Are you looking for an effective and efficient way to invest your money in mutual funds? If yes, then the process of empanelment with Kotak Mutual Fund is just the right fit for you. Having a reliable and trusted name like Kotak on your side will definitely make sure that your investments are safe, sound and secured. Here in this blog post, we’ll discuss about why you should opt for mutual funds under Kotak Mahindra Group as well as provide a step-by-step guide to complete the empanelment process with them easily. So if you want to know more about how to get started with investing via Kotak Mutual Funds or fill out the forms necessary for getting enrolled into one of their funds, then this blog post is surely worth your while!

| Question | Answer |

|---|---|

| Form Name | Kotak Mutual Fund Empanelment Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | kotak mf empanelment, kotak mahindra mutual fund distributor login, kotak distributor login, kotak mutual fund empanelment online |

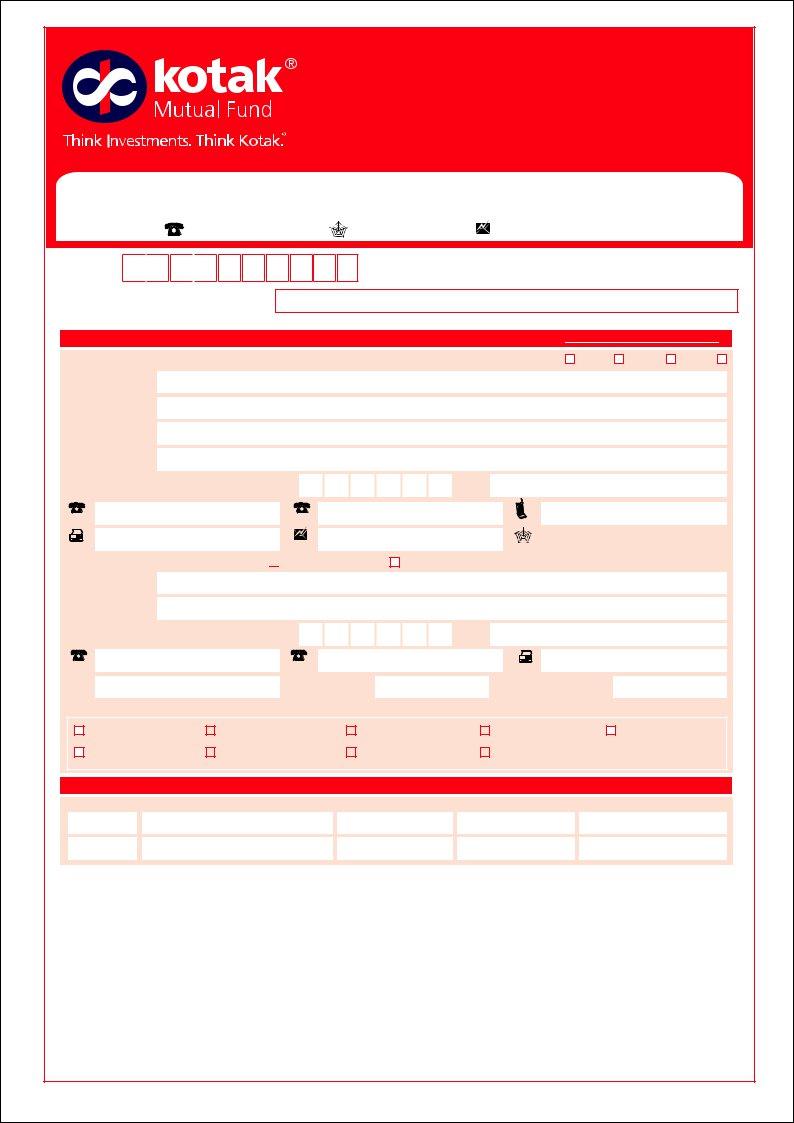

EMPANELMENT FORM

Kotak Mahindra Mutual Fund

(Investment Manager - Kotak Mahindra Asset Management Co. Ltd.)

6th Floor, Vinay Bhavya Complex,

: +91 22 6605 6825 |

: www.kotak.com |

: advisorhelp@kotak.com |

ARN Code

A R

N -

Distributor Name (as in AMFI/ NISM records)

I/We furnish below the particulars required for empanelling my self/ourselves as a Distributor of Schemes of Kotak Mahindra Mutual Fund:

PERSONAL DETAILS:

To be filled in BLOCK LETTERS Only

Mr. |

Ms. |

Mrs. |

Dr. |

Name: |

(First Name) |

Company's Name:

Principal Address:

City Pin Code

(Off.) |

(Code) |

(Tel. No.) |

(Off.) |

|

|

||

(Fax) |

(Code) |

(Tel. No.) |

|

|

|

(Middle Name) |

(Last Name) |

(if applicant is Non Individual) |

|

State

(Code) |

(Tel. No.) |

(Cell)

Website

Address for Correspondence (Please ) Principal Address

Other Address:

City Pin Code

(Off.) |

(Code) |

(Tel. No.) |

(Off.) |

(Code) |

|

|

|

||

PAN |

|

|

DOB (for individual) |

|

Tax Status (Please whichever is applicable)

Other Address (Please specify)

State

(Tel. No.)

(Fax)

D D / M M / Y Y Y Y Anniversary (for individual) D D / M M / Y Y Y Y

Resident Individual |

|

HUF |

|

Sole Proprietorship |

|

Partnership Firm |

Body Corporate |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Indian Company |

|

Foreign Company |

|

NRI |

|

Others : |

|

(Please specify) |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

CONTACT PERSONS:

|

Person Handling |

|

Name |

|

|

|

Direct Tel. No. |

Cell No. |

|||||||||

|

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS DETAILS: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of Computers: |

|

|

|

No. of Branches: |

|

|

No. of Employees: |

|

|

||||

Office Area: |

|

|

Sq. Ft |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographical Areas Covered: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Fund Houses empanelled with: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Experience : |

Years / Months |

|

Total no. of |

|

|

|

|

Total no. of |

|

|

|

|||||

|

|

Investors Serviced: |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Equity AUM: (Rs.) |

|

|

|

|

Debt AUM : (Rs.) |

|

|

|

|

Total AUM: (Rs.) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 of 4

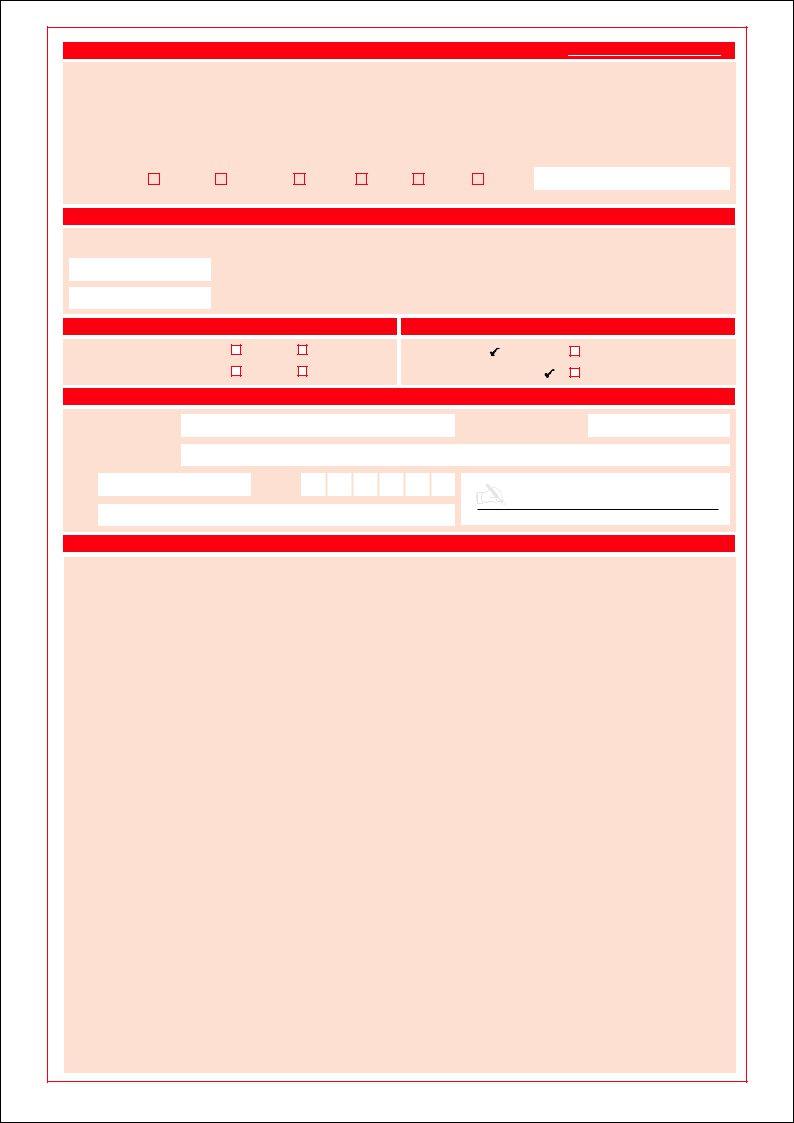

BANK DETAILS:

To be filled in BLOCK LETTERS Only

Name of Bank: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch/ City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEFT/ IFSC Code: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Account No.: |

|

|

|

|

|

|

|

|

|

|

|

(mandatory for NEFT) |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

MICR Code: |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(as appearing in your latest cheque book/ pass book/bank account statement) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

This is the 9 digit code next to your Cheque No. |

||||||||||||||||||||

Account Type: |

|

|

Savings |

|

Current |

|

NRO |

|

NRE |

|

|

FCNR |

|

|

Others |

(Please specify) |

|||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

Kindly attach a cancelled cheque copy or photocopy of a cheque

DIRECT CREDIT:

We offer a Direct Credit Facility with the following banks for paying out Brokerage to you faster. If your bank account is with any of these banks, we would directly credit your brokerage into the same.

HDFC Bank

Kotak Mahindra Bank

PREFERENCES:

Brokerage Reports (Please ):

Monthly Updates (Please ):

NOMINATION FACILITY:

Name of the Nominee:

Nominee's Address:

City

State

|

|

EMAIL SUBSCRIPTION: |

Printed |

Daily NAV (Please ): |

|

Printed |

Weekly Market Review (Please ): |

Relationship with you:

Pin Code

Nominee's Signature

DECLARATION:

I/We hereby declare that the information furnished is complete and correct in all respects. I/We undertake to abide by the terms and conditions stated and the changes in Terms & Conditions from time to time relating to the empanelment of distributor. I/We am/are not an Employee or a relative of a Director/Employee of the Kotak Mahindra Asset Management Company.

I/We declare that if Iam/We are empanelled to act as a Distributor for Schemes / Products of Kotak Mahindra Mutual Fund (KMMF), I/We shall preserve the confidentiality of all information relating to transactions executed for KMMF by me or my clients, except under circumstances where declaration of such information is necessitated by an order of any regulatory/ government / statutory authority with the specific written sanction of KMMF.

Terms and Conditions

1.KMAMC has been granted approval by Securities and Exchange Board of India (SEBI) to function, as an Asset Management Company of Kotak Mahindra Mutual Fund &

2.The statements made/information provided by the distributor in the Distributor Empanelment Form ('Form') and the declaration made therein read with these terms and conditions ("Terms and Conditions") shall be the basis of the contract between KMAMC and the distributor agrees to be legally bound by the same.

3.The appointment to act as the distributor for the Schemes of KMMF will be at the sole discretion of KMAMC and will be subject to written confirmation by KMAMC.

4.The distributor agrees to abide by these Terms and Conditions and rules in force and the changes in the Terms and Conditions from time to time relating to the agency. The distributor agrees to carry out such directions and instructions as issued by KMAMC, in this regard, from time to time.

5.In case of application by

6.The distributor agrees to read and understand the Scheme Information Document (SID), Statement of Additional Information (SAI) and any addendum /notice issued thereto of the respective scheme(s) carefully and explain the market risks, investment risks, investment objectives, and the special features of the schemes to the investors. The distributor will not make any representation concerning Units or the KMMF except those contained in the SID/SAI of the respective scheme(s), the Key Information Memorandum containing Application Forms and printed information issued by the KMAMC as information supplemental to such documents.

7.The distributor shall not issue any Advertising or Promotional Material about KMMF or its products without obtaining prior approval in writing from KMAMC. In particular, the distributor shall not communicate to the investors of KMMF or to the public at large, any information, whether by way of advertisement or sales literature, other than that provided to the distributor by KMAMC. The distributor shall not only refrain from assuring any returns under any of the schemes of KMMF which do not offer assured returns, but shall also ensure that whenever performance figures and related information are given, risk factors are clearly and completely stated.

8.The distributor agrees that he/she will not use any unethical means to sell, market or induce any investor to buy units of schemes of KMMF. The distributor further undertakes not to rebate commission back to investors or attract investors through temptation of rebate/gifts, passback of commission, etc.

9.The distributor is not authorised to issue any receipt for cheques and demand drafts received along with the application forms on behalf of KMAMC. The distributor shall at no point of time receive cash on behalf of KMAMC.

Certification

10.The distributor hereby agrees to comply with the provisions of the Securities and Exchange Board of India (Mutual Funds)Regulations, 1996 as amended from time to time with specific focus on regulations /guidelines on advertisements/sales literature and comply with and adhere to the Code of Conduct and best practices prescribed for the intermediaries of Mutual Fund by Association of Mutual Fund of India (AMFI) The distributor shall also comply with circulars and adhere to guidelines issued by the Association of Mutual Funds of India (AMFI) and SEBI from time

2 of 4

to time.

11.The distributor shall provide self certification in the prescribed format certifying compliance with the provisions of the extant SEBI/Mutual guidelines/circulars, adherence to the Code of Conduct as prescribed by SEBI/AMFI for intermediaries of Mutual Fund, fulfilling the minimum prescribed criteria regarding the number of investors and average assets under management at the end of every financial year to the KMAMC and certifying compliance with the requirements of SEBI Circular no SEBI/IMD/CIR/ No.4/168230/09 dated June 30, 2009. If the said self certification is not provided, then the brokerage will be suspended till the time of receipt of the certificate.

12.Requirements for minimum number of investors

a)Applicable to individual distributors- An individual distributor shall have at least 12 investors with the KMAMC, within one year of empanelment alternatively, furnish an undertaking stating that the individual distributor has serviced at least 25 investors across all mutual funds, this undertaking would form part of his /her annual self certification as specified in clause 10 hereinabove.

b)Applicable to

c)Corporate distributors obtaining empanelment with KMAMC is required to have at least 100 investors from

subsidiary and holding companies) within the period of one year of empanelment.

The limits prescribed above in shall be liable to changes as per the circulars /recommendation(s) issued by AMFI/ SEBI from time to time.

13.All distributors, personnel,

14.The distributor shall immediately notify KMAMC in writing if any of its personnel or any other person engaged by the distributor has committed any act amounting to moral turpitude, financial irregularities or has been arrested by the police or has been relieved from the services/employment of the distributor. Upon receipt of such notice from the distributor, KMAMC may suspend further business and payout of the commissions, etc. as it deems fit in the case.

15.The distributor hereby agrees that the distributor shall solely be responsible for all the acts of its

16.These Terms and Conditions are on a

17.The Distributor shall require that it shall at all times adhere to the requirements under the Prevention of Money Laundering Act, 2002 and the Rules and guidelines (PMLA requirements) stipulated for intermediaries and other requirements which may be communicated by AMC to the Distributor from time to time with regard to the Know Your Customer (KYC) requirements. The Distributor agrees to provide a confirmation to the above effect as and when required by the KMAMC. The customer opens the account with it after complying with the KYC requirements as PMLA requirements applicable from time to time. The Distributor shall comply with Investor's documents and KYC requirements as specified in the SEBI Circular SEBI/IMD/CIR No.12 /186868 /2009, December 11, 2009 and AMFI process note in this regard. Contents of AMFI process note shall be shared by the AMC with the Distributor from time to time

18.KMAMC, its directors, employees, associates, agents and representatives as well as KMMF, its trustees and their associates, agents and representatives shall in no way be held responsible or liable for any action taken for

Commissions

19.The distributor hereby agrees to disclose all commissions (in the form of trail commission or any other mode) payable to them for the different competing Schemes of various Mutual Funds from amongst which the Scheme is being recommended to the investor. The upfront Commission shall be paid directly by the investor to the Distributor based on the investors' assessment of various factors including the service rendered by the Distributor.

20.The distributor shall be eligible for commissions on the amounts mobilized at the rate(s) prescribed by KMAMC. No commission shall be paid on the investments made by the distributor in his/her/its own name. The rate(s) are subject to revision, from time to time, at the discretion of KMAMC and the distributor shall be bound by such changes. The commission payable shall be inclusive of any tax, service tax, cost, charges and expenses incurred by the distributor in connection with the distributor arrangement.

21.In the event of excess payment of Commissionsto the Distributor, KMAMC shall inform the Distributor to refund the excess amount paid, and the Distributor shall refund the excess amount received, if any, within 10 days from the date of receipt of written notice by the Distributor, subject however to KMAMC's right to

22.The distributor shall not have any claim against KMAMC/KMMF for any loss incurred as not anticipated and arising out of any revision in the rate(s) of commission for business canvassed.

23.KMAMC offers nomination facility to distributor to enable the nominee to receive trail commissions on the business done before the demise of distributor holding ARN provided the distributor has complied with the Terms and Conditions mentioned herein above.

24.In case of

Indemnity

25.The distributor declares and covenants with the KMAMC, to defend indemnify and hold the AMC and its affiliates, promoters, successors in interest and permitted assigns harmless from and against all claims, damages or assertions of liability of any kind or nature resulting from:

•Any breach of term, covenants and conditions or other provisions hereof, or offer documents (s) or any actions or omissions thereunder;

•Any failure to comply with all applicable legislation, statutes, ordinances, regulations, administrative rulings or requirement of law;

•The misfeasance, malfeasance or fraudulent acts of the personnel/ representative(s) of the distributor; and

•Any and all actions, suits, proceedings, assessments, settlement, arbitration judgments, cost and expenses, including attorneys' fees, resulting from any of the matters set forth above.

26.The distributor shall also indemnify and hold harmless KMAMC/KMMF/Trustees from and against any and all direct and indirect costs, charges, claims, losses, expenses, damages, liabilities, awards, judgments, fines and actions of any nature whatsoever which KMAMC/KMMF/Trustees may incur/suffer due to a) the

Termination

27.The appointment of the distributor shall be liable to be terminated by the KMAMC forthwith:

a)if he /she is found to be a minor or adjudicated as an insolvent or found to be of unsound mind by a court of competent jurisdiction;

b)if in course of any judicial proceeding it is found that he/she has knowingly participated in or connived at any fraud, dishonesty or misrepresentation, financial irregularities against KMAMC or any Unit holder of KMMF;

c)if KMAMC is satisfied that any statement made in the Form was false or misleading or calculated to mislead;

d)if he/she acts in any other manner prejudicial to the interest of the KMAMC/KMMF; and

e)if he /she does not comply with all applicable legislation, statutes, ordinances, regulations administrative rulings or requirement of law.

F)Non- compliance of any of the clauses of the Terms and Conditions specified herein and the changes made to the Terms and Conditions from time to time.

3 of 4

28.The agency shall stand automatically terminated without any notice from the KMAMC/KMMF upon disqualification or withdrawal of Regulatory /Government approval to act in the capacity contemplated herein. Upon any termination, the distributor shall forthwith handover all documents, papers and material pertaining to KMAMC/ KMMF and /or belonging to KMAMC/ KMMF to the KMAMC.

29.Additionally the appointment as distributor may be terminated by KMAMC without assigning any reason whatsoever.

30.In case of termination of the agency as per clauses (27) and (28) mentioned herein below, the AMC shall not pay any trail commission after the termination of the agency of the distributor for the all business brought /funds mobilized by them for AMC before the termination of the agency.

31.In respect of all disputes arising under this empanelment, the courts in Mumbai alone shall have jurisdiction.

|

|

|

|

|

|

|

Date: |

DD / MM / YYYY |

|

|

|

|

|

Place: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature* |

|

||

|

|

|

|

|

||

*To be signed by Partner / Director / Authorised Signatory in respect of |

|

(Company Stamp Required) |

|

|||

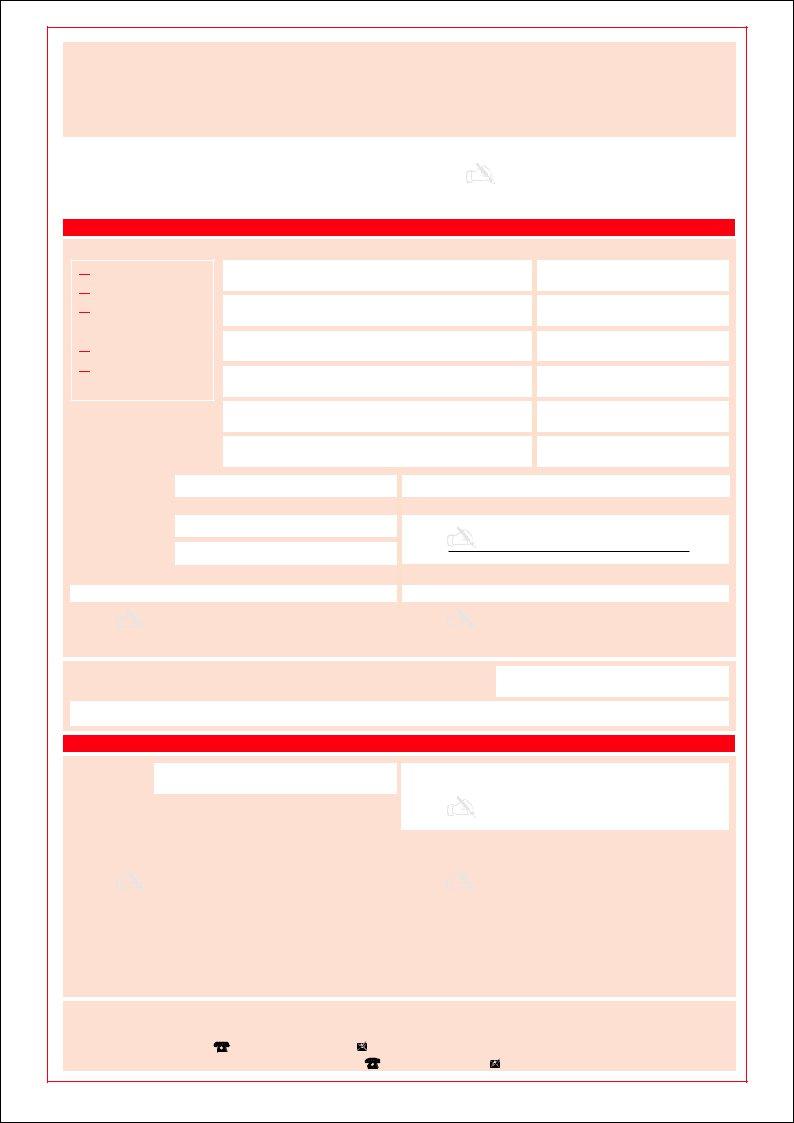

FOR KMMF BRANCH USE ONLY :

Broker Category (Please )

Bank

Institutional

Web

Retail

Retail (IFA)

Retail (Chief Agent)

Retail

Documents to be Submitted (Please )

ARN Card / ARMFA Certificate

Memorandum of Association / Articles of Association / Partnership Deed

Board resolution resolving that the company and the list of directors are authorized to distribute Mutual Fund Products of KMMF

List of Authorised Signatories

Cancelled cheque copy

PAN CARD copy

Individual |

|

|

(Required) |

|

(Required) |

|

||

N/A |

|

(Required) |

|

||

|

||

N/A |

|

(Required) |

|

||

|

||

N/A |

|

(Required) |

|

||

|

||

(Required) |

|

(Required) |

|

||

|

||

(Required) |

|

(Required) |

#Reporting Chief Agent:

Empanelment Requested By:

Relationship Manager:

Location:

Regional Head:

ARN Code

NameName

Name

(Relationship Manager)

Zonal Head:

Name

|

|

|

|

|

|

|

|

(Regional Head) |

|

|

(Zonal Head) |

||

|

|

|

|

|

|

|

Reporting Branch: Controlling Branch:

Comments (If any)

FOR KMMF H.O. USE ONLY:

Checked by:

Date of Receipt: |

|

DD / MM |

/ YYYY |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

Recommended by: |

|

|

|

|

|

|

Authorised by: |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Head of Sales / Distributor Services) |

|

|

|

|

|

|

(Compliance Officer) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Comments (If any) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Empanelment: |

DD / |

MM |

/ YYYY |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please mail this form to: Kotak Mahindra Mutual Fund (Investment Manager - Kotak Mahindra Asset Management Co. Ltd.)

Distributor Services Desk: 6th Floor, Kotak Towers, Building No. 21, Infinity Park, Off: Western Express Highway,

|

|||

|

: +91 22 6605 6810/16 |

: advisorhelp@kotak.com |

|

Investor Services Desk: |

Toll Free No: 1800 222 626 |

: +91 22 66056825 |

: mutual@kotak.com |

4 of 4