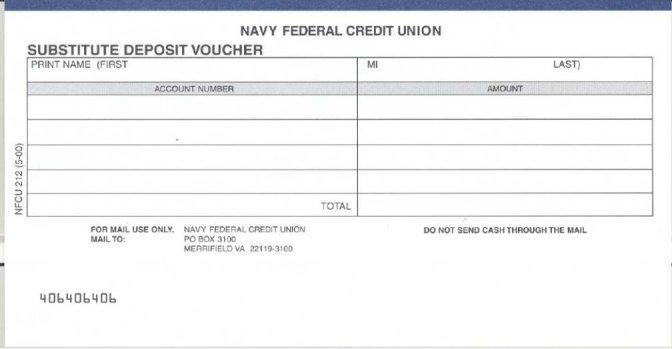

In the world of financial transactions, especially within the sphere of military and defense-associated banking, the significance of concise documentation cannot be overstated. Among such crucial documents is the Navy Federal Credit form, standing as a beacon for efficient processing of financial requests and services tailored for members of the Navy Federal Credit Union, including active duty, retired service members, their families, and Department of Defense civilians. This pivotal document is meticulously designed to cover a broad spectrum of financial interactions, from loan applications to account management, and fund transfers. It embodies a bridge between the credit union’s offerings and its members' needs, ensuring clarity, compliance, and convenience in transactions. Not only does it streamline the approval processes by gathering necessary personal and financial background information efficiently, but it also accelerates the pace at which members can access benefits, reinforcing the union's commitment to serving those who serve the nation. Understanding the complexities and the importance of this form can greatly enhance the financial well-being of its users, highlighting its role not just as a procedural necessity but as a tool for financial empowerment and security.

| Question | Answer |

|---|---|

| Form Name | Navy Federal Credit Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | navy federal void check, navy federal voided check, voided check navy federal credit union, voided check navy federal |