Our PDF editor allows you to complete forms. You won't need to undertake much to edit loan payoff request form forms. Simply check out these steps.

Step 1: You can select the orange "Get Form Now" button at the top of the webpage.

Step 2: Once you have accessed the vehicle payoff letter template editing page you can see all of the functions you may undertake with regards to your template within the top menu.

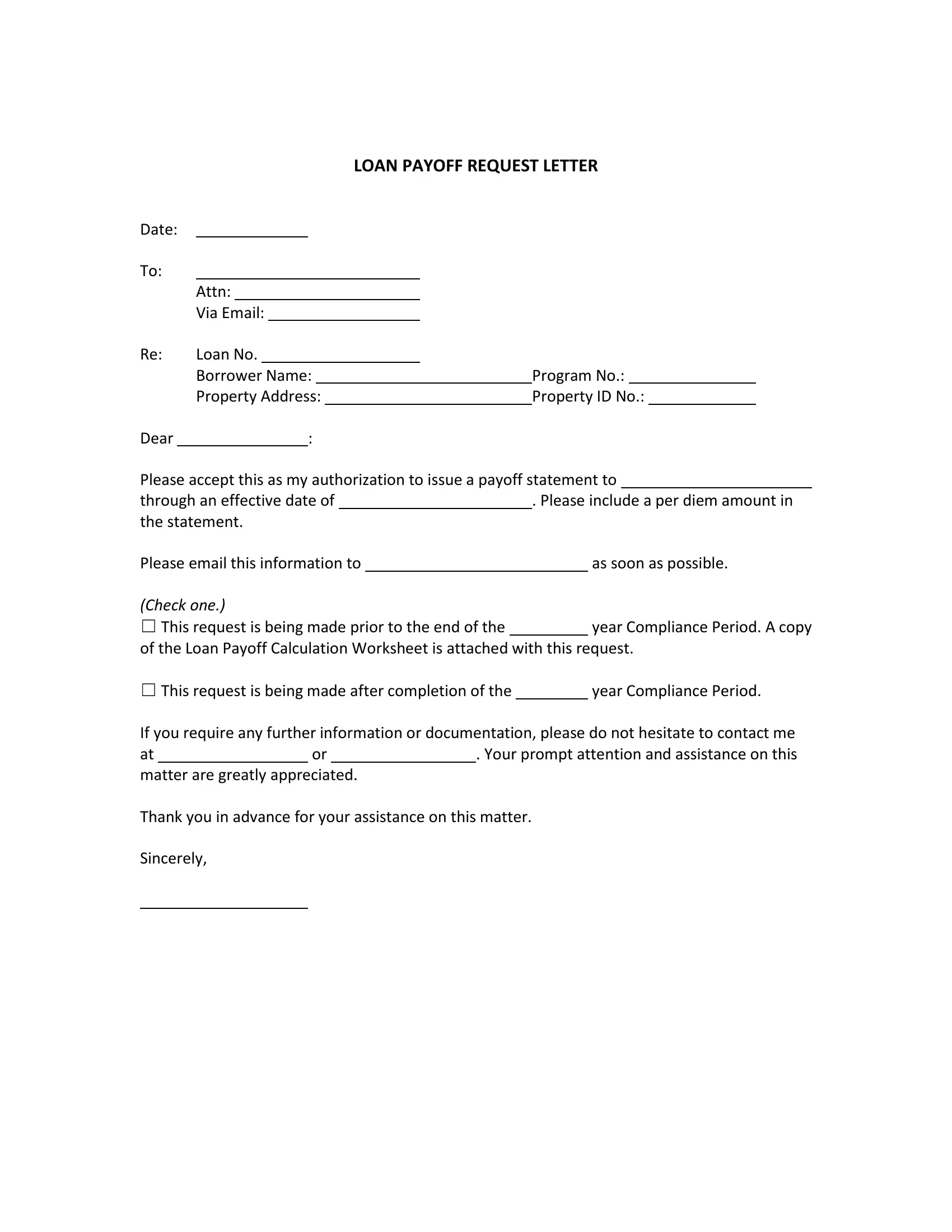

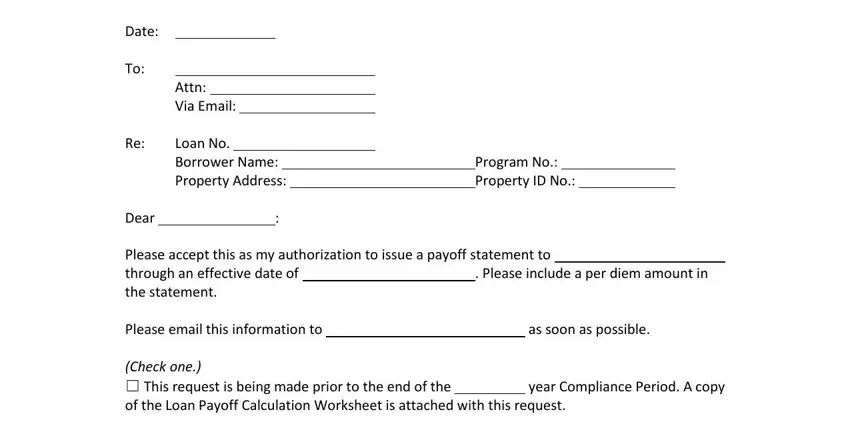

You will need to type in the next information in order to prepare the file:

Enter the requested information in the space This request is being made after, year Compliance Period, If you require any further, Thank you in advance for your, and Sincerely.

Step 3: When you are done, hit the "Done" button to export your PDF form.

Step 4: Produce at least several copies of the form to stay away from all of the possible troubles.