You are able to prepare e595e fillable effortlessly using our online PDF tool. To make our editor better and less complicated to use, we constantly implement new features, with our users' feedback in mind. To begin your journey, go through these basic steps:

Step 1: Open the PDF inside our tool by clicking on the "Get Form Button" in the top part of this page.

Step 2: This tool will allow you to change the majority of PDF forms in various ways. Change it with customized text, adjust what is originally in the file, and include a signature - all within the reach of several mouse clicks!

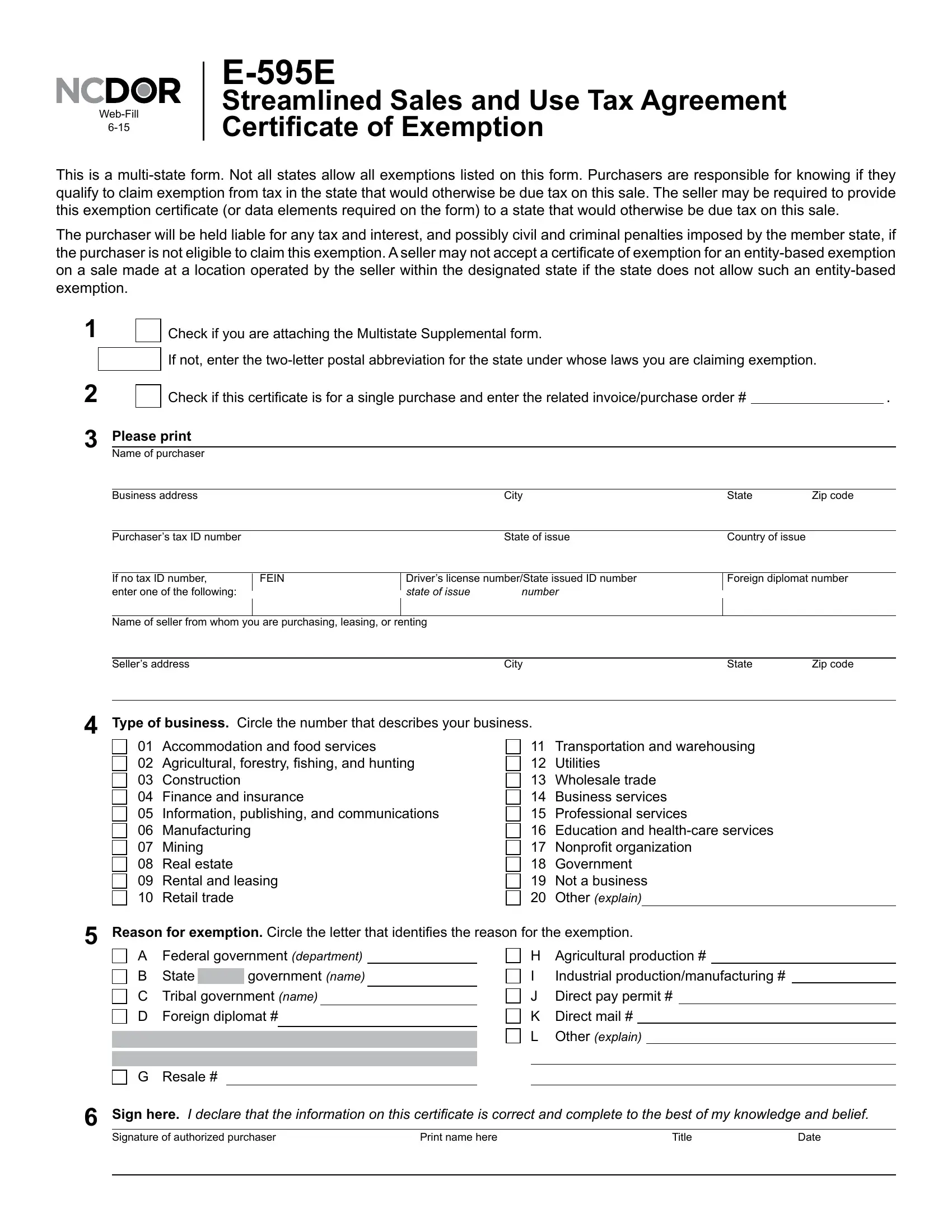

As a way to finalize this document, be certain to type in the information you need in each blank:

1. Start completing the e595e fillable with a group of essential blank fields. Consider all of the important information and be sure there is nothing overlooked!

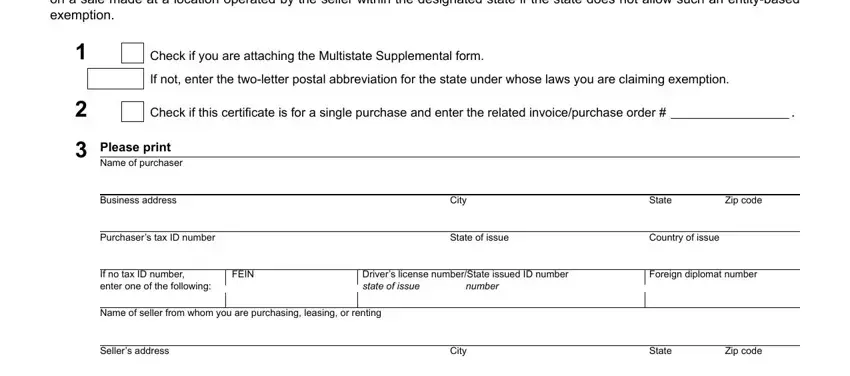

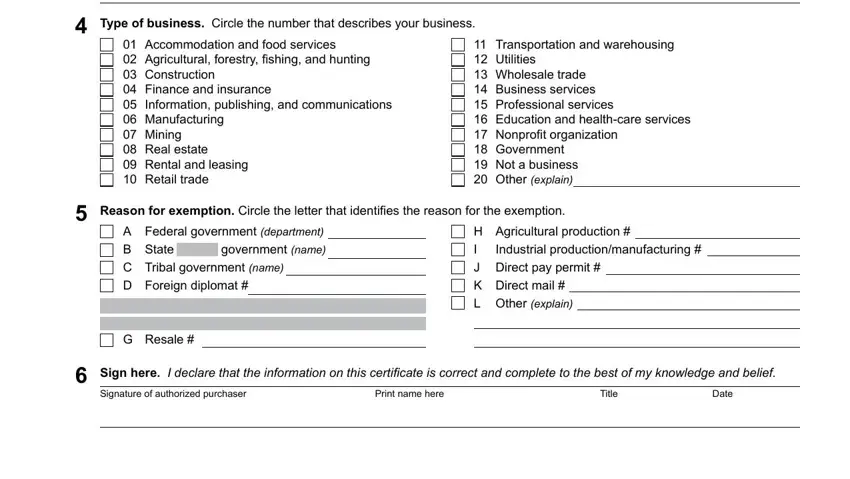

2. Once your current task is complete, take the next step – fill out all of these fields - Type of business Circle the number, Accommodation and food services, Transportation and warehousing, Reason for exemption Circle the, A Federal government department B, G Resale, Industrial productionmanufacturing, H Agricultural production I J, Sign here I declare that the, Signature of authorized purchaser, Print name here, Title, and Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

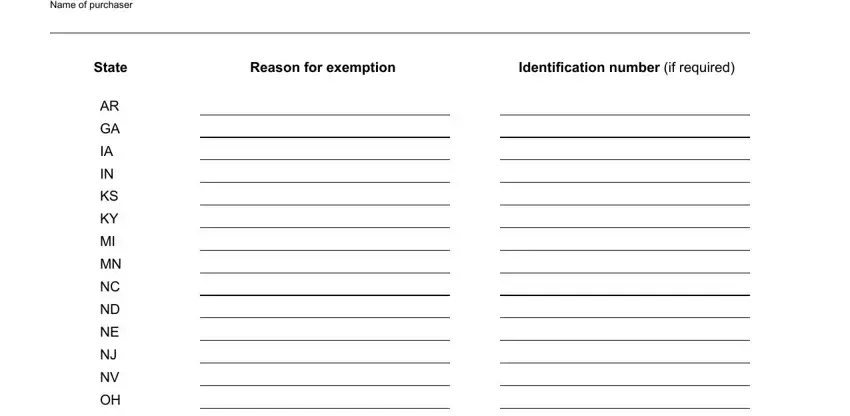

3. The next part is generally straightforward - complete all of the fields in Name of purchaser, State, Reason for exemption, and Identiication number if required in order to complete the current step.

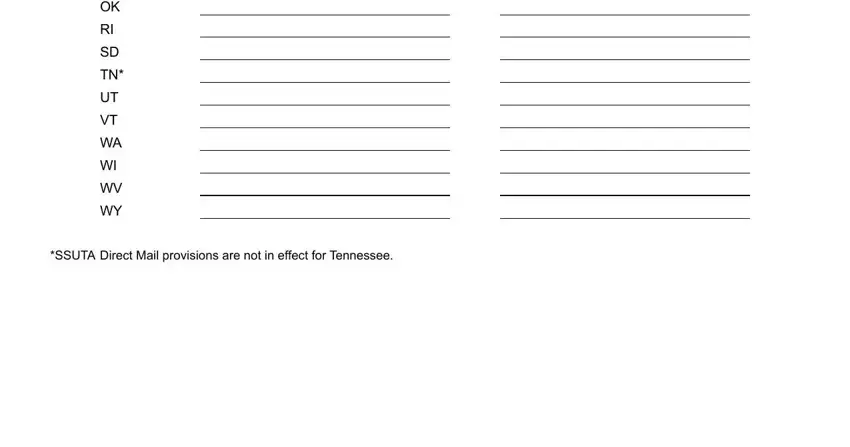

4. This next section requires some additional information. Ensure you complete all the necessary fields - SSUTA Direct Mail provisions are - to proceed further in your process!

When it comes to SSUTA Direct Mail provisions are and SSUTA Direct Mail provisions are, make certain you don't make any mistakes in this current part. These are considered the key fields in the PDF.

Step 3: Before submitting this form, ensure that all blank fields were filled in the proper way. Once you’re satisfied with it, click on “Done." Right after creating afree trial account at FormsPal, you'll be able to download e595e fillable or email it without delay. The file will also be easily accessible via your personal account menu with all of your changes. We do not share the information you provide whenever working with forms at FormsPal.