Dealing with PDF forms online is always very easy using our PDF tool. Anyone can fill out change ownership donee sample here effortlessly. To keep our tool on the forefront of practicality, we strive to implement user-oriented features and improvements regularly. We are always pleased to receive feedback - help us with reshaping how we work with PDF documents. Starting is simple! All you have to do is follow these simple steps down below:

Step 1: Access the PDF file inside our tool by clicking the "Get Form Button" above on this webpage.

Step 2: When you start the file editor, there'll be the document made ready to be filled out. In addition to filling in various blank fields, it's also possible to do other things with the form, namely writing custom words, changing the initial text, inserting images, signing the form, and much more.

Be attentive while completing this form. Make sure every single blank is done correctly.

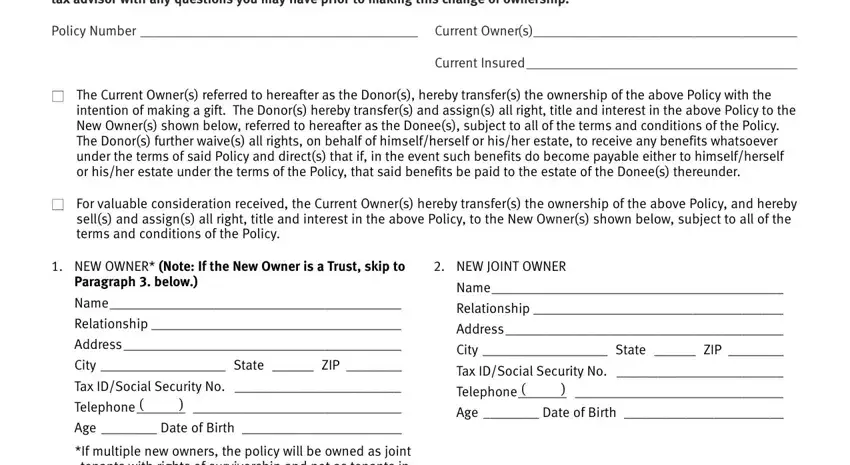

1. Fill out the change ownership donee sample with a selection of necessary fields. Consider all the required information and be sure nothing is left out!

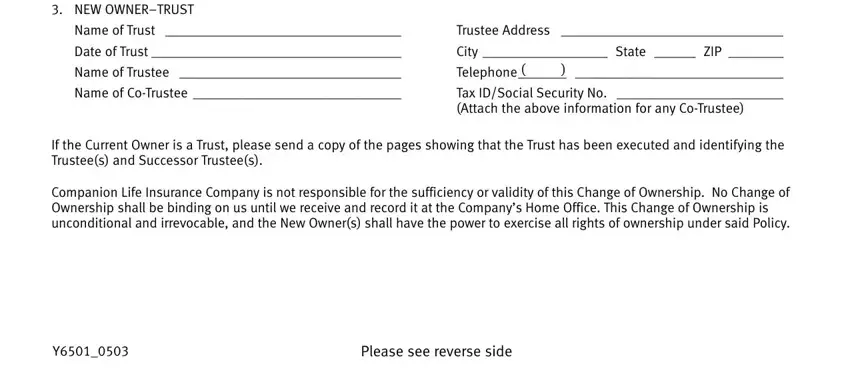

2. Soon after filling out this section, go on to the next stage and fill out the necessary details in all these fields - NEW OWNERTRUST, Name of Trust, Trustee Address, Date of Trust, City State ZIP, Name of Trustee, Telephone, Name of CoTrustee, Tax IDSocial Security No Attach, If the Current Owner is a Trust, Companion Life Insurance Company, and Please see reverse side.

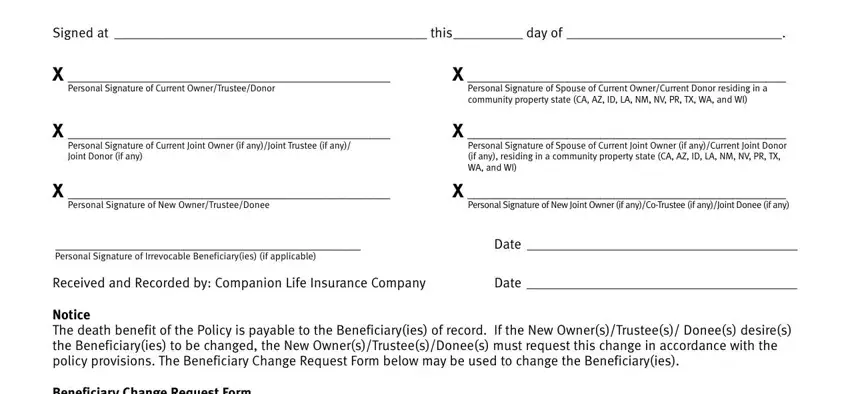

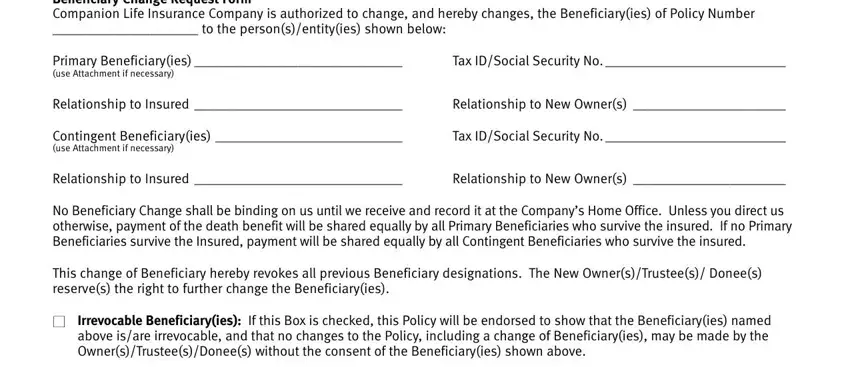

3. This 3rd section should be pretty uncomplicated, Signed at this day of, Personal Signature of Current, Personal Signature of Current, Personal Signature of Spouse of, Personal Signature of Spouse of, Personal Signature of New, Personal Signature of New Joint, Personal Signature of Irrevocable, Date, Received and Recorded by Companion, Date, Notice The death benefit of the, and Beneficiary Change Request Form - these fields has to be filled out here.

As to Received and Recorded by Companion and Beneficiary Change Request Form, be certain that you get them right in this current part. These two could be the most important fields in the document.

4. The subsequent subsection needs your details in the following parts: Beneficiary Change Request Form, Primary Beneficiaryies use, Tax IDSocial Security No, Relationship to Insured, Relationship to New Owners, Contingent Beneficiaryies use, Tax IDSocial Security No, Relationship to Insured, Relationship to New Owners, No Beneficiary Change shall be, This change of Beneficiary hereby, and Irrevocable Beneficiaryies If this. Be sure to type in all of the requested info to go forward.

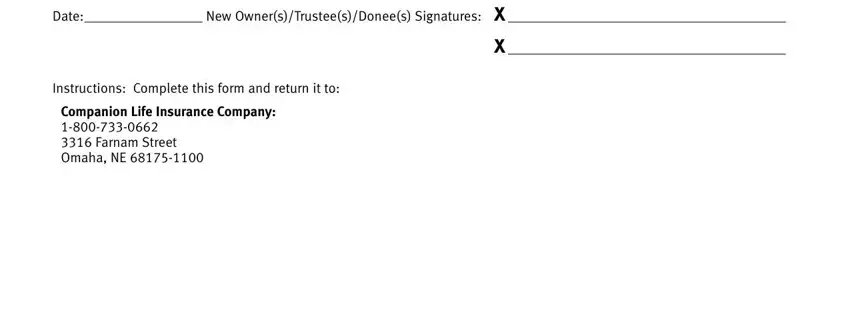

5. The document must be wrapped up by filling in this area. Here you will notice a detailed set of fields that require appropriate information to allow your document usage to be faultless: Date New OwnersTrusteesDonees, Instructions Complete this form, and Companion Life Insurance Company.

Step 3: Prior to moving forward, ensure that all blank fields were filled in the correct way. Once you believe it is all good, click “Done." Join us now and immediately gain access to change ownership donee sample, available for download. All changes made by you are preserved , letting you modify the file at a later stage if needed. At FormsPal, we aim to make sure that all your details are stored private.