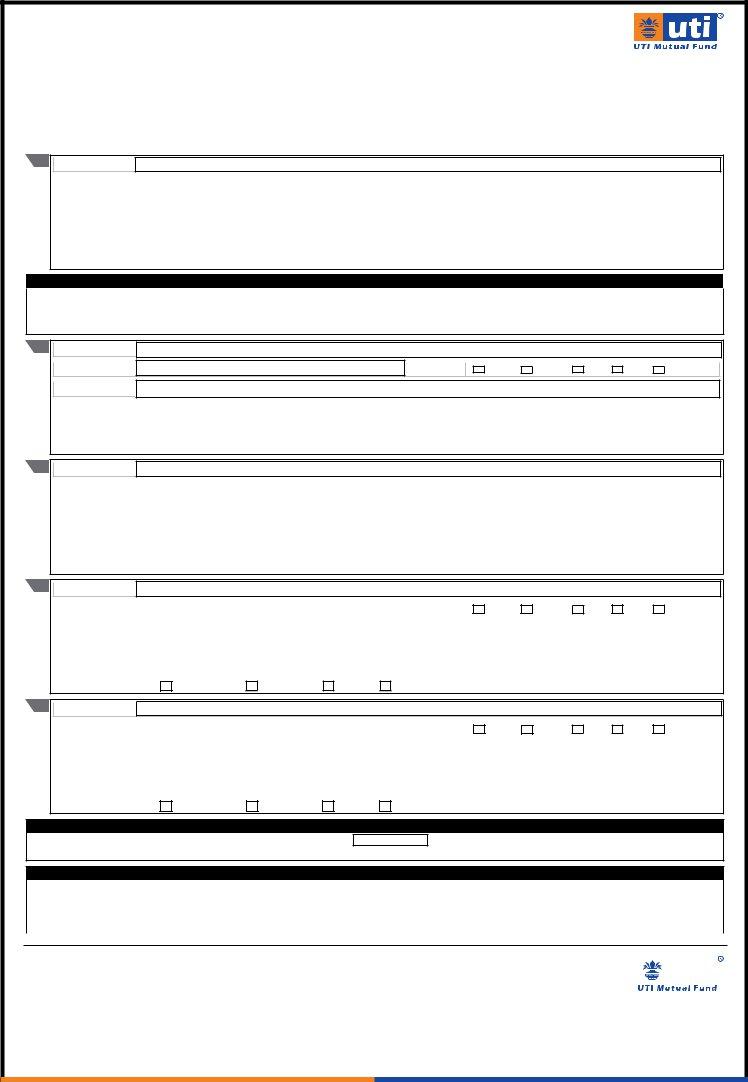

In the realm of financial management and transactions, particularly within investment scenarios, the utility of the Multiple Bank Accounts Registration Form stands paramount for investors seeking a streamlined and secure mechanism for managing funds across several banking institutions. This comprehensive document, primarily aimed at facilitating the registration or addition of multiple bank accounts under a single investment folio, caters to both individuals and non-individual entities, limiting the former to a maximum of five bank accounts and the latter to ten. The form encompasses sections for detailing existing bank accounts already registered, as well as provisions for adding new accounts, thus ensuring flexibility and ease of receiving payment proceeds through preferred channels. Essential details required include bank name, account number, account type, branch details, and specific codes for electronic funds transfer, supplemented by necessary documentation like cancelled cheques or bank statements to validate each account's authenticity. Moreover, the form allows for the designation of a default bank account for receiving dividends or redemption payments, highlighting an emphasis on customization to investor preferences. Significantly, the procedural aspect is tightened with guidelines on the deletion of bank accounts, mandating a robust verification process to prevent unauthorized changes. This meticulous attention to detail underscores the form's role in bolstering the security and efficiency of financial transactions in the investor's portfolio, tailored to accommodate the dynamic needs of modern investment strategies.

| Question | Answer |

|---|---|

| Form Name | Multiple Bank Accounts Registration Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | cams change of bank form, kfintech bank account change online, uti mutual fund change of bank form, karvy change of bank form |

Multiple Bank Accounts Registration Form

Please fill in the information below legibly in ENGLISH and in BLOCK LETTERS

Folio Number : |

|

|

|

|

PAN No. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of the sole / first holder |

|

|

|

|

|

|

|

|

Scheme / Plan / Option |

|

UTI - |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile No. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

A. EXISTING BANK ACCOUNT AS REGISTERED IN THE FOLIO |

|

|||

1.

Name of the Bank

|

Account Number |

|

|

|

|

|

|

|

|

|

|

|

Account Type |

|

|

|

Savings |

|

Current |

|

NRE |

|

NRO |

|

FCNR |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Bank Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pincode |

|

|

|

MICR Code |

|

|

|

|

|

|

|

IFS Code for NEFT |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document attached (any one) |

|

Cancelled Cheque |

|

|

Bank Statement |

|

Pass Book |

|

Bank Certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

B. ADDITION OF BANK ACCOUNTS

Please register my/our following bank accounts for all investments in my/our folio. I/we understand that I/we can choose to receive payment proceeds in any of these by making a specific request in my/our redemption request. I/We understand that the bank accounts listed below shall be taken up for registration in my/our folio in the order given below and the same shall be registered only if there is a scope to register additional bank accounts in the folio subject to a maximum of five in the case of individuals and ten in the case of non individuals.

2.

Name of the Bank |

|

|

|

|

|

|

Account Number |

Account Type |

Savings |

Current |

NRE |

NRO |

FCNR |

|

|

Bank Address

|

Branch |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pincode |

|

|

|

MICR Code |

|

|

|

|

|

|

IFS Code for NEFT |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document attached (any one) |

|

Cancelled Cheque |

|

|

Bank Statement |

|

Pass Book |

|

Bank Certificate |

|||||||

|

|

|

|

|

||||||||||||

3.

Name of the Bank

|

Account Number |

|

|

|

|

|

|

|

|

|

|

|

Account Type |

|

|

|

Savings |

|

Current |

|

NRE |

|

NRO |

|

FCNR |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Bank Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pincode |

|

|

|

MICR Code |

|

|

|

|

|

|

|

|

IFS Code for NEFT |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document attached (any one) |

|

Cancelled Cheque |

|

|

Bank Statement |

|

Pass Book |

|

Bank Certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

4.

Name of the Bank

|

Account Number |

|

|

|

|

|

|

|

|

Account Type |

|

|

|

Savings |

|

Current |

|

NRE |

|

NRO |

|

FCNR |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Bank Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch |

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pincode |

|

|

|

MICR Code |

|

|

|

|

|

|

|

IFS Code for NEFT |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document attached (any one) |

|

Cancelled Cheque |

Bank Statement |

|

Pass Book |

Bank Certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

5.

Name of the Bank

|

Account Number |

|

|

|

|

|

|

|

|

|

|

|

Account Type |

|

|

|

Savings |

|

Current |

|

NRE |

|

NRO |

|

FCNR |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Bank Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pincode |

|

|

|

|

MICR Code |

|

|

|

|

|

|

|

IFS Code for NEFT |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document attached (any one) |

|

Cancelled Cheque |

|

|

Bank Statement |

|

Pass Book |

|

Bank Certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

C. DEFAULT BANK ACCOUNT

From the above Bank Account details the Bank details registered at S. No. ______________ may be registered as default Bank Account for Receiving Dividend /

Redemption Payment

SIGNATURES (To be signed as per mode of holding. In case of

______________________________________ |

______________________________________ |

______________________________________ |

|

|||||

|

Sole / First Applicant / Unit holder |

Second Applicant / Unit holder |

|

Thrid Applicant / Unit holder |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

||||

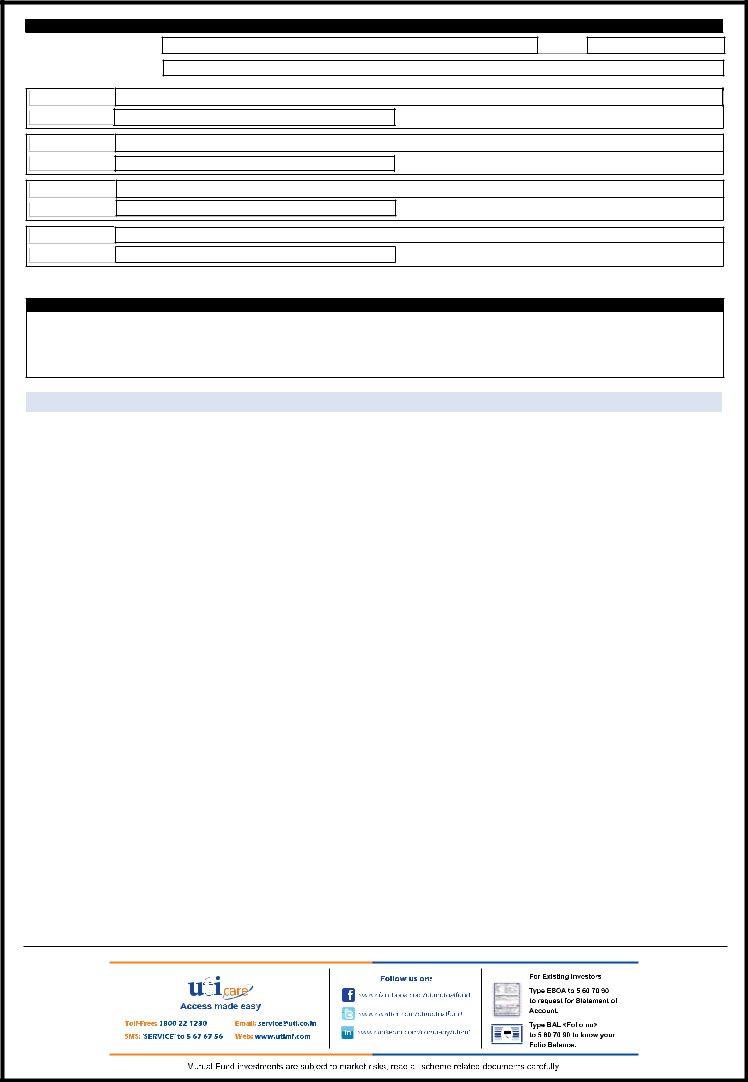

UTI Mutual Fund - Acknowledgement for Multiple Bank Accounts Registration Form (to be filled in by the investor) |

|

|

|

|

||||

Received, subject to verification, for Multiple Bank Accounts Registration Form |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

from Mr/ Mrs/ Ms : _____________________________________________________________ |

|

|

|

|

|

|

||

|

|

|

|

Receiving UFC/ Registrar’s official stamp |

||||

Folio No : _____________________________________________________________________ |

|

with date and signature |

||||||

|

|

|

|

|

|

|

|

|

Registrar: Karvy Computershare Pvt. Ltd., Unit: UTI Mutual Fund, Narayani Mansion,

D. BANK ACCOUNT DELETION FORM

Folio Number :

Name of the sole / first holder

Name of the Bank

Account Number

Name of the Bank

Account Number

Name of the Bank

Account Number

Name of the Bank

Account Number

PAN No.

Deletion of a default bank account is not permitted unless the investor mentions another registered bank account as a default account in Part C of this Form.

SIGNATURES (To be signed as per mode of holding. In case of

______________________________________ |

______________________________________ |

______________________________________ |

First Unit holder |

Second Unit holder |

Thrid Unit holder |

Guidelines

This facility allows a unit holder to register multiple bank account details for all investments held in the specified folio (existing or new). Individuals/HuF can register upto 5 different bank accounts for a folio by using this form.

Please enclose a cancelled cheque leaf for each of such banks accounts. This will help in verification of the account details and register them accurately. The application will be processed only for such accounts for which cancelled cheque leaf is provided. Accounts not matching with such cheque leaf thereof will not be registered.

If the bank account number on the cheque leaf is handwritten or investor name is not printed on the face of the cheque, bank account statement or pass book giving the name, address and the account number should be enclosed. If photocopies are submitted, investors must produce original for verification.

IMP: Please enclose cancelled cheque leaf/bank statement/ bank pass book giving the name, address and the account number of the existing bank account registered in the Folio and photo ID such as copy of PAN card/Election card/ Driving license etc. of the 1st unitholder and additionally, investment proof, if bank details are not available in the Folio.

Bank account registration/deletion request will be accepted and processed only if all the details are correctly filled and the necessary documents as per 2,3 & 4 above are submitted. The request is liable to be rejected if any information is missing or incorrectly filled or if there is deficiency in the documents submitted.

The first/sole unit holder in the folio should be one of the holders of the bank account being registered.

The existing bank account registered under the Folio, if any, will be the default bank account. The investors can change the default bank account by submitting this form and the required documents as may be specified by UTI AMC from time to time. In case multiple bank accounts are opted for registration as default bank account, the UTI AMC reserves the right to register any one of them as the default bank account.

A written confirmation of registration of the additional bank account details will be dispatched to you within 10 calendar days of receipt of such request.

If any of the registered bank accounts are closed/ altered, please intimate the AMC in writing of such change with an instruction to delete/alter it from of our records.

The Bank Account chosen as the default bank account will be used for all Redemption payouts/ Dividend payouts. At anytime, investor can instruct the AMC to change the default bank account by choosing one of the additional accounts already registered with the AMC.

If request for redemption received together with a change of bank account or before verification and validation of the new bank account, the redemption request may be processed to the currently registered default (old) bank account.

If in a folio, purchase investments are vide SB or NRO bank account, the bank account types for redemption can be SB or NRO only. If the purchase investments are made vide NRE account(s), the bank accounts types for redemption can be SB/ NRO/ NRE.

The registered bank accounts will also be used to identify the

UTI Mutual Fund, UTI Trustee Co. Pvt. Ltd or the UTI AMC Ltd will not be responsible for any delay or

This facility is subject to the terms and conditions of the Statement of Additional Information and Scheme Information Documents of the scheme of UTI Mutual Fund, and such other conditions and procedures as may be prescribed by the UTI AMC Ltd from time to time. to identify the