Michigan Department of Treasury 5076 (Rev. 07-21)

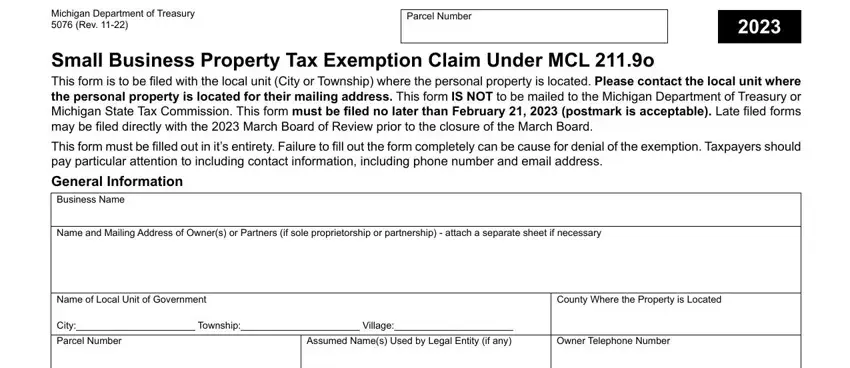

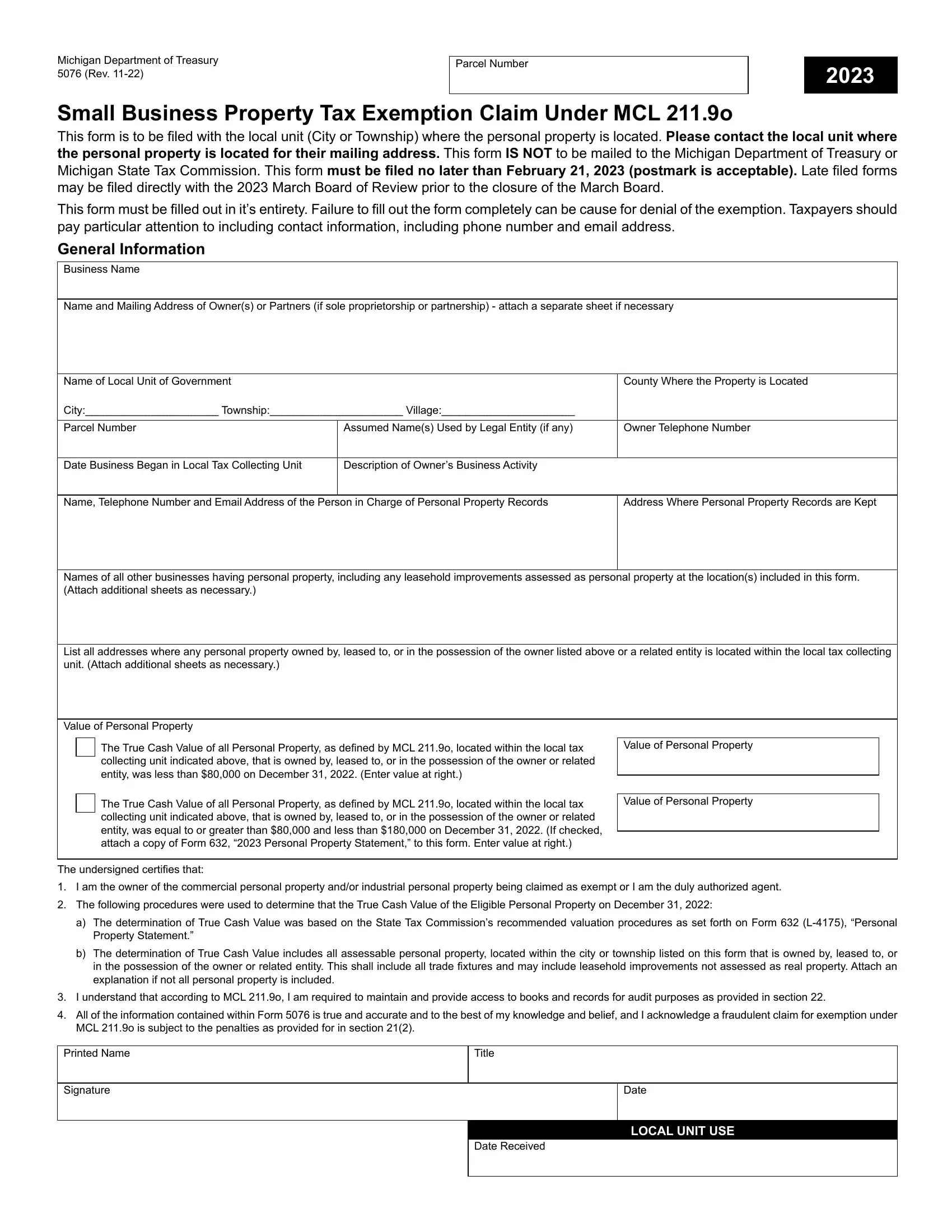

Small Business Property Tax Exemption Claim Under MCL 211.9o

This form is to be filed with the local unit (City or Township) where the personal property is located. Please contact the local unit where the personal property is located for their mailing address. This form IS NOT to be mailed to the Michigan Department of Treasury or

Michigan State Tax Commission. This form must be filed no later than February 22, 2022 (postmark is acceptable). Late filed forms may be filed directly with the 2022 March Board of Review prior to the closure of the March Board.

This form must be filled out in it’s entirety. Failure to fill out the form completely can be cause for denial of the exemption. Taxpayers should pay particular attention to including contact information, including phone number and email address.

General Information

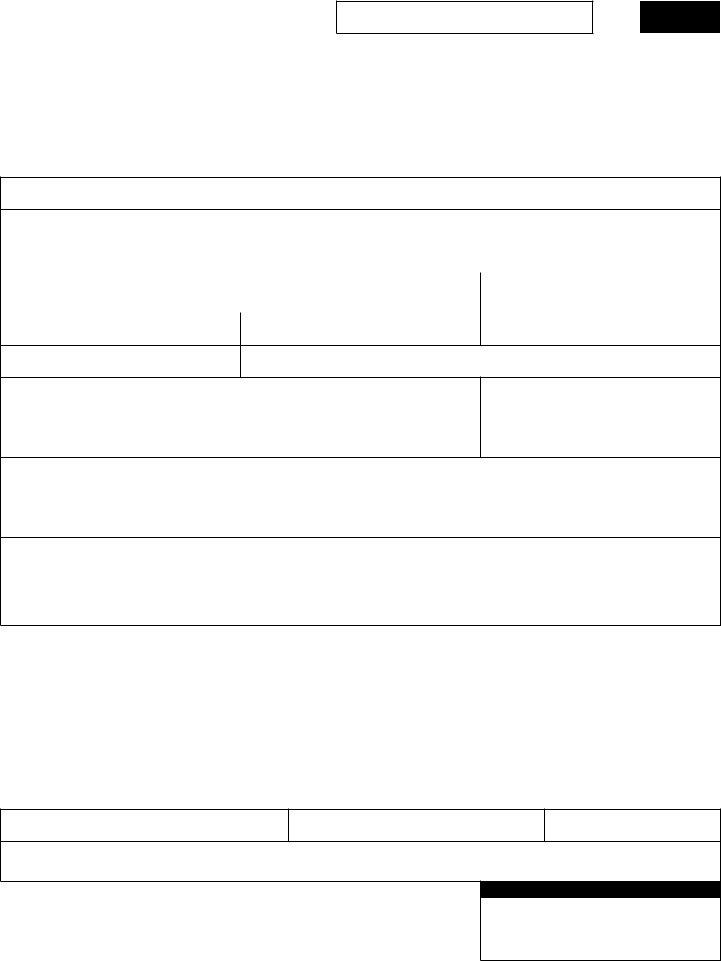

Business Name

Name and Mailing Address of Owner(s) or Partners (if sole proprietorship or partnership) - attach a separate sheet if necessary

Name of Local Unit of Government |

|

County Where the Property is Located |

City:______________________ Township:______________________ Village:______________________ |

|

|

|

|

Parcel Number |

Assumed Name(s) Used by Legal Entity (if any) |

Owner Telephone Number |

Date Business Began in Local Tax Collecting Unit

Description of Owner’s Business Activity

Name, Telephone Number and Email Address of the Person in Charge of Personal Property Records

Address Where Personal Property Records are Kept

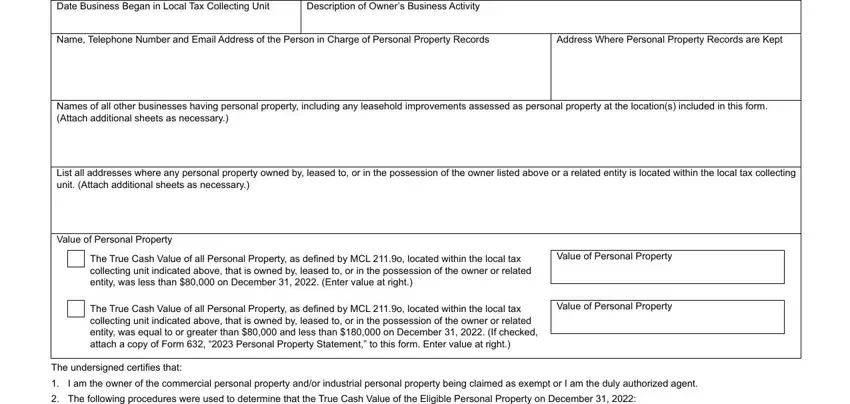

Names of all other businesses having personal property, including any leasehold improvements assessed as personal property at the location(s) included in this form. (Attach additional sheets as necessary.)

List all addresses where any personal property owned by, leased to, or in the possession of the owner listed above or a related entity is located within the local tax collecting unit. (Attach additional sheets as necessary.)

The undersigned certifies that:

1.I am the owner of the commercial personal property and/or industrial personal property being claimed as exempt or I am the duly authorized agent.

2.The True Cash Value of all the Personal Property, as defined by MCL 211.9o located within the local tax collecting unit indicated above, that is owned by, leased to, or in the possession of the owner or related entity was less than $80,000 on December 31, 2021.

3.The following procedures were used to determine that the True Cash Value of the Eligible Personal Property was less than $80,000 on December 31, 2021:

a)The determination of True Cash Value was based on the State Tax Commission’s recommended valuation procedures as set forth on Form 632 (L-4175), Personal Property Statement.

b)The determination of True Cash Value includes all assessable personal property, located within the city or township listed on this form that is owned by, leased to, or in the possession of the owner or related entity. This shall include all trade fixtures and may include leasehold improvements not assessed as real property. Attach an explanation if not all personal property is included.

4.I understand that according to MCL 211.9o, I am required to maintain and provide access to books and records for audit purposes as provided in section 22.

5.All of the information contained within Form 5076 is true and accurate and to the best of my knowledge and belief, and I acknowledge a fraudulent claim for exemption under MCL 211.9o is subject to the penalties as provided for in section 21(2).

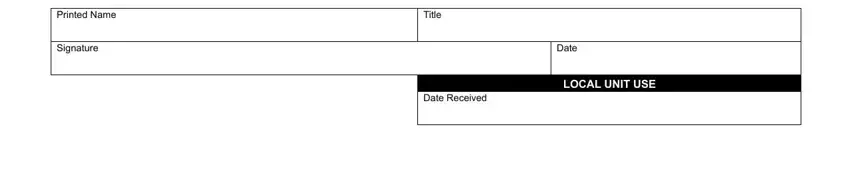

Signature

LOCAL UNIT USE ONLY

5076, Page 2

Instructions for Small Business Property Tax Exemption Claim Under

MCL 211.9o (Form 5076)

MCL 211.9o provides for a personal property tax exemption for “eligible personal property”. This is commonly referred to as the

Small Business Taxpayer Exemption. MCL 211.9o defines “eligible personal property” as meeting all of the following criteria:

•The personal property must be classified as industrial personal property or commercial personal property as defined in MCL 211.34c or would be classified as industrial personal property or commercial personal property if not exempt and

•The combined true cash value of all industrial personal property and commercial personal property owned by, leased by or in the possession of the owner or a related entity claiming the exemption is less than $80,000 in the local tax collecting unit and

•The property is not leased to or used by a person that previously owned the property or a person that, directly or indirectly controls, is controlled by, or under common control with the person that previously owned the property.

In order to claim this exemption, this form must be filed with the local unit (City or Township) where the personal property is located no later than February 22, 2022 (postmark is acceptable). This form IS NOT to be mailed to the Michigan Department of Treasury or the Michigan State Tax Commission. Please contact the local unit where the personal property is located for their mailing address. Late filed forms may be filed directly with the local unit March Board of Review prior to the closure of the March

Board of Review. Taxpayers must contact the local unit directly to determine the March Board of Review dates.

Taxpayers must appear in person or have a representative appear on their behalf in order to late file with the March Board of Review.

Once the exemption is granted, the taxpayer will continue to receive the exemption until they no longer qualify for the exemption. Once they no longer qualify, the taxpayer is required to file a rescission form and a personal property statement no later than February 20th of the year that the property is no longer eligible. Failure to file the rescission form will result in significant penalty and interest as prescribed by P.A. 132 of 2018: “An owner who fails to file a rescission and whose property is later discovered to be ineligible for the exemption is subject to repayment of any additional taxes with interest at a rate of 1% per month or fraction of a month and penalties computed from the date the taxes were last payable without interest or penalty.”

This form will exempt property owned only by the entity filing the form. If personal property is leased to or used by an entity other than the property’s owner, the owner of that personal property must file the form for that property, not the lessee or the user. The owner may file the form and claim the exemption only if the True Cash Value of all of the commercial or industrial personal property located within the local tax collecting unit that is owned by, leased to, or in the possession of the owner or a related entity was less than $80,000 on December 31, 2021.

This form must be filled out in it’s entirety. Failure to fill out the form completely can be cause for denial of the exemption. Taxpayers should pay particular attention to including contact information, including phone number and email address.

Taxpayers who file Form 5076 are not required to file a Personal Property Statement (Form 632) in the year they are claiming the

exemption.

NOTICE: Questions regarding this form should be directed to the assessor of the city or township where the personal property is located. This form is issued under the authority of Public Act 206 of 1893. Additional detailed information on the Small Business Taxpayer Personal Property Exemption can be found on the State Tax Commission Web site at www.michigan.gov/ statetaxcommission.