You may fill out Nebraska Form 10 easily in our online PDF editor. FormsPal is committed to providing you the best possible experience with our editor by consistently releasing new features and improvements. Our editor has become much more useful with the most recent updates! At this point, editing PDF documents is a lot easier and faster than before. If you're seeking to get started, this is what it requires:

Step 1: First, open the editor by pressing the "Get Form Button" above on this webpage.

Step 2: The editor will allow you to change PDF files in many different ways. Improve it by adding any text, adjust existing content, and add a signature - all manageable in minutes!

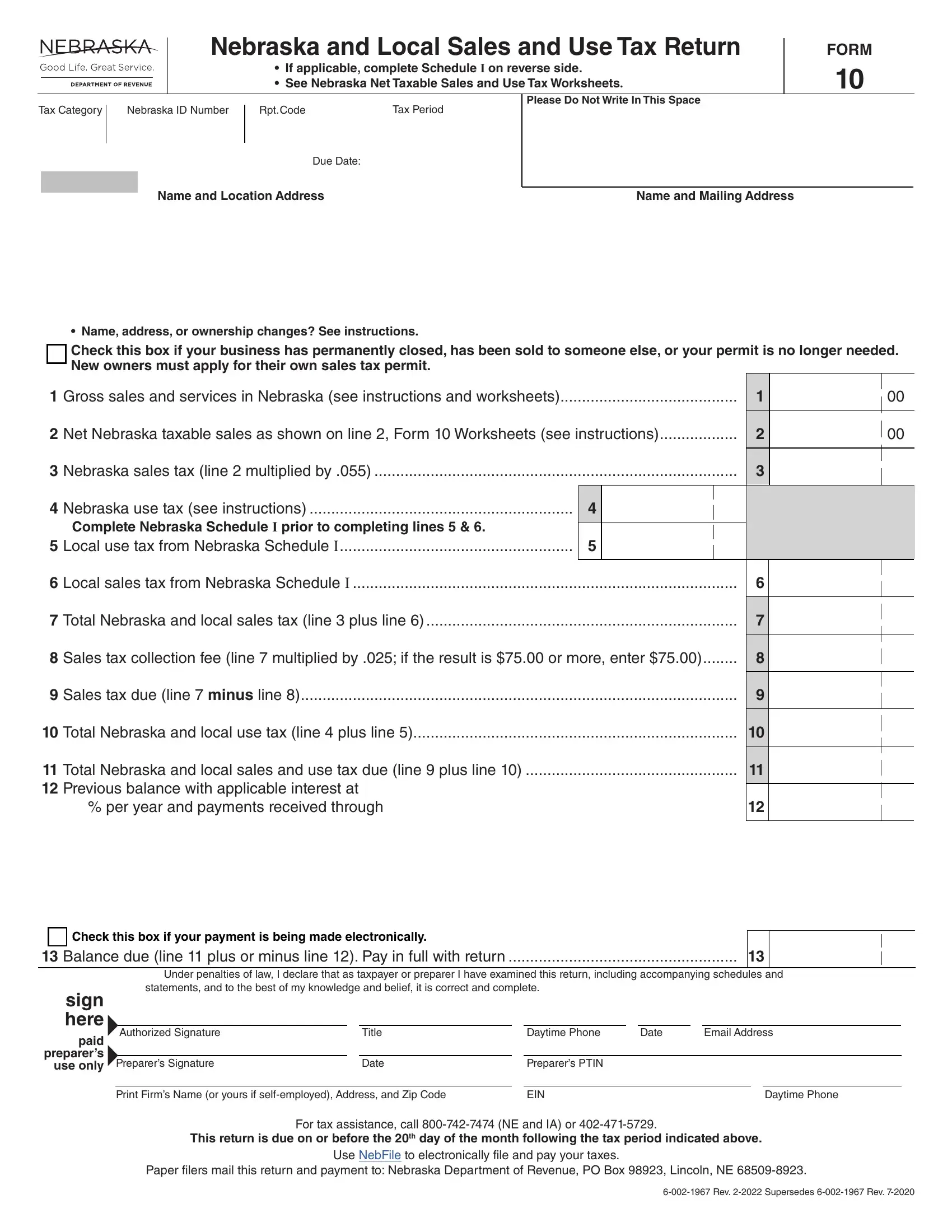

As for the blanks of this specific document, here's what you need to know:

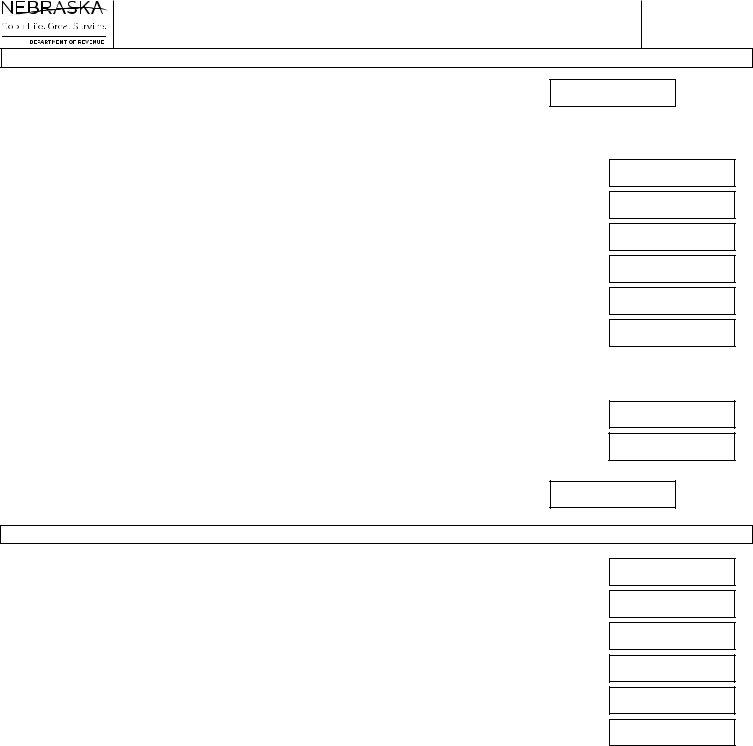

1. The Nebraska Form 10 usually requires specific details to be inserted. Ensure the subsequent fields are complete:

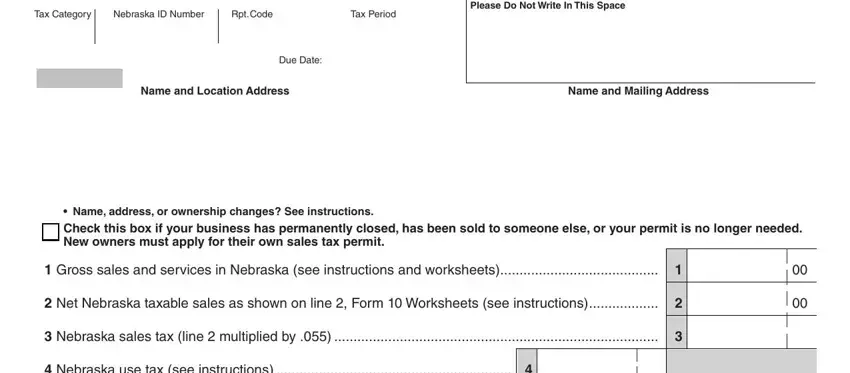

2. Given that this section is complete, you're ready include the required particulars in Complete Nebraska Schedule I prior, Local use tax from Nebraska, Local sales tax from Nebraska, Total Nebraska and local sales, Sales tax collection fee line, Sales tax due line minus line, and Total Nebraska and local use tax allowing you to proceed further.

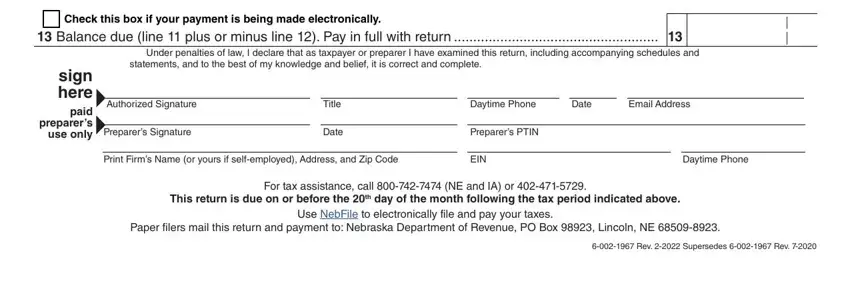

3. Completing Check this box if your payment is, Balance due line plus or minus, Under penalties of law I declare, Authorized Signature, Preparers Signature, Title, Date, Daytime Phone, Date, Email Address, Preparers PTIN, sign here paid preparers use only, Print Firms Name or yours if, EIN, and Daytime Phone is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be really mindful when filling out Daytime Phone and EIN, as this is the part in which many people make a few mistakes.

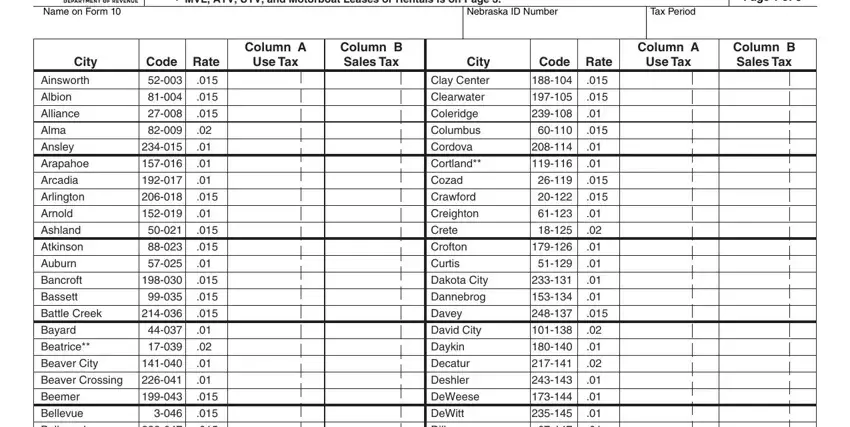

4. This next section requires some additional information. Ensure you complete all the necessary fields - Attach to Form If applicable, FORM Schedule I Page of, Name on Form, Nebraska ID Number, Tax Period, City, Column A, Code Rate, Use Tax, Column B Sales Tax, City, Column A, Code Rate, Use Tax, and Column B Sales Tax - to proceed further in your process!

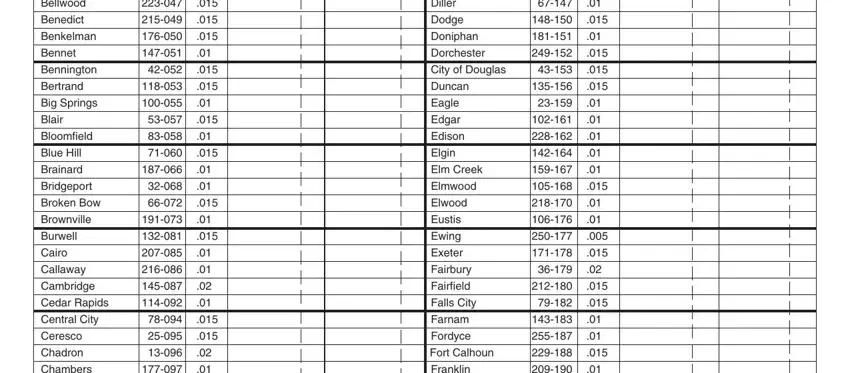

5. To finish your form, this particular segment requires a number of additional blanks. Entering Bellwood, Benedict, Benkelman, Bennet, Bennington, Bertrand, Big Springs, Blair, Bloomfield, Blue Hill, Brainard, Bridgeport, Broken Bow, Brownville, and Burwell will certainly conclude everything and you will be done in a snap!

Step 3: Proofread everything you've entered into the blanks and click the "Done" button. Sign up with us right now and instantly gain access to Nebraska Form 10, prepared for downloading. Every single modification you make is handily preserved , making it possible to modify the file later on anytime. FormsPal ensures your information privacy by having a protected method that in no way saves or distributes any type of private data involved in the process. Be assured knowing your docs are kept safe each time you use our editor!