Missouri Form Mo 1Nr can be filled in online in no time. Simply make use of FormsPal PDF editing tool to accomplish the job promptly. We at FormsPal are focused on providing you the ideal experience with our editor by continuously presenting new features and upgrades. With all of these improvements, working with our tool becomes better than ever! All it requires is a few easy steps:

Step 1: Firstly, access the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This tool gives you the ability to customize your PDF in a variety of ways. Improve it with personalized text, correct what is originally in the document, and add a signature - all possible in no time!

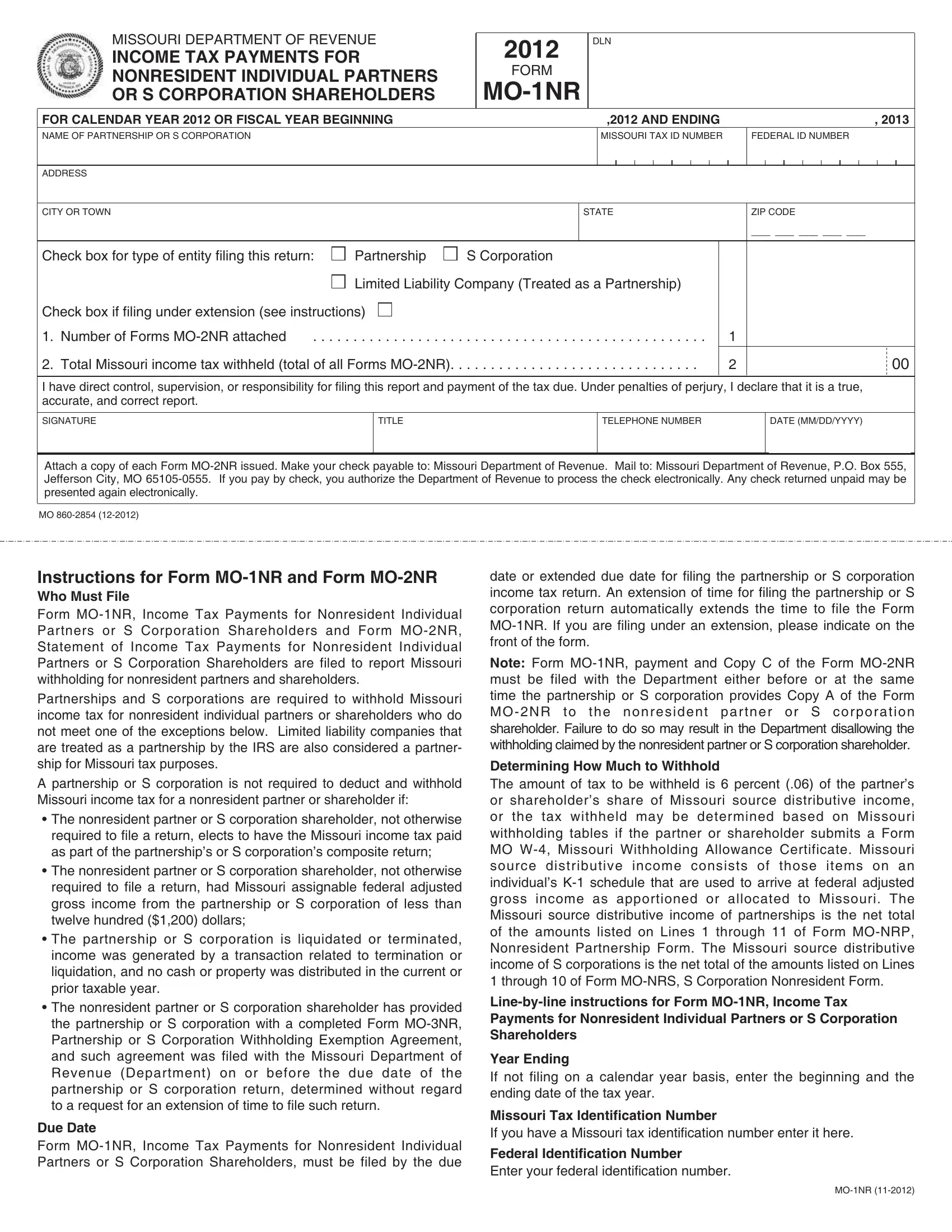

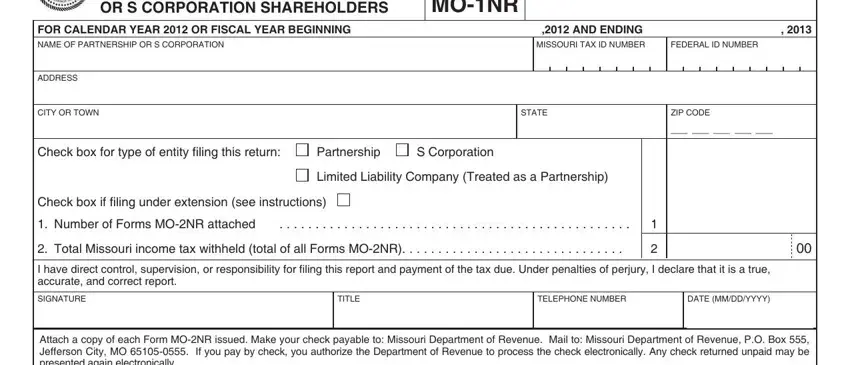

So as to complete this form, make sure that you enter the right details in every blank field:

1. Begin completing the Missouri Form Mo 1Nr with a group of necessary blanks. Collect all of the information you need and ensure not a single thing left out!

Step 3: As soon as you've reread the information you filled in, just click "Done" to finalize your form at FormsPal. Join us today and immediately use Missouri Form Mo 1Nr, available for download. All modifications made by you are saved , helping you to customize the file further as required. FormsPal guarantees your data privacy by having a secure method that in no way saves or shares any private data used. You can relax knowing your documents are kept confidential any time you work with our service!