Our top level web programmers have worked together to implement the PDF editor which you will work with. This particular app allows you to submit budget form files immediately and effortlessly. This is certainly all you need to undertake.

Step 1: To get started, choose the orange button "Get Form Now".

Step 2: Now you can change your budget form. You can use our multifunctional toolbar to include, erase, and adjust the content of the form.

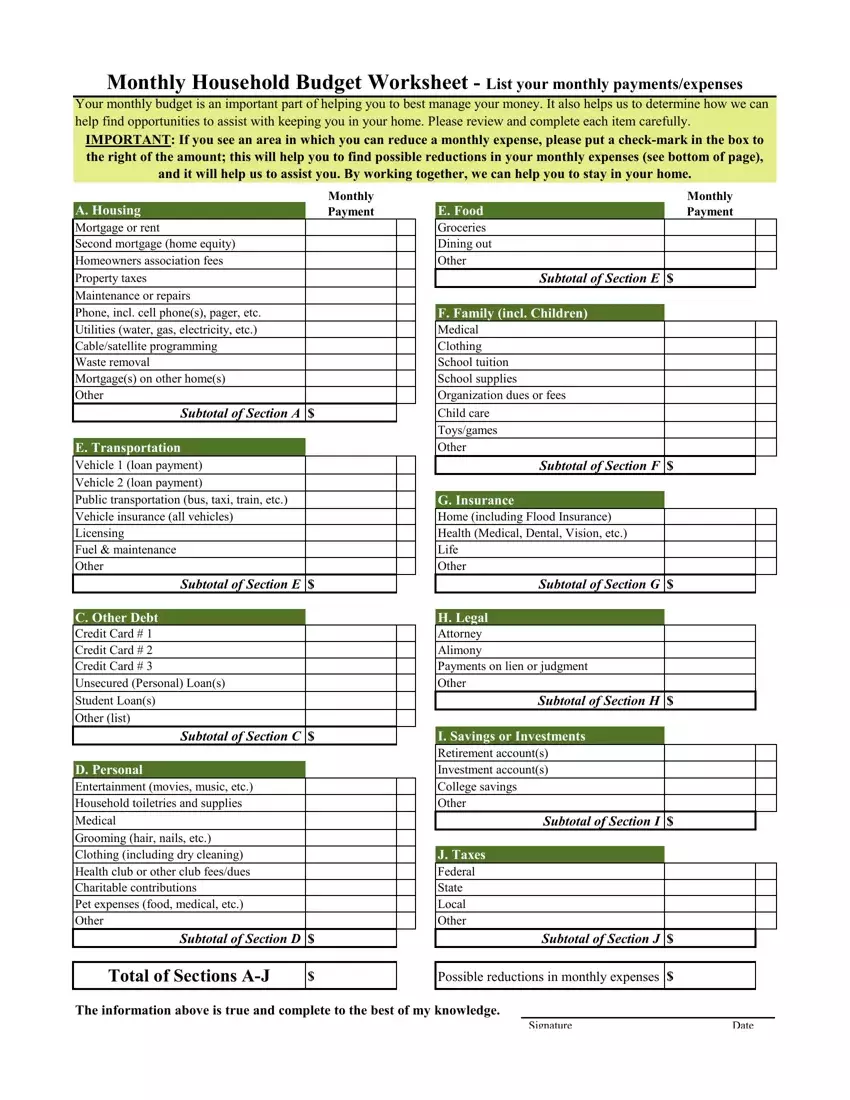

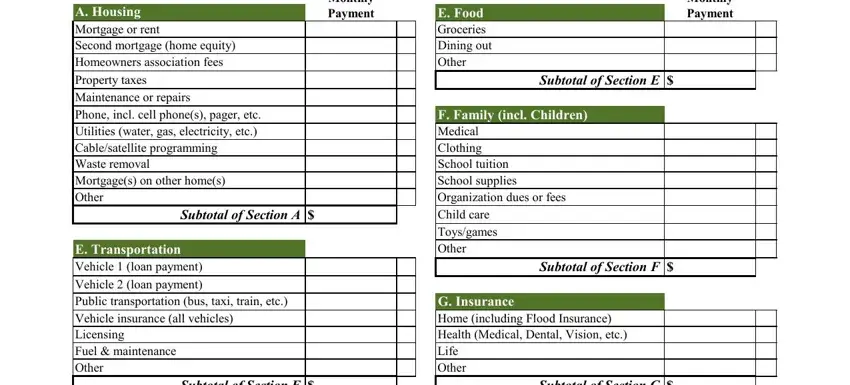

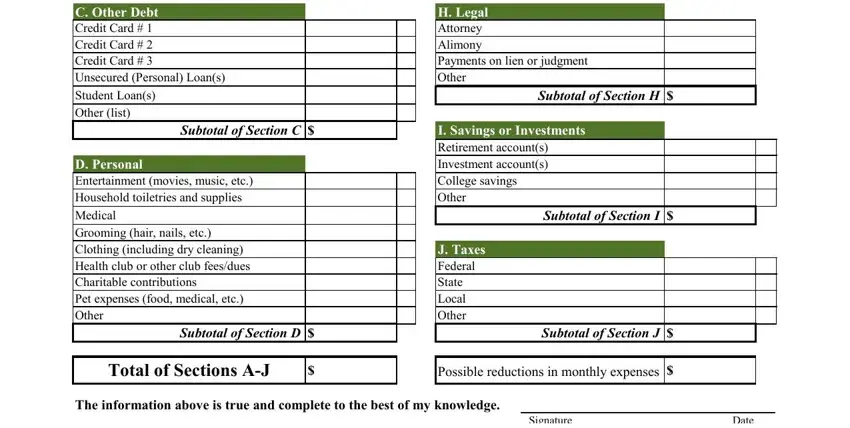

The next parts are inside the PDF document you will be filling in.

Fill out the C Other Debt Credit Card Credit, Subtotal of Section C, D Personal Entertainment movies, H Legal Attorney Alimony Payments, Subtotal of Section H, I Savings or Investments, Subtotal of Section I, J Taxes Federal State Local Other, Subtotal of Section D, Subtotal of Section J, Total of Sections AJ, Possible reductions in monthly, The information above is true and, Signature, and Date fields with any particulars that will be requested by the program.

Step 3: After you have clicked the Done button, your file is going to be readily available export to any kind of electronic device or email address you identify.

Step 4: Try to create as many duplicates of the document as you can to stay away from possible problems.