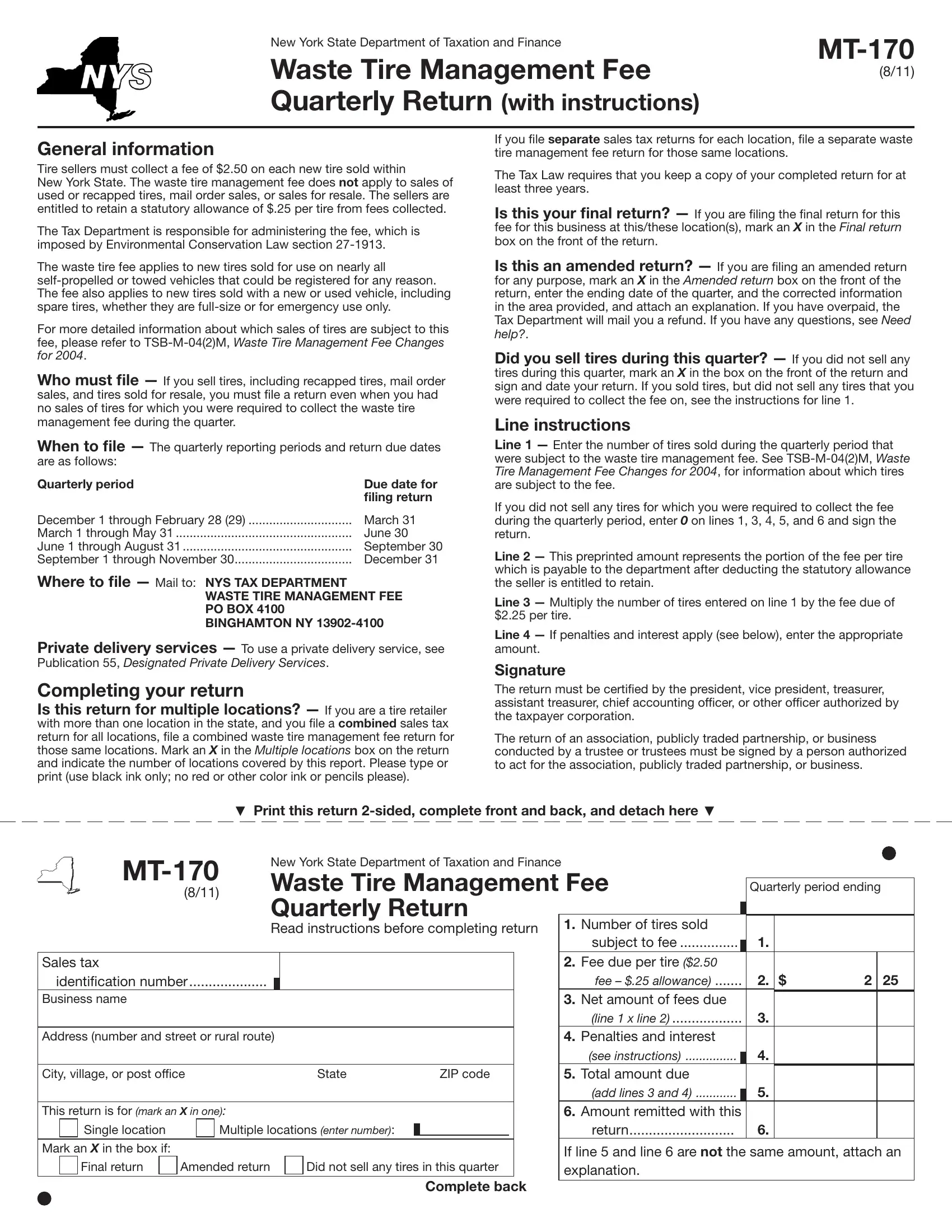

Handling PDF forms online is simple using our PDF editor. Anyone can fill out form waste tire here in a matter of minutes. Our team is focused on providing you the best possible experience with our tool by regularly presenting new functions and improvements. With these improvements, working with our editor becomes easier than ever! Starting is simple! What you need to do is take the following easy steps directly below:

Step 1: Access the form in our tool by clicking the "Get Form Button" at the top of this page.

Step 2: Using this advanced PDF editor, you could accomplish more than just fill in blank form fields. Try each of the features and make your forms look high-quality with customized textual content put in, or modify the file's original content to perfection - all comes with the capability to insert stunning pictures and sign it off.

Concentrate when filling in this form. Make sure all required blanks are done correctly.

1. Before anything else, when completing the form waste tire, begin with the part that features the subsequent blanks:

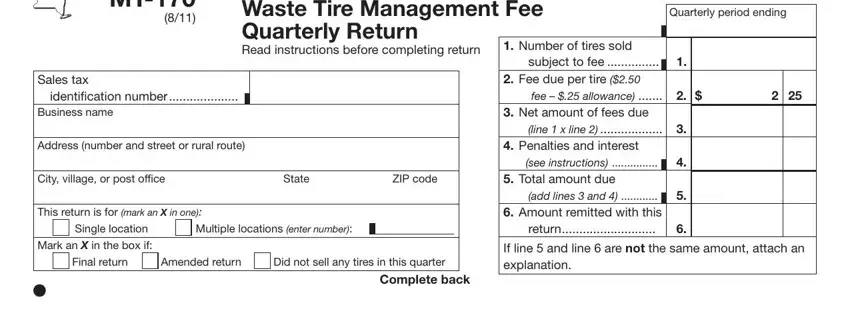

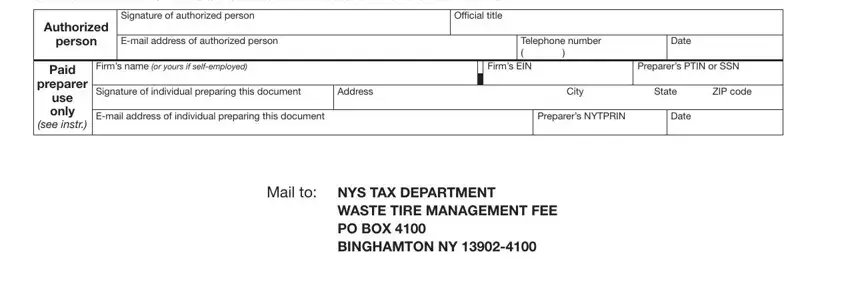

2. After this part is filled out, go to enter the relevant details in these: I hereby certify that this return, Signature of authorized person, Oficial title, Authorized, person, Email address of authorized person, Telephone number, Date, Paid, preparer, use only, see instr, Firms name or yours if selfemployed, Firms EIN, and Preparers PTIN or SSN.

Lots of people generally make some errors while completing Signature of authorized person in this section. Don't forget to re-examine what you type in here.

Step 3: Prior to submitting this file, ensure that blanks were filled out the correct way. The moment you establish that it's correct, press “Done." Download your form waste tire the instant you sign up at FormsPal for a 7-day free trial. Instantly access the pdf in your personal account, together with any modifications and adjustments being conveniently synced! FormsPal ensures your data privacy via a secure system that never records or distributes any personal information used. Be assured knowing your documents are kept safe every time you use our editor!