You are able to work with 2011 effortlessly with our PDFinity® PDF editor. Our expert team is always working to improve the editor and make it much faster for people with its cutting-edge functions. Make the most of the latest revolutionary opportunities, and discover a myriad of new experiences! Should you be looking to start, here is what it takes:

Step 1: Access the PDF inside our editor by clicking the "Get Form Button" above on this page.

Step 2: As soon as you open the file editor, you will see the form ready to be filled in. Aside from filling out various fields, you may as well perform other sorts of things with the form, including writing your own text, changing the original text, adding graphics, placing your signature to the document, and a lot more.

It is straightforward to finish the pdf following our helpful guide! Here is what you want to do:

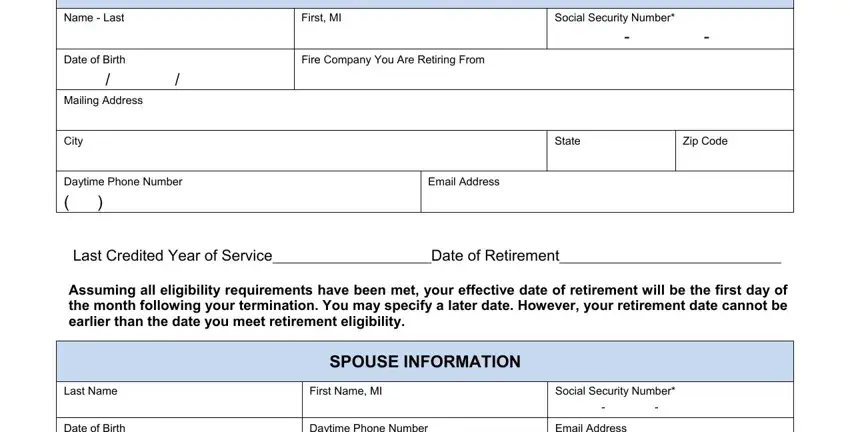

1. The 2011 will require specific information to be inserted. Be sure the subsequent blanks are filled out:

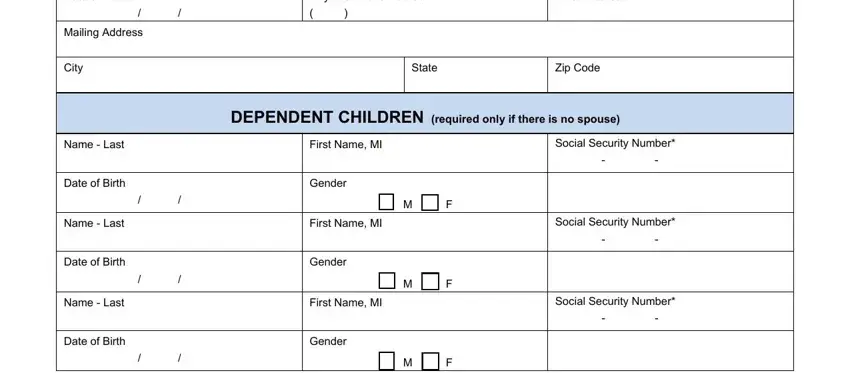

2. After this part is completed, you're ready add the needed details in Date of Birth, Mailing Address, City, Name Last, Date of Birth, Name Last, Date of Birth, Name Last, Date of Birth, Daytime Phone Number, Email Address, State, Zip Code, DEPENDENT CHILDREN required only, and First Name MI allowing you to go to the next step.

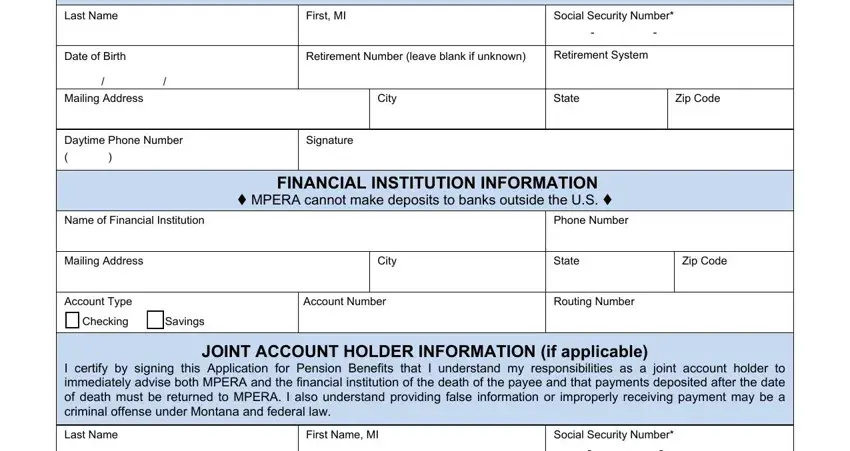

3. In this particular stage, review Last Name, Date of Birth Mailing Address, First MI, Social Security Number, Retirement Number leave blank if, Retirement System, City, State, Zip Code, Daytime Phone Number, Signature, Name of Financial Institution, Phone Number, FINANCIAL INSTITUTION INFORMATION, and MPERA cannot make deposits to. Each of these will need to be filled out with utmost accuracy.

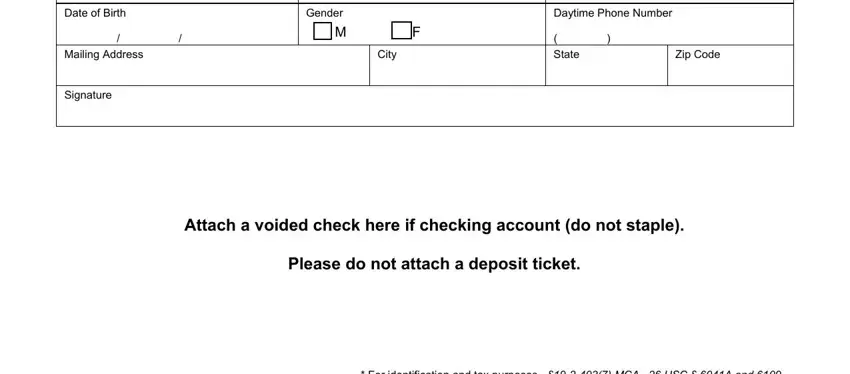

4. Filling in Date of Birth Mailing Address, Signature, Gender M F, City, Daytime Phone Number State, Zip Code, Attach a voided check here if, Please do not attach a deposit, and For identification and tax is key in the fourth step - ensure to devote some time and fill out every single field!

It's easy to make a mistake while completing the For identification and tax, thus be sure you go through it again prior to deciding to submit it.

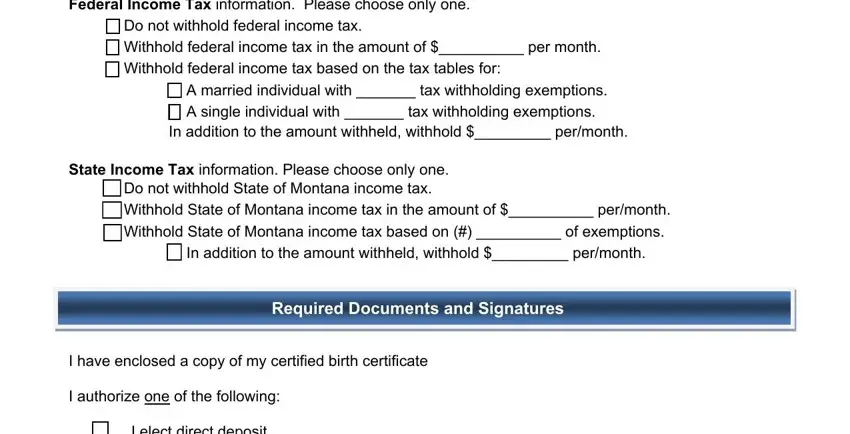

5. This pdf needs to be finalized by going through this segment. Further you will see a detailed set of blank fields that need specific details to allow your document submission to be complete: Federal Income Tax information, Do not withhold federal income, A married individual with tax, State Income Tax information, Do not withhold State of Montana, In addition to the amount, I have enclosed a copy of my, Required Documents and Signatures, I authorize one of the following, and I elect direct deposit.

Step 3: Immediately after double-checking your fields, press "Done" and you are done and dusted! Join us right now and immediately use 2011, available for downloading. Every single change you make is conveniently kept , helping you to change the pdf later if needed. FormsPal is devoted to the personal privacy of our users; we always make sure that all personal information used in our tool remains secure.