The filling in the nc 3 form fillable is quite uncomplicated. Our experts made sure our software is easy to utilize and helps fill out virtually any PDF very quickly. Consider a few simple steps you will need to follow:

Step 1: The first step will be to click the orange "Get Form Now" button.

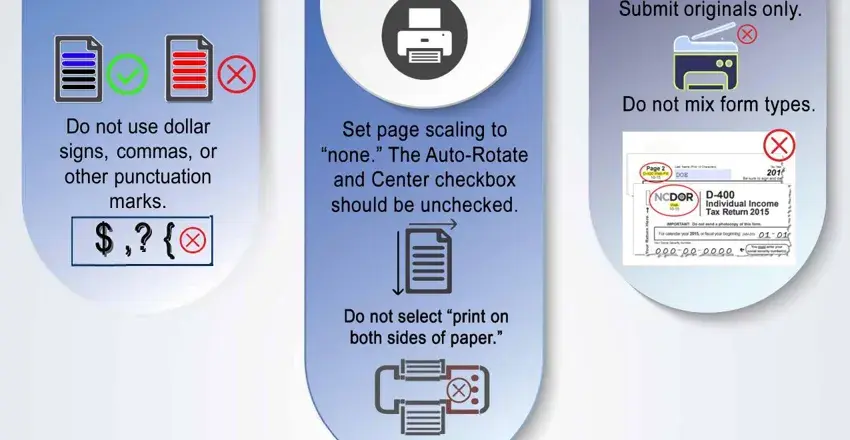

Step 2: At this point, you're on the document editing page. You may add content, edit present details, highlight particular words or phrases, place crosses or checks, add images, sign the form, erase unneeded fields, etc.

Type in the essential details in each segment to create the PDF nc 3 form fillable

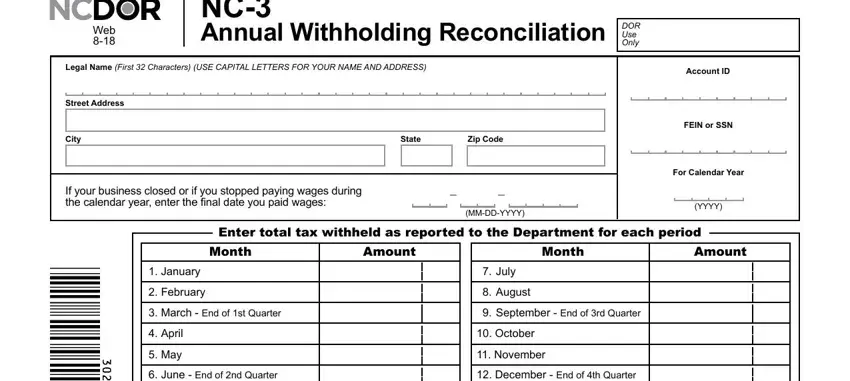

In the Web, NC Annual Withholding, DOR Use Only, Legal Name First Characters USE, Street Address, City, State, Zip Code, If your business closed or if you, MMDDYYYY, Account ID, FEIN or SSN, For Calendar Year, YYYY, and Enter total tax withheld as area, note down your information.

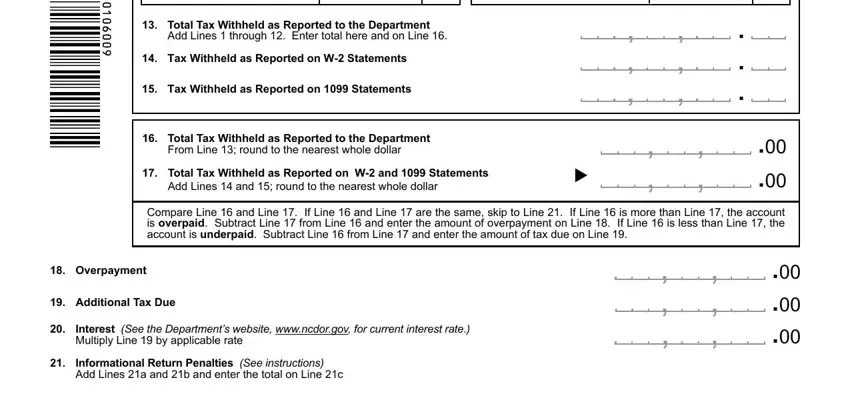

Note the essential particulars in June End of nd Quarter, December End of th Quarter, Total Tax Withheld as Reported to, Add Lines through Enter total, Tax Withheld as Reported on W, Tax Withheld as Reported on, Total Tax Withheld as Reported to, Total Tax Withheld as Reported on, Compare Line and Line If Line, Overpayment, Additional Tax Due, Interest See the Departments, Informational Return Penalties See, and b Failure to File in Format box.

For space b Failure to File in Format, Amount of Refund Requested If, Total Amount Due Add Lines and c, Pay in US Currency From a Domestic, Signature, Title, Date, I certify that to the best of my, and North Carolina law requires Form, indicate the rights and obligations.

Step 3: Select the button "Done". Your PDF file is available to be transferred. You can download it to your device or email it.

Step 4: You can generate copies of the document toprevent any kind of potential issues. Don't worry, we don't distribute or watch your details.

®

® ,

,