MV-77 (2-13)

www.dot.state.pa.us

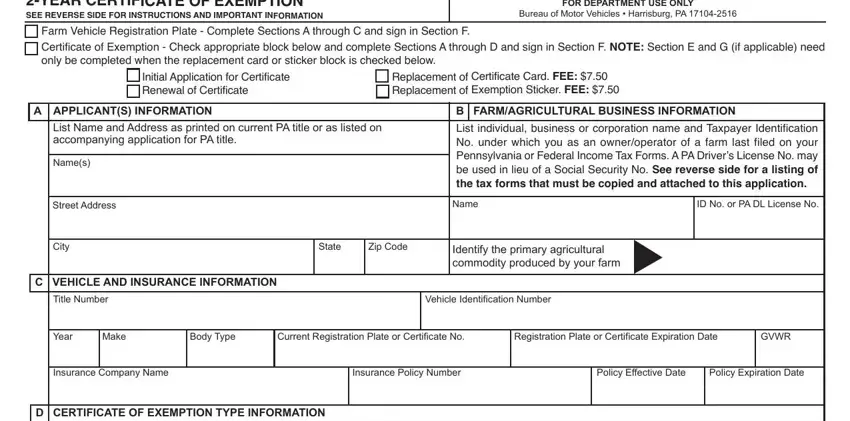

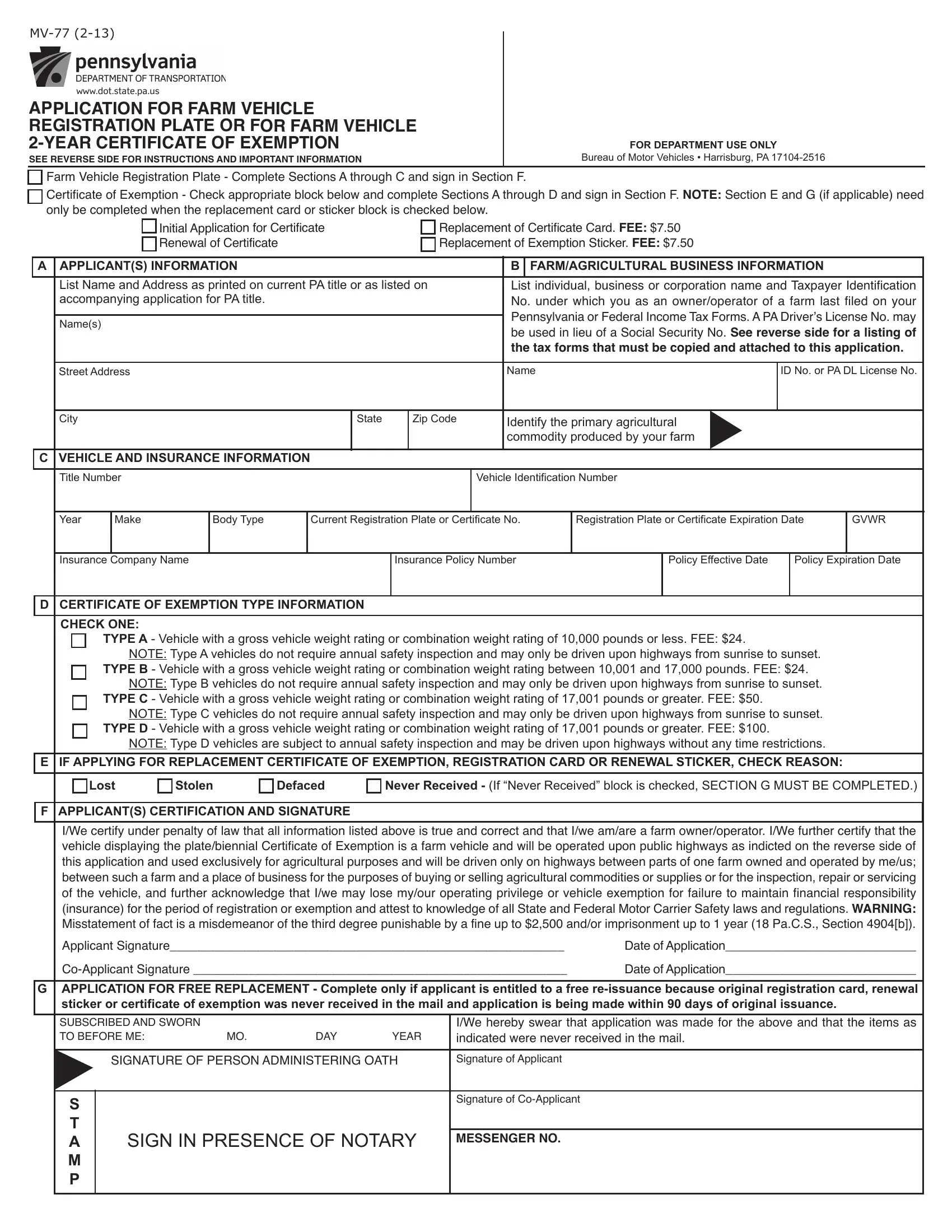

APPLICATION FOR FARM VEHICLE REGISTRATION PLATE OR FOR FARM VEHICLE 2-YEAR CERTIFICATE OF EXEMPTION

SEE REVERSE SIDE FOR INSTRUCTIONS AND IMPORTANT INFORMATION

FOR DEPARTMENT USE ONLY

Bureau of Motor Vehicles • Harrisburg, PA 17104-2516

Farm Vehicle Registration Plate - Complete Sections A through C and sign in Section F.

Certificate of Exemption - Check appropriate block below and complete Sections A through D and sign in Section F. NOTE: Section E and G (if applicable) need only be completed when the replacement card or sticker block is checked below.

|

|

|

Initial Application for Certificate |

|

|

Replacement of Certificate Card. FEE: $7.50 |

|

|

|

|

|

|

Renewal of Certificate |

|

|

|

Replacement of Exemption Sticker. FEE: $7.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A APPLICANT(S) INFORMATION |

|

|

|

|

|

B |

FARM/AGRICULTURAL BUSINESS INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List Name and Address as printed on current PA title or as listed on |

|

List individual, business or corporation name and Taxpayer Identification |

|

accompanying application for PA title. |

|

|

|

|

|

No. under which you as an owner/operator of a farm last filed on your |

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania or Federal Income Tax Forms. A PA Driver’s License No. may |

|

Name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

be used in lieu of a Social Security No. See reverse side for a listing of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the tax forms that must be copied and attached to this application. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

|

|

|

|

|

Name |

|

|

ID No. or PA DL License No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

Zip Code |

|

Identify the primary agricultural |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

commodity produced by your farm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C VEHICLE AND INSURANCE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title Number |

|

|

|

|

|

|

|

Vehicle Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Make |

|

Body Type |

|

Current Registration Plate or Certificate No. |

Registration Plate or Certificate Expiration Date |

GVWR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance Company Name |

|

|

Insurance Policy Number |

|

Policy Effective Date |

|

Policy Expiration Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

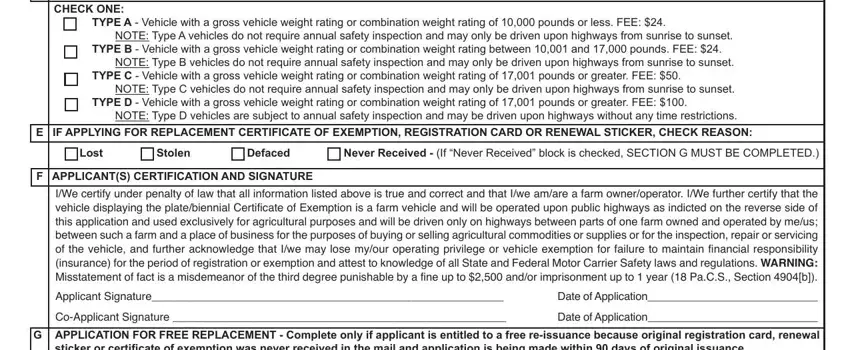

DCERTIFICATE OF EXEMPTION TYPE INFORMATION

CHECK ONE:

TYPE A - Vehicle with a gross vehicle weight rating or combination weight rating of 10,000 pounds or less. FEE: $24.

NOTE: Type A vehicles do not require annual safety inspection and may only be driven upon highways from sunrise to sunset. TYPE B - Vehicle with a gross vehicle weight rating or combination weight rating between 10,001 and 17,000 pounds. FEE: $24.

NOTE: Type B vehicles do not require annual safety inspection and may only be driven upon highways from sunrise to sunset. TYPE C - Vehicle with a gross vehicle weight rating or combination weight rating of 17,001 pounds or greater. FEE: $50.

NOTE: Type C vehicles do not require annual safety inspection and may only be driven upon highways from sunrise to sunset.

TYPE D - Vehicle with a gross vehicle weight rating or combination weight rating of 17,001 pounds or greater. FEE: $100.

NOTE: Type D vehicles are subject to annual safety inspection and may be driven upon highways without any time restrictions.

E IF APPLYING FOR REPLACEMENT CERTIFICATE OF EXEMPTION, REGISTRATION CARD OR RENEWAL STICKER, CHECK REASON:

Lost |

Stolen |

Defaced |

Never Received - (If “Never Received” block is checked, SECTION G MUST BE COMPLETED.) |

F APPLICANT(S) CERTIFICATION AND SIGNATURE

I/We certify under penalty of law that all information listed above is true and correct and that I/we am/are a farm owner/operator. I/We further certify that the vehicle displaying the plate/biennial Certificate of Exemption is a farm vehicle and will be operated upon public highways as indicted on the reverse side of this application and used exclusively for agricultural purposes and will be driven only on highways between parts of one farm owned and operated by me/us; between such a farm and a place of business for the purposes of buying or selling agricultural commodities or supplies or for the inspection, repair or servicing of the vehicle, and further acknowledge that I/we may lose my/our operating privilege or vehicle exemption for failure to maintain financial responsibility (insurance) for the period of registration or exemption and attest to knowledge of all State and Federal Motor Carrier Safety laws and regulations. WARNING: Misstatement of fact is a misdemeanor of the third degree punishable by a fine up to $2,500 and/or imprisonment up to 1 year (18 Pa.C.S., Section 4904[b]).

Applicant Signature_________________________________________________________ |

Date of Application____________________________ |

Co-Applicant Signature ______________________________________________________ |

Date of Application____________________________ |

GAPPLICATION FOR FREE REPLACEMENT - Complete only if applicant is entitled to a free re-issuance because original registration card, renewal sticker or certificate of exemption was never received in the mail and application is being made within 90 days of original issuance.

|

SUBSCRIBED AND SWORN |

|

|

|

I/We hereby swear that application was made for the above and that the items as |

|

TO BEFORE ME: |

MO. |

DAY |

YEAR |

indicated were never received in the mail. |

|

|

|

|

|

|

SIGNATURE OF PERSON ADMINISTERING OATH |

Signature of Applicant |

|

|

|

|

|

|

|

|

S |

|

|

|

|

Signature of Co-Applicant |

|

|

|

|

|

|

|

T |

SIGN IN PRESENCE OF NOTARY |

|

|

A |

MESSENGER NO. |

|

M |

|

|

|

|

|

|

P |

|

|

|

|

|

|

|

|

|

|

|

|

GENERAL INFORMATION

•Certificate of Exemption is non-transferable.

•A Farm Vehicle is defined as “a truck or truck tractor determined by the Department of Transportation to be used exclusively for agricultural purposes.”

•List name and address as printed on current Pennsylvania Certificate of Title or as listed on accompanying application for Pennsylvania Certificate of Title in Section A and complete all other applicable sections of the application. Tax and fees are payable at the time of application for Pennsylvania Certificate of Title and registration.

•A copy of your last current income tax return filing which demonstrates you are engaged commercially in farming, must be attached. The copy of the income tax return filing attached to the MV-77 must show the business activity code or business activity description. Specific income information filed in the original return may be blacked out. If you are:

-An individual - A copy of your PA Income Tax Form, Schedule F must be attached.

-A partnership - A copy of your Federal Income Tax Form 1165 or 1165B or a copy of the Schedule F filed with the 1065 or 1065B must be attached.

-A corporation - A copy of your Federal Income Tax Form 1120 or 1120A (Schedule K of the 1120 return or Part II of the 1120A return) must be attached.

-A Subchapter S corporation - A copy of your Federal Income Tax Form 1120S (Schedule B) must be attached.

•Mail completed application and fees to the address listed on the front of the application. Make check or money order payable to the “Commonwealth of Pennsylvania.” NOTE: If this application is submitted as an attachment to application for Pennsylvania Certificate of Title on Forms MV-1 or MV-4ST, mail all documents to the address printed in the upper right margin of Forms MV-1 or MV-4ST.

NOTE: A farm vehicle must be used exclusively for agricultural purposes and may not be used in other operations such as commerical trucking, logging, landscaping and transporting show horses. Agricultural purposes include produce, dairy, livestock and poultry farming, hay and field crop farming and orchard and nursery operations.

A. INSTRUCTIONS FOR FARM VEHICLE REGISTRATION

1.Qualified applicants for “farm vehicle” registration include produce, dairy, livestock and poultry farmers, hay and field crop farmers and orchard and nursery owners. The applicant must be either the owner or operator of the farm or such agricultural enterprise. Farm or agricultural business information will be verified with the Pennsylvania Department of Revenue to substantiate the applicant’s qualification for Farm Vehicle registration.

2.This application may not be used for a trailer, semi-trailer or implement of husbandry.

3.The certificate of title for the vehicle identified in Section C must currently be in the applicant’s name. If not, application for title must accompany this application.

4.Vehicles to be operated under farm vehicle registrations are subject to payment of motor vehicle sales tax.

5.Vehicles operated on the highways with “farm vehicle” registrations must be equipped according to law and display a currently valid inspection sticker.

6.For a replacement plate or registration card, use Form MV-44.

B.INSTRUCTIONS FOR FARM VEHICLE 2-YEAR CERTIFICATE OF EXEMPTION

1.Sections A through D and F must be completed in full. Section E need only be completed when applying for a replacement certificate of exemption, registration card or renewal sticker. A fee of $7.50 is required. NOTE: Complete Section G only if the “never received” block is checked in Section E. No fee is required if original certificate of exemption was lost in the mail and application is made within 90 days of original issuance.

2.Type A: Used exclusively:

(1)Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

(2)between such farms located within 50 miles of each other;

(3)between a farm or farms and place of business within a 50 mile radius of the farm or farms for the purpose of buying/selling agricultural commodities/supplies, or

(4)between a farm or farms and a place of business within a 50 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer or semitrailer being towed or hauled by the farm vehicle.

Type B: Used exclusively:

(1)Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

(2)between such farms located within 25 miles of each other;

(3)between a farm or farms and place of business within a 25 mile radius of the farm or farms for the purpose of buying/selling agricultural commodities/supplies, or

(4)between a farm or farms and a place of business within a 50 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer or semitrailer being towed or hauled by the farm vehicle.

Type C: Used exclusively:

(1)Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

(2)between such farms located within 10 miles of each other;

(3)between a farm or farms and place of business within a 10 mile radius of the farm or farms for the purpose of buying/selling agricultural commodities/supplies, or

(4)between a farm or farms and a place of business within a 25 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer or semitrailer being towed or hauled by the farm vehicle.

Type D: Used exclusively:

(1)Upon farm(s) owned/operated by the vehicle owner on highways only between parts of a farm;

(2)between such farms located within 50 miles of each other;

(3)between a farm or farms and place of business within a 50 mile radius of the farm or farms for the purpose of buying/selling agricultural commodities/supplies, or

(4)between a farm or farms and a place of business within a 50 mile radius of the farm or farms for repairing or servicing the farm vehicle or trailer or semitrailer being towed or hauled by the farm vehicle.

3.Farm vehicles being operated with a Certificate of Exemption cannot be used beyond the mileage or time restrictions listed in Section D on front of the application.

4.The owner of the farm vehicle must maintain the minimum levels of liability insurance coverage on the vehicle. This can be by a vehicle insurance policy or under farm liability insurance coverage maintained generally by the owner.

Visit us at www.dmv.state.pa.us or call us at:

In state: 1-800-932-4600 u TDD: 1-800-228-0676 u Out-of-State: 1-717-412-5300 u TDD Out-of-State: 1-717-412-5380