Making use of the online PDF tool by FormsPal, you can fill in or edit form 5081 right here. To keep our tool on the forefront of practicality, we work to put into practice user-oriented capabilities and enhancements on a regular basis. We are at all times pleased to receive suggestions - assist us with reshaping PDF editing. With some basic steps, it is possible to begin your PDF journey:

Step 1: Simply click the "Get Form Button" at the top of this site to see our form editing tool. Here you will find all that is required to fill out your document.

Step 2: As you access the editor, you will see the form prepared to be filled out. Apart from filling in different blanks, you might also perform many other actions with the form, such as adding custom textual content, modifying the initial text, inserting graphics, signing the document, and much more.

It really is straightforward to finish the form adhering to our detailed tutorial! This is what you have to do:

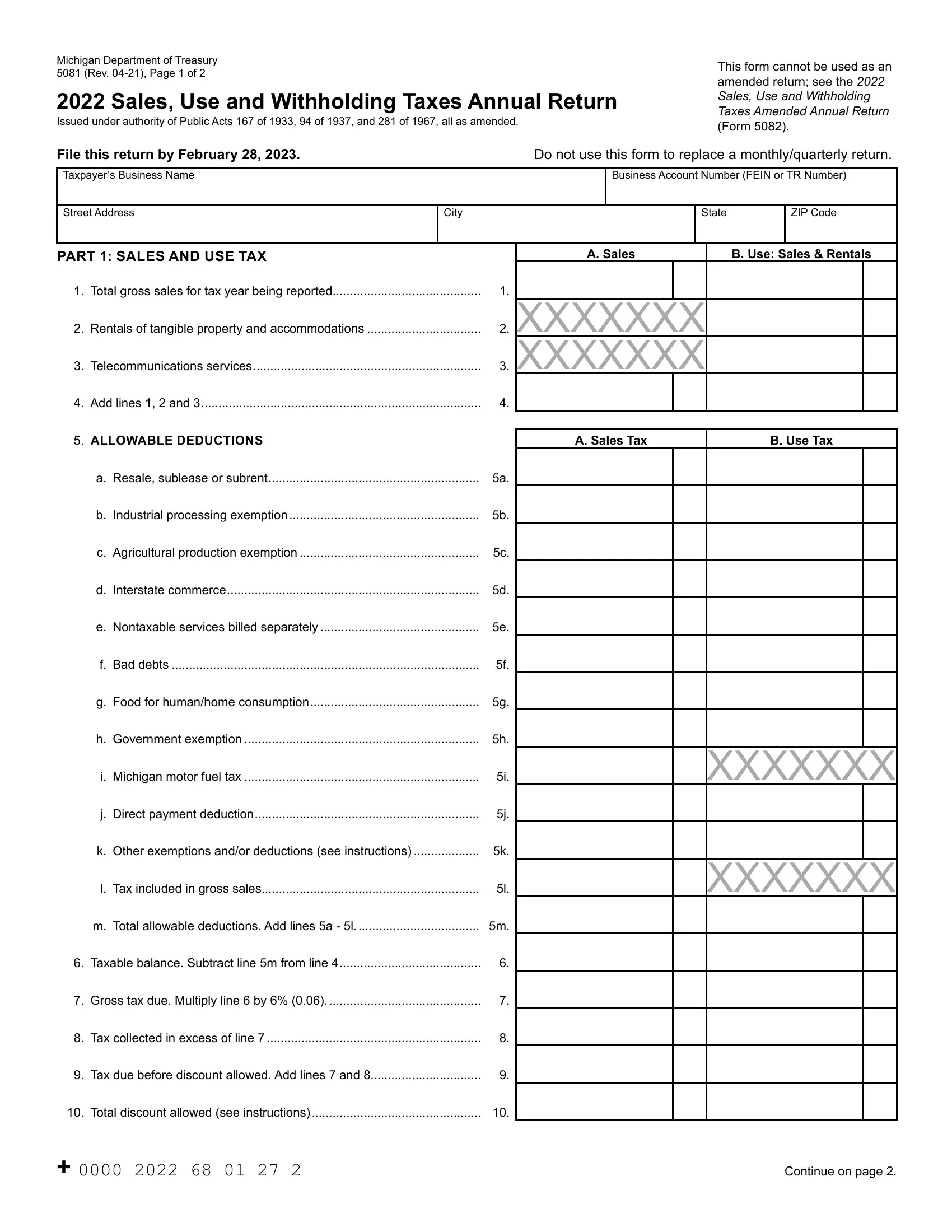

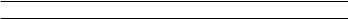

1. Fill out the form 5081 with a number of major blank fields. Consider all of the important information and be sure there is nothing omitted!

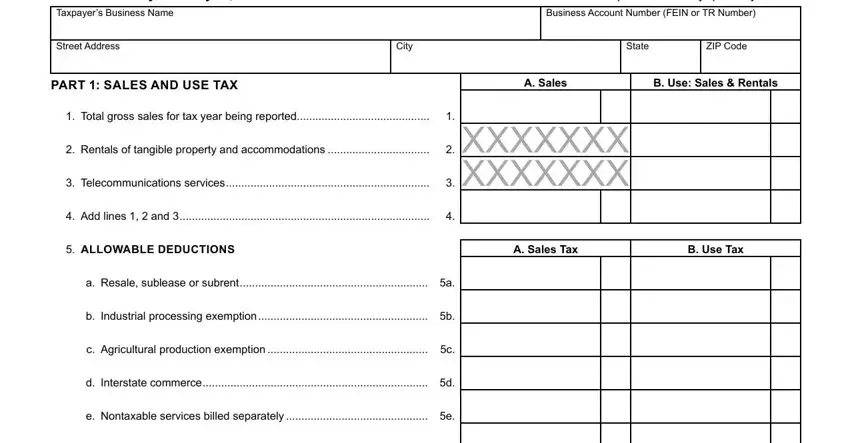

2. Once your current task is complete, take the next step – fill out all of these fields - f Bad debts f, g Food for humanhome consumption g, h Government exemption h, i Michigan motor fuel tax i, j Direct payment deduction j, k Other exemptions andor, l Tax included in gross sales l, m Total allowable deductions Add, Taxable balance Subtract line m, Gross tax due Multiply line by, Tax collected in excess of line, Tax due before discount allowed, XXXXXXX, and XXXXXXX with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

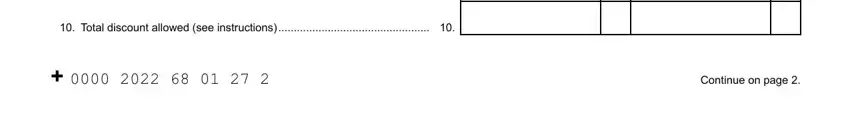

3. Completing Tax due before discount allowed, Total discount allowed see, and Continue on page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

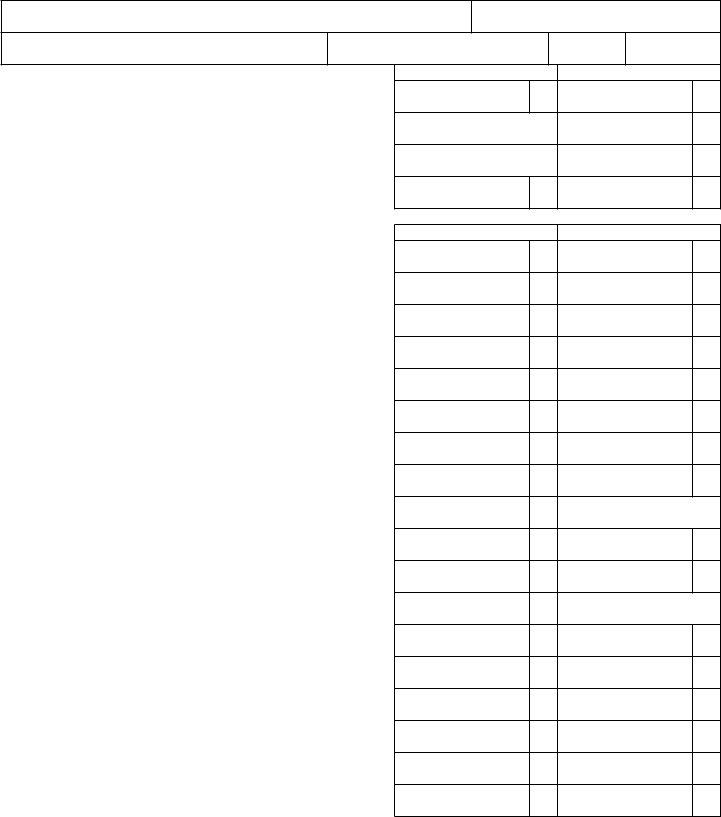

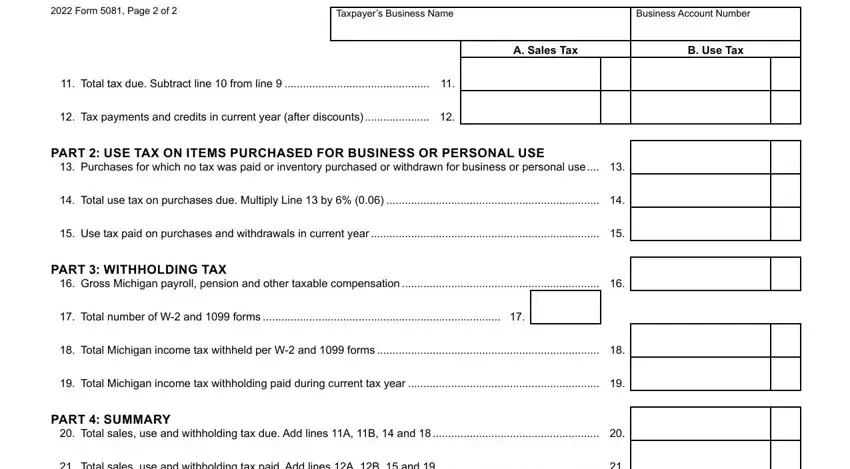

4. It is time to proceed to this fourth form section! Here you will get these Form Page of, Taxpayers Business Name, Business Account Number, A Sales Tax, B Use Tax, Total tax due Subtract line from, Tax payments and credits in, PART USE TAX ON ITEMS PURCHASED, Purchases for which no tax was, Total use tax on purchases due, Use tax paid on purchases and, PART WITHHOLDING TAX, Gross Michigan payroll pension, Total number of W and forms, and Total Michigan income tax blank fields to fill out.

Lots of people often make errors while filling in Purchases for which no tax was in this section. Ensure that you reread whatever you type in here.

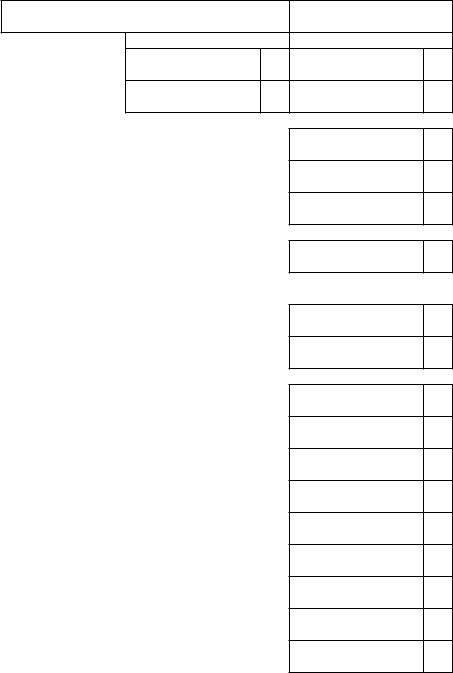

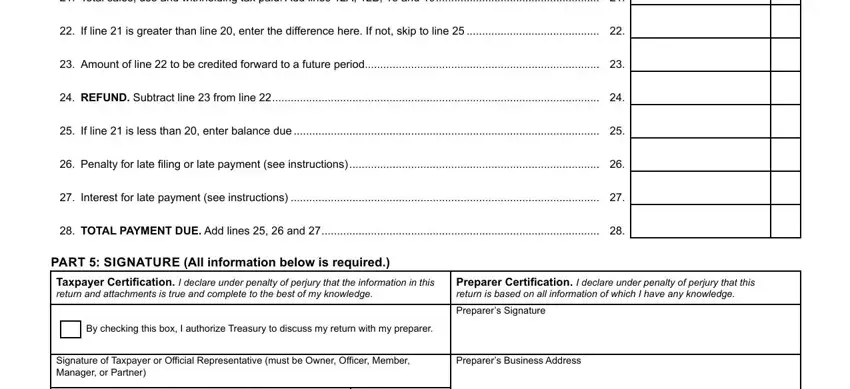

5. The very last point to finish this document is pivotal. Make sure to fill out the mandatory blanks, such as Total sales use and withholding, If line is greater than line, Amount of line to be credited, REFUND Subtract line from line, If line is less than enter, Penalty for late filing or late, Interest for late payment see, TOTAL PAYMENT DUE Add lines and, PART SIGNATURE All information, Preparer Certification I declare, Preparers Signature, By checking this box I authorize, Signature of Taxpayer or Official, Preparers Business Address, and Print Taxpayer or Official, prior to using the form. In any other case, it may contribute to a flawed and probably invalid paper!

Step 3: When you have reviewed the details you filled in, press "Done" to conclude your form at FormsPal. Right after registering a7-day free trial account at FormsPal, you'll be able to download form 5081 or send it through email right away. The PDF form will also be readily available from your personal account with all of your modifications. We do not share or sell any information you type in when dealing with documents at FormsPal.