In case you wish to fill out 53 tax return form, it's not necessary to download any software - simply try using our PDF editor. To keep our editor on the forefront of efficiency, we work to implement user-driven features and improvements on a regular basis. We are at all times grateful for any feedback - assist us with revolutionizing PDF editing. In case you are looking to begin, this is what it requires:

Step 1: Just press the "Get Form Button" in the top section of this webpage to see our pdf form editor. There you will find all that is needed to fill out your file.

Step 2: This editor allows you to work with your PDF document in a range of ways. Improve it by writing personalized text, correct what's already in the document, and include a signature - all at your convenience!

This PDF form will require specific information; to ensure accuracy and reliability, you need to take note of the next tips:

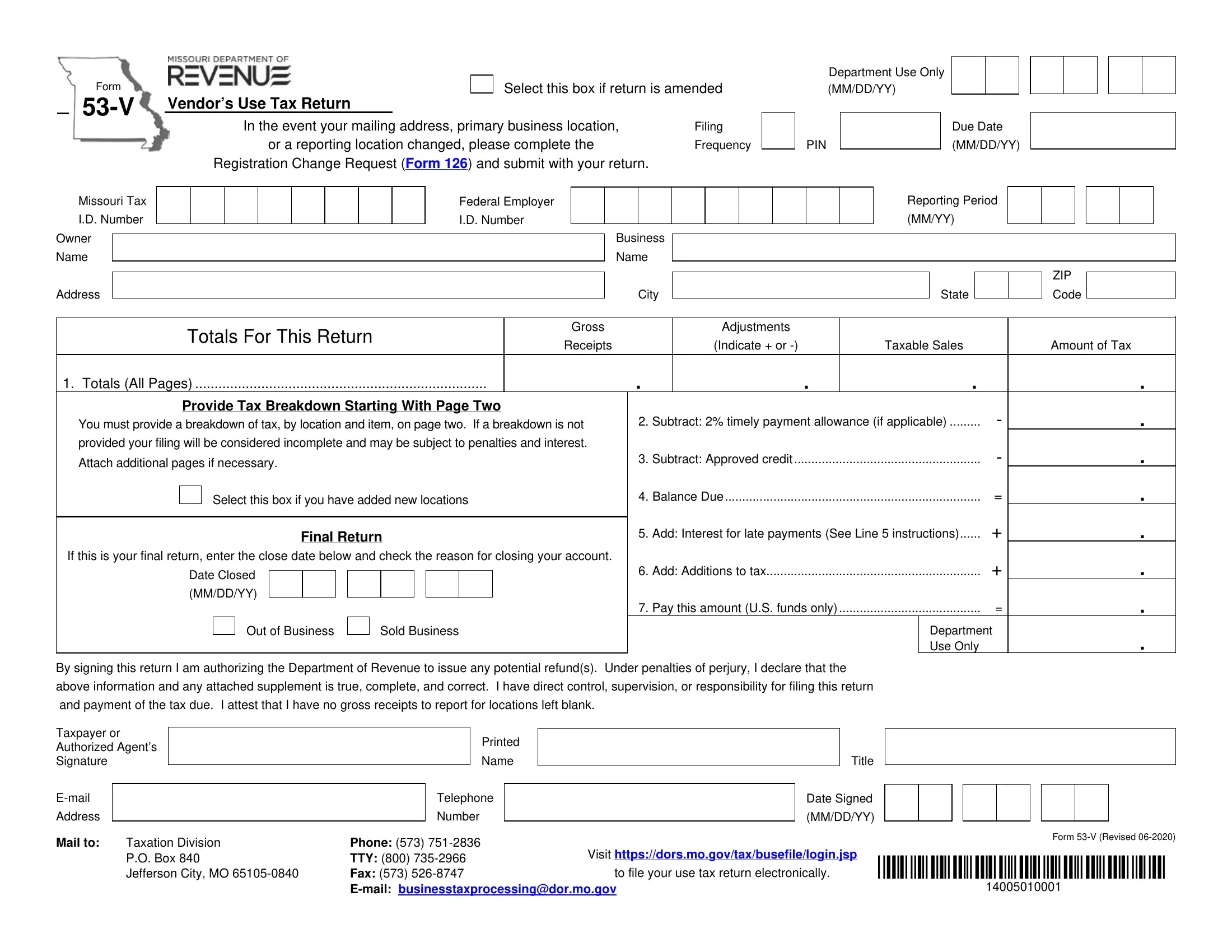

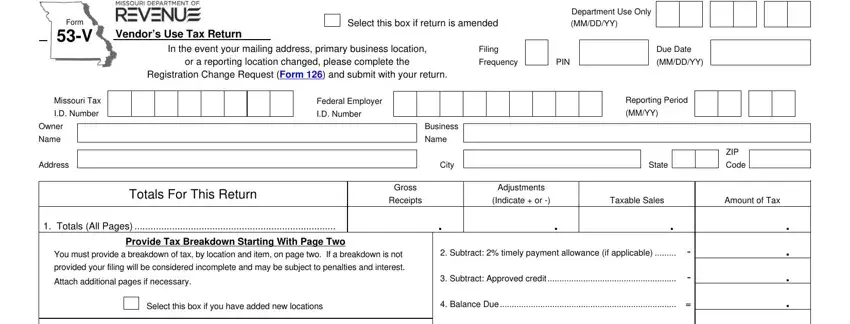

1. Begin completing your 53 tax return form with a number of major fields. Consider all the important information and be sure not a single thing overlooked!

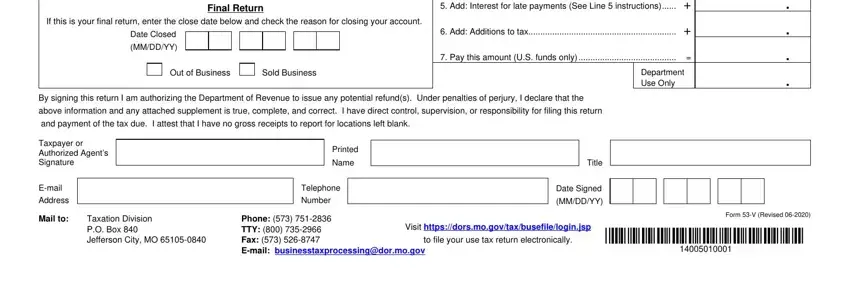

2. Once this selection of blank fields is done, go to type in the applicable details in these - If this is your final return enter, Final Return, Date Closed, MMDDYY, Out of Business, Sold Business, Add Interest for late payments, Add Additions to tax, Pay this amount US funds only, Department Use Only, By signing this return I am, above information and any attached, and payment of the tax due I, Taxpayer or Authorized Agents, and Email.

It's easy to get it wrong when filling out the If this is your final return enter, hence you'll want to look again prior to when you submit it.

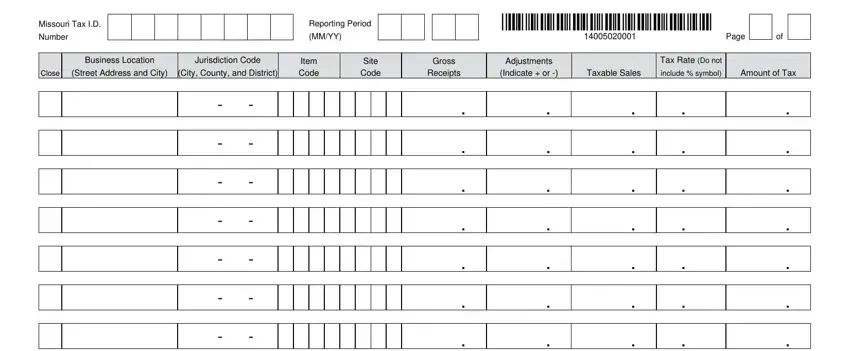

3. This next part should be relatively simple, Missouri Tax ID, Number, Reporting Period, MMYY, Page, Business Location, Jurisdiction Code, Close, Street Address and City, City County and District, Item Code, Site Code, Gross, Receipts, and Adjustments - every one of these empty fields will have to be filled in here.

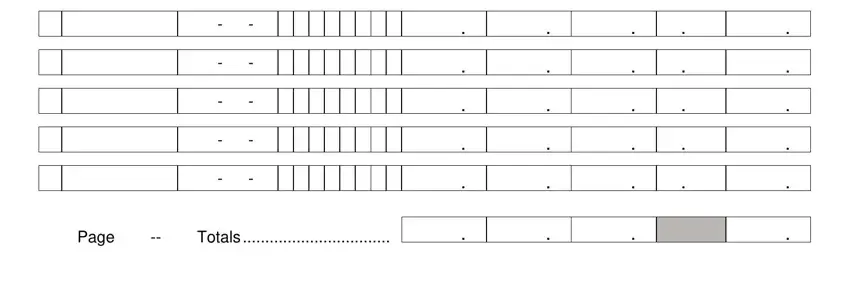

4. The next subsection requires your input in the following areas: Page Totals. Remember to provide all of the required info to move forward.

Step 3: Before submitting the form, double-check that all blank fields have been filled out as intended. Once you verify that it is correct, press “Done." Go for a free trial plan with us and obtain direct access to 53 tax return form - download or edit inside your personal account page. At FormsPal, we aim to be certain that all of your information is stored private.