Any time you desire to fill out Minnesota Form Rev184A, you won't need to install any applications - just use our PDF tool. Our editor is constantly developing to give the very best user experience achievable, and that's due to our commitment to constant development and listening closely to feedback from users. Should you be looking to get started, here is what it will take:

Step 1: Open the PDF doc in our tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: When you open the tool, you will see the form made ready to be filled out. Besides filling in different blank fields, it's also possible to do several other actions with the PDF, specifically writing custom text, editing the original text, adding illustrations or photos, signing the form, and a lot more.

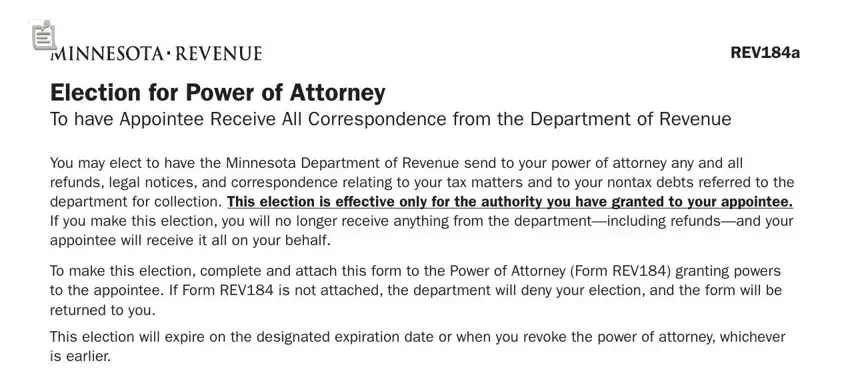

This PDF form will involve some specific information; in order to guarantee accuracy and reliability, you need to pay attention to the subsequent steps:

1. It is advisable to complete the Minnesota Form Rev184A correctly, therefore pay close attention while filling in the sections that contain these particular blanks:

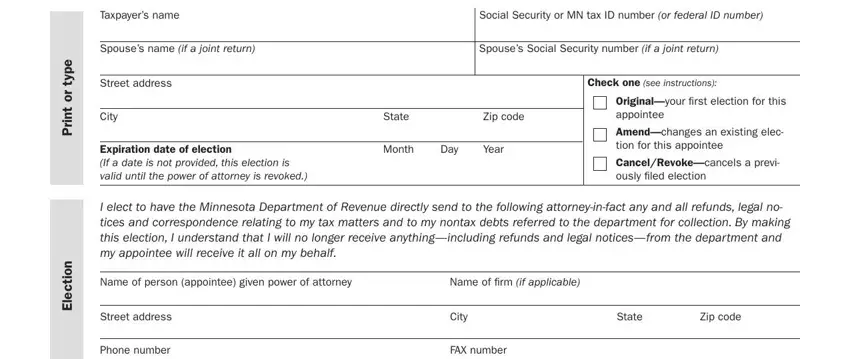

2. Once your current task is complete, take the next step – fill out all of these fields - Taxpayers name, Social Security or MN tax ID, Spouses name if a joint return, Spouses Social Security number if, Street address, City, Expiration date of election If a, Check one see instructions, State, Zip code, Month Day, Year, Originalyour first election for, Amendchanges an existing elec tion, and CancelRevokecancels a previ ously with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People frequently make errors while filling in Spouses name if a joint return in this part. Ensure you double-check everything you enter here.

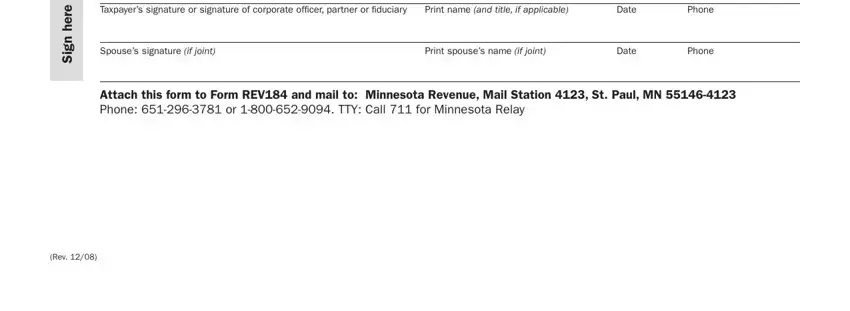

3. In this particular step, review Taxpayers signature or signature, Print name and title if applicable, Date, Phone, Spouses signature if joint, Print spouses name if joint, Date, Phone, Attach this form to Form REV and, e r e h n g S, and Rev. All these will have to be completed with greatest precision.

Step 3: Check the information you have inserted in the form fields and then press the "Done" button. After registering afree trial account at FormsPal, you'll be able to download Minnesota Form Rev184A or email it at once. The PDF will also be easily accessible via your personal account with your each change. We do not share the information that you enter while filling out forms at FormsPal.