosure of such information by health care providers and health plans and records and data related to alcohol and drug abuse protected by Federal Regulations 42 CFR part 2, once disclosed to MetLife or upon redisclosure by MetLife, may no longer be covered by those laws or regulations.

•Information relating to HIV test results will only be disclosed as permitted by applicable law.

•Information obtained pursuant to this authorization about a proposed insured may be used, to the extent permitted by applicable law, to determine the insurability of other family members.

•Each proposed insured has a right to receive a copy of this form.

A photocopy of this form is as valid as the original form.

----------------------------------------------------------------------- |

------------------------------------------------------------- |

---------------------------- |

Signature of Proposed Insured or |

Print Name of Proposed Insured |

Date (Mo./Day/Yr.) |

Signature & Relationship of Personal Representative* |

|

|

*If a child proposed for insurance is age 18 or over, the child must sign this Authorization. If the child is under age 18, a Personal Representative for the child must sign, and indicate the legal relationship between the Personal Representative and the proposed insured. A Personal Representative for the child is a person who has the right to control the child’s health care, usually a parent, legal guardian, or a person appointed by a court.

Privacy Notice

If you submit a request for insurance (Statement of Health form) we will evaluate it. We will review the information you give to us and we may confirm it or add to it in the ways explained below.

This Privacy Notice is given to you on behalf of METROPOLITAN LIFE INSURANCE COMPANY.

Please read this Privacy Notice carefully. It describes in broad terms how we learn about you and how we treat the information we get about you. (If anyone else is to be insured, what we say here also applies to information about him or her.) We are required by law to give you this notice.

Why We Need to Know about You: We need to know about you (and anyone else to be insured) so that we can provide the insurance and other products and services you’ve asked for. We may also need information from you and others to help us verify identities in order to prevent money laundering and terrorism.

What we need to know includes address, age and other basic information. But we may need more information, including finances, employment, health, hobbies or business conducted with us, with other MetLife companies (our “affiliates”) or with other companies.

How We Learn about You: What we know about you (and anyone else to be insured) we get mostly from you. But we may also have to find out more from other sources in order to make sure that what we know is correct and complete. Those sources may include adult relatives, employers, consumer reporting agencies, health care providers and others. Some of our sources may give us reports and may disclose what they know to others. We may ask for medical information about you from these sources. The Authorization that you sign when you request insurance permits these sources to tell us about you. So we may, for instance:

•Ask for a medical exam

•Ask for blood and urine tests

•Ask health care providers to give us health data, including information about alcohol or drug abuse

We may also ask a consumer reporting agency for a “consumer report” about you (or anyone else to be insured). Consumer reports may tell us about a lot of things, including information about your finances, employment, hobbies, mode of living, work history, and driving record.

The information may be kept by the consumer reporting agency and later given to others as permitted by law. The agency will give you a copy of the report it provides to us, if you ask the agency and can provide adequate identification. If you write to us and we have asked for a consumer report about you, we will tell you so and give you the name, address and phone number of the consumer reporting agency.

Another source of information is MIB Group, Inc. (“MIB”). It is a non-profit association of life insurance companies. We and our reinsurers may give MIB health or other information about you. If you apply for life or health coverage from another member of MIB, or claim benefits from another member company, MIB will give that company any information it has about you. If you contact MIB, it will tell you what it knows about you. You have the right to ask MIB to correct its information about you. You may do so by writing to MIB, Inc., P.O. Box 105, Essex Station, Boston, MA 02112, by calling MIB at (866) 692-6901 (TTY (866) 346-3642 for the hearing impaired), or by contacting MIB at www.mib.com.

How We Protect What We Know About You: Because you entrust us with your personal information, we treat what we know about you confidentially. Our employees are told to take care in handling your information. They may get information about you only when there is a good reason to do so. We take steps to make our computer data bases secure and to safeguard the information we have.

How We Use and Disclose What We Know About You: We may use anything we know about you to help us serve you better. We may use it, and disclose it to our affiliates and others, for any purpose allowed by law. For instance, we may use your information, and disclose it to others, in order to:

• Help us evaluate your request for a product or service |

• |

Help us comply with the law |

• Help us process claims and other transactions |

• |

Help us run our business |

• Confirm or correct what we know about you |

• |

Process data for us |

• Help us prevent fraud, money laundering, terrorism and |

• |

Perform research for us |

other crimes by verifying what we know about you |

|

|

|

• |

Audit our business |

Other reasons we may disclose what we know about you include:

•Doing what a court or government agency requires us to do; for example, complying with a search warrant or subpoena

•Telling another company what we know about you, if we are or may be selling all or any part of our business or merging with another company

•Giving information to the government so that it can decide whether you may get benefits that it will have to pay for

•Telling a group customer about its members’ claims or cooperating in a group customer’s audit of our service

•Telling your health care provider about a medical problem that you have but may not be aware of

•Giving your information to a peer review organization if you have health insurance with us

•Giving your information to someone who has a legal interest in your insurance, such as someone who lent you money and holds a lien on your insurance or benefits

Generally, we will disclose only the information we consider reasonably necessary to disclose.

We may use what we know about you in order to offer you our other products and services. We may share your information with other companies to help us. Here are our other rules on using your information to market products and services:

•We will not share information about you with any of our affiliates for use in marketing its products to you, unless we first notify you. You will then have an opportunity to tell us not to share your information by “opting out.”

•Before we share what we know about you with another financial services company to offer you products or services through a joint marketing arrangement, we will let you “opt-out.”

•We will not disclose information to unaffiliated companies for use in selling their products to you, except through such joint marketing arrangements.

•We will not share your health information with any other company, even one of our affiliates, to permit it to market its products and services to you.

How You Can See and Correct Your Information: Generally, we will let you review what we know about you if you ask us in writing. (Because of its legal sensitivity, we will not show you anything that we learned in connection with a claim or lawsuit.) If you tell us that what we know about you is incorrect, we will review it. If we agree with you, we will correct our records. If we do not agree with your, you may tell us in writing, and we will include your statement when we give your information to anyone outside MetLife.

You Can Get Other Material from Us: In addition to any other privacy notice we may give you, we must give you a summary of our privacy policy once each year. You may have other rights under the law. If you want to know more about our privacy policy, please contact us at our website, www.metlife.com, or write to your MetLife Insurance Company, c/o MetLife Privacy Office - Inst, P.O. Box 489, Warwick, RI 02887-9954. Please identify the specific product or service you are writing about.