|

Michigan Department of Treasury |

Report Year |

|

2196 (Rev. 09-12) |

|

2012 |

|

|

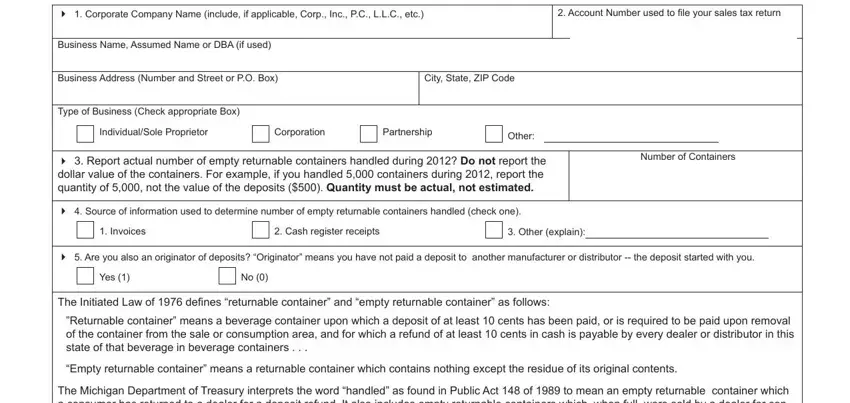

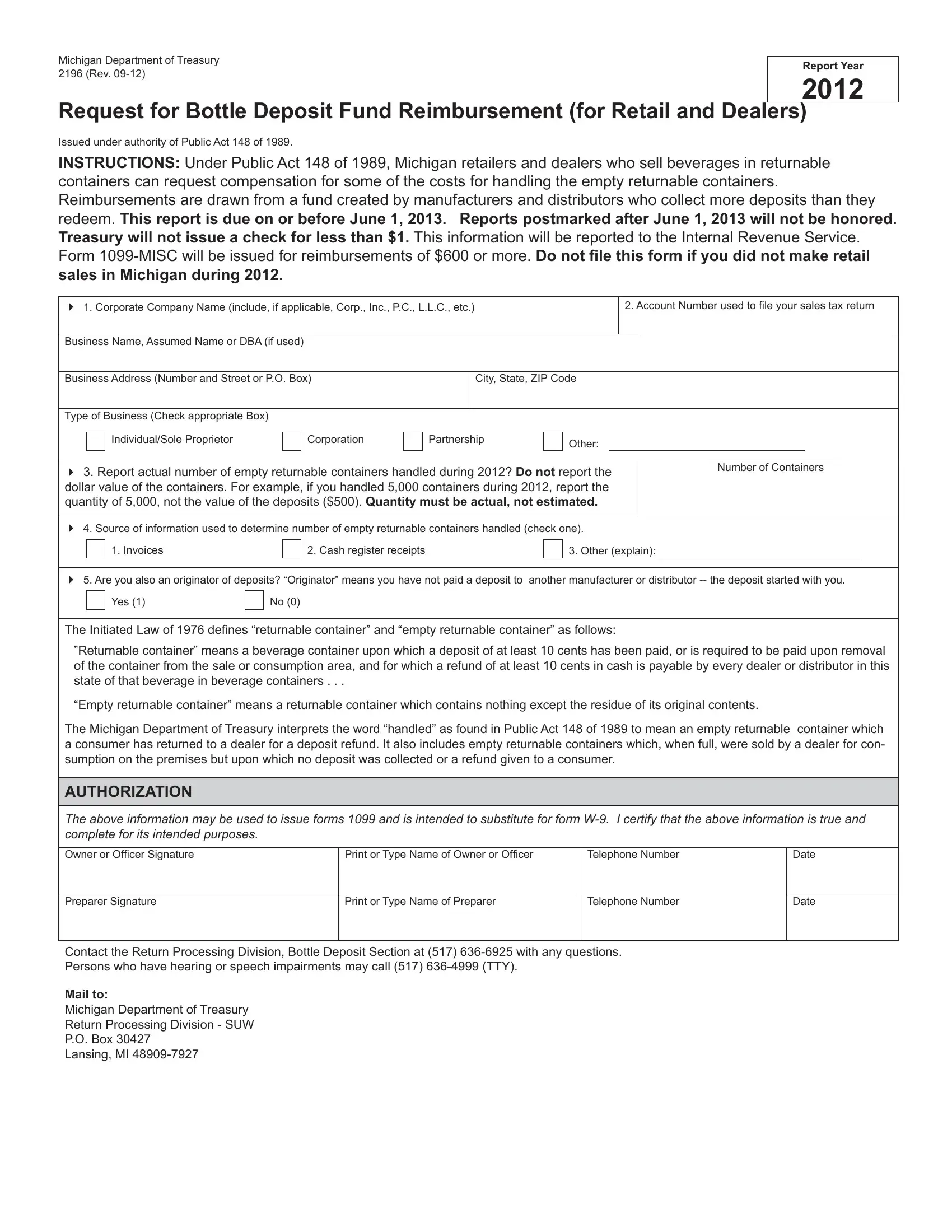

Request for Bottle Deposit Fund Reimbursement (for Retail and Dealers)

Issued under authority of Public Act 148 of 1989.

INSTRUCTIONS: Under Public Act 148 of 1989, Michigan retailers and dealers who sell beverages in returnable containers can request compensation for some of the costs for handling the empty returnable containers. Reimbursements are drawn from a fund created by manufacturers and distributors who collect more deposits than they redeem. This report is due on or before June 1, 2013. Reports postmarked after June 1, 2013 will not be honored. Treasury will not issue a check for less than $1. This information will be reported to the Internal Revenue Service. Form 1099-MISC will be issued for reimbursements of $600 or more. Do not fi le this form if you did not make retail sales in Michigan during 2012.

1. Corporate Company Name (include, if applicable, Corp., Inc., P.C., L.L.C., etc.) |

|

|

|

|

2. Account Number used to fi le your sales tax return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name, Assumed Name or DBA (if used) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address (Number and Street or P.O. Box) |

|

City, State, ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Business (Check appropriate Box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual/Sole Proprietor |

|

|

Corporation |

|

|

Partnership |

|

|

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Report actual number of empty returnable containers handled during 2012? Do not report the |

|

|

Number of Containers |

|

|

|

|

|

|

dollar value of the containers. For example, if you handled 5,000 containers during 2012, report the |

|

|

|

|

|

|

quantity of 5,000, not the value of the deposits ($500). Quantity must be actual, not estimated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Source of information used to determine number of empty returnable containers handled (check one). |

|

|

|

|

|

|

|

|

1. Invoices |

|

|

2. Cash register receipts |

|

|

|

|

3. Other (explain): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Are you also an originator of deposits? “Originator” means you have not paid a deposit to |

another manufacturer or distributor -- the deposit started with you. |

|

|

Yes (1) |

|

|

No (0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Initiated Law of 1976 defi nes “returnable container” and “empty returnable container” as follows:

”Returnable container” means a beverage container upon which a deposit of at least 10 cents has been paid, or is required to be paid upon removal of the container from the sale or consumption area, and for which a refund of at least 10 cents in cash is payable by every dealer or distributor in this state of that beverage in beverage containers . . .

“Empty returnable container” means a returnable container which contains nothing except the residue of its original contents.

The Michigan Department of Treasury interprets the word “handled” as found in Public Act 148 of 1989 to mean an empty returnable container which a consumer has returned to a dealer for a deposit refund. It also includes empty returnable containers which, when full, were sold by a dealer for con- sumption on the premises but upon which no deposit was collected or a refund given to a consumer.

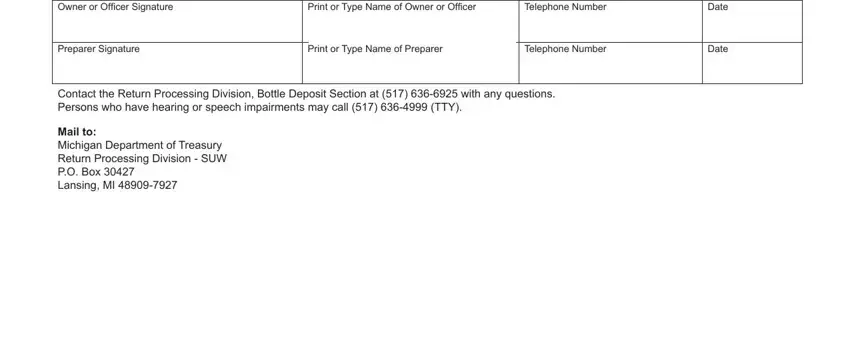

AUTHORIZATION

The above information may be used to issue forms 1099 and is intended to substitute for form W-9. I certify that the above information is true and complete for its intended purposes.

Owner or Offi cer Signature |

|

Print or Type Name of Owner or Officer |

|

Telephone Number |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer Signature |

|

Print or Type Name of Preparer |

|

Telephone Number |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact the Return Processing Division, Bottle Deposit Section at (517) 636-6925 with any questions.

Persons who have hearing or speech impairments may call (517) 636-4999 (TTY).

Mail to:

Michigan Department of Treasury

Return Processing Division - SUW

P.O. Box 30427

Lansing, MI 48909-7927

Bottle Deposit Fund Reimbursement Availability

INSTRUCTIONS: Under Public Act 148 of 1989, Michigan retailers and dealers who sell beverages in returnable containers can request compensation for some of the costs for handling the empty returnable containers.

Reimbursements are drawn from a fund created by manufacturers and distributors who collect more deposits than they redeem.

The payment is based on the number of empty returnable containers handled in a calendar year. Payment amounts will be known after Treasury determines how much money is available.

To apply, you must complete and mail a Request for Bottle Deposit Fund Reimbursement (Form 2196) to Treasury. Form 2196 is due on or before June 1, 2013. Use Form 2196 or contact Return Processing Division, Bottle Deposit Section, at (517) 636-6925 for more information.

Treasury will begin issuing checks after August 1.