Should you intend to fill out Michigan Form 2823, it's not necessary to download and install any kind of applications - just use our online tool. In order to make our tool better and more convenient to utilize, we constantly implement new features, considering feedback from our users. Getting underway is simple! Everything you need to do is adhere to these basic steps directly below:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: This tool grants the ability to work with your PDF file in a variety of ways. Transform it by adding any text, adjust original content, and add a signature - all possible in minutes!

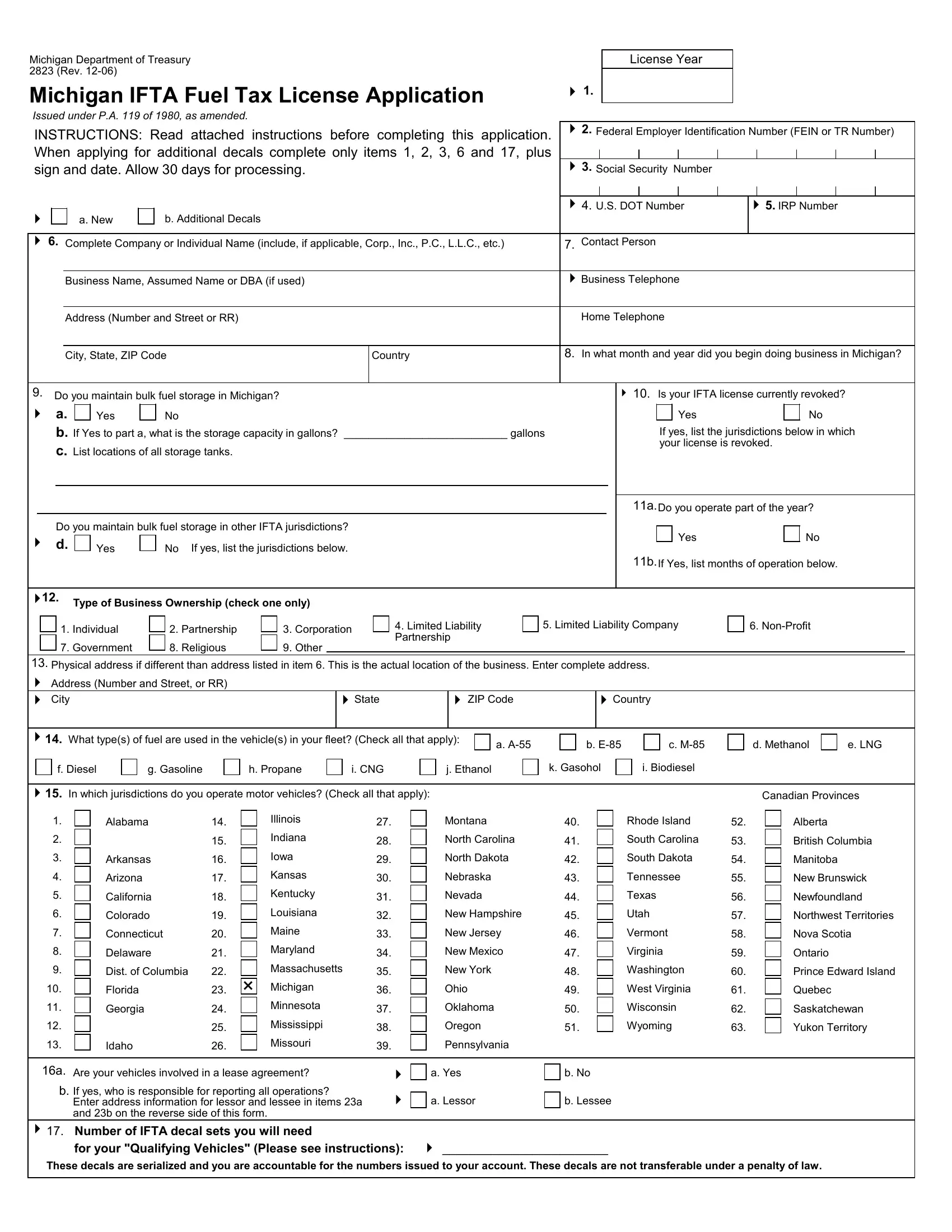

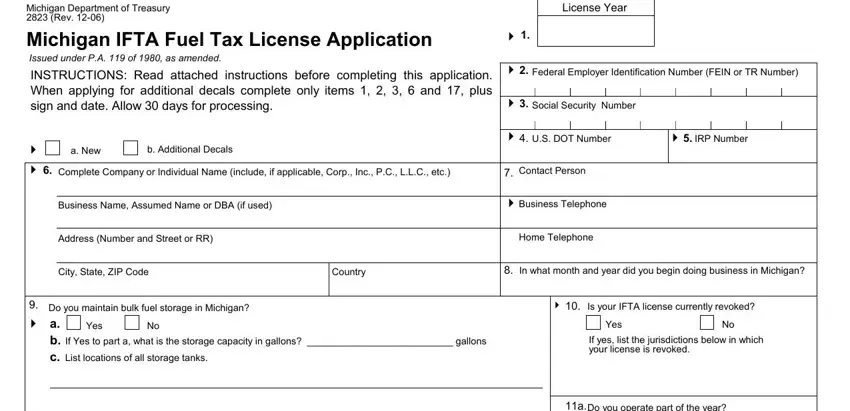

So as to fill out this document, make sure you enter the required details in every single blank:

1. While completing the Michigan Form 2823, ensure to include all necessary blank fields in their corresponding section. This will help to expedite the work, allowing for your details to be handled without delay and correctly.

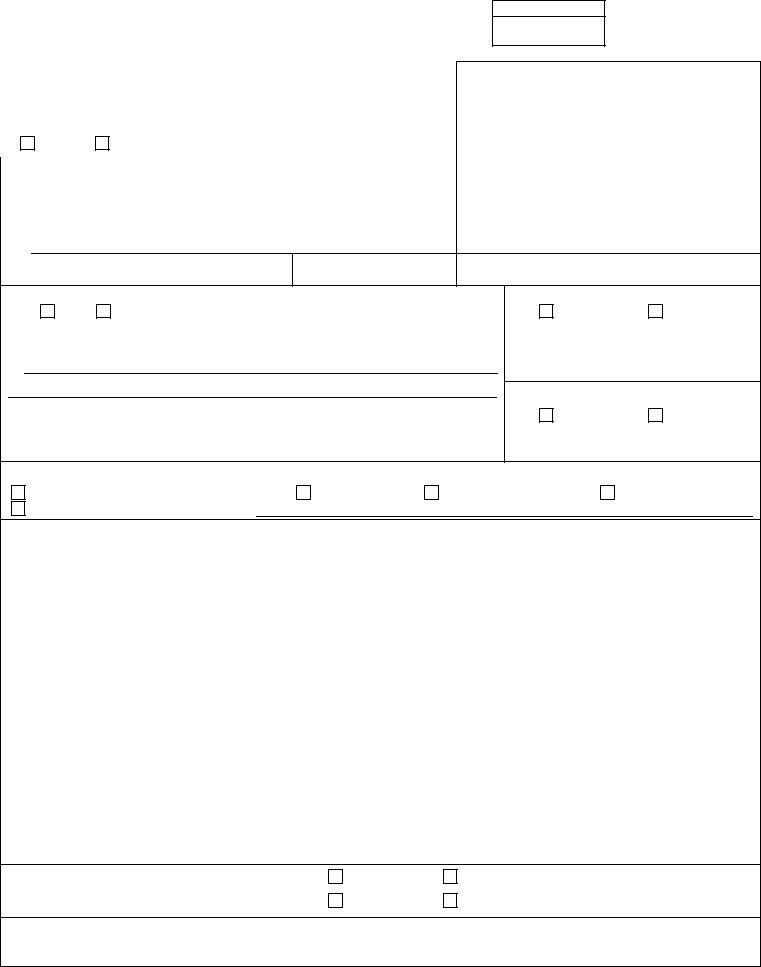

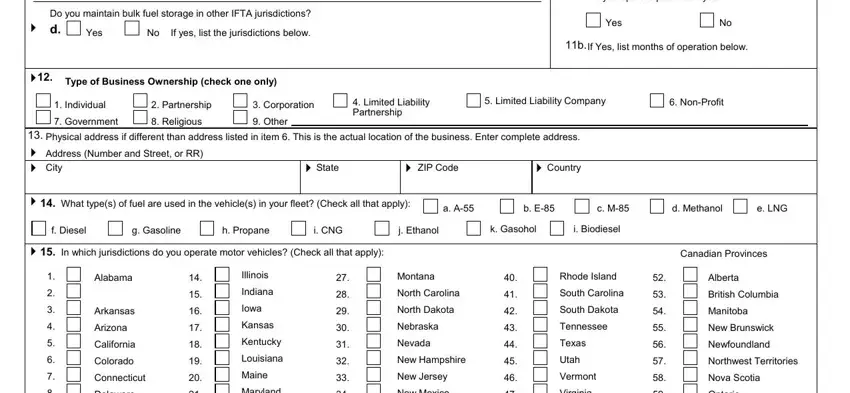

2. After this selection of blank fields is completed, proceed to enter the relevant information in these - cid, Do you maintain bulk fuel storage, If yes list the jurisdictions below, Yes, Do you operate part of the year, Yes, If Yes list months of operation, cid Type of Business Ownership, Individual, Partnership, Corporation, Government, Religious, Other, and Limited Liability Partnership.

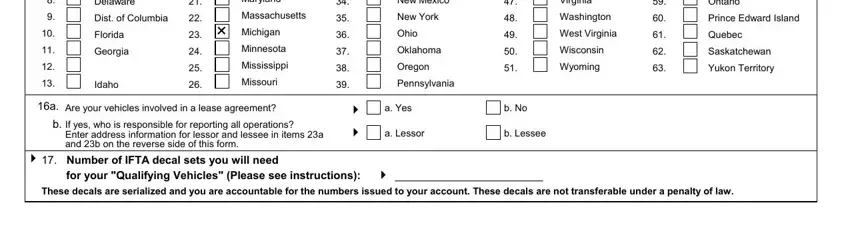

3. The next part is generally easy - fill out all of the fields in Delaware, Dist of Columbia, Florida, Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, New Mexico, New York, Ohio, and Oklahoma to conclude this segment.

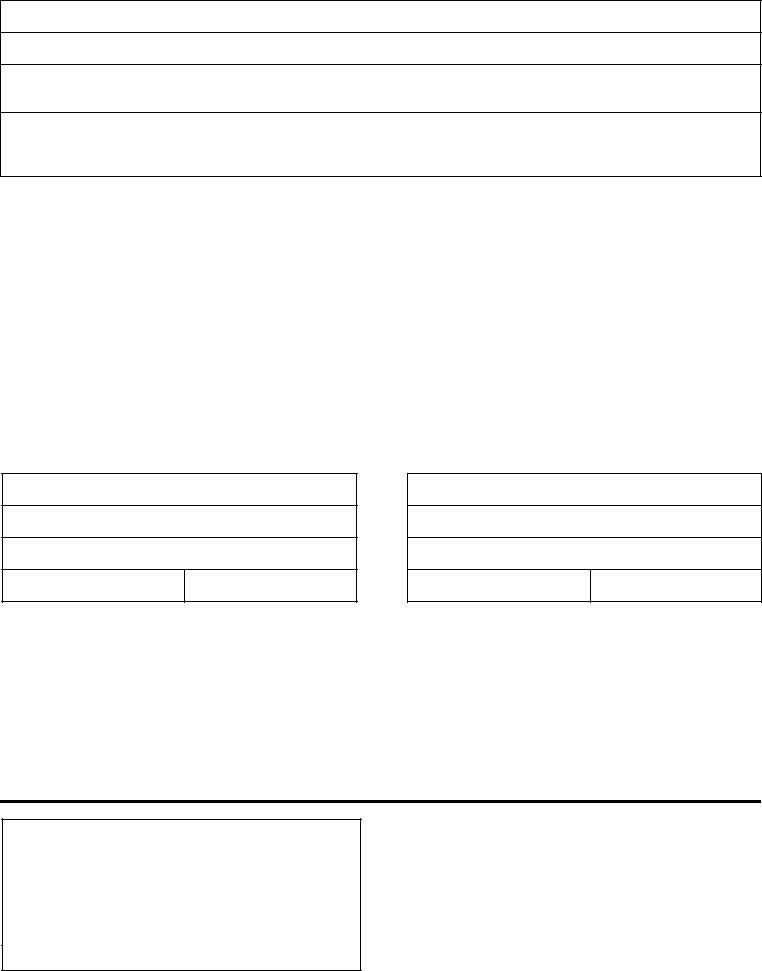

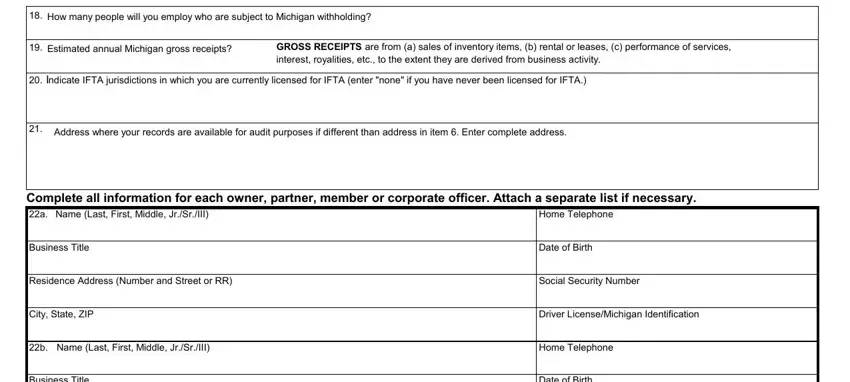

4. Your next subsection requires your information in the following places: How many people will you employ, Estimated annual Michigan gross, GROSS RECEIPTS are from a sales of, Indicate IFTA jurisdictions in, Address where your records are, Complete all information for each, Home Telephone, Business Title, Date of Birth, Residence Address Number and, Social Security Number, City State ZIP, Driver LicenseMichigan, b Name Last First Middle JrSrIII, and Business Title. Just remember to fill in all required details to move forward.

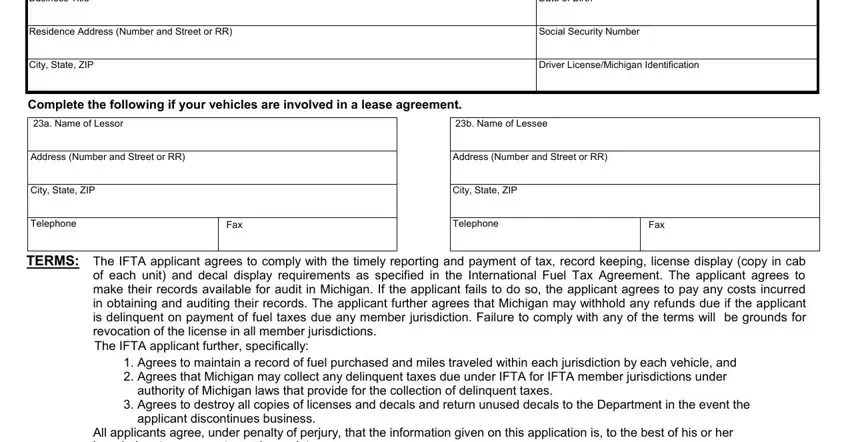

5. When you reach the end of your file, there are a few extra points to complete. Mainly, Business Title, Date of Birth, Residence Address Number and, Social Security Number, City State ZIP, Driver LicenseMichigan, Complete the following if your, a Name of Lessor, b Name of Lessee, Address Number and Street or RR, Address Number and Street or RR, City State ZIP, City State ZIP, Telephone, and TERMS must be done.

As to Address Number and Street or RR and a Name of Lessor, make sure that you don't make any errors here. Those two are the most important ones in this file.

Step 3: Right after you've looked once again at the details entered, click on "Done" to complete your FormsPal process. After registering afree trial account with us, you'll be able to download Michigan Form 2823 or send it through email without delay. The document will also be accessible in your personal account with all your modifications. We do not share the information you enter while filling out forms at FormsPal.