Working with PDF forms online is definitely a piece of cake using our PDF editor. You can fill out michigan form 5092 here painlessly. FormsPal team is aimed at providing you the perfect experience with our tool by constantly introducing new capabilities and upgrades. With these improvements, using our tool gets better than ever! Getting underway is effortless! All that you should do is take the following easy steps down below:

Step 1: Simply hit the "Get Form Button" at the top of this page to start up our pdf form editor. Here you'll find all that is required to work with your document.

Step 2: The editor lets you work with PDF files in various ways. Change it by writing your own text, correct what is originally in the document, and place in a signature - all when you need it!

Filling out this PDF demands attention to detail. Ensure all required fields are filled in properly.

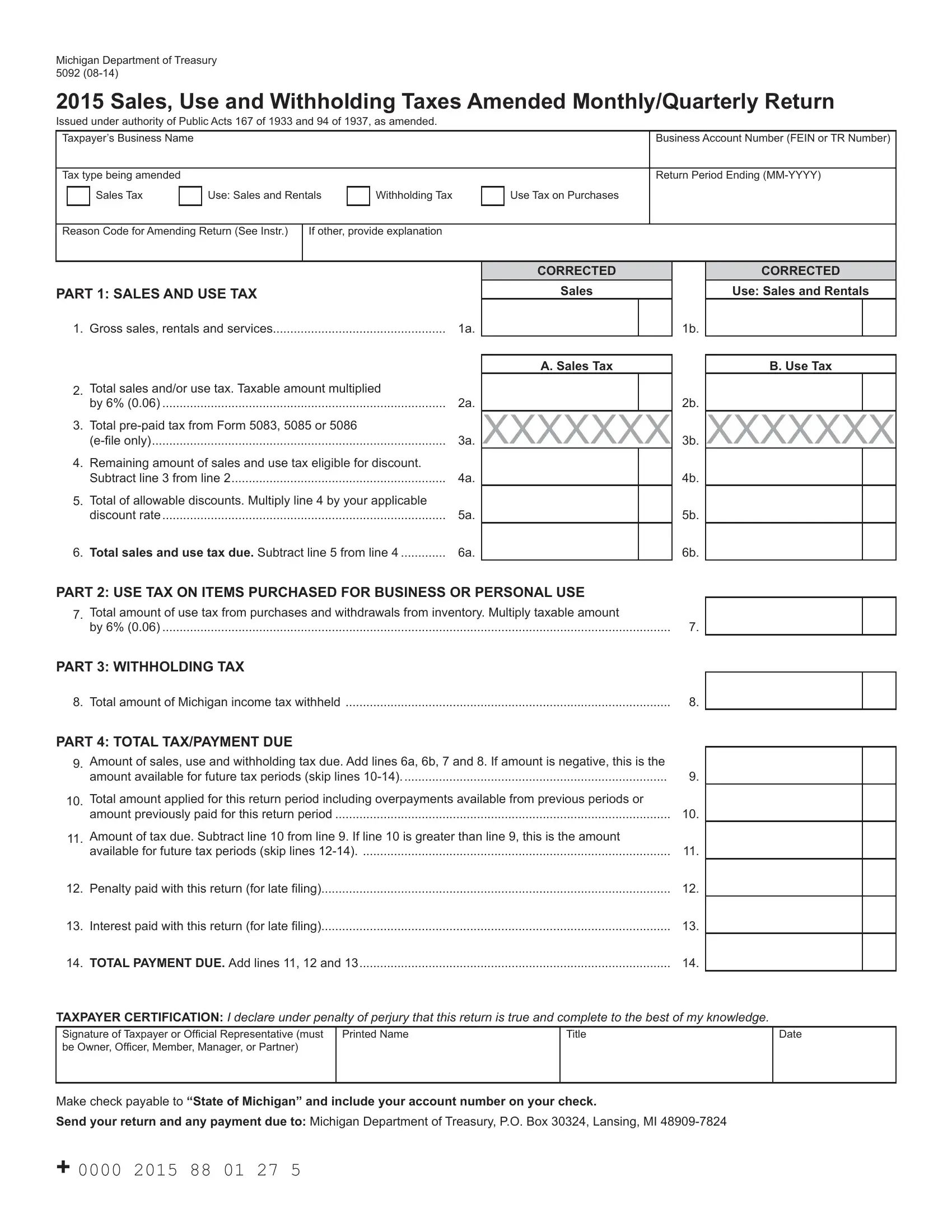

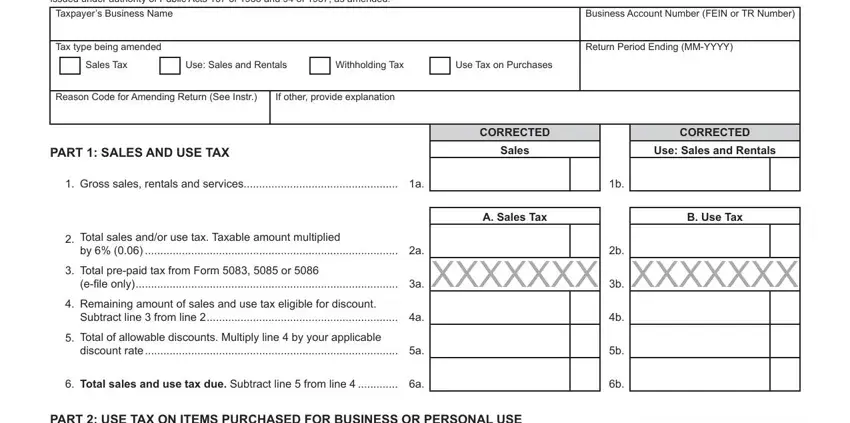

1. The michigan form 5092 necessitates particular information to be entered. Be sure the subsequent blanks are filled out:

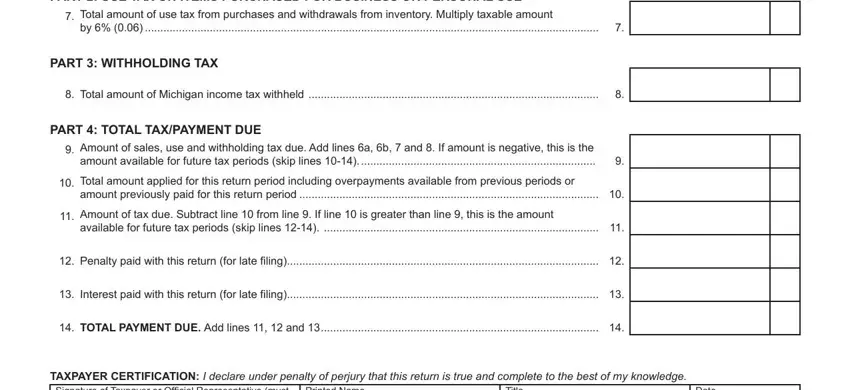

2. Once the last section is complete, you'll want to insert the needed specifics in PART USE TAx On ITEMS PURChASED, Total amount of use tax from, PART WIThhOlDIng TAx, Total amount of Michigan income, PART TOTAl TAxPAyMEnT DUE, Amount of sales use and, Total amount applied for this, amount previously paid for this, Amount of tax due Subtract line, available for future tax periods, Penalty paid with this return for, Interest paid with this return, TOTAl PAyMEnT DUE Add lines and, TAxPAyER CERTIfICATIOn I declare, and Printed Name allowing you to move on to the 3rd stage.

It is easy to make a mistake while completing the Interest paid with this return, hence make sure you look again before you decide to finalize the form.

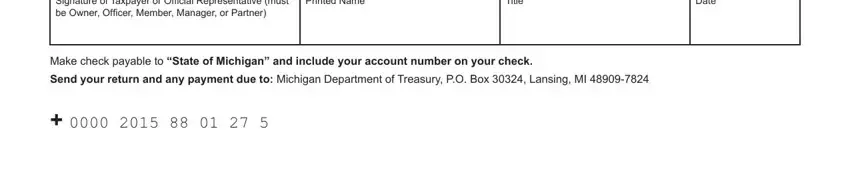

3. This next step is mostly about TAxPAyER CERTIfICATIOn I declare, Printed Name, Title, Date, Make check payable to State of, and Send your return and any payment - fill in all of these empty form fields.

Step 3: Prior to getting to the next step, you should make sure that blanks have been filled in the right way. Once you confirm that it's fine, click “Done." Right after registering a7-day free trial account here, you'll be able to download michigan form 5092 or send it via email promptly. The file will also be accessible via your personal account page with your modifications. Here at FormsPal.com, we strive to be sure that all of your details are stored private.