|

FORM E--590 |

NORTH CAROLINA DEPARTMENT OF REVENUE |

|

|

|

(REV. 10--92) |

SALES AND USE TAX DIVISION |

|

|

|

|

|

P. O. BOX 25000 |

|

|

|

|

|

RALEIGH, N. C. 27640--0001 |

|

|

|

|

|

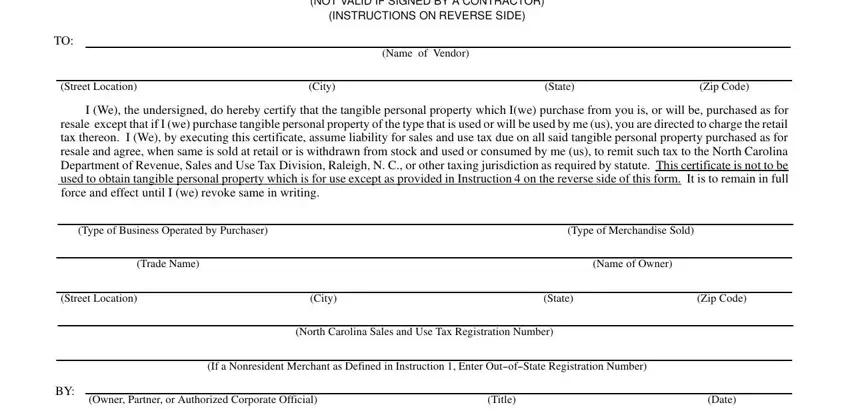

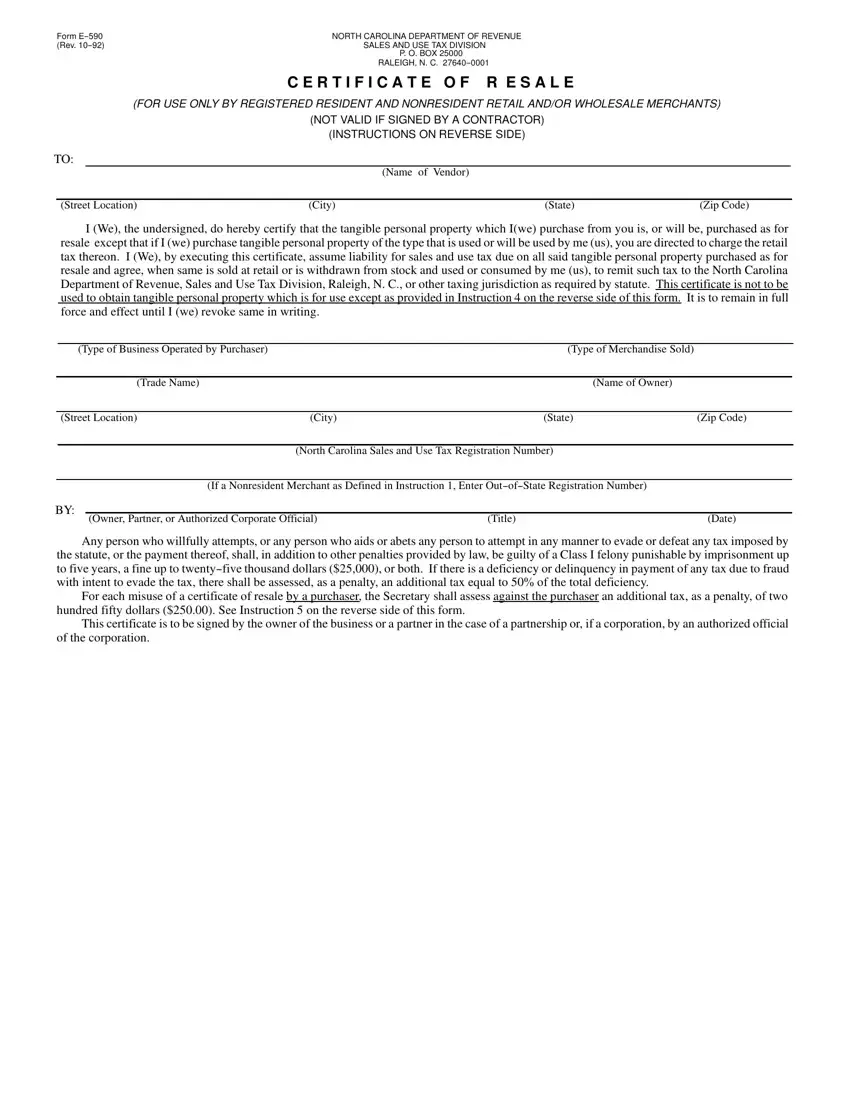

C E R T I F I C A T E O F R E S A L E |

|

|

|

(FOR USE ONLY BY REGISTERED RESIDENT AND NONRESIDENT RETAIL AND/OR WHOLESALE MERCHANTS) |

|

|

|

(NOT VALID IF SIGNED BY A CONTRACTOR) |

|

|

|

|

|

(INSTRUCTIONS ON REVERSE SIDE) |

|

|

TO: |

|

|

|

|

|

|

(Name of Vendor) |

|

|

|

|

|

|

|

|

(Street Location) |

(City) |

(State) |

(Zip Code) |

I (We), the undersigned, do hereby certify that the tangible personal property which I(we) purchase from you is, or will be, purchased as for resale except that if I (we) purchase tangible personal property of the type that is used or will be used by me (us), you are directed to charge the retail tax thereon. I (We), by executing this certificate, assume liability for sales and use tax due on all said tangible personal property purchased as for resale and agree, when same is sold at retail or is withdrawn from stock and used or consumed by me (us), to remit such tax to the North Carolina Department of Revenue, Sales and Use Tax Division, Raleigh, N. C., or other taxing jurisdiction as required by statute. This certificate is not to be used to obtain tangible personal property which is for use except as provided in Instruction 4 on the reverse side of this form. It is to remain in full force and effect until I (we) revoke same in writing.

|

|

(Type of Business Operated by Purchaser) |

(Type of Merchandise Sold) |

|

|

|

|

|

|

|

|

|

|

|

(Trade Name) |

|

(Name of Owner) |

|

|

|

|

|

|

|

|

|

|

(Street Location) |

(City) |

(State) |

(Zip Code) |

|

|

|

|

|

|

|

|

|

|

(North Carolina Sales and Use Tax Registration Number) |

|

|

|

|

|

|

|

|

|

|

|

(If a Nonresident Merchant as Defined in Instruction 1, Enter Out--of--State Registration Number) |

|

|

BY: |

|

|

|

|

|

(Owner, Partner, or Authorized Corporate Official) |

(Title) |

(Date) |

|

|

|

Any person who willfully attempts, or any person who aids or abets any person to attempt in any manner to evade or defeat any tax imposed by the statute, or the payment thereof, shall, in addition to other penalties provided by law, be guilty of a Class I felony punishable by imprisonment up to five years, a fine up to twenty--five thousand dollars ($25,000), or both. If there is a deficiency or delinquency in payment of any tax due to fraud with intent to evade the tax, there shall be assessed, as a penalty, an additional tax equal to 50% of the total deficiency.

For each misuse of a certificate of resale by a purchaser, the Secretary shall assess against the purchaser an additional tax, as a penalty, of two hundred fifty dollars ($250.00). See Instruction 5 on the reverse side of this form.

This certificate is to be signed by the owner of the business or a partner in the case of a partnership or, if a corporation, by an authorized official of the corporation.

FORM E--590 (REVERSE)

(REV. 10--92)

INSTRUCTIONS

1.This certificate is for use only by registered resident and nonresident retail and/or wholesale merchants. ‘‘Nonresident retail or wholesale merchant” means a person who does not have a place of business in this State, is engaged in the business of acquiring, by purchase, consignment, or otherwise, tangible personal property and selling the property outside this State, and is registered for sales and use tax purposes in a taxing jurisdiction outside this State. Merchants issuing this certificate must keep a copy of the executed certificate in their records.

2.This certificate is not to be used to obtain tangible personal property for use except as provided in Instruction 4 below. See Sales and Use Tax Administrative Rules 7B .0106 and 7B .2301 for additional information in regard to the proper use of this certificate.

3.Retailers and wholesalers making occasional or infrequent purchases of tangible personal property for resale should furnish their suppliers with

a copy of this certificate with each purchase order for such tangible personal property. Only one certificate is necessary where frequent purchases are made.

4.Any registered merchant selling tangible personal property at retail and, in addition to such sales, makes purchases of such tangible personal

property |

for use in the general conduct of business and who cannot determine at the time of purchase whether the property will be resold or used may |

purchase |

the property from his suppliers without payment of tax by issuing a certificate to such suppliers as their authority for not charging the tax. |

Such merchant assumes responsibility for payment of the applicable sales and/or use taxes either (1) directly to the North Carolina Department of Revenue, if the transaction is taxable in this State or (2) to the appropriate taxing jurisdiction in another state, if the transaction is taxable in that state. An example of such a merchant is a retailer--contractor. A retailer--contractor is any person who engages in the business of selling building materials, supplies, equipment and fixtures at retail and, in addition to such business, enters into contracts for constructing, building, erecting, altering or

repair-- |

ing buildings or other structures and for installing equipment and fixtures to buildings and, in the performance of such contracts, consumes |

or uses |

such materials and merchandise. |

5.A seller who accepts a certificate of resale from a purchaser of tangible personal property has the burden of proving that the sale was not a retail sale unless all of the following conditions are met:

(a)The seller acted in good faith in accepting the certificate of resale.

(b)The certificate is in the form required by the Secretary.

(c)The certificate is signed by the purchaser, states the purchaser’s name, address, and registration number, and describes the type of tangible personal property generally sold by the purchaser in the regular course of business.

(d)The purchaser is licensed under the North Carolina Sales and Use Tax Law or under the law of another taxing jurisdiction.

(e)The purchaser is engaged in the business of selling tangible personal property of the type sold.

A purchaser who does not resell property purchased under a certificate of resale is liable for any tax subsequently determined to be due on the sale. A seller of property sold under a certificate of resale is jointly liable with the purchaser of the property for any tax subsequently determined to be due on the sale only if the Secretary proves that the sale was a retail sale.

6.This certificate is not valid if signed by a contractor. A contractor is the user or consumer of tangible personal property and sales to contractors

are taxable at the retail rate of tax.

7.The vendor must obtain a corrected certificate in the event of change of ownership of a business for which a certificate of resale is on file. Such changes in ownership of North Carolina businesses may be verified with the Sales and Use Tax Taxpayer Assistance Section, North Carolina Department of Revenue, Post Office Box 25000, Raleigh, N. C. 27640--0001, or telephone No. (919) 733--3661.