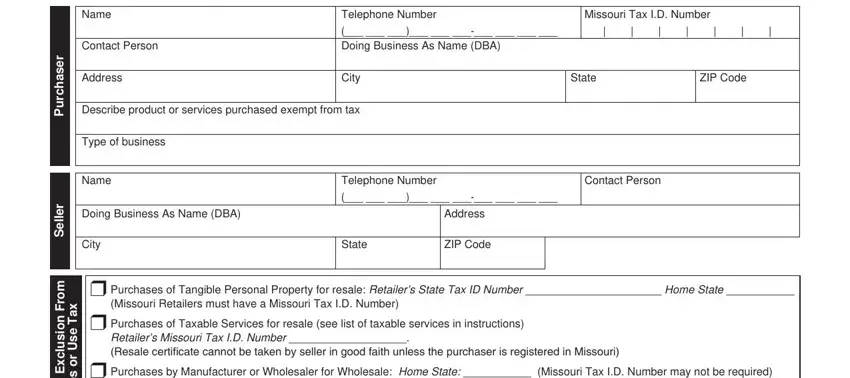

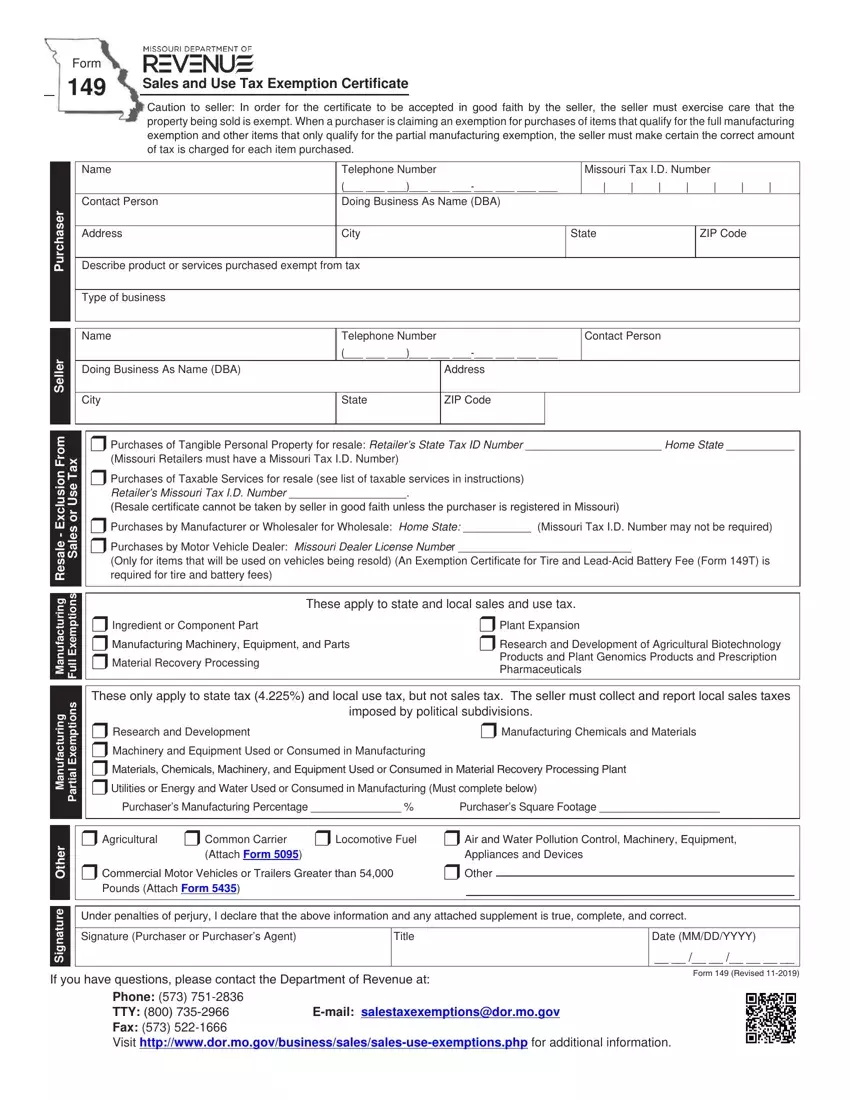

Sales or Use Tax Exemption Certificate (Form 149) Instructions

Select the appropriate box for the type of exemption to be claimed and complete any additional information requested.

•Purchases of Tangible Personal Property for resale: Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax.

The purchaser’s state tax ID number can be found on the Missouri Retail License or out of state registration for retail sales.

•Purchases of Taxable Services for resale: Purchasers for resale must have a Missouri retail license in order to claim resale of taxable services in Missouri. A taxable service includes sales of restaurants, hotels, motels, places of amusement, recreation, entertainment, games and athletic events not at arms length, and sales of telecommunications and utilities (see Section 144.018, RSMo).

•Purchases by Manufacturer or Wholesaler for Wholesale: A Missouri Tax I.D. Number is not required to claim this exclusion.

•Purchaser’s Home State: Provide the state in which purchaser is located and registered.

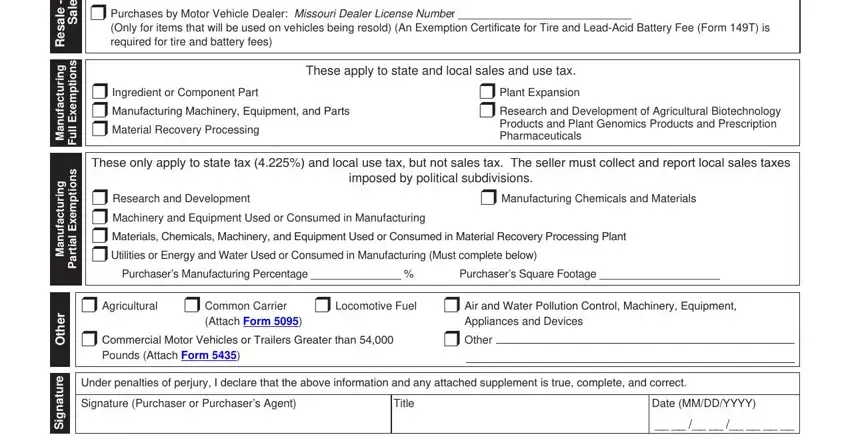

•Purchases by Motor Vehicle Dealer: A motor vehicle dealer who is purchasing items for the repair of a vehicle being resold is exempt from sales or use tax. The dealer’s license is issued by the Missouri Motor Vehicle Bureau or by the out of state registration authority that issues such licenses.

Check the appropriate box for the type of exemption to be claimed. All items selected in this section are exempt from state and local sales and use

tax under Section 144.030, RSMo.

•Ingredient or Component Parts: This exemption includes materials, manufactured goods, machinery, and parts that become a part of the final product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

•Manufacturing Machinery, Equipment and Parts: This exemption includes only machinery and equipment and their parts that are used directly in manufacturing a product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

•Material Recovery Processing: This exemption includes machinery and equipment used to establish new or to replace existing material recovery processing plants. See Sections 144.030.2(5) and (32), RSMo, for a definition of, and exemptions for, material recovery processing.

•Plant Expansion: This exemption includes machinery, equipment, and parts and the materials and supplies solely required for installing or constructing the machinery and equipment, used to establish new or to expand existing Missouri manufacturing, mining, or fabricating plants. To qualify, the machinery must be used directly in manufacturing, mining or fabricating a product that is ultimately subject to sales or use tax, or its equivalent, in Missouri or other states.

•Research and Development of Agricultural Biotechnology Products and Plant Genomics Products and Prescription Pharmaceuticals: This exemption is specifically authorized in Section 144.030.2(34), RSMo, and exempts any tangible personal property used or consumed directly or exclusively in research and development of agricultural, biotechnology, and plant genomics products and prescription pharmaceuticals consumed by humans or animals.

Check the appropriate box for the type of exemption to be claimed according to Section 144.054, RSMo. All items in this section are exempt from state sales and use tax and local use tax, but are still subject to local sales tax. Section 144.054, RSMo, exempts electrical energy and gas (natural, artificial and propane), water, coal, energy sources, chemicals, machinery, equipment and materials used or consumed in manufacturing, processing, compounding, mining or producing any product. These same items are exempt if used or consumed in processing recovered materials. To qualify for this exemption, the item must be used or consumed and does not have the same requirement of direct use that is required in Section 144.030, RSMo. Additionally, the manufactured product is not required to be ultimately subject to tax.

•Research and Development: Check this box if the exemption is for the research and development related to manufacturing, processing, compounding or producing a product.

•Manufacturing Chemicals and Materials: Check this box if the exemption is for chemicals or materials used or consumed in manufacturing, processing, compounding or producing a product.

•Machinery and Equipment Used or Consumed in Manufacturing: Check this box if the exemption is for machinery or equipment used or consumed in manufacturing, processing, compounding or producing a product.

•Materials, Chemicals, Machinery, and Equipment Used or Consumed in Material Recovery Processing Plant: Check this box if the exemption is for material recovery processing.

•Utilities or Energy and Water Used or Consumed in Manufacturing: If claiming utilities (electrical energy, gas or water), record account numbers, meter numbers, or other information as required by the vendor. All purchasers who are claiming an exemption for energy use must provide the amount of energy use which is related to manufacturing in the space provided and also select the method by which this percentage was obtained.

•Agricultural: Farm machinery and equipment are exempt from tax if used exclusively for agricultural purposes, used on land owned or leased for the purpose of producing farm products, and used directly in the production of farm products to be ultimately sold at retail. The sale of grains to be converted into foodstuffs or seed, and limestone, fertilizer, and herbicides used in connection with the growth or production of crops, livestock or poultry is exempt from tax. The sale of livestock, animals or poultry used for breeding or feeding purposes, feed for livestock or poultry, feed additives, medications or vaccines administered to livestock or poultry in the production of food or fiber, and sales of pesticides and herbicides used in the production of aquaculture, livestock or poultry are exempt from tax. All sales of fencing materials used for agricultural purposes and the purchase of motor fuel are exempt from tax.

•Common Carrier: Materials, replacement parts and equipment purchased for use directly upon, and for the repair and maintenance or manufacture of, motor vehicles, watercraft, railroad rolling stock or aircraft engaged as common carriers of persons or property. See Section 144.030.2(3), RSMo. Attach completed Form 5095.

•Locomotive Fuel: Fuel purchased for use in a locomotive that is a common carrier is exempt from sales and use tax.

•Air and Water Pollution Control Machinery, Equipment, Appliances and Devices: Machinery, equipment, appliances and devices purchased or leased and used solely for the purpose of preventing, abating or monitoring water and air pollution, and materials and supplies solely required for the installation, construction or reconstruction of such machinery, equipment, appliances and devices. See Sections 144.030.2(15) and (16), RSMo.

•Commercial Motor Vehicles or Trailers Greater Than 54,000 Pounds: Motor vehicles registered for and capable of pulling in excess of 54,000

pounds and their trailers actually used in the normal course of business to haul property on the public highways of the state are exempt from tax. The purchase of materials, replacement parts, and equipment used directly on, for the repair of and maintenance or manufacture of these vehicles is also exempt. See Section 144.030.2(4), RSMo.

•Other: Exemptions not listed on this sheet, but are provided by statute. Provide explanation of exemption being claimed. See Chapter 144 of the Missouri Revised Statutes for exemption http://www.moga.mo.gov/mostatutes/statutesAna.html#T10.