In the landscape of road construction and maintenance, the Nebraska Department of Roads plays a crucial role in ensuring that contractors who bid for projects are adequately qualified and prepared. This is where Form R-123, "Contractor's Statement of Experience, Equipment, and Financial Condition," dated May 2005, becomes a vital piece of documentation for contractors aiming to secure government contracts. Available through the Contract Lettings’ website, this form serves as a prerequisite for contractors before they can proceed with submitting their bids for any project. It is required that prequalification statements are submitted to the Contract Lettings Section of the Nebraska Department of Roads no later than 5:00 PM, at least ten days before the letting date as specified in the letting schedule on their website. This ensures that all contractors are vetted for their experience, capabilities, and financial stability ahead of the competitive bidding process. The form highlights the stringent procedures and regulations set forth by the State of Nebraska Department of Roads relating to the letting of contracts and prequalification of bidders. From advertising sealed bids to the evaluation of a contractor’s financial condition, every aspect underscores the department's commitment to transparency, fairness, and quality in the construction, reconstruction, improvement, maintenance, or repair of roads and bridges. Ensuring that contractors are prequalified not only streamlines the bidding process but also guarantees that road projects are executed by entities that are not just the lowest bidders but are also thoroughly vetted for their reliability and quality of work.

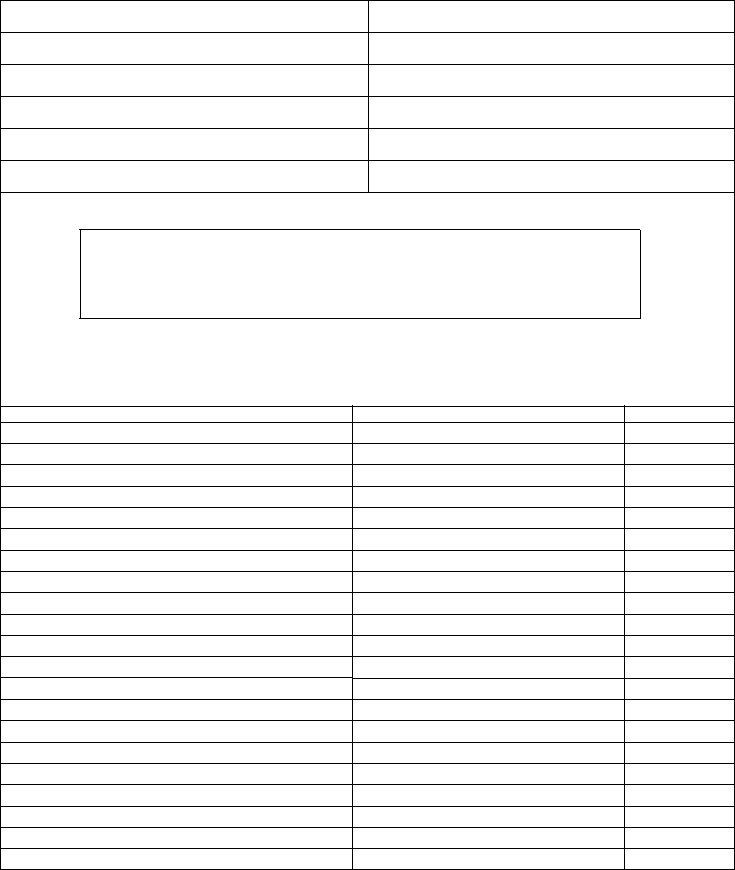

| Question | Answer |

|---|---|

| Form Name | Nebraska Department Of Roads Form |

| Form Length | 27 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 6 min 45 sec |

| Other names | printable nebraska map counties, ndor, nebraska map that can be filled in, nebraska dept of roads downloadable forms |

The Department's Form

PREQUALIFICATION STATEMENTS MUST BE RECEIVED BY THE CONTRACT LETTINGS SECTION OF THE NEBRASKA DEPARTMENT OF ROADS PRIOR TO 5:00 P.M. AT LEAST

TEN (10) DAYS BEFORE THE LETTING IN WHICH THE APPLICANT INTENDS TO SUBMIT BIDS. (See letting schedule posted on the Nebraska Department of Roads’ Contract Lettings

Section Website.)

If you have any questions, please contact us at:

Nebraska Department of Roads

Contract Lettings Section

P.O. Box 94759

Lincoln, NE

Phone: (402)

FAX: (402)

Email: NDOR_Contract_Lettings@dor.state.ne.us

State of Nebraska

Department of Roads

Pertinent Sections of the States Relating to

Letting of Contracts and Prequalifications of Bidders

Section

Section

amount retained and on the final payment due the contractor beginning sixty days after the work under the contract has been completed as evidenced by the completion date established in the department’s letter of tentative acceptance or, when tentative

acceptance has not been issued, beginning sixty days after completion of the work and running until the date when payment is tendered to the contractor.

(2)When the department is required by acts of Congress and rules and regulations made by an agent of the United States in pursuance of such acts to predetermine minimum wages to be paid laborers and mechanics employed on highway construction, the

(3)The department, in its sole discretion may permit a city or county to let state or federally funded contracts for the construction, reconstruction, improvement, maintenance, or repair of state highways, bridges, and their appurtenances located within the jurisdictional boundaries of such city or county, to the lowest responsible bidder prequalified to bid by the department when the work to be let is primarily local in nature and the department determines that it is in the public interest that the contract be let by the city or the county.

Section

Section

Section

Section

Section

STATE OF NEBRASKA

DEPARTMENT OF ROADS

RULES AND REGULATIONS FOR THE QUALIFICATION OF

CONTRACTORS PROPOSING TO BID ON STATE HIGHWAY WORK

(Pursuant to Section

- PREQUALIFICATION OF BIDDERS -

1.All persons, (any individual,

2.The financial showing required in such statement shall be certified by a public accountant holding a currently valid permit from the Nebraska Board of Public Accountancy, or by any certified public accountant holding a currently valid permit.

3.The use of a "Letter of Credit" as an alternate means of showing financial condition will be permitted when the net amount of the "Letter of Credit" does not exceed five hundred thousand dollars ($500,000). The "Letter of Credit" must be from a licensed or chartered financial institution. The "Letter of Credit" shall be certified by a public accountant holding a currently valid permit from the Nebraska Board of Public Accountancy, or by any certified public accountant holding a currently valid permit.

-QUALIFICATION -

1.Each person will be qualified upon such statement for an amount of work which he or she can perform properly as evidenced by his or her financial statement and supplementing documents, and his or her competency and responsibility as evidenced by the amount, condition, and availability of equipment, experience of personnel, and previous record with this and other awarding authorities.

2.Each person will be notified of the "maximum qualification" rating established in his or her case by the department. The “maximum qualification" rating established may be increased or decreased at any time if, as determined by the department, the performance record of the contractor warrants such action. A new statement may be requested at any time if, in the opinion of the department, significant changes in responsibility or financial ability of the person qualified have occurred.

3.Ratings for any one or combination of the following classes of work will be given:

(1) |

Grading |

(8) |

Specialty |

(2) |

Aggregates |

(8a) |

Building Construction |

(3) |

Concrete Pavement |

(8b) |

Electrical |

(4) |

Culverts |

(8c) |

Signing |

(5) |

Landscaping |

(8d) |

Painting |

(6) |

Bridges |

(8e) |

Demolition |

(7) |

Guard Rail and Fence |

(9) |

Bituminous |

|

|

(10) |

General (All Classes) |

Any person who desires a change in the class or classes of work for which he or she is qualified to submit proposals must submit a request in writing for such change, at least ten days before the letting at which he or she desires to bid with the new classification.

- CURRENT RATING -

Each person desiring to bid on work for which prequalification of bidders is required shall submit a request for proposal forms and with such request shall submit, on forms provided by the department, a complete report of all work he or she then has under contract, including subcontracts, and the amount of work not completed on all such contracts. A current qualification based on this statement and the contractor's "maximum qualification" will be established by the department, taking into account the rate of progress which is being made in performing the uncompleted work, the requirements for the performance of the work for which the contractor desires to bid and any other pertinent information that is available to the department. This current qualification shall be the "current rating" which determines the amount of work for which any person is qualified at the particular letting and for which he or she may be awarded a contract or contracts, except that the department may use a tolerance of not more than

- PROPOSAL FORMS -

1.Proposal forms, for which prequalification of bidders is required, will be issued only to those qualified to bid on each contract. A person will not be considered as qualified for any particular letting if his or her qualification rating will expire on or before the date of the letting. Any person submitting two or more bids in a total amount exceeding his or her current qualification by more than

2.Proposal forms, for which prequalification of bidders is required, will be labeled with the name of the bidder to whom they are issued and shall not be transferable. Any proposal which is submitted by a bidder other than the one to whom the proposal form was issued shall be void.

3.Proposal forms for which prequalification of bidders is required, may be issued by the department at its discretion for information only, but such proposal forms shall not be used for bidding and shall be stamped with the words "For information only, not to be used for bidding" and bids submitted on such forms shall be void and not considered.

4.Proposal forms will not be issued to any bidder later than 5:00 o'clock P.M. of the day preceding the letting.

5.A proposal form for any contract, for which prequalification of bidders is required, may be issued at the discretion of the department, to two or more qualified bidders jointly if the classes of work for which the prospective bidders are qualified to perform, satisfy in the aggregate, the qualification requirements for the particular contract. Two or more qualified bidders may not bid jointly to perform any contract, for which prequalification of bidders is required, to be let by the department unless a proposal form is issued by the department to those bidders jointly for that purpose.

Form

State of Nebraska

Department of Roads

Contract Lettings Section

Construction Division

P.O. Box 94759

Lincoln, NE

Contractor’s Statement of Experience,

Equipment and Financial Condition

At the close of business on the |

day of |

|

Fed. I.D. No. |

|

|

For |

|

|

Name |

|

|

Business Address |

|

|

Street |

|

P.O. Box |

City |

State |

Zip Code |

Mailing Address |

|

|

Street |

|

P.O. Box |

City |

State |

Zip Code |

, 20

Corporation

Partnership

Individual

Area Code |

Telephone No. |

Fax No. |

Person to contact regarding this statement:

Name |

Area Code |

Telephone No. |

State of Nebraska Statute

State of Nebraska Statute

INDICATE CLASS OR CLASSES OF WORK

IN WHICH YOU DESIRE TO BE QUALIFIED

(Requesting the major classes of work which include 1, 3, 4, 6, 9 and 10 shown below, without experience in those areas, may decrease the maximum qualification rating which could otherwise be established for your firm.)

(1) Grading

(2) Aggregates

(3) Concrete Pavement

(4) Culverts

(5) Landscaping

(6) Bridges

(7) Guard Rail and Fence

(8) Specialty

(8a) Building Construction

(8b) Electrical

(8c) Signing

(8d) Painting

(8e) Demolition

(9) Bituminous

(10) General (All Classes)

Includes, but may not be limited to, the following items:

Armor Coat, Chip Seal, Fog Seal, Slurry Seal, Microsurfacing, Pavement Repair & Patching, Joint Repair & Patching, Joint Sealing, Crack Sealing, Dowel Bar Retrofit, Diamond Grinding, Rumble Strips, Noise Walls, Paint Striping, Bridge Painting

- 2 -

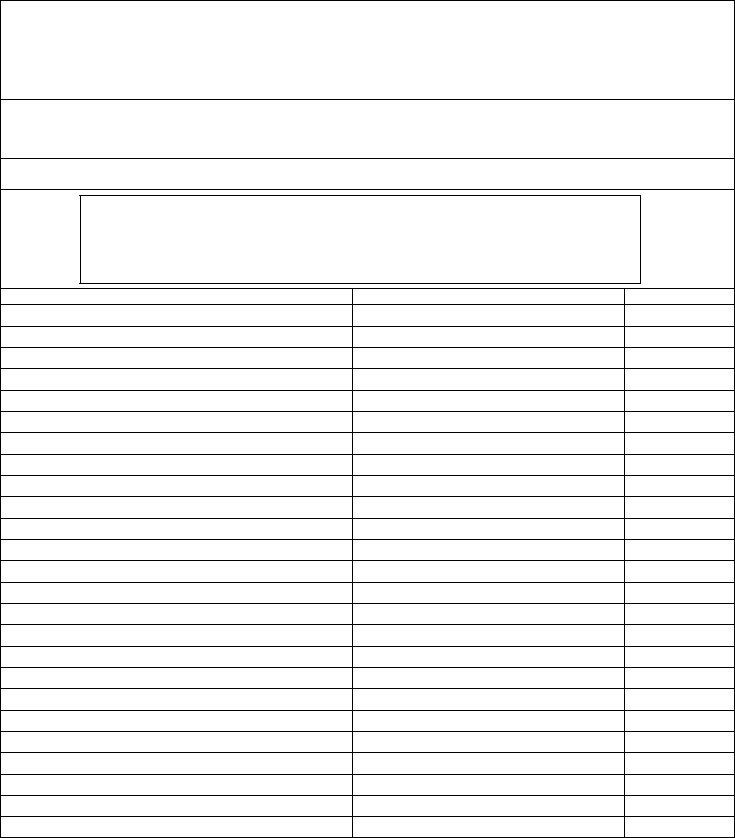

|

CONTRACTOR’S |

|

|

STATEMENT OF EXPERIENCE, EQUIPMENT |

|

|

AND FINANCIAL CONDITION |

|

|

TABLE OF CONTENTS |

|

|

|

PAGE NO. |

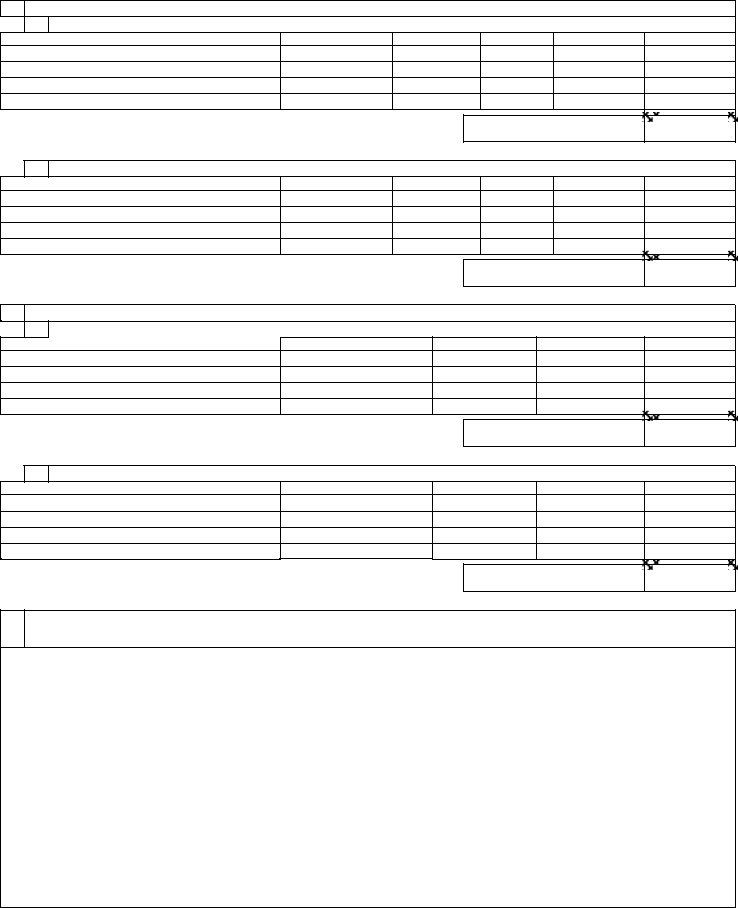

CLASS OF WORK DESIRED FOR QUALIFICATION |

2 |

|

TABLE OF CONTENTS |

3 |

|

INSTRUCTIONS TO ACCOUNTANTS FOR PREPARING FINANCIAL STATEMENTS |

4, 5 |

|

CONTRACTOR’S BALANCE SHEET (Pages |

|

|

Assets |

6 |

|

Liabilities and Capital |

7 |

|

LETTER OF CREDIT (Form |

8 |

|

SUPPORTING SCHEDULES TO BALANCE SHEET (Pages 9 – 13) |

|

|

1. |

Investments |

9 |

2. |

Notes Receivable |

9 |

3. |

Accounts Receivable |

9 |

4. |

Inventories |

10 |

5. |

Prepaid Insurance, Other Prepaid Expenses and Other Assets |

10 |

6. |

Cash Surrender Value of Life Insurance |

10 |

7. |

Property, Plant and Equipment |

10,11 |

8. |

Notes Payable |

12 |

9. |

Accounts Payable |

12 |

10.Accumulated Costs and Gross Income Recognized on Uncompleted Contracts and/or Deferred Credits From

|

Billings and Advance Collections on Uncompleted Contracts |

............................................................................ 12 |

11. |

Individual or Partnership Capital |

13 |

12. |

Capital Stock |

13 |

13. |

Surplus |

13 |

Accountant’s Questionnaire |

14, 15 |

|

Independent Auditor’s Report (Financial Statement) |

16 |

|

Accountant’s Verification Statement (Letter of Credit) |

17 |

|

Contractor’s Questionnaire |

18, 19 |

|

Corporation Information Sheet |

20 |

|

Appointee and Signature Authorization |

21 |

|

Affidavit for Individual |

22 |

|

Affidavit for Partnership |

22 |

|

Affidavit for Corporation |

22 |

|

- 3 -

INSTRUCTIONS TO ACCOUNTANTS FOR PREPARING FINANCIAL STATEMENTS

The accountant preparing contractor's financial statements will adhere to the generally accepted auditing standards as adopted by the American Institute of Certified Public Accountants. Reviews or compilations are not acceptable.

1.Applications for Prequalification will be accepted only on forms furnished by the Department. One copy is

to be submitted to the Nebraska Department of Roads. Reproduced copies of good quality of the

Form

2.The statement shall show the condition of business as determined under generally accepted accounting principles.

3.The date of the report need not necessarily be the contractor's fiscal year; however, the reporting period should be consistent from year to year, except for those contractors reporting on a period basis. The reporting year of a contractor may be a period basis, i.e., 13 periods of 4 weeks each, etc.

4.The name of the person or organization being prequalified must be the proper legal name of the entity and must be shown IDENTICALLY on the Cover of this Statement, in the Letter of Credit, in the Independent Auditor's Report, in the Accountant's Verification Statement and in the Affidavit of the Entity.

The business name used shall be such that full disclosure is assured, i.e., an individual doing business as a trade name shall include the individual's name, DBA, and the trade name. A CORPORATION FILING A

CONSOLIDATED STATEMENT SHALL FULLY DISCLOSE THE IDENTITIES OF SUCH ENTITIES CONSOLIDATED.

5.The Financial Statement Data shall be certified by a Public Accountant holding a currently valid permit from the Nebraska State Board of Public Accountancy, or by any Certified Public Accountant holding a currently valid permit. Whenever the term Certified Public Accountant appears on said form, it shall be construed to include a Public Accountant holding a valid permit from the Nebraska State Board of Public Accountancy. If additional schedules, notes and addenda are attached to Form

REPORT FOUND ON PAGE 16 MUST BE FULLY EXPLAINED BY THE CPA.

6.The Financial Statements SHALL NOT be prepared and certified by an accountant who has directly or indirectly a financial interest in, or is connected with the business of the contractor submitting the statement.

The Contractor's Statement of Experience, Equipment and Financial Condition must be complete in all aspects to be considered as being an acceptable statement. This means all schedules must be completed as required, Detailed Equipment Schedules furnished including all data requested, all signatures are original and not copies or facsimiles, all questions answered and explanations furnished if required, etc. Unacceptable statements will be returned or additional information requested. The last day to accept resubmission of such data by the Contract Lettings Section is by 5:00 p.m., ten (10) days before the letting in which the Contractor desires to bid.

- 4 -

SPECIFIC INSTRUCTIONS - CONTRACTOR'S BALANCE SHEET AND SCHEDULES

(Pages 6 through 13)

(Where there are no instructions for a particular schedule, it is presumed that the schedule itself is self- explanatory.)

CONTRACTOR'S BALANCE SHEET

(Pages 6 and 7)

This statement shall be completed in all aspects. The use of cents is not necessary. Any further rounding of figures must be explained. The classification of Assets and Liabilities between current and

SUPPORTING SCHEDULES

(Pages 9 through 13)

All totals required by the supporting schedules should be shown on the appropriate schedule, even if supplementary additional sheets are used in lieu of the schedule blanks provided in the form.

Where schedules are not complete in themselves, attach supplementary memoranda explaining fully.

INVESTMENTS (Schedule 1) - Where there is no quoted market price of securities of affiliated organizations and investments in partnerships, joint ventures, etc., the investment should be shown at cost, with an indication of the book value of the underlying net assets. Cost of investment should reflect initial cost adjusted for additional investment and subsequent profits, losses and distributions.

NOTES RECEIVABLE (Schedule 2) - All itemizations under (a) and (b) must be complete.

ACCOUNTS RECEIVABLE (Schedule 3) - All itemizations under (a) and (b) must be complete.

INVENTORIES (Schedule 4) - Inventories of similar classification may be grouped. Basis of valuation of inventory must be stated.

PREPAID INSURANCE, OTHER PREPAID EXPENSES, AND OTHER ASSETS (Schedule 5) Self- explanatory.

CASH SURRENDER VALUE OF INSURANCE (Schedule 6) -

PROPERTY, PLANT AND EQUIPMENT (Schedule 7) - Under 7(a) where composite amounts or guideline method of depreciation are used, it would be practically impossible to show the accumulated depreciation by major asset category. Where plant and equipment have been included in group accounts for purposes of computing depreciation, it is suggested that some reasonable allocation be made of the reserve for depreciation of plant, equipment, construction, and other asset categories.

Equipment schedules should be updated for evaluation purpose and include, by classification, all equipment which is still serviceable although fully depreciated.

Under 7(b), land should indicate the carrying amount, that is cost less depletion. Also, under 7(b), items of a like nature can be grouped. Only owned land should be included in the schedule.

Under 7(c), if plant and equipment held under lease or rental contracts are listed in this schedule, the leases should be current as of the statement date, and should not include leases which have been recorded as purchases.

NOTES PAYABLE (Schedule 8) - All itemizations under (a) and (b) must be complete.

ACCOUNTS PAYABLE (Schedule 9) - All itemizations under (a) and (b) must be complete.

ACCUMULATED COSTS AND GROSS INCOME RECOGNIZED ON UNCOMPLETED CONTRACTS AND/OR DEFERRED CREDITS FROM BILLINGS AND ADVANCE COLLECTIONS ON UNCOMPLETED CONTRACTS (Schedule 10) - All explanations under Schedule 10 must be complete.

INDIVIDUAL OR PARTNERSHIP CAPITAL (Schedule 11)

CAPITAL STOCK (Schedule 12)

SURPLUS (Schedule 13)

ACCOUNTANT'S QUESTIONNAIRE

(Pages 14 and 15)

All questions must be answered and explanations furnished if required. - 5 -

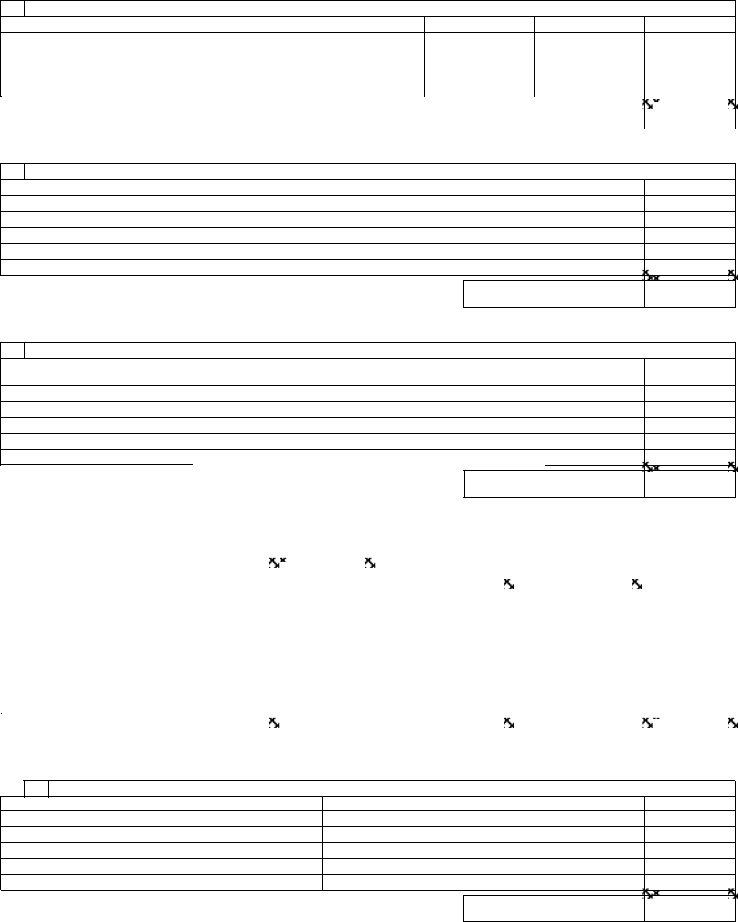

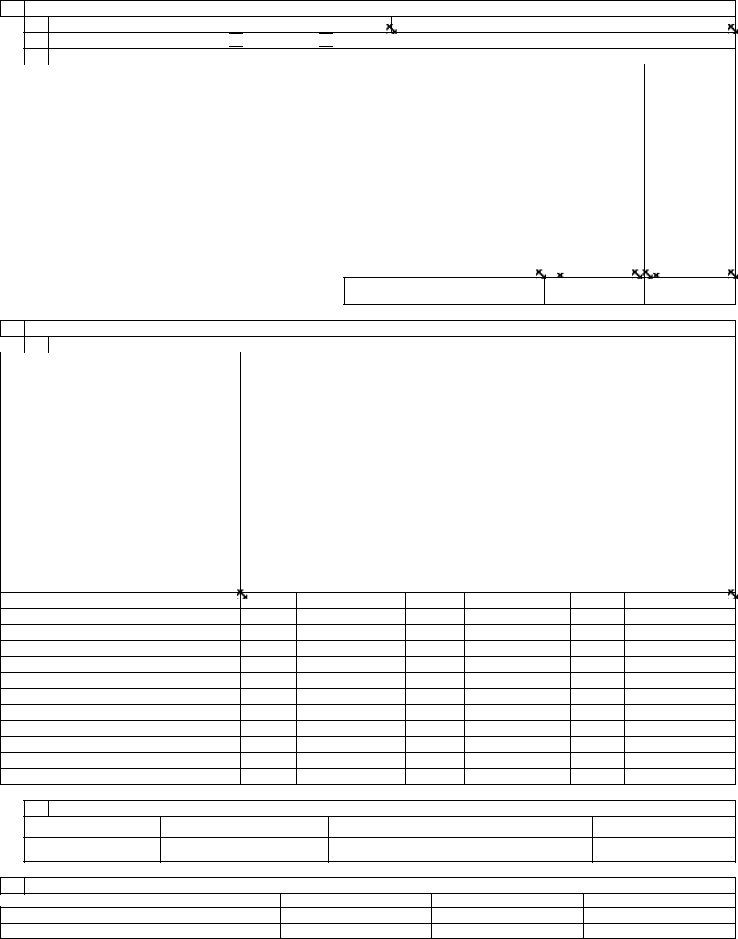

NAME

AS OF |

, 20 |

SCHEDULE

NUMBER

CASH

- ASSETS -

CURRENT |

NONCURRENT |

TOTAL |

|

|

|

$ |

|

$ |

|

|

|

1 |

|

|

INVESTMENTS |

|

|

|

|

|

MARKET VALUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Government Obligations |

|

|

$ |

$ |

|

|

Listed Securities |

|

|

|

|

|

|

Securities of Affiliated Organizations |

|

|

|

|

|

|

Partnerships or Joint Ventures |

|

|

|

|

|

|

Others |

|

|

|

|

|

TOTAL INVESTMENTS |

|

$

$

$

2 |

|

NOTES RECEIVABLE |

|

|

|

|

||

a From Officers, Directors, Stockholders, or Partners |

|

$ |

|

$ |

|

|

||

b |

From Affiliated Companies, Partnerships, Organizations, |

|

|

|

|

|

||

Joint Ventures, Etc. |

|

|

|

|

|

|

|

|

|

From Other Contractors |

|

|

|

|

|

|

|

|

From Others |

|

|

|

|

|

|

|

|

Less Allowances for Estimated Losses |

|

|

< |

> |

< |

> |

|

|

TOTAL NOTES RECEIVABLE |

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

|

ACCOUNTS RECEIVABLE |

|

|

|

|

||

|

From Completed Contracts |

|

$ |

$ |

|

|

||

|

From Uncompleted Contracts |

|

|

|

|

|

|

|

aFrom Officers, Directors, Stockholders, or Partners

b |

From Affiliated Companies, Partnerships, Organizations, |

|

|

|

|

|

|

Joint Ventures, Etc. |

|

|

|

|

|

|

|

|

From Others |

|

|

|

|

|

|

|

Less Allowances for Estimated Losses |

|

< |

> < |

> |

|

|

|

TOTAL ACCOUNTS RECEIVABLE |

$ |

$ |

|

$ |

||

|

|

|

|

|

|

|

|

10 |

Accumulated Costs and Gross Income Recognized on |

$ |

|

$ |

|

$ |

|

Uncompleted Contracts |

|

|

|

|

|

|

|

4 |

Inventories |

|

$ |

|

$ |

|

$ |

5 |

Prepaid Insurance, Other Prepaid Expenses and Other |

$ |

|

$ |

|

$ |

|

Assets |

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS |

|

$

6 |

Cash Surrender Value of Life Insurance |

|

$ |

|

$ |

|||

7 |

Property, Plant and Equipment Cost |

|

|

|

|

|||

Less Accumulated Depreciation |

|

< |

> |

|

||||

ASSETSOTHER |

Goodwill |

|

|

|

|

|||

Unamortized Organization Expenses |

|

|

|

|

||||

Deferred Charges and Other Assets |

|

|

|

|

||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL NONCURRENT ASSETS |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Statements based on reviews or compilations will not be acceptable.

- 6 -

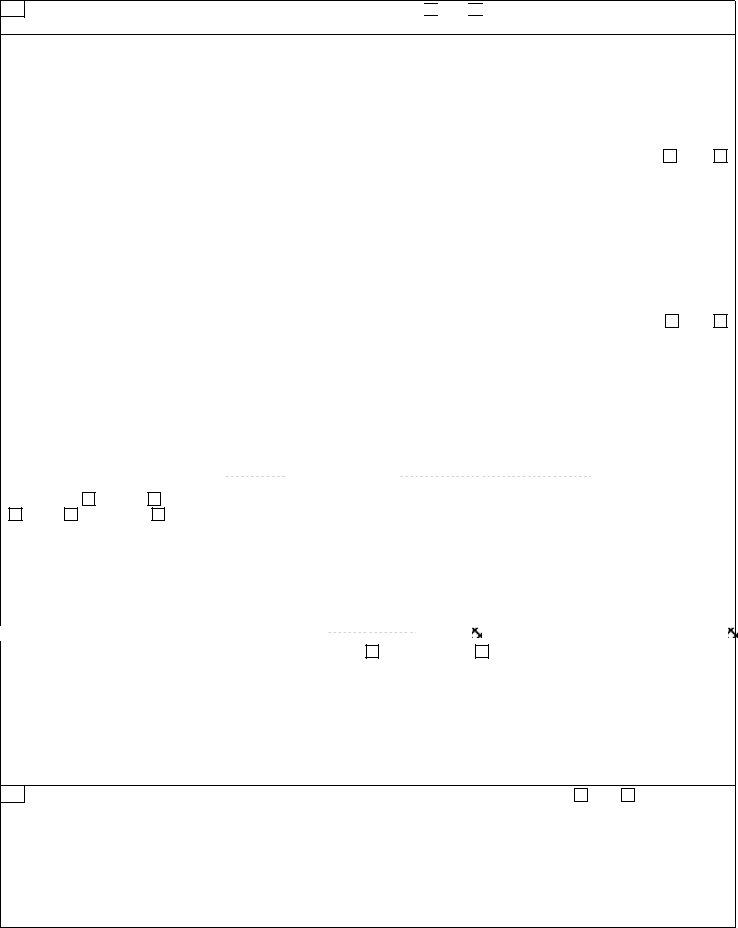

NAME

AS OF |

, 20 |

- LIABILITIES AND CAPITAL -

- LIABILITIES-

SCHEDULE

NUMBER

CURRENT

NONCURRENT

TOTAL

|

|

|

|

|

|

8 |

|

NOTES PAYABLE |

|

|

|

|

To Banks |

|

$ |

$ |

|

a |

To Officers, Directors, Stockholders, or Partners |

|

|

|

|

b |

To Affiliated Companies, Organizations, Partnerships, |

|

|

|

|

Joint Ventures, Etc. |

|

|

|

|

|

|

Other Notes Not Included Above |

|

|

|

|

|

TOTAL NOTES PAYABLE |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

||

9 |

ACCOUNTS PAYABLE |

|

|

||

a |

To Officers, Directors, Stockholders, or Partners |

|

$ |

$ |

|

(Including Wages, Salaries and Bonuses) |

|

|

|||

|

|

|

|

||

|

|

|

|

|

|

b |

To Affiliated Companies, Organizations, Partnerships, |

|

|

|

|

Joint Ventures, Etc. |

|

|

|

|

|

|

To Subcontractors |

|

|

|

|

|

To Trade Suppliers |

|

|

|

|

|

Others |

|

|

|

|

|

TOTAL ACCOUNTS PAYABLE |

|

$ |

$ |

$ |

|

|

|

|

|

|

ACCRUED EXPENSES

Wages, Salaries and Bonuses (Excluding 9a) |

|

$ |

$ |

Taxes, Other Than Taxes On Income |

|

|

|

Other |

|

|

|

TOTAL ACCRUED EXPENSES |

|

$ |

$ |

|

|

|

|

$

10 |

Deferred Credits from Billings and Advance Collections |

$ |

$ |

$ |

on Uncompleted Contracts |

|

|

|

|

Taxes on Income |

|

|

|

|

Other Liabilities: (Describe Below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES |

$ |

|

|

|

||

|

|

|

|

|

|

|

|

TOTAL NONCURRENT LIABILITIES |

$ |

||||

|

|

TOTAL LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

- CAPITAL -

$

11 |

Individual or Partnership Capital |

$ |

|

||

12 |

Capital |

Preferred Stock |

|

|

|

Stock |

Common Stock |

|

|

||

|

Surplus |

Capital or |

|

|

|

13 |

Appraisal Surplus |

|

|

||

Retained Earnings |

|

|

|||

|

|

|

|||

|

Less Treasury Stock at Cost |

< |

> |

||

|

|

||||

Are there ‘Notes to Balance Sheet’? Yes No |

TOTAL CAPITAL |

|

|

|

|

If ‘yes’, attach copy to last page of this statement. |

TOTAL LIABILITIES AND CAPITAL |

|

|

|

|

Statements based on reviews or compilations will not be acceptable.

$

$

- 7 -

Form

STATE OF NEBRASKA

DEPARTMENT OF ROADS

Letter of Credit for

(As required by Nebraska Revised Statutes

(Date)

Gentlemen:

For the purpose of qualification to perform contracts on road construction with the State of Nebraska under the laws of the State of Nebraska and in order to show the financial resources for that purpose, the undersigned

hereby declares and states that

(Name of Financial Institution)

carries a line of credit with this

(Name of Contractor)

Financial Institution and that this Financial Institution is, at this time, willing to loan to this contractor the total sum of

$ |

, and that we have loans in the total amount of $ |

outstanding to this contractor |

against this line of credit at this time leaving a net line of credit for this contractor in the amount of $ |

||

This letter of Credit is valid for 15 months from the date signed, or until |

**. |

|

*The name must agree with the name used on the Cover of this Statement, in the Accountant’s Verification Statement and in the Affidavit.

**Any stipulations or restrictions to this Letter of Credit during the time period of its validity must be submitted to the Contract Lettings Section of the Nebraska Department of Roads, P.O. Box 94759, Lincoln, Nebraska

The general nature of the collateral which we will require to secure loans is excess of those that are outstanding at this time is as follows:

We are signing this instrument with the understanding that it is a special form of letter of credit that is for use only by the Department of Roads in connection with the administration of Nebraska Revised Statutes

It is understood that an actual commitment to loan is not being made but this document expresses our carefully considered judgment of the contractor’s eligibility for a loan and our willingness at this time to loan this contractor the

stipulated amount.

This information is being furnished with the further understanding that this expression of our willingness at this time to

loan this contractor the stated amount of money will be given the same weight by the Department in estimating the contractor’s current assets as would cash or negotiable securities listed in a financial statement.

(Name of Financial Institution)

Attest: |

(Address) |

By

President or Managing Officer

(Only Original Signature Accepted)

Note: This form (Page 8), must be accompanied by pages 1, 2, (Questions 13 and 14 on page 15), 17, 18, 19, 20, 21 and 22 of Form

public accountant holding a currently valid permit from the Nebraska Board of Public Accountancy, or by a certified public accountant holding a currently valid permit.)

- 8 -

SUPPORTING SCHEDULES TO BALANCE SHEET

Instructions to Accountants: All schedules must be complete and all questions answered; otherwise the statement will not be accepted. In no instance will the amount of the Letter of Credit be included in the computation of the Balance Sheet. Statements on forms other than those provided by the Department of Roads WILL NOT be accepted.

ASSETS

1 |

|

INVESTMENTS |

|

|

|

|||

|

Itemize securities of all affiliated organizations and all investments in partnerships and joint ventures: |

|

||||||

|

Name of Organization and City |

Percent If |

|

Date of |

|

Amount of |

|

Market Value |

|

Affiliated |

Annual Closing |

|

Investment |

|

|||

|

|

|

|

|

||||

|

|

% |

|

|

$ |

|

|

$ |

|

|

% |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

2

a

NOTES RECEIVABLE

Itemize all Notes Receivable from officers, directors, stockholders or partners:

Receivable From |

Position |

For What |

Date of Origin |

Due Date |

How Secured |

Amount |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

$

b

Itemize all Notes Receivable from affiliated companies, partnerships, organizations, joint ventures, etc.:

Receivable From |

Affiliation |

For What |

Date of Origin |

Due Date |

How Secured |

Amount |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

$

3

a

ACCOUNTS RECEIVABLE

Itemize all amounts due from officers, directors, stockholders or partners:

Receivable From |

Position |

For What |

Date of Origin |

Amount |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

$

b

Itemize all amounts due from affiliated companies, partnerships, organizations, joint ventures, etc.:

|

Receivable From |

Relationship |

For What |

Date of Origin |

Amount |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

$

- 9 -

4

INVENTORIES

Itemize Inventories by Classification |

Valuation Basis |

Cost |

Book Value |

Repair Parts |

$ |

|

Materials |

|

|

Other |

|

|

|

|

|

|

|

|

|

TOTAL |

$ |

|

|

|

5

PREPAID INSURANCE, OTHER PREPAID EXPENSES AND OTHER ASSETS

Description |

Amount |

$

TOTAL

$

6

CASH SURRENDER VALUE OF LIFE INSURANCE

Company |

Policy No. |

Beneficiary |

On Whose Life |

Date Issued |

|

|

Face of Policy |

Net Cash |

|

|

Value |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

TOTAL |

$ |

7 |

|

|

|

|

|

|

|

PROPERTY, PLANT AND EQUIPMENT |

|

|

||||

|

a |

|

Summary |

|

|

|

|

|

|

Accumulated Depreciation |

Net Book |

|||

|

|

|

|

|

|

Schedule |

|

Cost (b) |

|

Amount |

Method Used |

Value |

||

Land |

|

|

|

|

b |

$ |

|

$ |

|

|

$ |

|||

Plant and Equipment - Construction |

|

c |

|

|

|

|

PER 7 (c) |

|

||||||

Plant Facilities and Equipment – Other |

|

d |

|

|

|

|

PER 7 (d) |

|

||||||

than Construction |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Furniture and Fixtures |

Total Only |

$ |

|

|

|

|

|

|||||||

Other (Describe Below) |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

TOTAL |

|

|

$ |

|

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bLand List all items including quarries, gravel pits, etc.: (Transfer TOTAL COST to Line (b) of Summary 7a).

Description |

Location |

Cost |

$

TOTAL

$

- 10 -

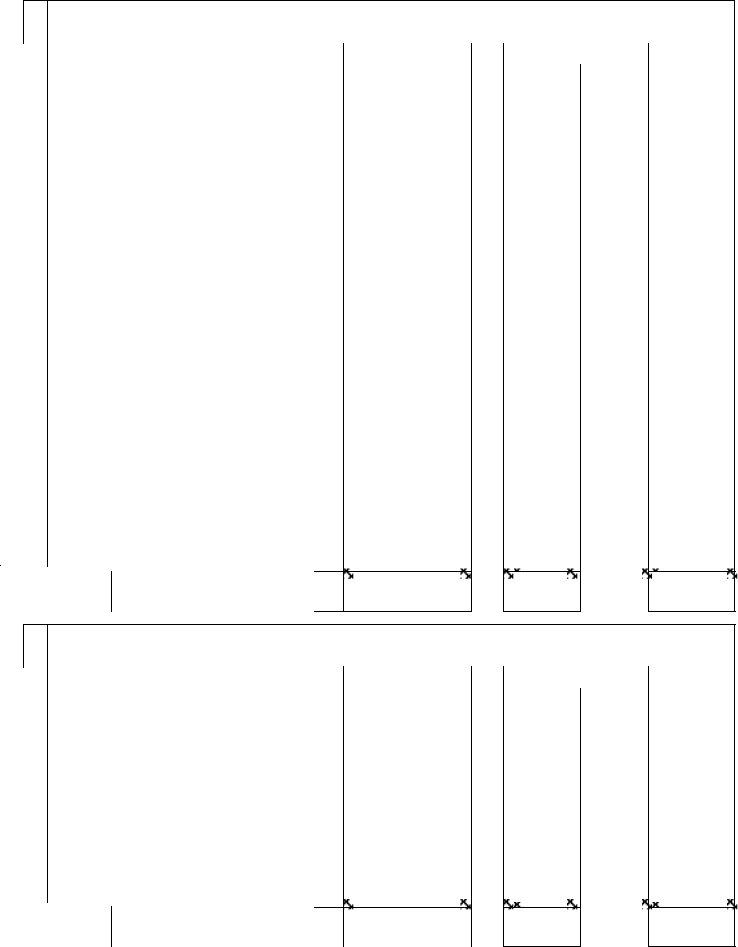

Plant Facilities and Equipment – Construction List items in support of totals shown on Summary 7a. (Like

citems and items costing less than $500.00 can be grouped). (Use additional schedules, if necessary, and transfer the TOTALS OF ALL SCHEDULES to Line (c) of Summary 7a).

Qty. |

Description, Name |

Condi- |

Pur. |

|

Age |

Accumulated Depreciation |

Net Book |

||||

New |

Purchase Price |

of |

|

|

|||||||

and Size of Item |

tion |

Amount |

Method |

Value |

|||||||

|

Used |

|

Item |

||||||||

|

|

|

|

|

Used |

|

|||||

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

OF ALL SCHEDULES |

||

|

||

|

|

$

$

$

Plant Facilities and Equipment Other Than Construction List items in support of totals shown on

dSummary 7a. (Like items and items costing less than $500.00 can be grouped). (Use additional schedules, if necessary,

|

and transfer the TOTALS OF ALL SCHEDULES to Line (d) of Summary 7a). |

|

|

|

|

||||||

Qty. |

Description, Name |

Condi- |

Pur. |

|

Age |

Accumulated Depreciation |

Net Book |

||||

New |

Purchase Price |

of |

|

|

|||||||

and Size of Item |

tion |

Amount |

Method |

Value |

|||||||

|

Used |

|

Item |

||||||||

|

|

|

|

|

Used |

|

|||||

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

$ |

|

OF ALL SCHEDULES |

||

|

||

|

|

|

|

- 11 - |

$

$

LIABILITIES

8 |

NOTES PAYABLE |

aItemize all Notes Payable to officers, directors, stockholders or partners:

Payable To |

Position |

For What |

Due Date |

How Secured |

Amount |

$

TOTAL

$

b

Itemize all Notes Payable to affiliated companies, partnerships, organizations, joint ventures, etc.:

Payable To |

Affiliation |

For What |

Due Date |

How Secured |

Amount |

$

TOTAL

$

9 |

ACCOUNTS PAYABLE |

aItemize all amounts payable to officers, directors, stockholders or partners: (Including wages, salaries and bonuses)

Payable To |

Position |

For What |

Due Date |

Amount |

$

TOTAL

$

b

Itemize all amounts payable to affiliated companies, organizations, partnerships, joint ventures, etc.:

Payable To |

Relationship |

For What |

Due Date |

Amount |

$

TOTAL

$

10

Accumulated costs and gross income recognized on uncompleted contracts and/or deferred credits from billings and advance collections on uncompleted contracts.

Explain the Nature and Basis of Accounting for items included under these captions:

- 12 -

CAPITAL

11 |

INDIVIDUAL OR PARTNERSHIP CAPITAL |

aDate of organization:

bIf a partnership, is it General or Limited ? If Limited, indicate which partners are limited in 11C. c Names and addresses of all partners:

Names |

If |

Address |

Capital Balance |

Capital Balance |

|

LTD. |

Beginning of Year |

End of Year |

|||

|

|

||||

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

$

$

12

a

CAPITAL STOCK

Complete the following schedule.

CLASS AND PAR VALUE |

|

AUTHORIZED |

TREASURY STOCK |

|

ISSUED |

||

|

|

|

|

|

|

|

|

Preferred Stock |

Shares |

|

Amount |

Shares |

Cost |

Shares |

Amount |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

b

If additional stock was issued during the past year, specify how much for each below:

Cash

Other Contributions

Identify Other Contributions

How Many Total

Shares

13

SURPLUS

Paid in Surplus |

Appraisal Surplus |

Retained Earnings |

Balance, Beginning of the Year

Balance, End of Year

- 13 -

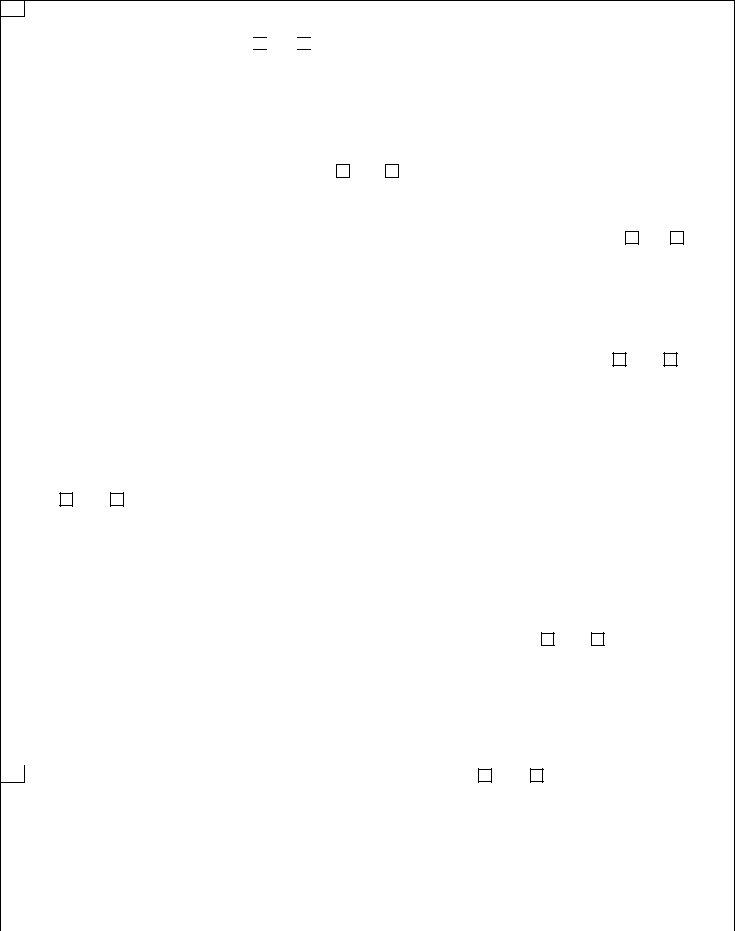

ACCOUNTANT’S QUESTIONNAIRE

1

(All questions must be answered and explanations furnished if required.)

Is Property, Plant and Equipment valued at other than cost? Yes No If yes, explain the basis of valuation and indicate the amount in excess of cost for each classification.

2 |

|

Are any of the properties included under Property, Plant and Equipment held in joint Ownership? Yes |

No |

||||||

|

|

If yes, itemize and explain. |

|

|

|

|

|

||

|

|

|

|

||||||

3 |

|

Are there any items of construction, plant and equipment and land not listed in Property, Plant and Equipment |

|||||||

|

|||||||||

|

|

schedules which are held under lease or rental contracts, including those from related companies? Yes |

No |

||||||

|

|

If yes, list individual items covered.. |

|

|

|

|

|

||

|

|

|

|

|

|

||||

4 |

|

Income tax returns are filed on a |

year basis ending |

Indicate method of tax |

|||||

|

|

yeabasis ending |

|

(month) |

(day) |

|

|||

|

|

|

|

|

|

|

|||

accounting |

Cash |

Accrual. Indicate |

method of |

accounting on the |

financial statements submitted |

herein |

|||

|

|

Cash |

Accrual or |

Other. (Explain “other” below.) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

5 |

|

Federal tax returns have been examined through |

(year). |

|

|

|

|||

|

|

|

|

||||||

|

|

|

|

|

|

||||

6 |

|

Were any Federal or State tax deficiencies Assessed |

or Proposed |

which are not reflected in this report? |

|||||

|

|

If so, explain. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7

Are there contingent liabilities which could affect the financial condition of this entity? Yes fully.

No

If yes, explain

- 14 -

8

(Individuals and Partnerships only) Are there any transactions reflected in the individual or partners capital accounts during the current reporting period which are not the result of (1) capital contributions, (2) net earnings,

(3) withdrawals, or (4) net loss? Yes No If yes, explain fully.

9 |

(Individuals and Partnerships only) Is any part of the individuals or partners capital accounts the result of an |

||||||||||

|

increase in asset values due to appraisals? Yes |

No |

If yes, a schedule must be attached segregating the |

||||||||

|

increase by asset types, i.e. land, buildings, equipment, etc. The appraisal values must be substantiated by current |

||||||||||

|

documentation attached to this statement. (Does not imply recognition by the Nebraska Department of Roads). |

||||||||||

|

|

|

|

||||||||

10 |

(Corporations only) |

Are any transactions reflected in the surplus accounts during the current reporting period which |

|||||||||

|

are not the result of (1) net income, (2) capital contributions, (3) dividends paid, or (4) net loss? Yes |

No |

If yes, |

||||||||

|

explain fully. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

11 |

(Corporations only) |

Are there any restrictions on the distribution of retained earnings? Yes |

|

No |

If yes, |

||||||

|

explain fully. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

12 |

(Corporations only) Is any part of the total Capital the result of an increase in asset value due to appraisals? |

||||||||||

|

Yes |

No |

If yes, a schedule must be attached segregating the increase by asset type, i.e. land, buildings, |

||||||||

|

equipment, etc. The appraisal values must be substantiated by current documentation attached to this statement. |

||||||||||

|

(Does not imply recognition by the Nebraska Department of Roads). |

|

|

|

|

|

|||||

|

|

|

|

|

|

||||||

13 |

(Corporations only) |

Is this corporation considered a subsidiary corporation? Yes |

No |

If yes, provide the |

|||||||

|

following information. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Parent |

|

|

|

|

Percent of |

|

|

|

|

|

|

|

|

|

|

Shares Owned |

|||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14(Corporations only) Does this corporation own any subsidiaries? Yes information.

No

If yes, provide the following

|

Are Subsidiaries |

|

|

Names and Addresses |

Consolidated in this |

Percent of |

|

|

Financial Statement |

||

|

Shares Owned |

||

|

Yes |

No |

|

|

|

||

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

% |

|

|

|

|

- 15 -

INDEPENDENT AUDITOR'S REPORT

FINANCIAL STATEMENT ONLY

STATE OF |

|

DATE |

COUNTY OF |

|

|

I |

, do affirm that I am a Certified Public Accountant |

|

holding unrevoked Certificate No. |

in the State of |

, and License or |

Permit No. |

in the State of |

, or a Public Accountant holding unrevoked |

Certificate No. |

in the State of Nebraska, and License or Permit No. |

|

in the State of Nebraska, and I have signed this opinion as a member of the firm of

.

The balance sheet referred to below has been prepared solely for filing with the State of Nebraska, Department of Roads and is not intended for any other purpose.

I/We have audited the accompanying balance sheet of *

as of, 20 , as set forth on pages 6 and 7 herein including accompanying notes thereto. This financial statement is the responsibility of the Company's management. My/Our responsibility is to express an opinion on this financial statement based on my/our audit.

I/We conducted our audit in accordance with accounting principles generally accepted in the United State of America. Those standards require that I/we plan and perform the audit to obtain reasonable assurance about whether the balance sheet is free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the balance sheet. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall balance sheet presentation. I/We believe that my/our audit of the balance sheet provides a reasonable basis for my/our opinion.

(ADD EXPLANATORY PARAGRAPH IF NECESSARY)

In my/our opinion, (except for the effects of

as discussed in the preceding paragraph), the balance sheet referred to above presents fairly, in all material respects, the

financial position of * |

|

as of |

, 20 , in conformity with accounting principles generally accepted in the |

United States of America. |

|

The additional information presented on Pages 9 through 15 herein has been taken primarily from accounting and other records of the entity and has been subjected to the tests and other auditing procedures applied in my/our examination of the balance sheet of *

as of, 20 In my/our opinion, such information is fairly presented in all material respects in relation to the balance sheet taken as a whole although it is not necessary for a fair presentation of financial position.

I/We have read and complied with all the instructions found on pages 4 and 5 in the preparation of the financial part of this statement, and the balance sheet referred to in this report is not presented as a review or compilation.

*The name must agree with the name used on the Cover of this Statement and in the Affidavit.

If a substitute Independent Auditor's Report is submitted in lieu of this report, it must make reference to Pages 6 and 7, and 9 thru 15 of Form

Accounting Firm

Address

Signature of Certified Public Accountant/Public Accountant

(Must be signed by individual – only original signature accepted)

Area Code |

Telephone No. |

- 16 -

ACCOUNTANT’S VERIFICATION STATEMENT

LETTER OF CREDIT ONLY

STATE OF |

DATE |

|

COUNTY OF |

|

|

I |

, do affirm that I am a Certified Public Accountant |

|

holding unrevoked Certificate No. |

in the State of |

, and License or |

or Permit No. |

in the State of |

, or a Public Accountant |

holding unrevoked Certificate No. |

in the State of Nebraska, and License or Permit |

|

No. |

in the State of Nebraska, and I have signed this certification |

|

as a member of the firm of |

|

|

This is to state that I/we have verified the authenticity of the attached State of Nebraska, Department of Roads’

Letter of Credit for |

|

, 20 , with |

|

, |

|

(Name of Financial Institution) |

, |

(City) |

, for a net line of credit of $ |

, issued to * |

|

(State)

(Name of Contractor)

(City) |

(State) |

Questions 13 and 14 on page 15 is accurately presented.

*The name must agree with the name used on the Cover of this Statement, in the Letter of Credit and in the Affidavit.

, and that the subsidiary information in

Accounting Firm

Address

Signature of Certified Public Accountant/Public Accountant

(Must be signed by individual - only original signature accepted)

Area Code |

Telephone No. |

- 17 -

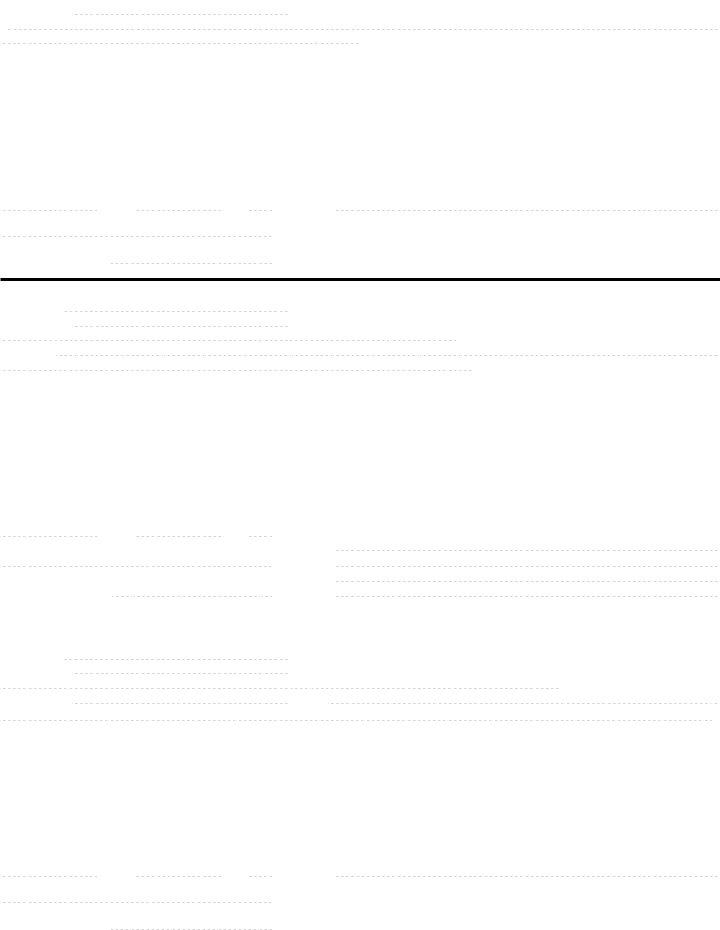

CONTRACTOR’S QUESTIONNAIRE

All questions must be completed and a full disclosure made. The Nebraska Department of Roads may require Form

1 |

How many years experience have |

In highway construction? |

As a Principal Contractor? |

|

you had: |

Years |

Years |

||

|

||||

|

|

|

|

2How many years has this entity operated under its present business name?

3 Has this entity operated under any other business names? Yes |

No |

If yes, specify. |

|

|

|

|

|

4In what types of construction have you been mainly engaged? (specify)

5 |

Are you interested in more than one line of business? Yes |

No |

If yes, describe. |

As a Subcontractor?

Years

6

Do you intend to sublet any portion of work awarded to you? Yes No

If yes, explain.

7

Is this entity authorized to transact business in other states? Yes No

If yes, specify.

8

Have you performed work as a prime or subcontractor for any state highway department? Yes No

If yes, which and to whom do you refer.

9

What is the largest contract you have ever completed? (Explain)

10

Are there any claims on file or suits pending against you or any of your work? Yes No

If yes, state amount and character.

11

Has this entity or any of the officers, members, owners or partners, etc., in this entity ever been or are now officers, members, owners or partners,

etc., in an entity that has failed in business or failed to complete work awarded? Yes |

No |

If yes, explain. |

12

Does this entity or any of its officers, members, owners or partners, etc., have a financial interest and/or serve as an officer or director in any other entity filing Form

Yes |

No |

If yes, list the organization, personnel involved and the nature of the affiliation. |

- 18 -

13

Is this entity related through principal owners and/or stockholders, officers, directors, partners, employees or others with any other businesses or

ventures in |

the highway construction industry which do not file for prequalification with the Nebraska Department of Roads? |

|

Yes |

No |

If yes, describe in detail these relationships. |

14

Has this entity or any of its officers, members, owners or partners, etc., ever been or are now an officer, member, owner or partner, etc., in an entity

that |

has been |

denied prequalification or removed from an approved bidder’s list by this or any other state or the Federal Government? |

Yes |

No |

If yes, provide complete details including when, where and why. |

15

Has anyone been obliged to pay a loss on account of having become surety for you? Yes

No

If yes, explain.

16

Provide a list of all principals, officers, partners, companies or organizations owning any part of this entity.

17 |

Is this entity certified as a Disadvantaged and/or Women’s Business Enterprise with the Nebraska Department of Roads? Yes |

No |

If yes, |

check appropriate category below. If no, you may write to the Nebraska Department of Roads DBE/WBE Section for further information on certification.

Socially and economically disadvantaged individual means a person who is a citizen or lawful permanent resident of the United States, and who is:

a |

|

BLACK AMERICAN (a person having origins in any of the black racial groups of Africa); |

b |

|

HISPANIC AMERICAN (Includes a person of Mexican, Puerto Rican, Cuban, Central or South American, or |

|

||

|

any Spanish culture or origin, regardless of race); |

|

c |

|

|

|

NATIVE AMERICAN (Includes a person who is American Indian, Eskimo, Aleut or Native Hawaiian); |

|

|

||

|

|

|

d |

|

Vietnam, Laos, Cambodia, the Philippines, Samoa, Guam, the U.S. Trust Territories of the Pacific, or the |

|

|

Northern Marianas); |

e |

|

|

|

||

f |

|

Members of groups, or other individuals, found to be economically and socially disadvantaged under |

|

||

|

Section 8(a) of the Small Business Act, as amended [15 USC 637(a)]. |

|

g |

|

|

|

WOMAN |

|

|

- 19 -

CORPORATION INFORMATION SHEET

This questionnaire must be completed.

Print or Type

Name as Incorporated:

Date Incorporated:

In What State Incorporated:

Directors:

President:

Secretary:

Treasurer:

As adopted by the Board of Directors, the officers and employees listed below are appointed and authorized to approve and execute on the Corporation’s behalf, the following documents:

* 1 - Contractor’s Statement of Experience, Equipment and Financial Condition

*2 – Bids, Contracts and Bonds

*Specify the appropriate number(s) and TITLE(S) of each officer in the designated column below.

If any changes are made in the appointee list by the action of the Board of Directors during the continuance of this Financial Prequalification, it SHALL be the sole responsibility and WILL be required of the corporation to submit a document advising of such action to the Contract Lettings Section, Nebraska Department of Roads. (Unless the signatory on any of the documents included in 1 and 2 above is listed below as authorized to sign for that document(s), the signature will be considered unacceptable.

Name

Title

*Number(s)

Use reverse side if necessary for additional entries.

- 20 -

APPOINTEE AND SIGNATURE AUTHORIZATION

THIS FORM IS TO BE COMPLETED IF ANY OF THE FOLLOWING APPLY:

1.More than one Corporation, more than one Partnership, more than one individual or any combination of these entities is a part of this Financial Prequalification.

2.This Financial Prequalification is for a Partnership.

3.The Individual or Partnership named in this Financial Prequalification has additional appointees.

THE PERSON(S) LISTED BELOW ARE APPOINTED AND AUTHORIZED TO APPROVE AND EXECUTE ON BEHALF OF THE CORPORATIONS(S), PARTNERSHIP(S), AND/OR INDIVIDUAL(S) NAMED HEREIN, THE FOLLOWING DOCUMENTS:

Name of Company or Companies:

*1 – Contractor’s Statement of Experience, Equipment and Financial Condition

*2 – Bids, Contracts and Bonds

*Specify the appropriate number(s) and TITLE(S) of each officer in the designated column below.

Name

Title

*Number(s)

If any changes are made in the appointee and/or authorization list during the continuance of this Financial Prequalification, it SHALL be the sole responsibility and WILL be required of the contractor to submit a document advising of such action to the Contract Lettings Section, Nebraska Department of Roads. (Unless the signatory on any of the documents included in 1 and 2 above is listed as authorized to sign for that document(s), the signature will be considered unacceptable.

- 21 -

|

AFFIDAVIT FOR INDIVIDUAL |

STATE OF |

|

COUNTY OF |

ss. |

* |

|

being duly sworn, deposes and says that the foregoing financial statement taken from

his/her books, is a true and accurate statement of his/her financial condition as of the date thereof, and has been audited and prepared by an independent Public Accountant holding a currently valid permit from the Nebraska Board of Public Accountancy, or by an independent Certified Public Accountant holding a currently valid permit whose report will be found on page 16 of this submittal, and/or if a Letter of Credit (Form

*Business Trade Name shall include individual’s name/DBA. (The name must agree with the name used on the Cover of this Statement, in the Independent Auditor’s Report, in the Accountant’s Verification Statement and in the Letter of Credit.)

Any false, deceptive or fraudulent statements made herein by the applicant will be cause for disqualification as a future bidder on projects let by the Nebraska Department of Roads.

Sworn to before me this

day of |

, 20 |

(Individual must sign here)

Notary Public

My commission expires

|

AFFIDAVIT FOR PARTNERSHIP |

STATE OF |

|

COUNTY OF |

ss. |

being duly sworn, deposes and says that they are members of

the firm of *

; that they are familiar with the books of said firm showing

its financial condition; that the foregoing financial statement taken from the books of said firm, is a true and accurate statement of the financial condition of said firm as of the date thereof, and has been audited and prepared by an independent Public Accountant holding a currently valid permit from the Nebraska Board of Public Accountancy, or by an independent Certified Public Accountant holding a currently valid permit whose report will be found on page 16 of this submittal, and/or if a Letter of Credit (Form

*Firm name (The name must agree with the name used on the Cover of this Statement, in the Independent Auditor’s Report, in the Accountant’s Verification Statement and in the Letter of Credit.)

Any false, deceptive or fraudulent statements made herein by the applicant will be cause for disqualification as a future bidder on projects let by the Nebraska Department of Roads.

Sworn to before me this

day of |

, 20 |

|

Notary Public |

My commission expires |

|

|

(All partners must sign here) |

|

|

|

AFFIDAVIT FOR CORPORATION |

STATE OF |

|

COUNTY OF |

ss. |

|

being duly sworn, deposes and says |

that he/she is |

of the * |

;

that he/she is familiar with the books of the said corporation showing its financial condition; that the foregoing financial statement taken from the books of said corporation, is a true and accurate statement of the financial condition of said corporation as of the date thereof, and has been audited and prepared by an independent Public Accountant holding a currently valid permit from the Nebraska Board of Public Accountancy, or by an independent Certified Public Accountant holding a currently valid permit whose report will be found on page 16 of this submittal, and/or if a Letter of Credit (Form

*Full Corporate name (The name must agree with the name used on the Cover of this Statement, in the Independent Auditor’s Report, in the Accountant’s Verification

Statement and in the Letter of Credit.)

Any false, deceptive or fraudulent statements made herein by the applicant will be cause for disqualification as a future bidder on projects let by the Nebraska Department of Roads.

Sworn to before me this

day of |

, 20 |

|

|

|

(Individual must sign here) |

|

Notary Public |

(Affix Corporate Seal) |

My commission expires

- 22 -