michigan department of treasury form 163 can be filled in online in no time. Simply open FormsPal PDF editing tool to complete the job promptly. Our editor is constantly evolving to provide the very best user experience attainable, and that is thanks to our dedication to constant enhancement and listening closely to comments from users. With just a few basic steps, it is possible to start your PDF journey:

Step 1: Access the PDF doc in our editor by clicking the "Get Form Button" in the top part of this page.

Step 2: This tool helps you customize PDF documents in a variety of ways. Modify it by adding any text, adjust original content, and add a signature - all readily available!

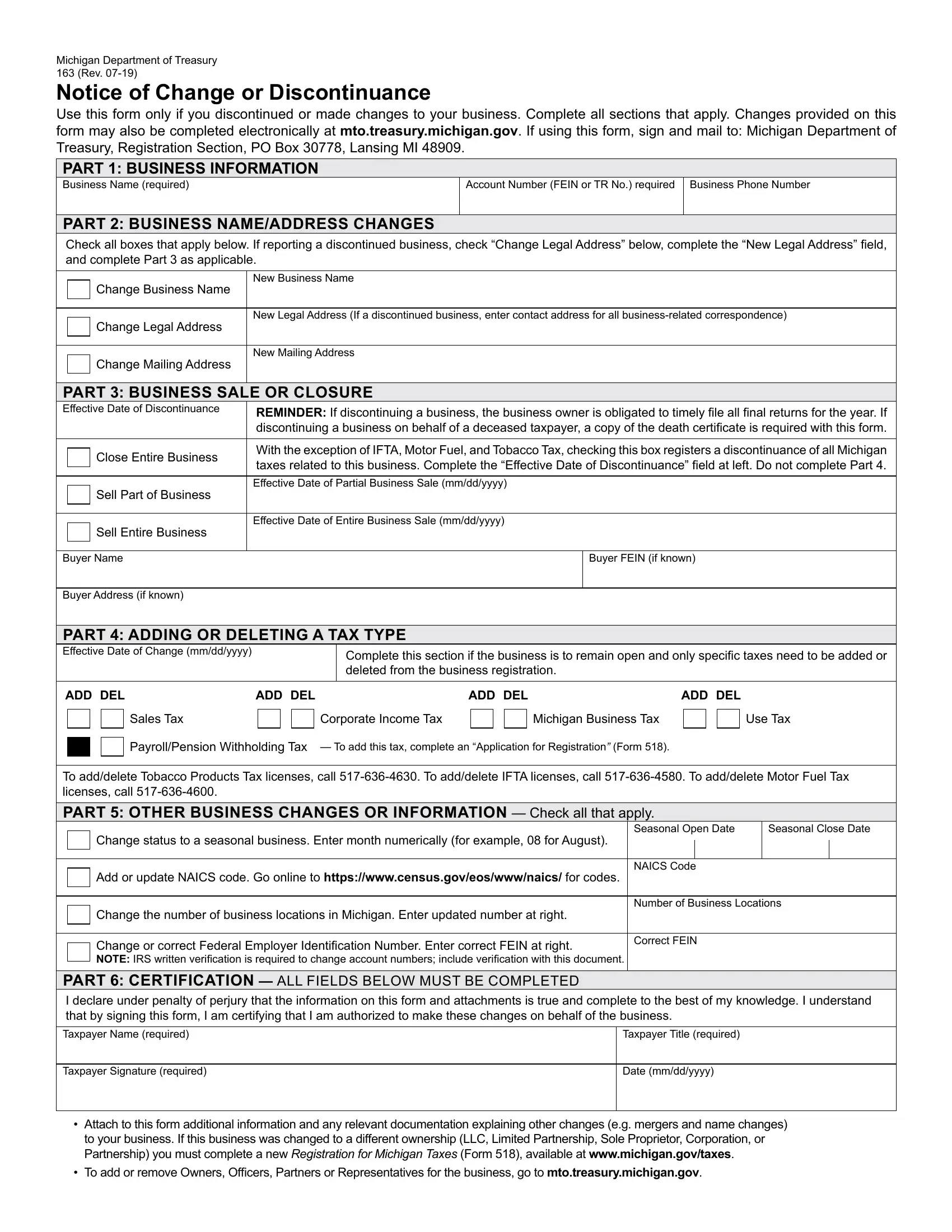

This PDF doc will involve specific details; in order to ensure accuracy and reliability, you need to take heed of the following recommendations:

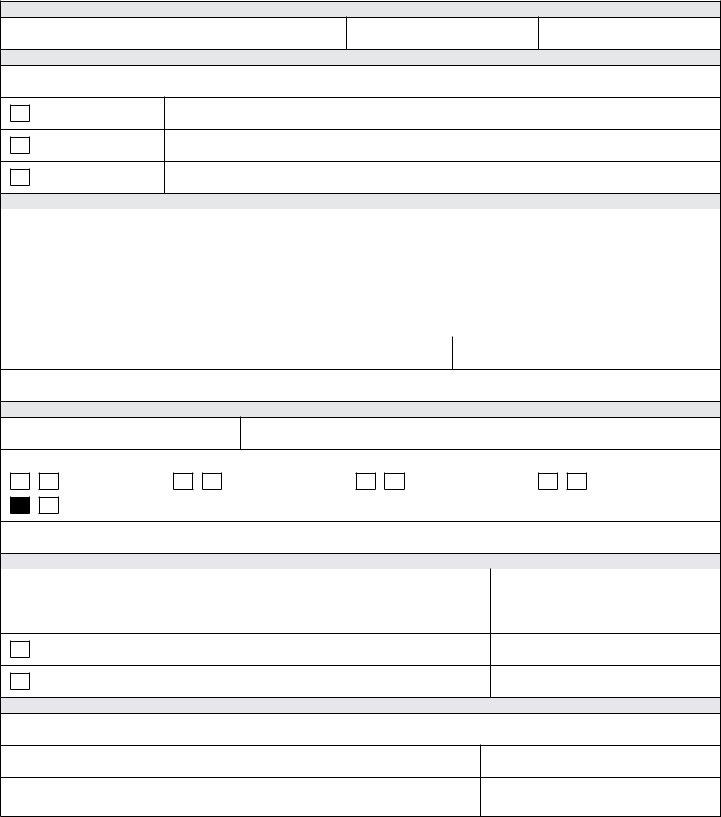

1. The michigan department of treasury form 163 needs particular details to be entered. Be sure the next fields are filled out:

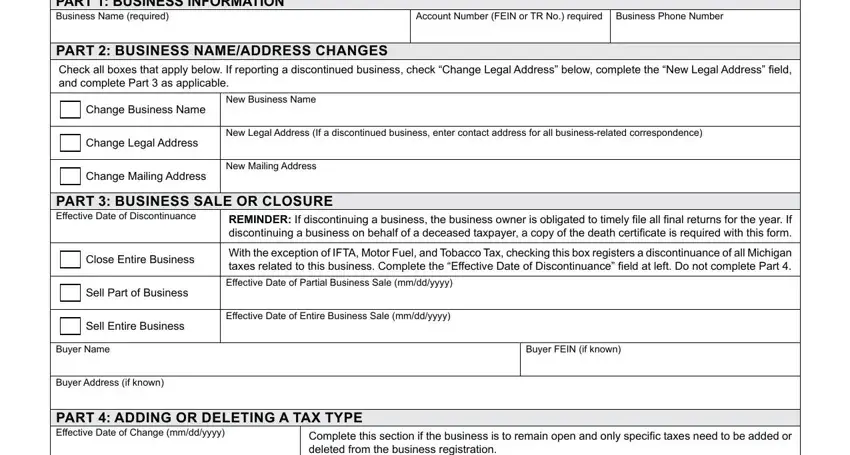

2. Once your current task is complete, take the next step – fill out all of these fields - ADD DEL, ADD DEL, ADD DEL, ADD DEL, Sales Tax, Corporate Income Tax, Michigan Business Tax, Use Tax, PayrollPension Withholding Tax To, To adddelete Tobacco Products Tax, PART OTHER BUSINESS CHANGES OR, Change status to a seasonal, Seasonal Open Date, Seasonal Close Date, and Add or update NAICS code Go online with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Those who use this PDF often make errors when completing To adddelete Tobacco Products Tax in this part. Be sure you revise whatever you enter here.

Step 3: After taking another look at your fields you've filled out, hit "Done" and you're done and dusted! Join FormsPal today and easily access michigan department of treasury form 163, available for download. Each and every edit made is handily saved , helping you to edit the form at a later point as required. We don't share or sell the information you enter when working with documents at FormsPal.