The Michigan 777 form is a crucial document for residents who have faced taxes imposed by a Canadian province, offering a structured approach for those looking to claim credit on their Michigan tax returns. Issued under Public Act 281 of 1967, this form, known formally as the Resident Credit for Tax Imposed by a Canadian Province, assists filers in navigating the complexities of cross-border taxation. Applying to the tax year 2000 and onwards, it requires detailed information such as social security numbers, addresses, and a thorough conversion of Canadian wages and taxes into United States currency. The form is divided into three parts: conversion of Canadian wages, computation of Michigan tax, and calculation of allowable credit for tax paid to a Canadian province. By meticulously converting Canadian income and taxes and detailing the process of subtracting U.S. adjustments and computing Michigan tax on Canadian province income, it plays an indispensable role in ensuring Michigan residents receive adequate credit for taxes paid in Canada. Moreover, the form emphasizes the voluntary nature of this filing, highlighting the taxpayer's responsibility in accurately reporting and converting their Canadian income and taxes. Notably, meticulous attention to the conversion rates and the proper calculation of both Canadian and Michigan taxes are paramount to optimizing the credit received, showcasing the form's pivotal role in cross-border financial planning and compliance.

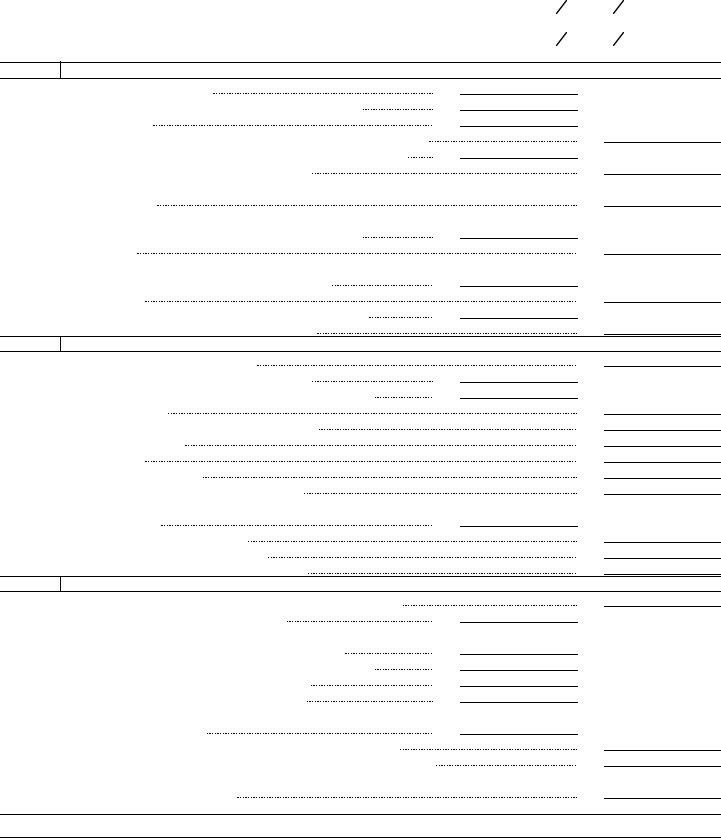

| Question | Answer |

|---|---|

| Form Name | Michigan Form 777 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 777rcf_2751_7 michigan tax form 777 2012 |

Michigan Department of Treasury, ITD

777 (Rev.

RESIDENT CREDIT FOR TAX IMPOSED |

|

|

|

BY A CANADIAN PROVINCE |

For Tax Year |

Issued under P.A. 281 of 1967. Filing is voluntary. |

2000 |

|

|

Name(s) as shown on your |

Social Security Number |

|

|

Address, City, State and ZIP |

Spouse's Social Security Number |

|

|

PART 1

CONVERSION OF CANADIAN WAGES AND TAXES TO UNITED STATES CURRENCY

1. |

Canadian income taxed by Michigan |

1. |

|

|

|

2. |

Fringe benefits included in Box 14 of the |

2. |

|

|

|

3. |

Subtract line 2 from line 1 |

3. |

|

|

|

4. |

Multiply line 3 by the annualized conversion rate of 67.40% (.6740) (see inst.) |

|

5. |

Total Canadian income from line 150 of your Canadian income tax return |

5. |

|

|

6.Multiply line 5 by the conversion rate of 67.40% (.6740)

7.Divide line 4 by line 6 (percentage of Canadian income taxed by Michigan to total Canadian income)

8.Multiply the Canadian federal tax (line 420 of Canadian return)

|

$__________________by the conversion rate of 67.40% (.6740) |

8. |

|

|

|

9. |

Multiply line 8 by line 7 |

|

10. |

Multiply the provincial tax (line 428 of Canadian return) |

|

|

$_____________ by the conversion rate of 67.40% (.6740) |

10. |

11. |

Multiply line 10 by line 7 |

|

12. |

Contribution to Canadian Pension Plan from |

12. |

13. |

Multiply line 12 by the conversion rate of 67.40% (.6740) |

|

4.

6.

7.%

11.

13.

PART 2 COMPUTATION OF MICHIGAN TAX

14.Adjusted gross income from

15.Canadian income taxed by Michigan from line 4, above

16.U.S. adjustments to Canadian wages (from U.S. 1040 lines 23

17.Subtract line 16 from line 15

18.Subtract line 17 from line 14 for Michigan source income

19.Additions from

20.Add lines 17, 18 and 19

21.Subtractions from

22.Subtract line 21 from line 20 for income subject to tax

23.Divide line 17 by line 22 for percentage of Canadian income to

total income subject to tax

24.Exemption allowance from

25.Subtract line 24 from line 22 for taxable income

26.Multiply line 25 by the Michigan tax rate of 4.2% (.042)

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.%

24.

25.

26.

PART 3 ALLOWABLE CREDIT FOR TAX PAID CANADIAN PROVINCE

27. |

Multiply line 26 by line 23 for Michigan tax on Canadian province income |

|

|

28. |

Add lines 9, 11 and 13 for total tax paid in Canada |

28. |

|

29. |

Adjustments to credit claimed on U.S. 1040: |

|

|

|

29a. |

Canadian portion of credit claimed on U.S. 1040, line 43 |

29a. |

|

29b. |

Canadian income taxed by Michigan from all U.S. 1116 forms |

29b. |

|

29c. |

Gross Canadian income from all U.S. 1116 forms |

29c. |

|

29d. |

Divide line 29b by line 29c and enter percentage |

29d. |

|

29e. |

Multiply line 29a by line 29d for adjusted |

|

|

|

amount claimed on U.S. 1040 |

29e. |

30.Subtract line 29e from line 28 for amount available for credit on

31.Canadian provincial tax from line 11. Enter here and on form

32.Credit for tax paid Canadian province (lesser of lines 27, 30 or 31). Enter here and on form

27.

%

30.

31.

32.

ATTACH THIS FORM TO YOUR