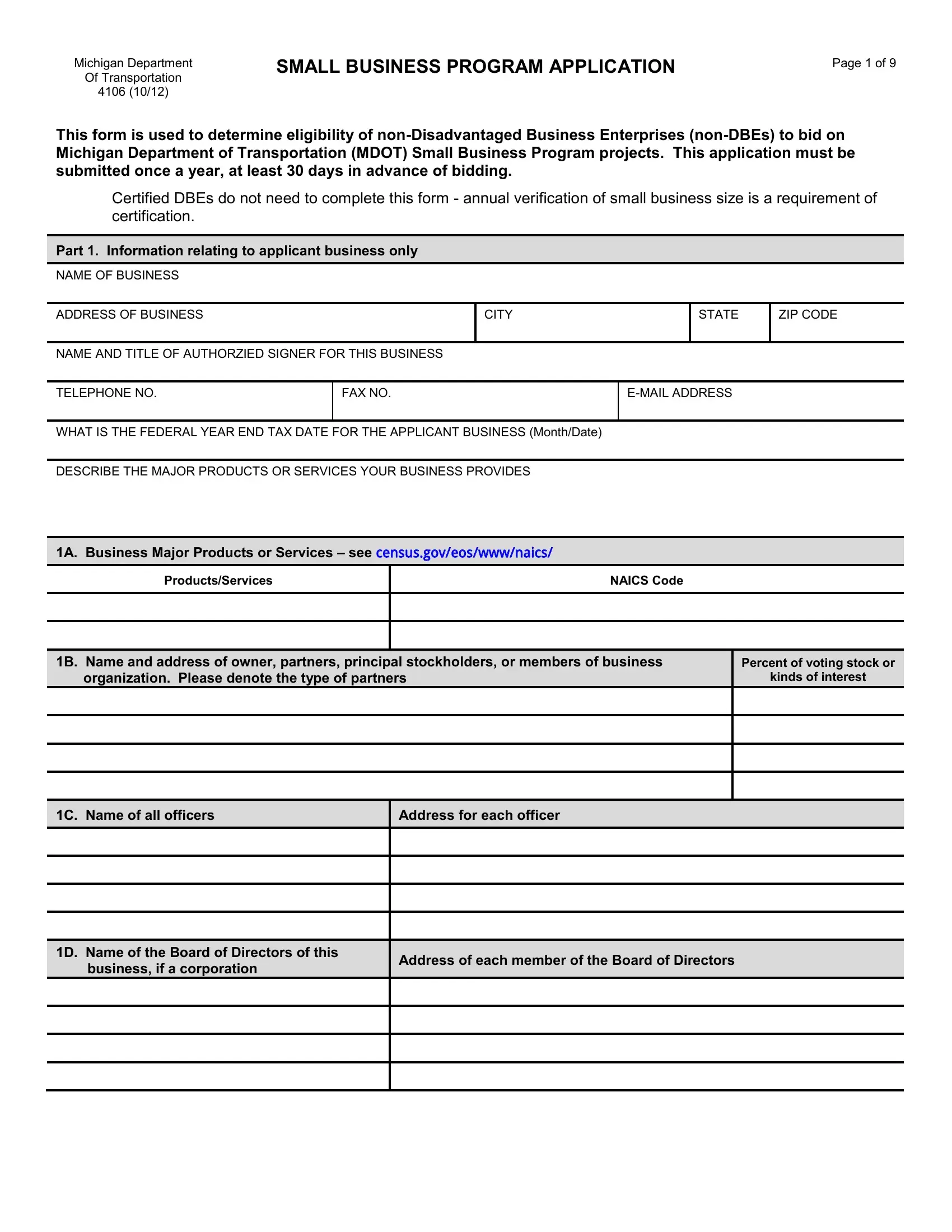

Michigan Department

Of Transportation

4106 (10/12)

SMALL BUSINESS PROGRAM APPLICATION

This form is used to determine eligibility of non-Disadvantaged Business Enterprises (non-DBEs) to bid on Michigan Department of Transportation (MDOT) Small Business Program projects. This application must be submitted once a year, at least 30 days in advance of bidding.

Certified DBEs do not need to complete this form - annual verification of small business size is a requirement of certification.

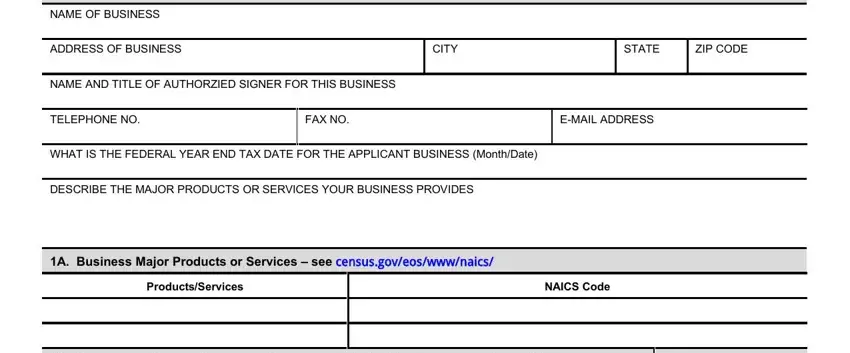

Part 1. Information relating to applicant business only

NAME OF BUSINESS

ADDRESS OF BUSINESS |

|

CITY |

|

STATE |

ZIP CODE |

|

|

|

|

|

|

NAME AND TITLE OF AUTHORZIED SIGNER FOR THIS BUSINESS |

|

|

|

|

|

|

|

TELEPHONE NO. |

FAX NO. |

E-MAIL ADDRESS |

|

|

|

|

|

|

WHAT IS THE FEDERAL YEAR END TAX DATE FOR THE APPLICANT BUSINESS (Month/Date) |

|

|

|

|

|

|

|

DESCRIBE THE MAJOR PRODUCTS OR SERVICES YOUR BUSINESS PROVIDES |

|

|

|

1A. Business Major Products or Services – see FHVVJRYHRVZZZDLFV

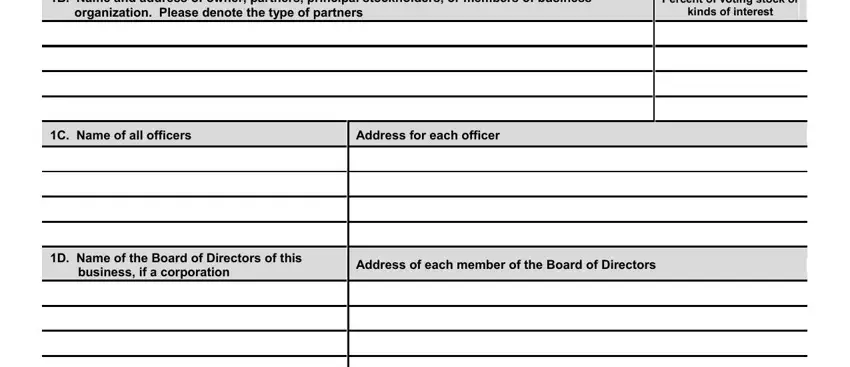

1B. Name and address of owner, partners, principal stockholders, or members of business

organization. Please denote the type of partners

Percent of voting stock or

kinds of interest

|

|

|

|

|

|

1C. Name of all officers |

|

|

Address for each officer |

|

|

|

|

|

|

|

|

|

|

|

|

1D. Name of the Board of Directors of this |

|

|

|

|

|

|

|

|

Address of each member of the Board of Directors |

|

business, if a corporation |

|

|

|

|

|

|

|

|

MDOT 4106 (10/12) |

Page 2 of 9 |

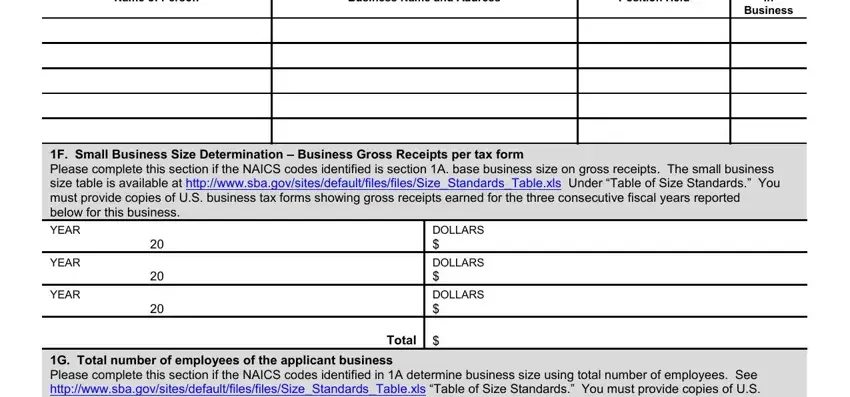

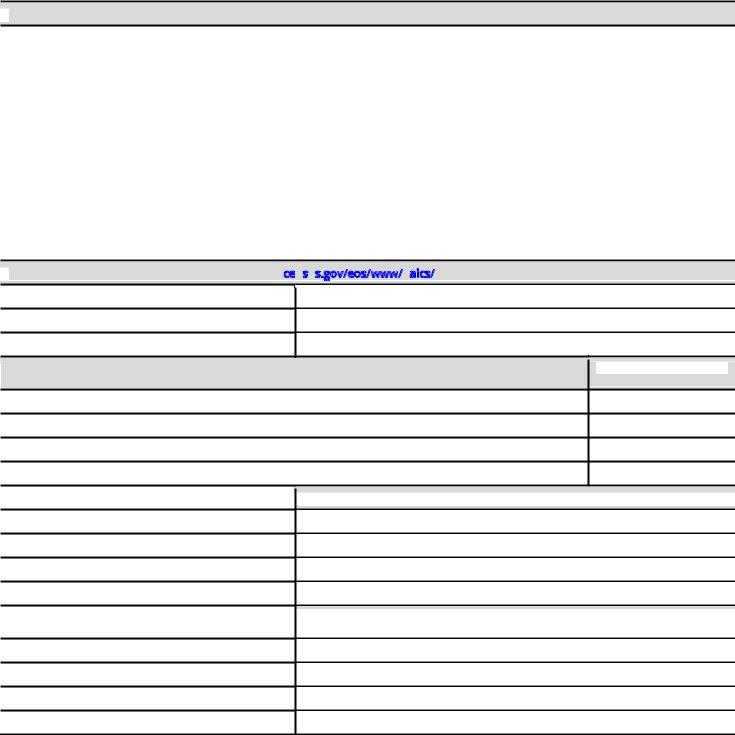

1E. If any person listed in 1B, 1C, or 1D is an owner, partner, director, officer, member, employee or principal stockholder in

another business, please provide the following information (add extra pages if needed).

Business Name and Address

1F. Small Business Size Determination – Business Gross Receipts per tax form

Please complete this section if the NAICS codes identified is section 1A. base business size on gross receipts. The small business size table is available at http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls Under “Table of Size Standards.” You must provide copies of U.S. business tax forms showing gross receipts earned for the three consecutive fiscal years reported below for this business.

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

Total |

$ |

|

|

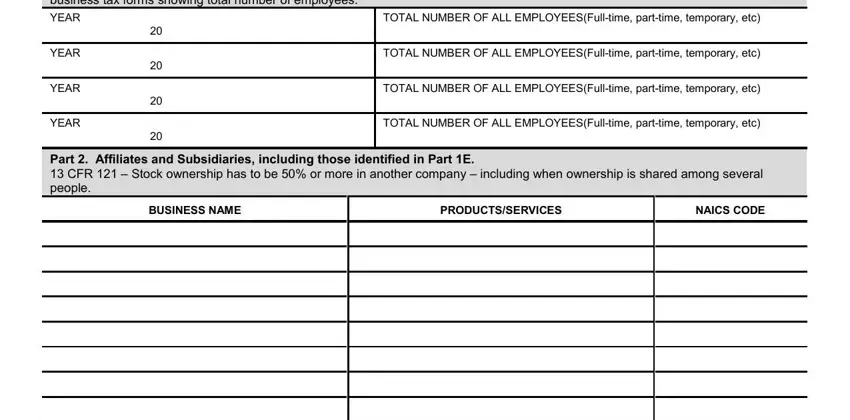

1G. Total number of employees of the applicant business

Please complete this section if the NAICS codes identified in 1A determine business size using total number of employees. See http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls “Table of Size Standards.” You must provide copies of U.S. business tax forms showing total number of employees.

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

|

|

|

Part 2. Affiliates and Subsidiaries, including those identified in Part 1E.

13 CFR 121 – Stock ownership has to be 50% or more in another company – including when ownership is shared among several people.

MDOT 4106 (10/12) |

Page 3 of 9 |

2A. Gross sales or receipts of 1st affiliate business for the past three fiscal years

You must provide copies of U.S. business tax forms for the fiscal years reported below which show gross receipts of all subsidiaries or affiliates.

NAME AND ADDRESS OF AFFILIATE OR SUBSIDIARY

YEAR

20

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

Total |

$ |

|

|

2B. Gross sales or receipts of 2nd affiliate business for the past three fiscal years

You must provide copies of U.S. business tax forms for the fiscal years reported below which show gross receipts of all subsidiaries or affiliates. If you have more than two affiliates or subsidiaries, please attach additional pages for those affiliates.

NAME AND ADDRESS OF 2nd AFFILIATE

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

Total |

$ |

2C. Total number of employees of 1st affiliate |

|

Please complete this section if the NAICS codes identified in section 1A. base business size on number of employees. The small business size table is available at http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls under “Table of Size Standards.” You must provide copies of U.S. business tax forms showing total numbers of full-time, part-time, temporary, or seasonal employees who have worked for this affiliate during each of the last three consecutive fiscal years.

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

2D. Total number of employees of 2nd affiliate

Please complete this section if the NAICS codes identified in section 1A. base business size on number of employees.

The small business size table is available at http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls under “Table of

Size Standards.” You must provide copies of U.S. business tax forms showing total numbers of full-time, part-time, temporary, or seasonal employees who have worked for this affiliate during each of the last three consecutive fiscal years. If you have more than two affiliates, attach separate pages containing the required information.

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL EMPLOYEES(Full-time, part-time, temporary, etc) |

|

|

|

|

|

CERTIFICATION

I hereby certify that all information provided on this form and in attachments are true and correct to the best of my knowledge and belief. This information is submitted for the purpose of assisting the MDOT in making a size determination in order that my business may participate in the Race-Neutral Small Business Program.

NAME OF SOLE PROPRIETORSHIP, PARTNERSHIP, LIMITED LIABILITY COMPANY, OR CORPORATION

MDOT 4106 (10/12) |

Page 4 of 9 |

Instructions FOR SMALL BUSINESS Program application

For participation in the Michigan Department of Transportation (MDOT)

SMALL BUSINESS PROGRAM

Carefully read these instructions and the United States Small Business Administration (SBA) size regulations found at 13 Code of Federal Regulations Part 121 before completing this form.

To qualify for the Small Business Program, applicants must meet SBA small business size standards for the industry in which the applicant will be bidding.

No business, including affiliates and subsidiaries, will qualify for this program if gross receipts as averaged over the previous three years exceed $22.41 million.

General Instructions

1.Information provided will be used by the MDOT to determine small business size of non- disadvantaged business enterprises (non-DBEs). MDOT may, at its discretion, request additional information not specifically identified on this form.

a.Non-DBEs must provide this information once a year, or at least 30 days before bidding, in order to bid on Small Business Program projects.

b.Michigan-certified DBEs do not need to complete this form. Annual verification of small business size is a condition of DBE certification.

2.Select North American Industry Classification System (NAICS) codes that best describe your business and then determine if the business meets size standards for the selected codes. SBA size standards are usually stated either in number of employees over the past 12 months, or average annual receipts over the past three years – whichever number represents the largest size of your business right now (including subsidiaries and affiliates). Size standards are available for every private sector industry in the U.S. economy, with the NAICS used to identify the industries. The steps are simple to determine your size:

a.Identify the NAICS code(s) that best describe(s) your business activities. http://www.census.gov/eos/www/naics/

See Identifying Industry Codes at http://www.sba.gov/content/identifying-industry- codes for more helpful resources.

b.Determine your Industry's size standard using the Table of Small Business Size Standards at http://www.sba.gov/content/table-small-business-size-standards. Match your NAICS code(s) with the appropriate size standard(s).

3.One copy of MDOT SBP Application, with additional sheets attached as needed, must be returned to the MDOT Office of Business Development.

4.The person signing this form must be authorized to do so. Non-employee representatives of the business, such as attorneys or accountants, must provide a letter authorizing them to represent the firm. The information requested must be complete. Failure to supply complete information may cause delays in making a size determination or impose adverse inferences that the business is not small.

5.All affiliates of the business, whether acknowledged or not, and whether foreign or domestic, must be disclosed. SBA's criteria for defining affiliates should be carefully reviewed. In 13 CFR §121.103, SBA identifies various forms of affiliation.

MDOT 4106 (10/12) |

Page 5 of 9 |

6.Where the applicable size standard involves "number of employees", a business' average number of employees on payroll before for the 12 months preceding the application or offers is examined, including all individuals who are fulltime, part-time, temporary or other basis, of both domestic and foreign affiliates. See 13 CFR § 121.106 of SBA's regulations.

7.Where applicable size standards involve "average annual receipts", a business' annual receipts mean total income (or gross income in the case of a sole proprietorship) plus cost of goods sold as these terms are defined and reported on the business' Federal Income Tax Return, which must be attached to this eligibility request determination. See 13 CFR § 121.104 of SBA's regulations.

8.MDOT must determine the primary industry activity or the NAICS code of a business as part of its size determination for the Small Business Program. In making this size determination, consideration is given to various criteria, such as the distribution of a business' revenues, employment and costs associated with doing business. See 13 CFR 121.107.

9.For purposes of this form, MDOT considers a principal of the business as those persons or affiliated businesses that own 10 percent or more of its ownership. In cases where no individual or affiliated business owns at least 10 percent interest, the five largest interest holders and their percentages of interest must be listed. Additionally, the principal officers and their interest in the business must be listed.

10.Affiliation is defined in the Small Business Administration (SBA) regulations, 13 CFR part 121.

(1)Except as otherwise provided in 13 CFR part 121, concerns are affiliates of each other when, either directly or indirectly:

(i)One concern controls or has the power to control the other; or

(ii)A third party or parties controls or has the power to control both; or

(iii)An identity of interest between or among parties exists such that affiliation may be found.

(2)In determining whether affiliation exists, it is necessary to consider all appropriate factors, including common ownership, common management, and contractual relationships. Affiliates must be considered together in determining whether a concern meets small business size criteria and the statutory cap on the participation of firms in the DBE program.

(6)In determining the concern's size, SBA counts the receipts, employees, or other measure of size of the concern whose size is at issue and all of its domestic and foreign affiliates, regardless of whether the affiliates are organized for profit.

(b)Exceptions to affiliation coverage. (1) Business concerns owned in whole or substantial part by investment companies licensed, or development companies qualifying, under the Small Business Investment Act of 1958, as amended, are not considered affiliates of such investment companies or development companies.

(7)(c) Affiliation based on stock ownership. (1) A person (including any individual, concern or other entity) that owns, or has the power to control, 50 percent or more of a concern's voting stock, or a block of voting stock which is large compared to other outstanding blocks of voting stock, controls or has the power to control the concern.

(7)(4)(e) Affiliation based on common management. Affiliation arises where one or more officers, directors, managing members, or partners who control the board of directors and/or management of one concern also control the board of directors or management of one or more other concerns.

MDOT 4106 (10/12) |

Page 6 of 9 |

(f)Affiliation based on identity of interest. Affiliation may arise among two or more persons with an identity of interest. Individuals or firms that have identical or substantially identical business or economic interests (such as family members, individuals or firms with common investments, or firms that are economically dependent through contractual or other relationships) may be treated as one party with such interests aggregated. Where SBA determines that such interests should be aggregated, an individual or firm may rebut that determination with evidence showing that the interests deemed to be one are in fact separate.

PENALTIES FOR CRIMINAL VIOLATIONS

It is a criminal offense to misrepresent in writing the status of a concern as a small business in order to obtain a prime or subcontract contract awarded pursuant to Section 9 or 15 of the Act (15 U.S.C. § 638 and § 644) and Section 8(a) of the Act ( 15 U.S.C. § 637(a)) or subcontract included as part or all of a goal contained in a subcontracting plan required according to the Section 8(d) of the Act (15 U.S.C. § 637 (d)), or prime or subcontract awarded under Federal Law that references Section 8(d) of the Act (15 U.S.C. § 637 (d)) that defines eligibility for such programs as the Small and Disadvantaged Business contracting program. Under Section 16(d) of the Act (15 U.S.C. 645(d)), the punishment for this offense is imprisonment of not more than 10 years or a fine of not more than $500,000 or both. It can also result in certain administrative penalties, such as suspension or debarment from further contracting with the US Government.

MDOT 4106 (10/12) |

Page 7 of 9 |

PERSONAL FINANCIAL STATEMENT

Complete this form for: (1) each proprietor, or (2) each limited partner who owns 20% or more interest and each general partner, or (3) each stockholder owning or (4) any person or entity providing a guaranty loan.

Name |

|

|

|

|

|

|

|

Business Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

Residence Address |

|

|

|

|

|

|

Residence Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, & Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name of Applicant/Borrower |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

(Omit Cents) |

|

|

LIABILITIES |

|

(Omit Cents) |

|

|

|

|

|

|

|

|

|

Cash on hand & in Banks |

$ |

|

|

|

Accounts Payable |

|

|

|

$ |

|

Savings Accounts |

$ |

|

|

|

Notes Payable to Banks and Others |

$ |

|

IRA or Other Retirement Account |

$ |

|

|

|

(Describe in Section 2) |

|

|

Accounts & Notes Receivable |

$ |

|

|

|

Installment Account (Auto) |

|

|

|

$ |

|

Life Insurance-Cash Surrender Value Only |

$ |

|

|

|

Mo. Payments |

$ |

|

|

|

|

(Complete Section 8) |

$ |

|

|

|

Installment Account (Other) |

$ |

|

Stocks and Bonds |

|

|

|

Mo. Payments |

$ |

|

|

|

|

(Describe in Section 3) |

$ |

|

|

|

Loan on Life Insurance |

|

|

|

$ |

|

|

|

|

|

|

|

|

Real Estate |

|

|

|

|

Mortgages on Real Estate |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

(Describe in Section 4) |

|

|

|

|

(Describe in Section 4) |

|

|

Automobile-Present Value |

$ |

|

|

|

Unpaid Taxes |

|

|

|

$ |

|

Other Personal Property |

$ |

|

|

|

(Describe in Section 6) |

|

|

(Describe in Section 5) |

|

|

|

|

Other Liabilities |

|

|

|

$ |

|

Other Assets |

|

$ |

|

|

|

(Describe in Section 7) |

$ |

|

(Describe in Section 5) |

|

|

|

|

Total Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Net Worth |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

Total |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 1. |

Source of Income |

|

|

|

|

Contingent Liabilities |

|

|

|

|

|

Salary |

|

$ |

|

|

|

As Endorser or Co-Maker |

|

|

|

$ |

|

Net Investment Income |

$ |

|

|

|

Legal Claims & Judgments |

|

|

|

$ |

|

Real Estate Income |

$ |

|

|

|

Provision for Federal Income Tax |

$ |

|

Other Income (Describe below)* |

$ |

|

|

|

Other Special Debt |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Other Income in Section 1.

*Alimony or child support payments need not be disclosed in "Other Income" unless it is desired to have such payments counted toward total income.

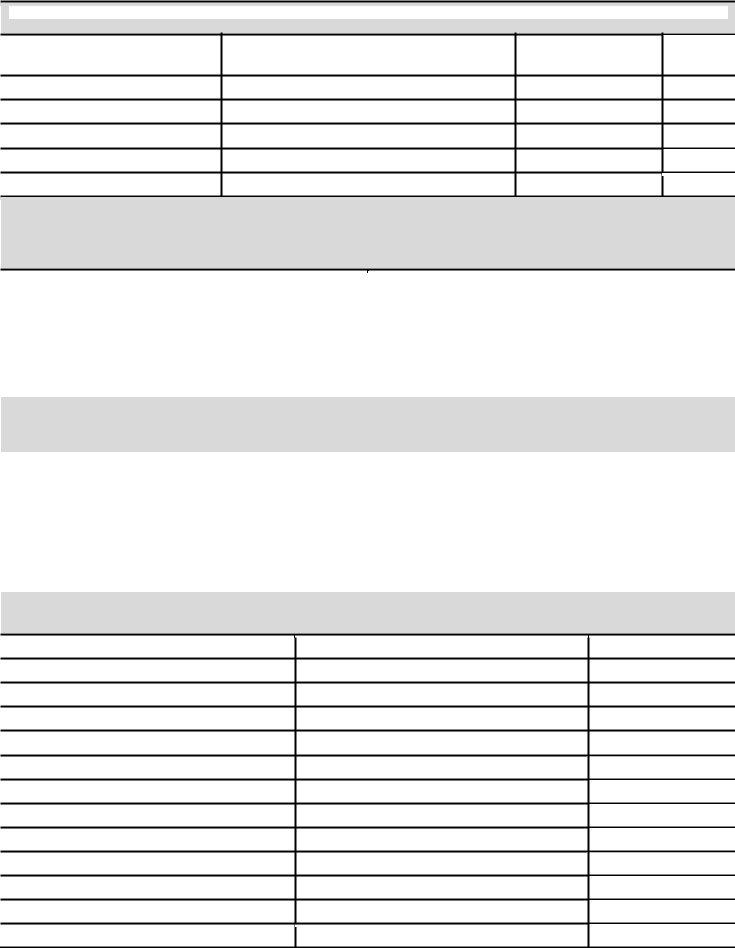

Section 2. Notes Payable to Banks and Others. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Name and Address of Noteholder(s)

How Secured or Endorsed

Type of Collateral

MDOT 4106 (10/12)

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed).

Market Value

Quotation/Exchange

Date of

Quotation/Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4. Real Estate Owned. |

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a part |

|

|

of this statement and signed.) |

|

|

|

|

|

|

|

Property A |

|

Property B |

Property C |

Type of Property |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Purchased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present Market Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Mortgage Holder |

|

|

|

|

|

|

|

|

|

Mortgage Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Payment per Month/Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status of Mortgage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 5. Other Personal Property and Other Assets. |

|

(Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms |

of |

payment and if delinquent, describe delinquency) |

|

|

|

|

|

|

|

Section 6. |

Unpaid Taxes. |

(Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.) |

Section 7. Other Liabilities. (Describe in detail.)

Section 8. |

Life Insurance Held. |

(Give face amount and cash surrender value of policies - name of insurance company and beneficiaries) |

I authorize SBA/Lender to make inquiries as necessary to verify the accuracy of the statements made and to determine my creditworthiness. I certify the above and the statements contained in the attachments are true and accurate as of the stated date(s). These statements are made for the purpose of either obtaining a loan or guaranteeing a loan. I understand FALSE statements may result in forfeiture of benefits and possible prosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001).

Signature: |

Date: |

Social Security Number: |

|

|

|

Signature: |

Date: |

Social Security Number: |

|

|

|

|

|

|

MDOT 4106 (10/12) |

Page 9 of 9 |

Small Business Program (SBP) Application Checklist and

required attachments:

Legal business name: ______________________________

PERSONAL NET WORTH (PNW)

All owners of businesses applying for the SBP must have a pnw less than $1.32 million. This figure excludes each owner’s primary residence, and the value of the business applying for participation in the SBP.

SMALL BUSINESS PROGAM SIZE

Businesses, including affiliates, qualifying for the SBP must not exceed the U.S. Small Business Administration size standard(s) for the North American Industry Classification (NAICS) code for the type(s) of work performed. In no case shall any eligible business, including affiliate businesses, have gross receipts over $22.41 million as averaged over the three most recent tax years.

The following documents must be provided in order for MDOT to determine eligibility to participate in the SBP:

A completed copy of the entire SBP application, signed and notarized with last 4 digits of SS #.

All assets listed as joint on PNW must provide a break down for each individual.

The personal financial statement must include the value of ownership in all other companies owned by the applicant.

United States 1040 Personal Income Tax Returns for the most recent three (3) consecutive years (i.e., 2009, 2010, 2011)

O Include all schedules and W-2’s.

Federal business tax returns for the most recent three (3) consecutive years for the applicant business and all affiliate businesses:

O Include all business tax schedules and required attachments and W-3’s.

Please DO NOT bind or staple the application

Mail completed application to the following address:

MDOT Office of Business Development,

P.O. Box 30050,

Lansing, Michigan 48909

Note: Incomplete application packages will be returned.