Using the online PDF editor by FormsPal, you'll be able to fill in or modify Missouri Form 943 right here. We are committed to providing you with the best possible experience with our editor by consistently presenting new functions and enhancements. Our editor is now a lot more helpful as the result of the newest updates! At this point, filling out documents is easier and faster than ever. With a few simple steps, you'll be able to begin your PDF editing:

Step 1: Click on the "Get Form" button above. It is going to open our pdf tool so you could start completing your form.

Step 2: Using this handy PDF editing tool, it is possible to do more than just fill out blank fields. Edit away and make your docs seem high-quality with customized textual content added in, or adjust the original input to excellence - all accompanied by an ability to insert stunning images and sign the document off.

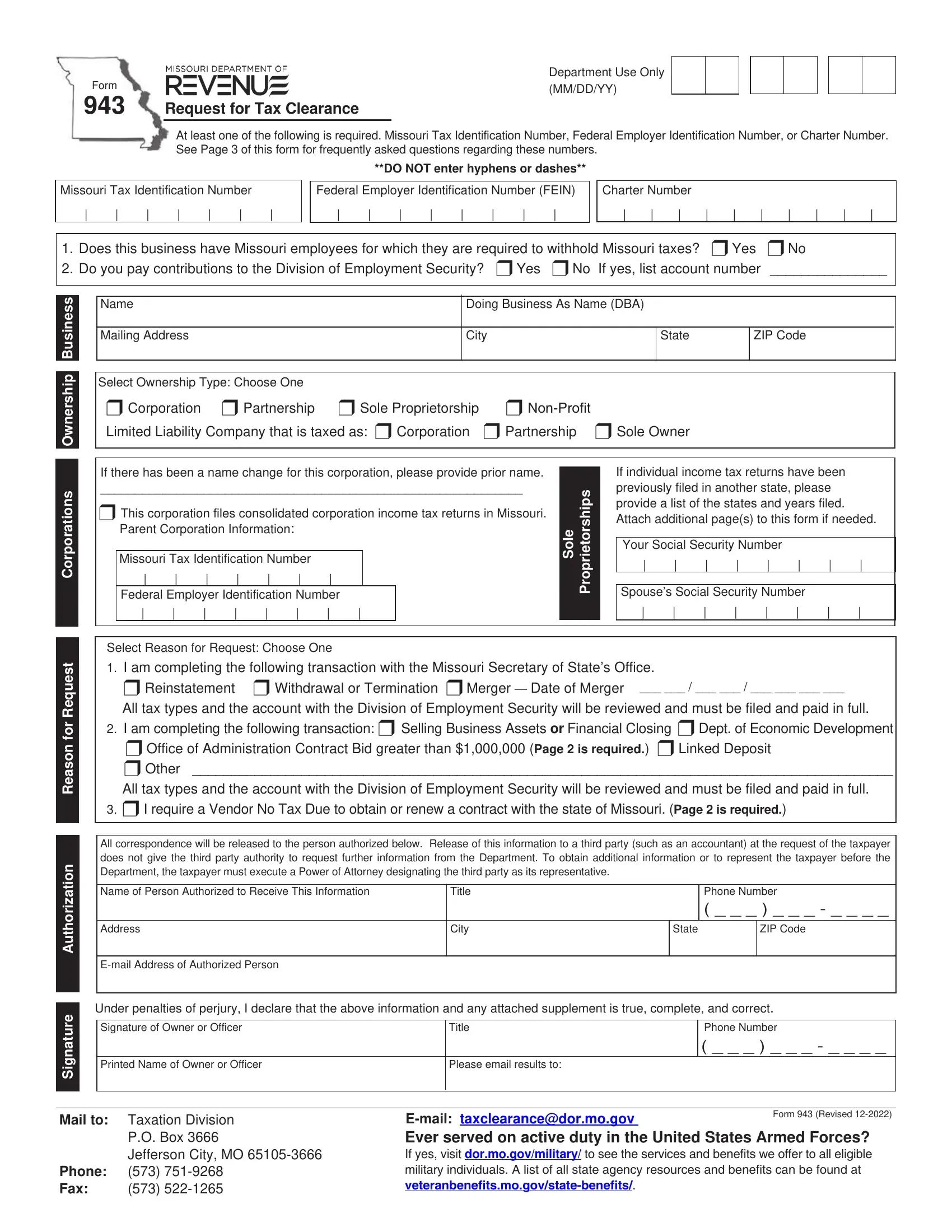

This document will require you to type in specific information; to ensure accuracy and reliability, don't hesitate to adhere to the guidelines down below:

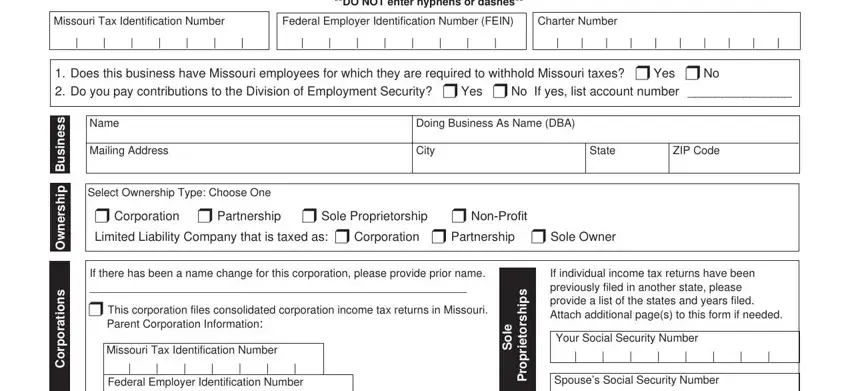

1. When filling out the Missouri Form 943, be sure to include all of the needed blank fields within the relevant part. It will help facilitate the process, enabling your details to be processed quickly and correctly.

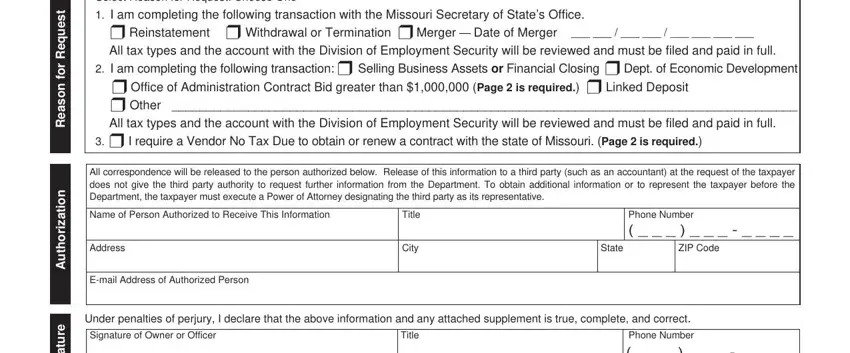

2. Soon after finishing the last part, go to the subsequent stage and complete all required particulars in all these blank fields - Select Reason for Request Choose, r Reinstatement r Withdrawal or, All tax types and the account with, r Other, All correspondence will be, Name of Person Authorized to, Address, Email Address of Authorized Person, Title, City, Phone Number, State, ZIP Code, Under penalties of perjury I, and Title.

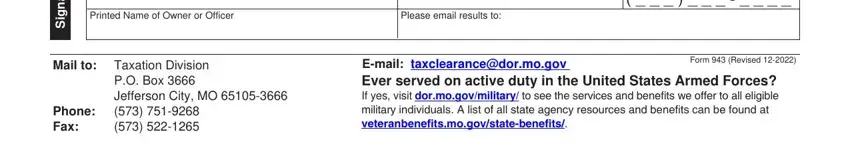

3. The third stage is going to be straightforward - fill out every one of the empty fields in Under penalties of perjury I, Printed Name of Owner or Officer, Please email results to, e r u t a n g S, PO Box Jefferson City MO, Mail to Taxation Division Phone Fax, Email taxclearancedormogov Ever, and Form Revised to conclude this part.

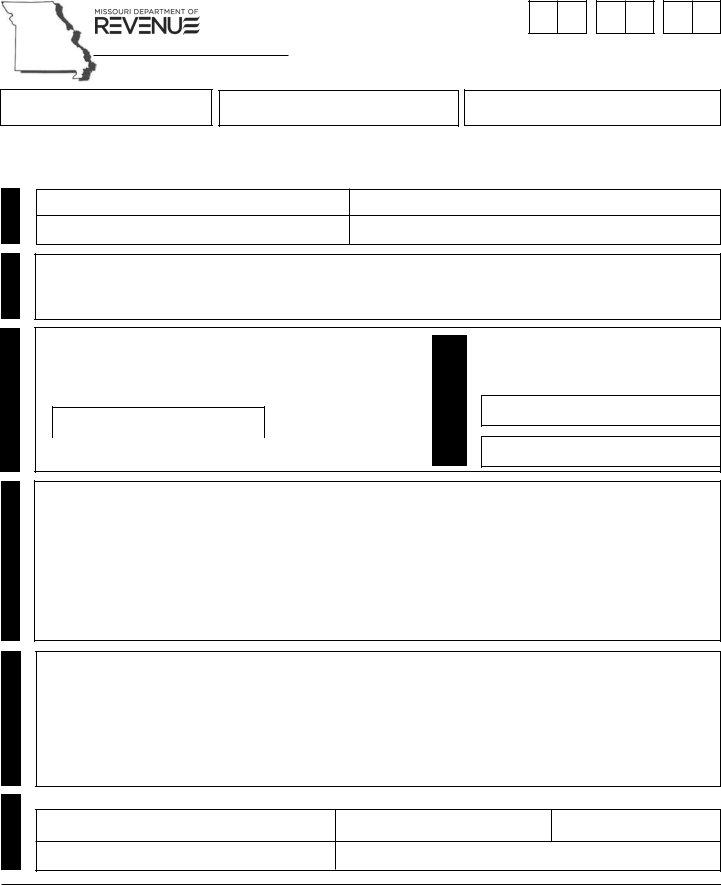

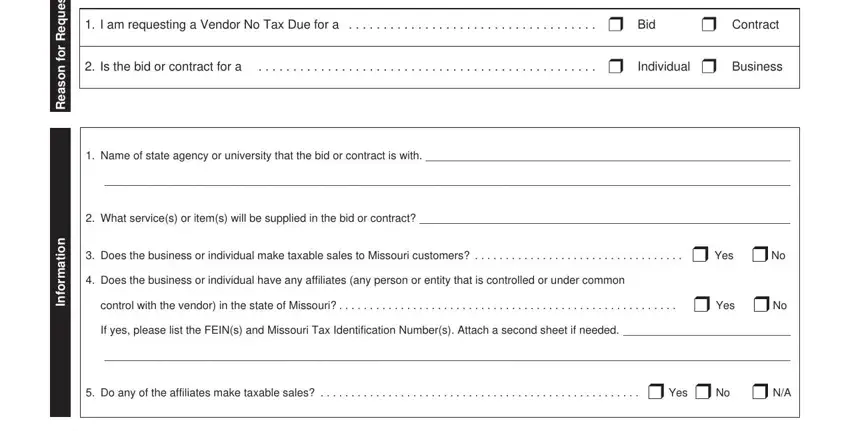

4. To move ahead, the next section involves filling in a few fields. These comprise of t s e u q e R r o f n o s a e R, n o i t a m r o f n, I am requesting a Vendor No Tax, r Contract, Is the bid or contract for a, Individual r Business, Name of state agency or, What services or items will be, Does the business or individual, Does the business or individual, control with the vendor in the, If yes please list the FEINs and, and Do any of the affiliates make, which are essential to carrying on with this particular form.

5. Since you come close to the conclusion of this form, there are several more requirements that have to be met. In particular, s t n e m m o C must all be filled in.

Be really mindful while filling in s t n e m m o C and s t n e m m o C, since this is where a lot of people make errors.

Step 3: Glance through the information you have inserted in the blank fields and press the "Done" button. Obtain the Missouri Form 943 the instant you subscribe to a free trial. Instantly get access to the form inside your personal account, with any edits and adjustments being automatically saved! FormsPal is devoted to the privacy of our users; we make certain that all personal information handled by our system continues to be protected.