In case you wish to fill out michigan form 5082 2019, it's not necessary to install any programs - simply try our PDF tool. To keep our tool on the cutting edge of convenience, we strive to put into operation user-driven features and enhancements regularly. We're always looking for feedback - join us in revolutionizing how you work with PDF forms. To get the ball rolling, take these simple steps:

Step 1: Open the PDF file in our editor by pressing the "Get Form Button" above on this page.

Step 2: Once you open the PDF editor, you'll see the form made ready to be completed. Besides filling out different blank fields, you might also perform several other things with the PDF, such as adding any text, modifying the original text, inserting illustrations or photos, affixing your signature to the form, and much more.

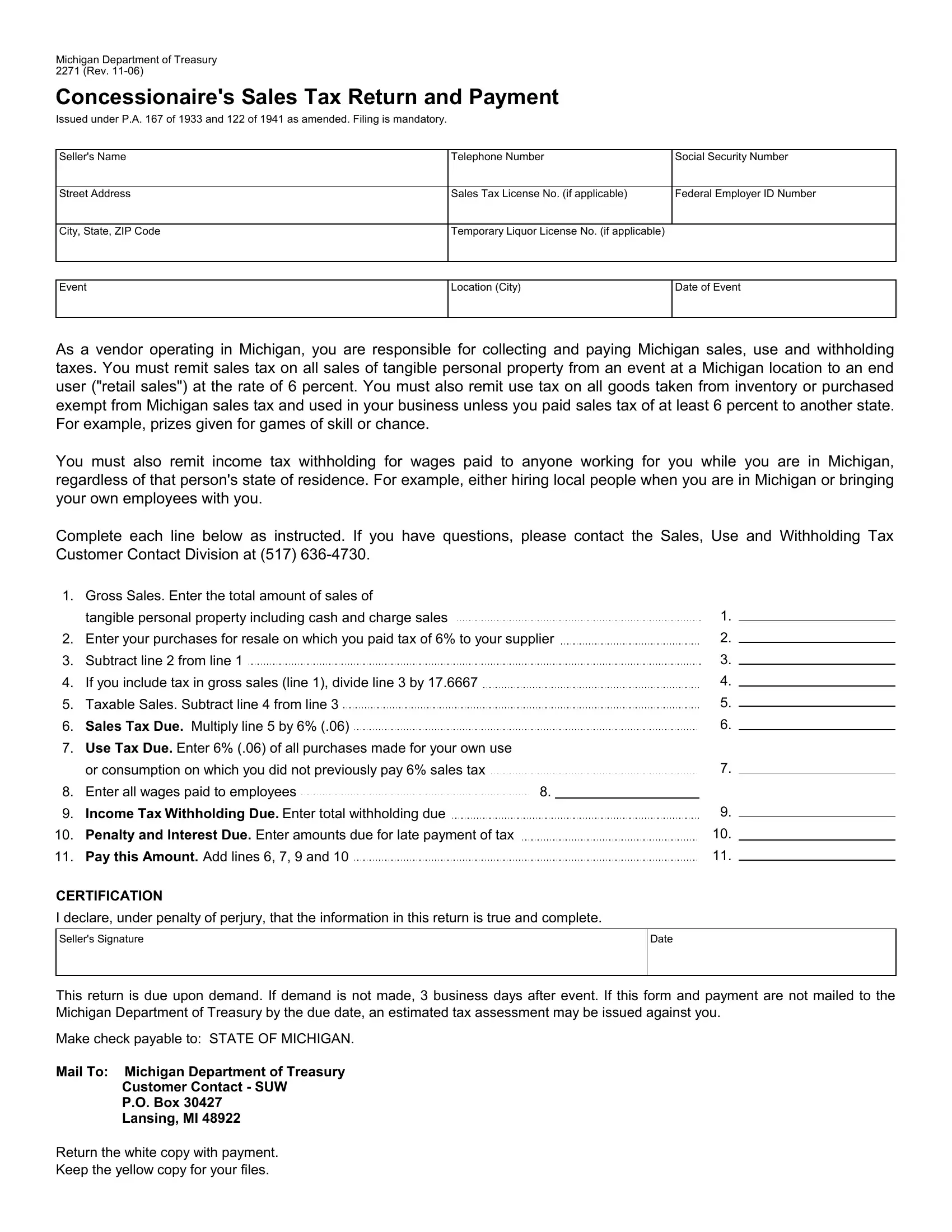

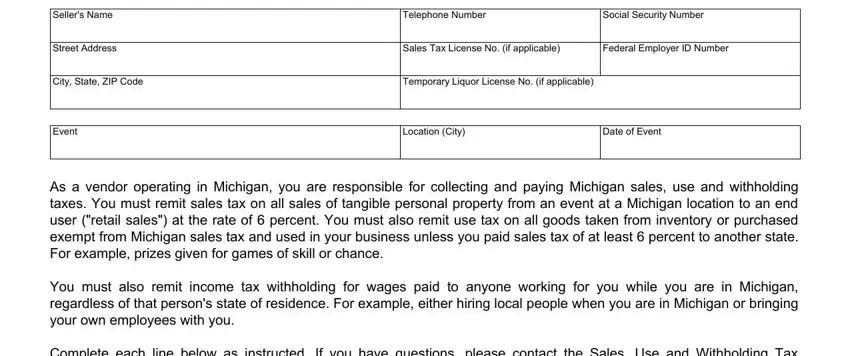

As a way to finalize this form, make certain you provide the required information in each blank field:

1. Fill out the michigan form 5082 2019 with a group of major fields. Note all of the necessary information and ensure absolutely nothing is omitted!

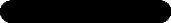

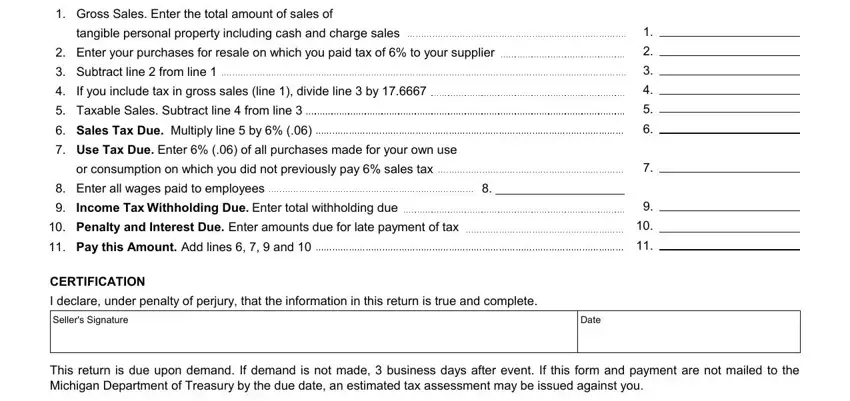

2. Right after performing the last step, go on to the next part and fill out the essential particulars in all these blank fields - Gross Sales Enter the total amount, tangible personal property, Enter your purchases for resale on, Subtract line from line, If you include tax in gross sales, Taxable Sales Subtract line from, Sales Tax Due Multiply line by, Use Tax Due Enter of all, or consumption on which you did, Enter all wages paid to employees, Income Tax Withholding Due Enter, Penalty and Interest Due Enter, Pay this Amount Add lines and, CERTIFICATION, and I declare under penalty of perjury.

Always be extremely careful when completing Taxable Sales Subtract line from and Subtract line from line, since this is the section in which many people make a few mistakes.

Step 3: Go through all the information you have typed into the form fields and press the "Done" button. Acquire the michigan form 5082 2019 when you register here for a free trial. Quickly view the pdf inside your personal account, along with any edits and changes being automatically preserved! FormsPal ensures your data confidentiality by having a secure system that in no way saves or distributes any type of personal information involved in the process. Rest assured knowing your documents are kept protected whenever you work with our services!