Whenever you need to fill out Nd Form 306, you don't have to download and install any kind of programs - just give a try to our online PDF editor. Our professional team is ceaselessly endeavoring to improve the editor and enable it to be much faster for users with its multiple functions. Bring your experience to another level with constantly improving and great opportunities available today! By taking some basic steps, you can start your PDF journey:

Step 1: Just hit the "Get Form Button" in the top section of this site to get into our pdf file editing tool. Here you will find everything that is necessary to fill out your file.

Step 2: After you launch the tool, you'll see the document ready to be filled out. Apart from filling in various blanks, you can also do other actions with the file, namely putting on your own text, editing the initial text, inserting images, affixing your signature to the document, and a lot more.

It really is simple to finish the form with this helpful guide! This is what you want to do:

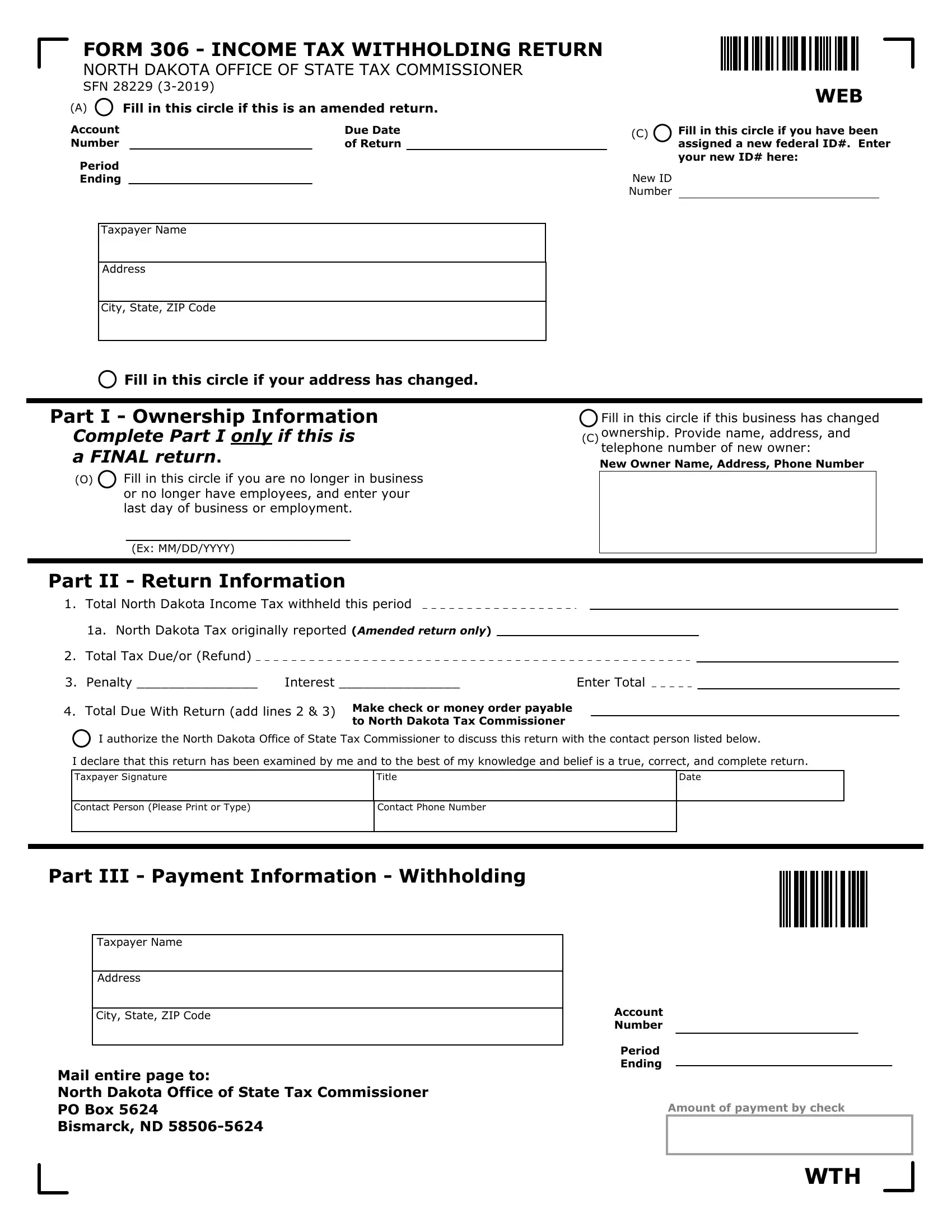

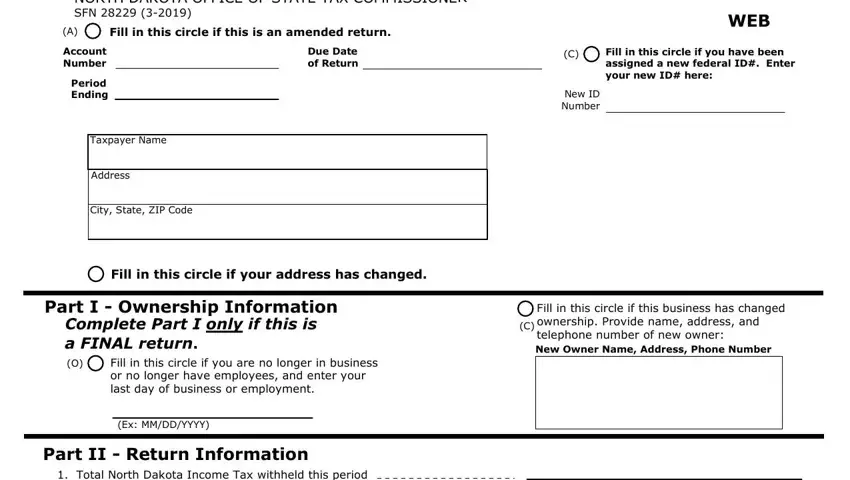

1. It's very important to fill out the Nd Form 306 correctly, therefore take care while filling in the sections containing these particular blank fields:

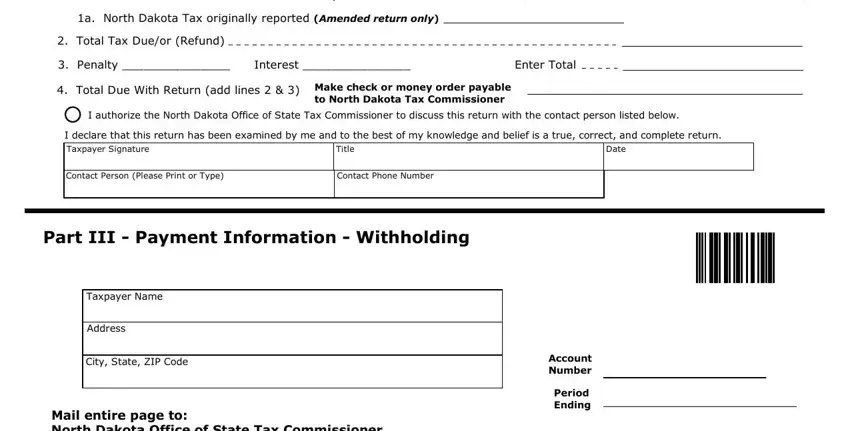

2. After filling in this section, go on to the next stage and fill out the necessary particulars in these blank fields - Total North Dakota Income Tax, a North Dakota Tax originally, Total Tax Dueor Refund, Penalty Interest, Enter Total, Total Due With Return add lines, I authorize the North Dakota, I declare that this return has, Taxpayer Signature, Title, Date, Contact Person Please Print or Type, Contact Phone Number, Part III Payment Information, and Taxpayer Name.

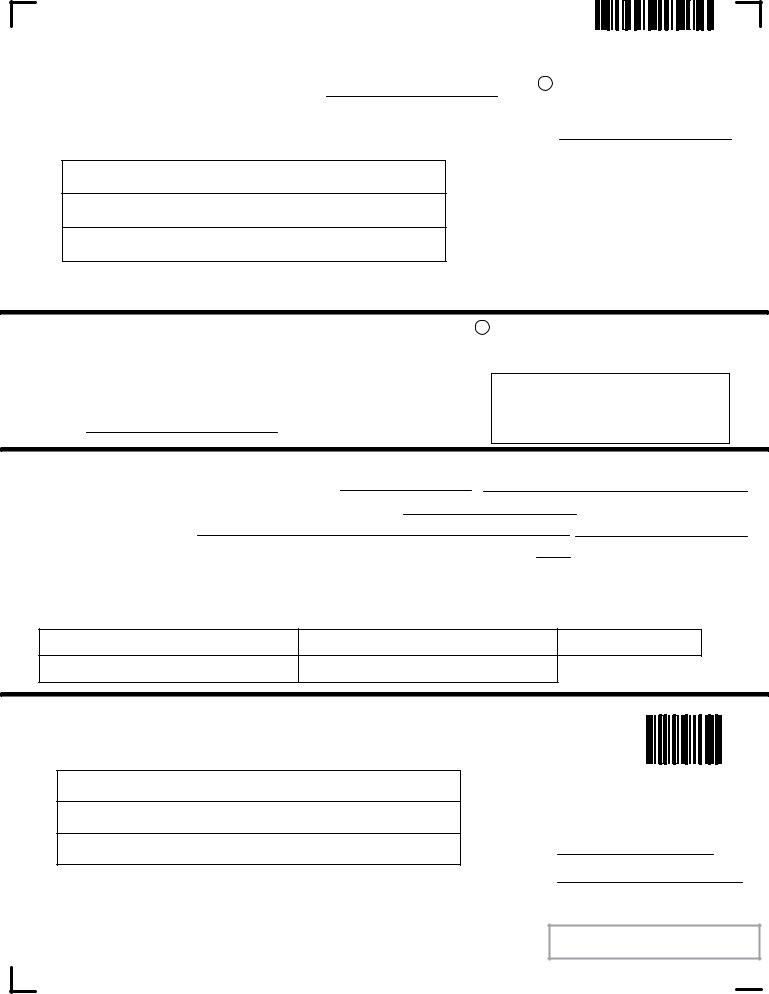

3. This next segment will be about Mail entire page to North Dakota, Amount of payment by check, and WTH - complete every one of these blank fields.

It is easy to make a mistake when completing your Mail entire page to North Dakota, so you'll want to look again before you decide to submit it.

Step 3: Before addressing the next step, make sure that all form fields have been filled in as intended. The moment you are satisfied with it, press “Done." Grab the Nd Form 306 after you subscribe to a free trial. Quickly access the document in your FormsPal cabinet, along with any edits and changes being all saved! FormsPal ensures your data privacy by having a protected system that never saves or distributes any sensitive information involved. Be assured knowing your files are kept protected every time you use our services!