You can certainly complete forms working with our PDF editor. Updating the state document is a breeze as soon as you stick to the following steps:

Step 1: Step one should be to pick the orange "Get Form Now" button.

Step 2: You will find all the actions that you can take on the file as soon as you've accessed the state editing page.

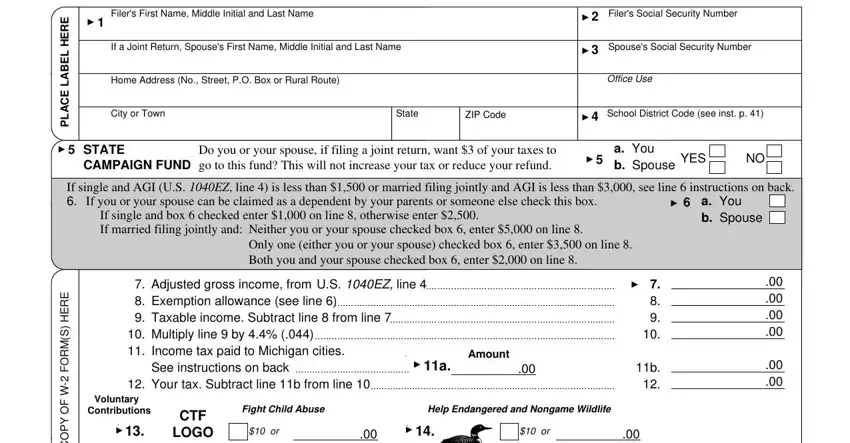

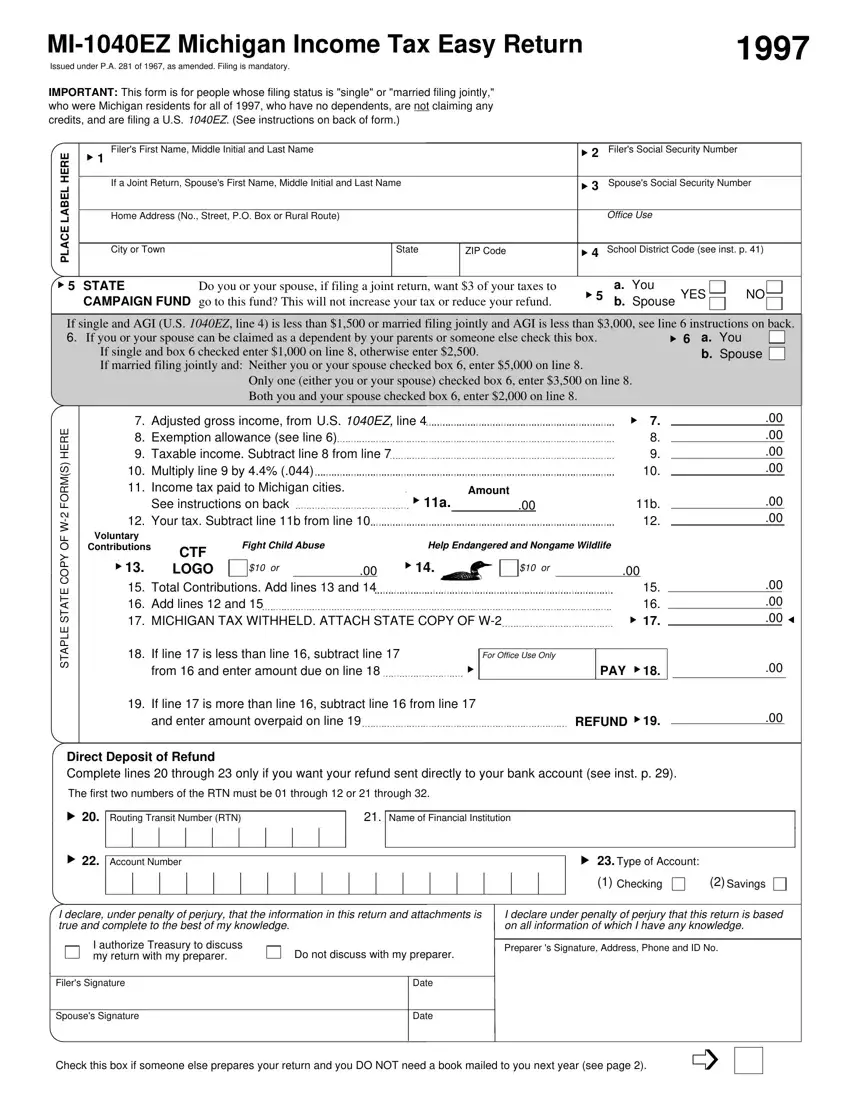

The next segments will constitute the PDF document that you'll be creating:

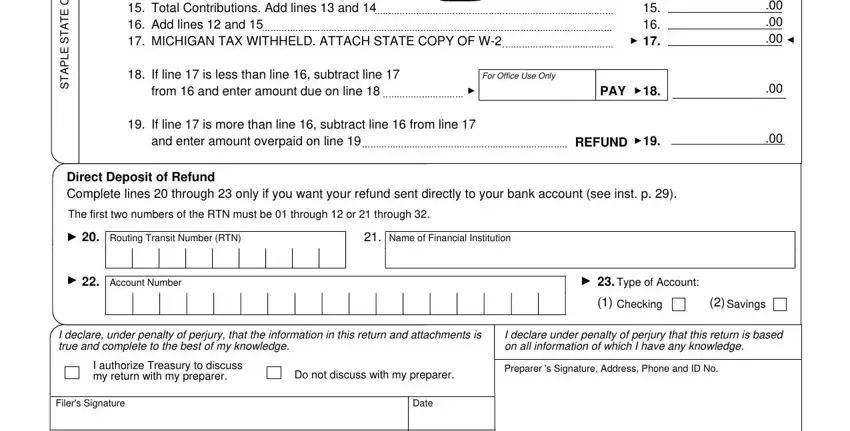

Type in the requested information in the space Total Contributions Add lines, If line is less than line, For Office Use Only, PAY, If line is more than line, REFUND, S M R O F W F O Y P O C E T A T, Direct Deposit of Refund Complete, The first two numbers of the RTN, Routing Transit Number RTN, Name of Financial Institution, Account Number, Type of Account, Checking Savings, and I declare under penalty of perjury.

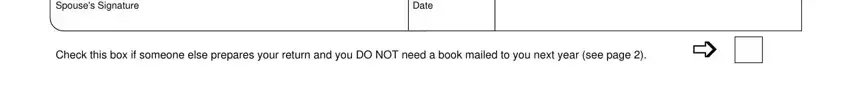

Write the main particulars in Spouses Signature, Date, and Check this box if someone else section.

Step 3: As you press the Done button, your ready document can be easily exported to each of your gadgets or to electronic mail given by you.

Step 4: Ensure you stay clear of possible issues by making minimally 2 duplicates of the form.

Routing Transit Number (RTN)

Routing Transit Number (RTN) Account Number

Account Number Name of Financial Institution

Name of Financial Institution