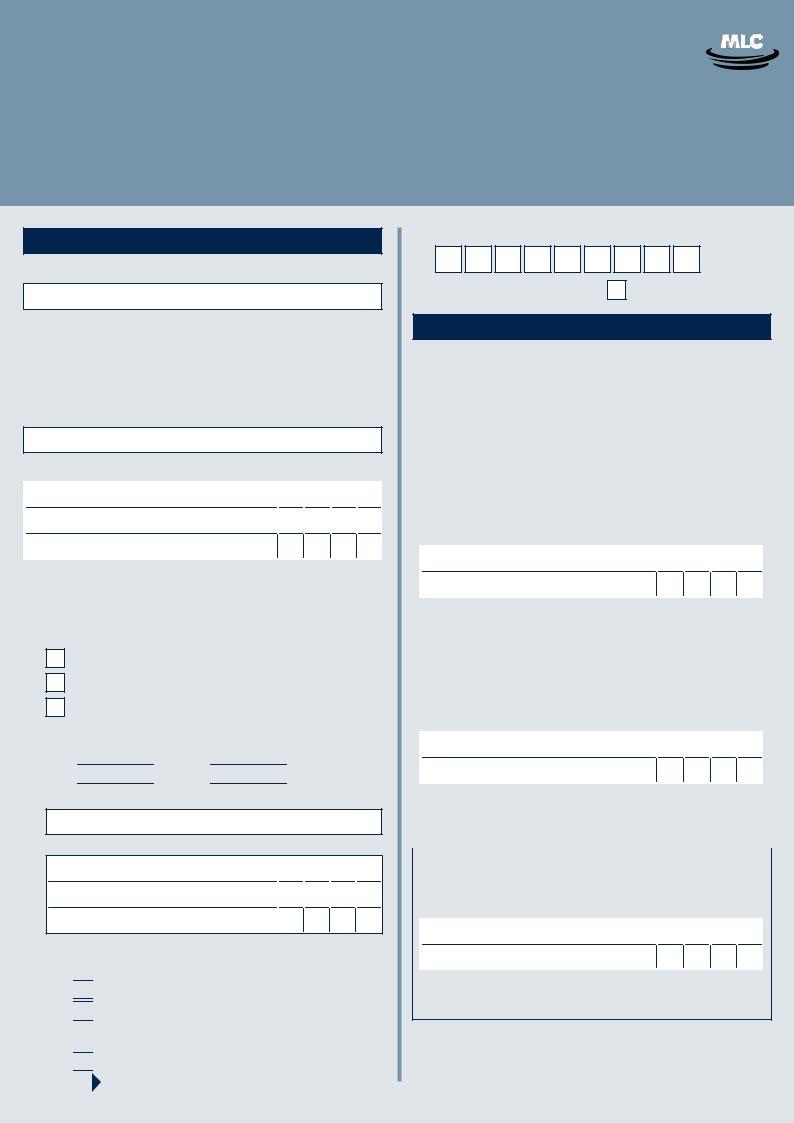

ELEGAL PERSONAL REPRESENTATIVE COMPLETION ONLY CONTINUED

Full name and qualification of person before whom the declaration is made (PLEASE PRINT)

Address of person before whom the declaration is made

Postcode

Note 1: A person who intentionally makes a false statement in a statutory declaration is guilty of an offence, the punishment for which is imprisonment for a term of 4 years—see section 11 of the Statutory Declarations Act 1959 (Cwlth).

Note 2: Chapter 2 of the Criminal Code applies to all offences against the Statutory Declarations Act 1959—see section 5A of the Statutory Declarations Act 1959 (Cwlth).

A Statutory Declaration under the Statutory Declarations Act 1959 (Cwlth) may be made before:

(1)A person who is currently licensed or registered under a law to practice in one of the following occupations: Chiropractor, Dentist, Legal Practitioner, Medical Practitioner, Nurse, Optometrist, Patent Attorney, Pharmacist, Physiotherapist, Psychologist, Trade Marks Attorney, Veterinary Surgeon.

(2)A person who is enrolled on the roll of the Supreme Court of the State or Territory, Or the High Court of Australia, as a legal Practitioner (However described); or A Person on the following list:

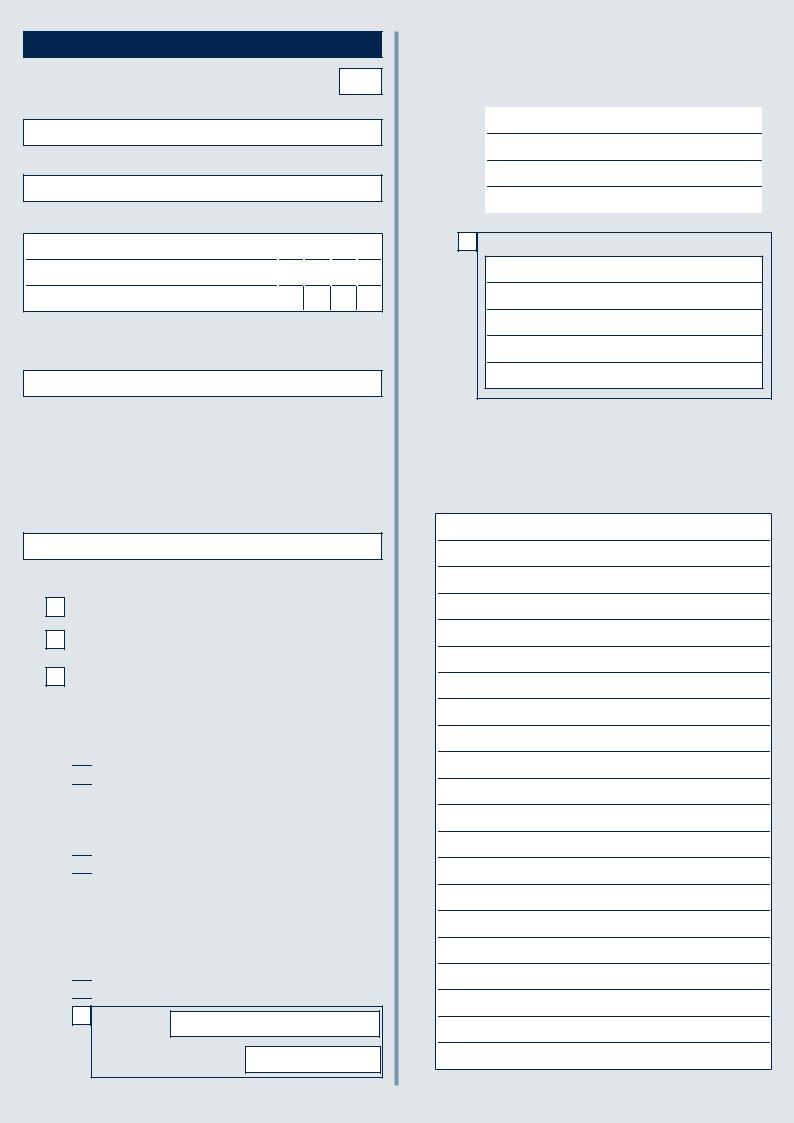

•Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public

•Australian Consular Officer or Australian Diplomatic Officer (within the meaning of the Consular Fees Act 1955)

•Bailiff

•Bank officer with 5 or more continuous years of service

•Building society officer with 5 or more years of continuous service

•Chief executive officer of a Commonwealth court

•Clerk of a court

•Commissioner for Affidavits

•Commissioner for Declarations

•Credit union officer with 5 or more years of continuous service

•Employee of the Australian Trade Commission who is:

(a)in a country or place outside Australia; and

(b)authorised under paragraph 3 (d) of the Consular Fees Act 1955; and

(c)exercising his or her function in that place

•Employee of the Commonwealth who is:

(a)in a country or place outside Australia; and

(b)authorised under paragraph 3 (c) of the Consular Fees Act 1955; and

(c)exercising his or her function in that place

•Fellow of the National Tax Accountants’ Association

•Finance company officer with 5 or more years of continuous service

•Holder of a statutory office not specified in another item in this Part

•Judge of a court

•Justice of the Peace

•Magistrate

•Marriage celebrant registered under Subdivision C of Division 1 of Part IV of the Marriage Act 1961

•Master of a court

•Member of Chartered Secretaries Australia

•Member of Engineers Australia, other than at the grade of student

•Member of the Association of Taxation and Management Accountants

•Member of the Australian Defence Force who is:

(a)an officer; or

(b)a non-commissioned officer within the meaning of the Defence Force Discipline Act 1982 with 5 or more years of continuous service; or

(c)a warrant officer within the meaning of that Act

•Member of the Institute of Chartered Accountants in Australia, the Australian Society of Certified Practising Accountants or the National Institute of Accountants

•Member of:

(a)the Parliament of the Commonwealth; or

(b)the Parliament of a State; or

(c)a Territory legislature; or

(d)a local government authority of a State or Territory

•Minister of religion registered under Subdivision A of Division 1 of Part IV of the Marriage Act 1961

•Notary public

•Permanent employee of the Australian Postal Corporation with 5 or more years of continuous service who is employed in an office supplying postal services to the public

•Permanent employee of:

(a)the Commonwealth or a Commonwealth authority; or

(b)a State or Territory or a State or Territory authority; or

(c)a local government authority; with 5 or more years of continuous service who is not specified in another item in this Part

•Person before whom a statutory declaration may be made under the law of the State or Territory in which the declaration is made

•Police officer

•Registrar, or Deputy Registrar, of a court

•Senior Executive Service employee of:

(a)the Commonwealth or a Commonwealth authority; or

(b)a State or Territory or a State or Territory authority

•Sheriff

•Sheriff’s officer

•Teacher employed on a full-time basis at a school or tertiary education institution

•Member of the Australasian Institute of Mining and Metallurgy

How to contact us

MLC Client Service Centre

If you have any questions, please contact your financial adviser, or the MLC Client Service Centre on 132 652 between 8.00 am and 6.00 pm (AEST/AEDT) Monday to Friday.

Return this form and any attachments to:

Trustee Services |

Website |

PO Box 1585 |

For details on MLC’s range of products |

North Sydney NSW 2059 |

and services visit: mlc.com.au |

Fax: 02 9966 3502 |

|

71323M0310