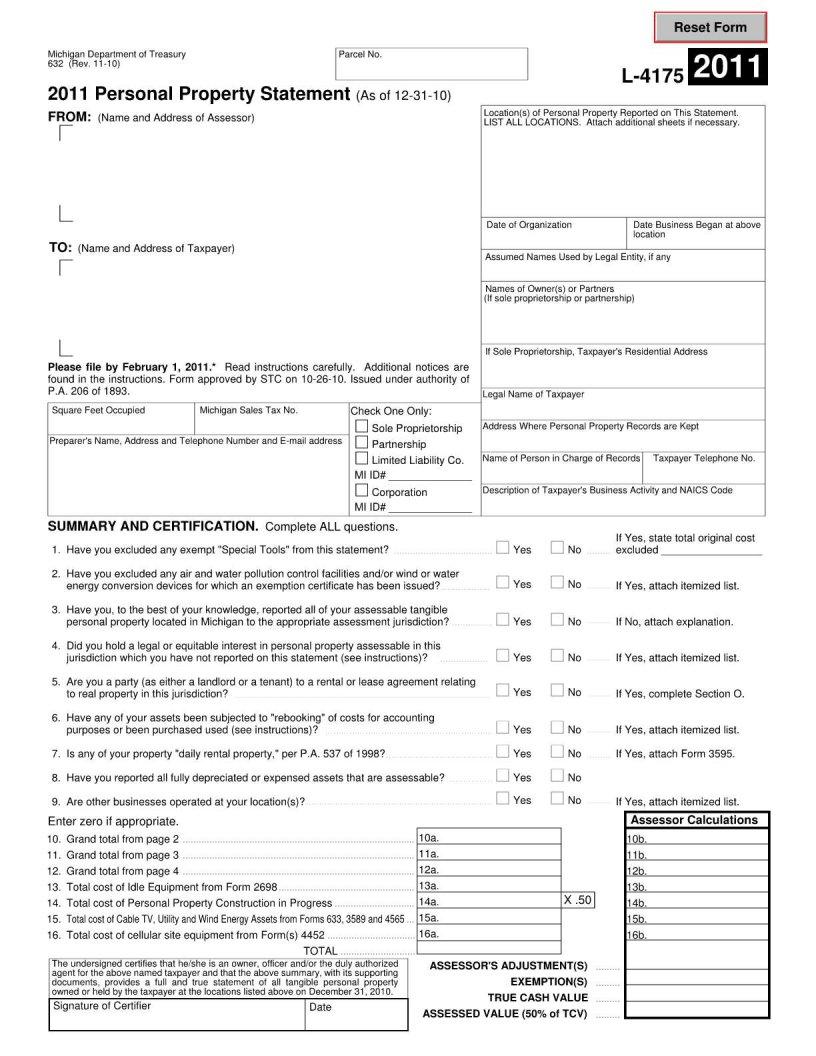

For individuals and businesses navigating taxes within Michigan, understanding the nuances of specific documentation is critical. Among these, the Michigan 632 form stands out as a pivotal piece of paperwork, particularly for entities grappling with the complexities of certain taxes in the state. This form, primarily designed for the reconciliation of taxes, acts as a summary or a recap, detailing the payment history and outstanding amounts over a tax period. The relevance of such a document cannot be overstated, both for compliance purposes and for the clarity it provides to taxpayers. It allows taxpayers to ensure that their records are in agreement with those of the tax authorities, helping to prevent possible disputes or discrepancies. Additionally, its role in facilitating a smoother process for tax-related declarations and adjustments adds another layer of importance for those looking to maintain transparency and accuracy in their financial dealings.

| Question | Answer |

|---|---|

| Form Name | Michigan Form 632 |

| Form Length | 9 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 15 sec |

| Other names | michigan l'4175, form l 4175, michigan department of treasury form l 4175, michigan form l 4175 |