Our PDF editor that you will use was designed by our best programmers. You may get the form mvu 26 file immediately and efficiently with our app. Merely follow the following procedure to get started.

Step 1: Search for the button "Get Form Here" on the webpage and next, click it.

Step 2: After you've accessed the editing page form mvu 26, you'll be able to discover every one of the functions readily available for the form within the top menu.

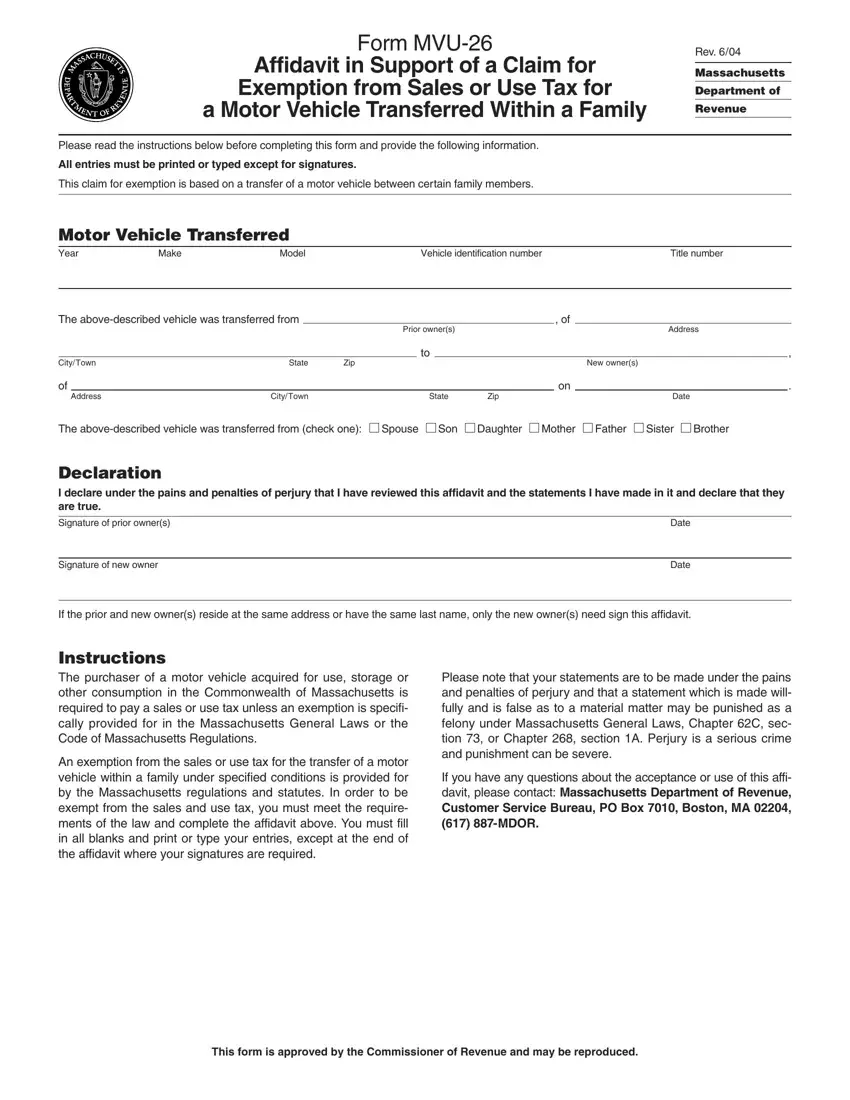

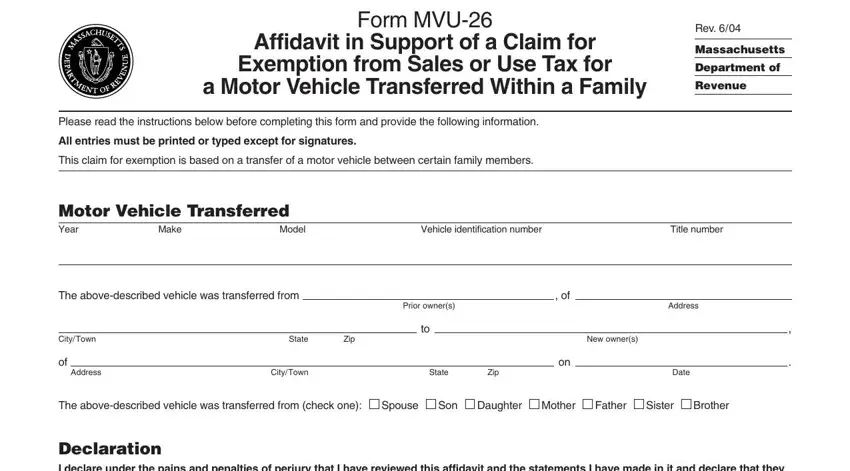

Fill in the next sections to complete the file:

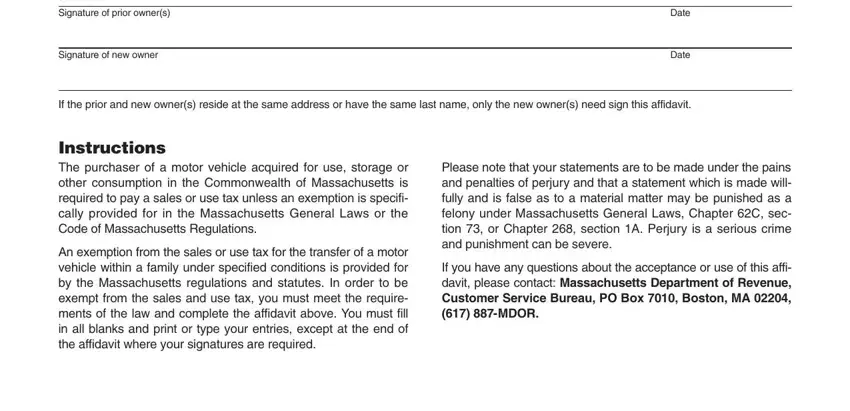

Write the details in Declaration I declare under the, Signature of prior owners, Signature of new owner, Date, Date, If the prior and new owners reside, Instructions The purchaser of a, An exemption from the sales or use, Please note that your statements, and If you have any questions about.

Step 3: At the time you hit the Done button, your final document is readily exportable to any type of of your gadgets. Or, you can easily send it by using mail.

Step 4: Produce minimally two or three copies of your form to stay away from any kind of possible challenges.