Working with PDF files online is always very simple using our PDF tool. You can fill in DEP here painlessly. Our editor is continually developing to deliver the very best user experience achievable, and that is thanks to our commitment to continuous enhancement and listening closely to comments from users. If you are seeking to begin, here is what you will need to do:

Step 1: Just click the "Get Form Button" in the top section of this webpage to see our form editing tool. This way, you'll find everything that is necessary to fill out your document.

Step 2: As you start the editor, you will find the form all set to be completed. Besides filling out various blanks, you may also perform other things with the Document, particularly writing custom words, editing the initial textual content, adding graphics, putting your signature on the PDF, and a lot more.

It is an easy task to finish the form with our detailed guide! This is what you want to do:

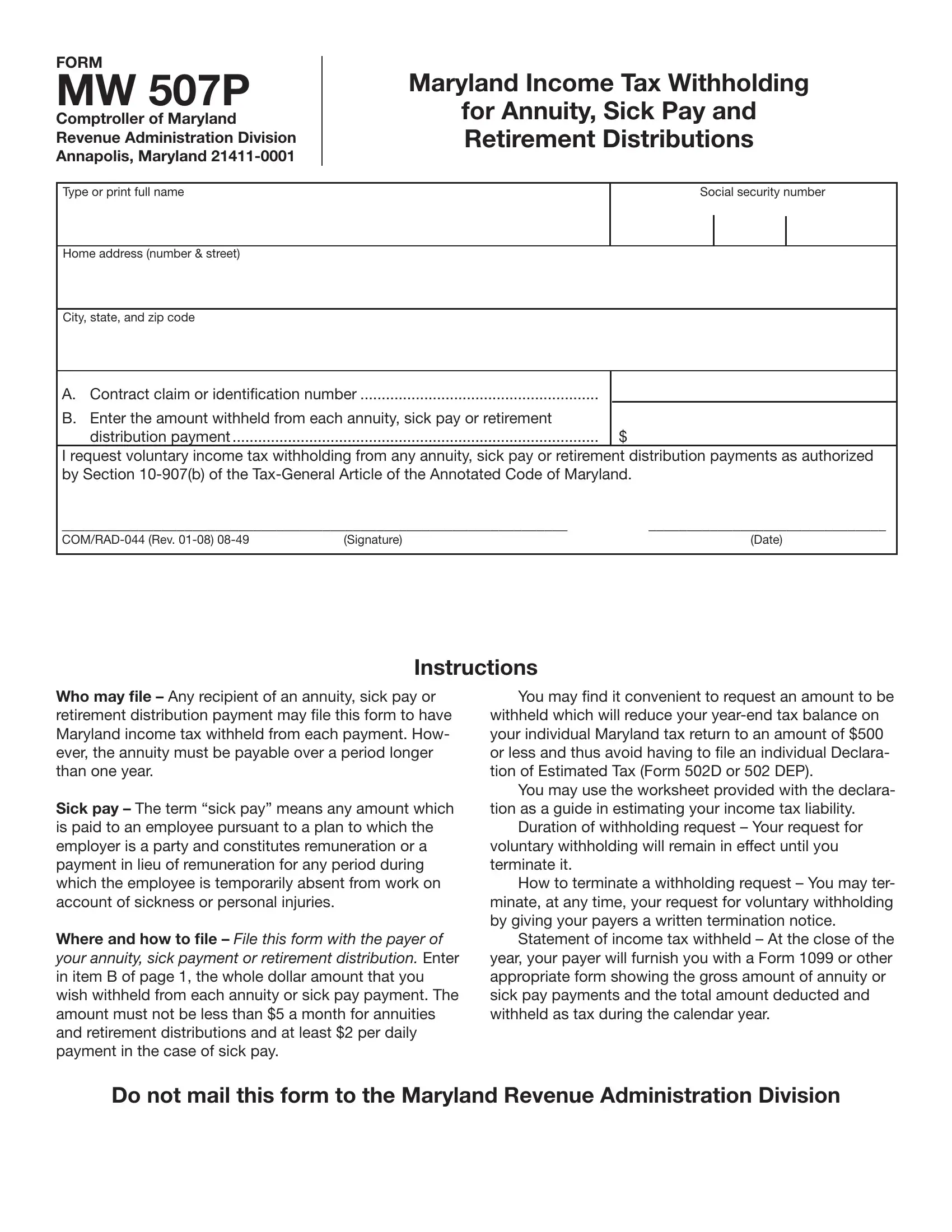

1. It's vital to complete the DEP correctly, hence be attentive when filling out the parts that contain these specific blank fields:

Step 3: Reread the information you've typed into the form fields and press the "Done" button. Make a free trial option at FormsPal and get direct access to DEP - downloadable, emailable, and editable from your personal account. FormsPal guarantees your information privacy by using a protected system that in no way records or distributes any type of sensitive information provided. Be assured knowing your documents are kept safe any time you use our services!