This PDF editor was made with the goal of making it as simple and easy-to-use as it can be. The following steps will make filling up the mn estimated tax payment voucher 2020 easy and quick.

Step 1: The website page contains an orange button that says "Get Form Now". Click it.

Step 2: Now you are able to edit mn estimated tax payment voucher 2020. You've got a lot of options with our multifunctional toolbar - it's possible to add, eliminate, or alter the text, highlight the certain components, and carry out various other commands.

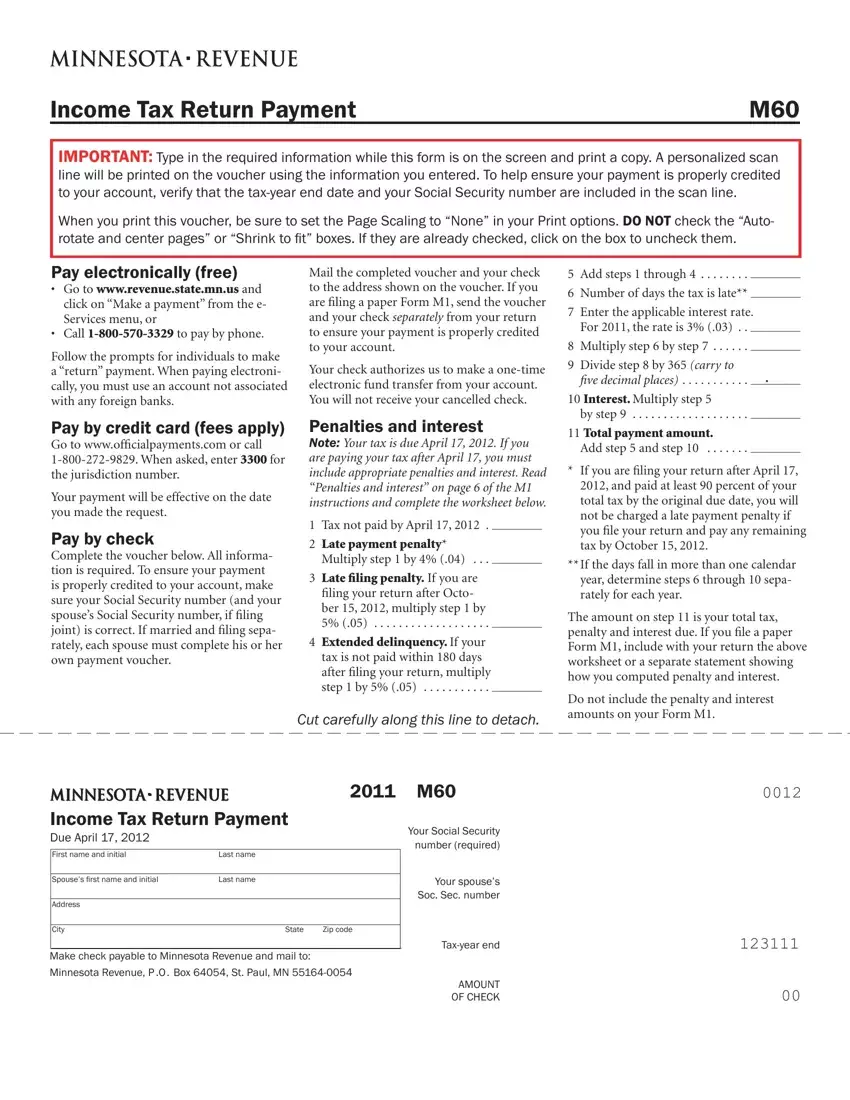

The next segments will help make up the PDF form:

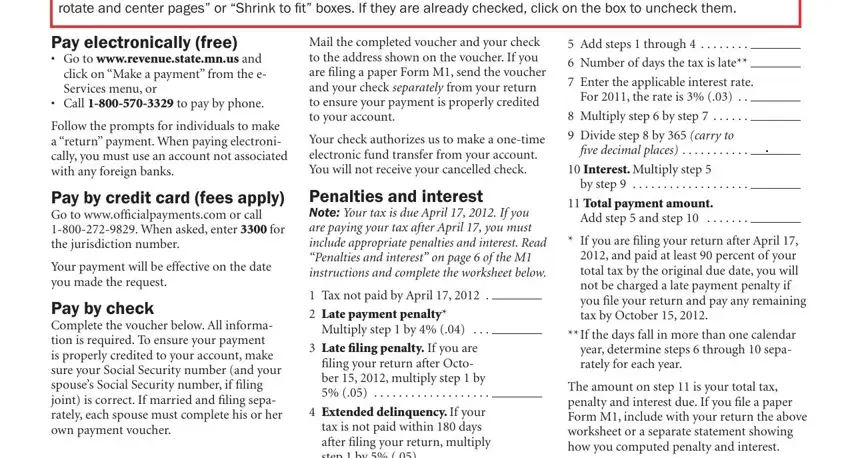

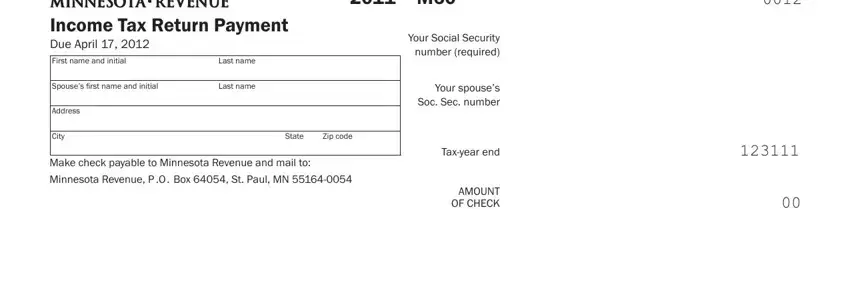

Remember to note your information in the part Income Tax Return Payment Due, First name and initial, Last name, Spouses irst name and initial, Last name, Address, City, State, Zip code, Make check payable to Minnesota, Minnesota Revenue P O Box St, Your Social Security number, Your spouses Soc Sec number, Taxyear end, and AMOUNT OF CHECK.

Step 3: Click "Done". Now you can upload your PDF document.

Step 4: You can also make copies of your document torefrain from any future issues. Don't get worried, we cannot disclose or record your data.

2011 Income Tax Return Payment

2011 Income Tax Return Payment