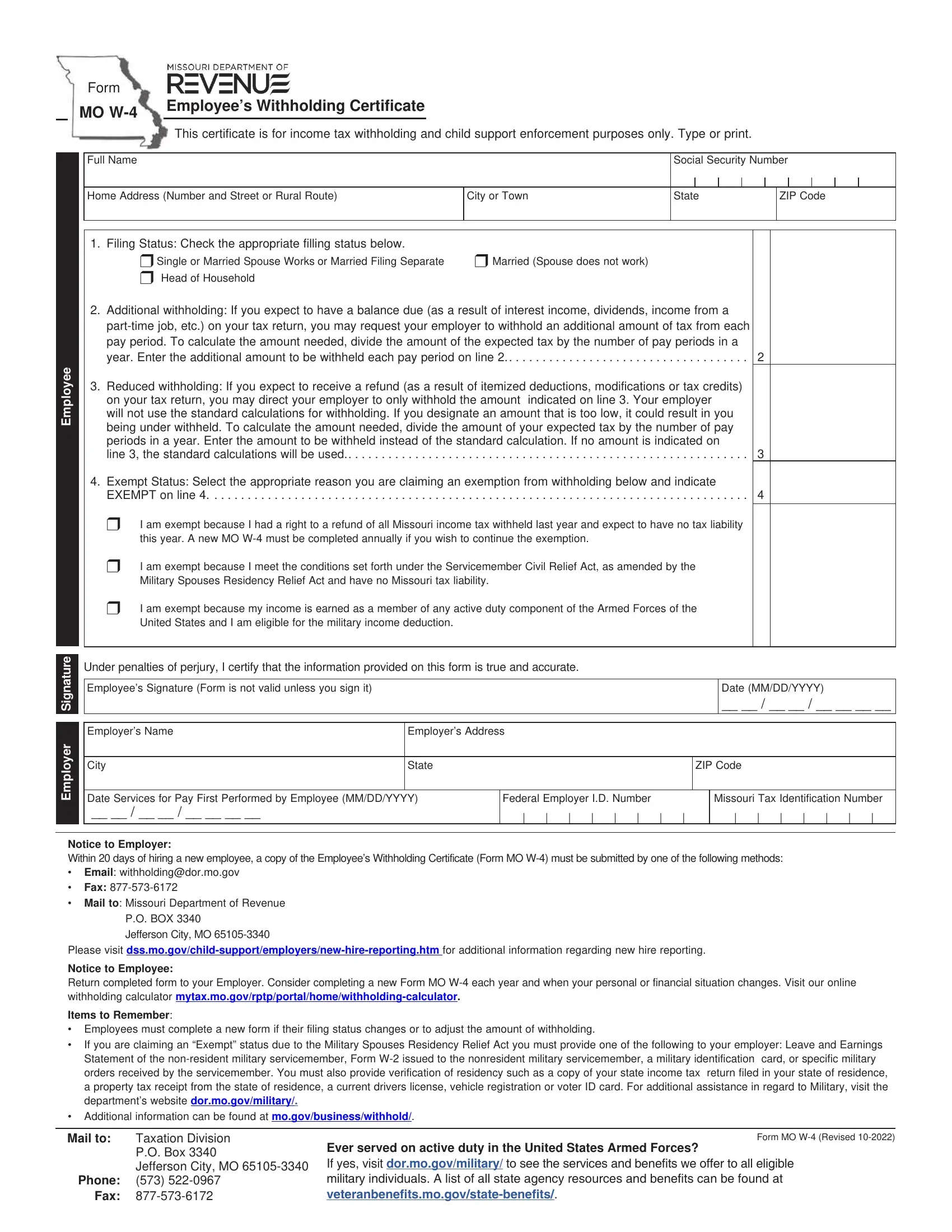

You can fill out missouri w4 instantly by using our PDFinity® editor. In order to make our tool better and more convenient to use, we constantly come up with new features, with our users' feedback in mind. With some simple steps, you can start your PDF journey:

Step 1: Open the PDF inside our tool by hitting the "Get Form Button" at the top of this page.

Step 2: The tool offers the ability to customize most PDF documents in a range of ways. Modify it by writing any text, correct original content, and add a signature - all when it's needed!

Pay close attention when filling out this pdf. Make certain every blank field is done properly.

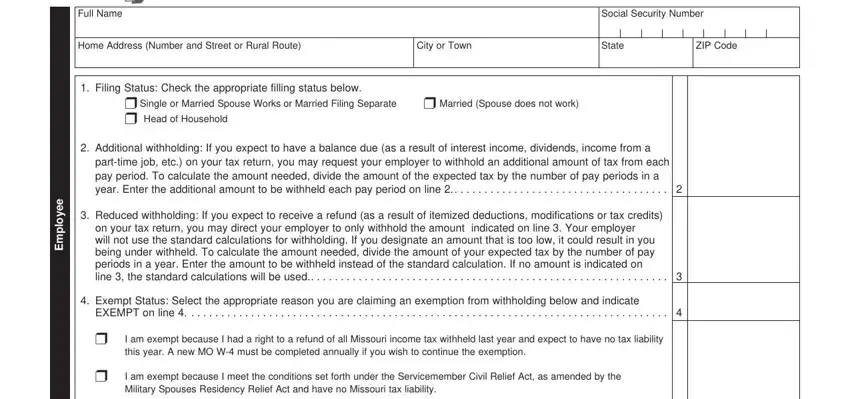

1. Firstly, when completing the missouri w4, begin with the part that includes the subsequent blanks:

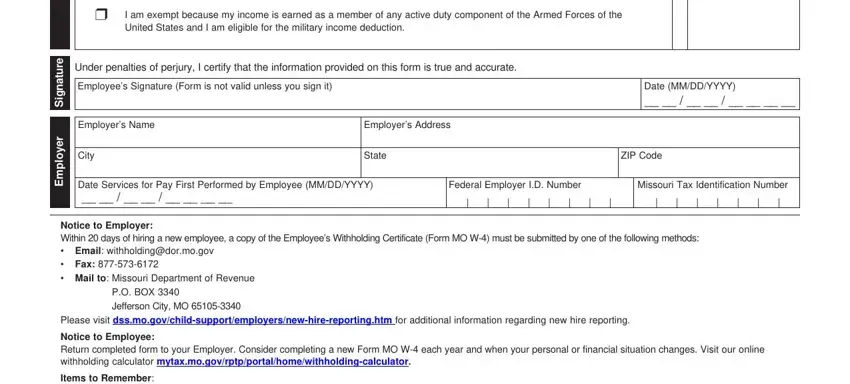

2. After the last part is finished, you have to put in the needed specifics in I am exempt because my income is, Under penalties of perjury I, Employees Signature Form is not, Employers Name, Employers Address, Date MMDDYYYY, City, State, ZIP Code, Date Services for Pay First, Federal Employer ID Number, Missouri Tax Identification Number, e r u t a n g S, r e y o p m E, and Notice to Employer Within days of so you can progress further.

Regarding Date MMDDYYYY and Date Services for Pay First, make sure that you do everything correctly here. These are surely the most important ones in this form.

Step 3: Be certain that the information is accurate and then click "Done" to proceed further. Right after setting up a7-day free trial account at FormsPal, you'll be able to download missouri w4 or send it through email right away. The PDF will also be at your disposal through your personal account page with your each edit. FormsPal ensures your information privacy by having a protected system that never saves or shares any type of private data used in the form. Be assured knowing your docs are kept confidential each time you work with our services!