|

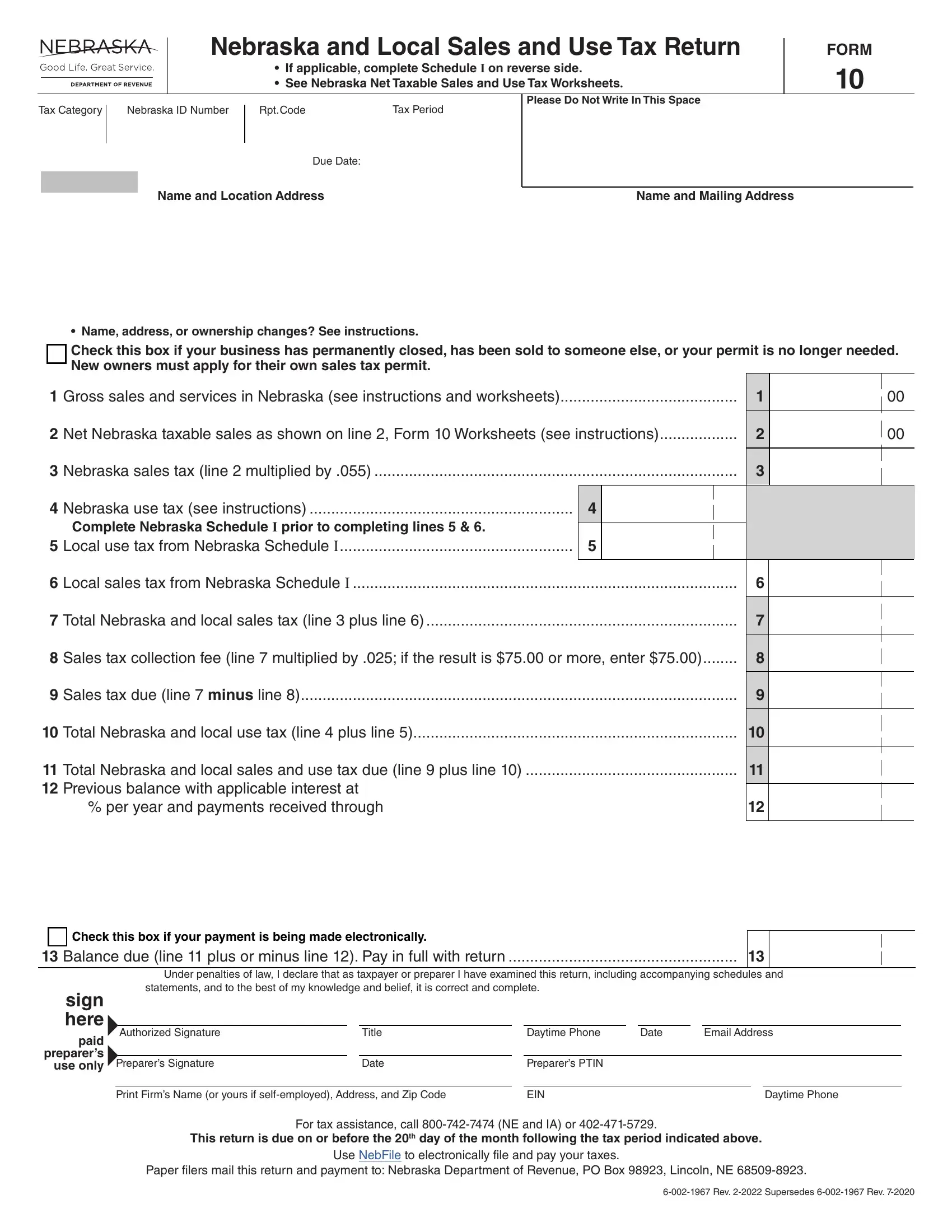

Instructions for Form 10 |

|

Who Must File. Every remote seller and every Multivendor Marketplace |

Specific Instructions |

|

Platform (MMP) with more than $100,000 of gross sales or 200 or more |

Retailers must report the tax due for each type of tax. If no sales or use tax is due, |

|

transactions in Nebraska is engaged in business in Nebraska. Sales of a remote |

the retailer must indicate that by entering a zero, N/A, line, word, or statement on |

|

seller through an MMP count towards the thresholds. Every person, including |

the appropriate line for each tax. Failure to do so extends the statute of limitations |

|

every MMP making taxable sales in Nebraska is a retailer and must hold a |

to six years for audit and collection purposes. |

|

Nebraska Sales Tax Permit and must file a Nebraska and Local Sales and Use |

Complete the Nebraska Net Taxable Sales and Use Tax Worksheets to assist |

|

Tax Return, Form 10, on or before the due date. Retailers should only report |

|

with the Form 10. The paper version is attached; however, the online version |

|

Nebraska sales on this return. |

|

has many links that provide additional detail. |

|

How to Obtain a Permit. You must complete a Nebraska Tax Application, |

|

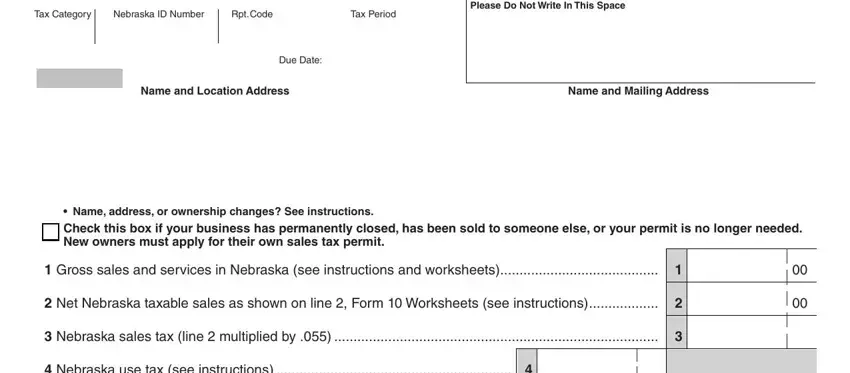

Line 1. Enter the total dollar amount of ALL Nebraska sales, leases, rentals, |

|

Form 20, to apply for a sales tax permit. After the application has been processed, |

|

and services made or facilitated by your business or by an MMP on your behalf. |

|

you will receive your Nebraska sales tax ID number printed on the permit. |

|

Enter both taxable and exempt sales. Line 1 does not include the amount of |

|

When and Where to File. This return and payment are due the 20th of the |

|

sales tax collected. |

|

month following the tax period covered by the return. Refer to Payment Options |

|

Line 2. Complete the Nebraska Net Taxable Sales and Use Tax Worksheets for |

|

for specific details on electronic payment options. Payments made by check or |

|

allowable exemptions, deductions, or the MMP deduction. Enter the Nebraska net |

|

money order must be postmarked by the U.S. Postal Service on or before the due |

|

taxable sales rounded to the nearest whole dollar. Retailers making sales through |

|

date. Paper returns must be mailed to the Nebraska Department of Revenue, |

|

MMPs refer to the MMP Users Only instructions below. |

|

PO Box 98923, Lincoln, NE 68509-8923. Retain a copy of this return and all |

|

|

|

schedules and worksheets for your records. |

Lines 4 and 5. Transactions Subject to Use Tax. Use tax is due on |

|

Electronic Filing. The Nebraska Department of Revenue (DOR) encourages |

all taxable purchases when Nebraska and any applicable local sales tax is not |

|

all taxpayers to file and pay electronically. Taxpayers who have been approved |

paid. Use tax is due on your cost of these items or taxable services. Some |

|

to file a combined return must e-file original returns. Taxpayers required to pay |

examples include: |

|

electronically or by credit card are also required to e-file the Form 10. DOR will |

Purchase of property (for example, uniforms, magazines, computers, |

|

not mail a Form 10 to anyone required to pay electronically or to anyone who |

software) from a retailer; |

|

has e-filed a Form 10 in the past. If you have questions about Internet filing or |

Purchase of taxable services (for example, repair or installation labor on |

|

payment options, visit revenue.nebraska.gov. |

|

tangible personal property, pest control, building cleaning, motor vehicle |

|

Preidentified Return. This return should be used only by the retailer whose |

|

towing) from a retailer; |

|

name is printed on it. Do not file returns that are photocopies, are for another tax |

Purchase of property from outside Nebraska, brought to Nebraska for use |

|

period, or have not been preidentified. If you have not received a return for the tax |

|

or storage; and |

|

period, and will be filing a paper return, visit the DOR’s website to print a Form 10. |

|

Items withdrawn from inventory for use or donation. |

|

Complete the Nebraska ID number, tax period, name, and address information. |

|

|

|

Name and Address Changes. If the business name has changed and it is a |

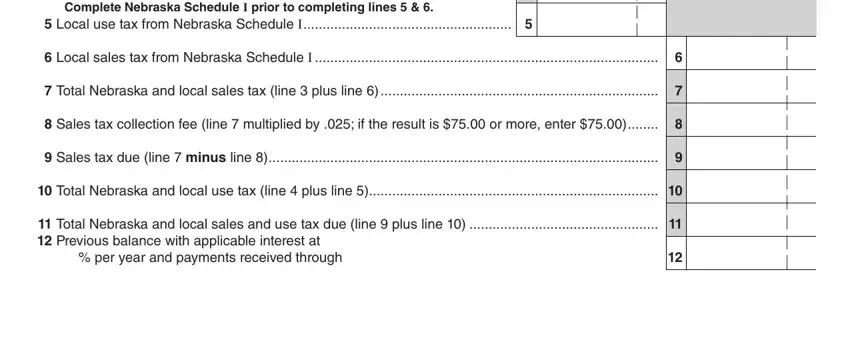

Line 6. Enter the total local sales tax from the Schedule I. |

|

|

|

name change only (for example, if the ownership or federal ID number has not |

Line 8. The retailer is allowed to retain a fee for collecting the Nebraska and |

|

changed), mark through the previous name and plainly print the new name and |

local sales tax. |

|

write “name change only.” If you e-file, name changes should be made on a |

Line 12. A balance due resulting from a partial payment, mathematical or |

|

Nebraska Change Request, Form 22. |

|

clerical errors, penalty, or interest relating to prior returns is entered on this line. |

|

|

|

If there is a change or correction in the name or address, mark through the incorrect |

The amount of interest includes interest on unpaid tax through the due date of this |

|

information and plainly print the correct information. If this is the result of a |

return. If the amount due is paid before the due date, interest will be recomputed |

|

relocation of your business, indicate this by writing “relocated” on the return. |

and a credit will be on your next return. If you have already paid the amount on |

|

If you are e-filing, you may make an address change during filing; however, |

|

this line with a previous remittance, please disregard it. A credit is indicated by the |

|

name changes must be done by filing a Form 22. See previous paragraph for |

word “subtract” and can be subtracted from the amount due on line 11. However, |

|

name change information. Reminder: A sales tax permit is required for each |

if your records do not support this credit, please contact DOR. |

|

location. If an additional location is opened, you must apply for another sales tax |

|

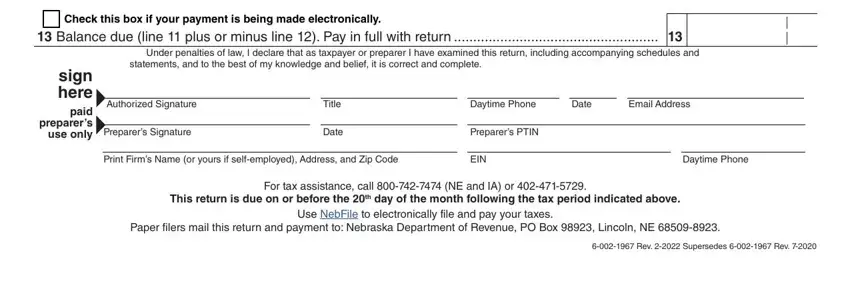

Line 13. All taxpayers are encouraged to make payments electronically. Do not |

|

permit by filing a Form 20. |

|

send a paper check if you are mandated to pay electronically. Electronic payments |

|

Ownership Changes. A change in ownership, or type of ownership |

|

may be made using DOR’s free e-pay program (EFT Debit), by ACH Credit, |

|

(individual to a partnership, partnership to a corporation, etc.) requires you to |

|

credit card, or by phone. Refer to DOR’s website for payment and filing options. |

|

cancel your permit and obtain a new permit for the new business. To cancel the |

|

Signatures. Paper returns must be signed by the taxpayer, partner, officer, or |

|

old permit, check the box in the upper left corner of the Form 10 or follow the |

|

member. If the taxpayer authorizes another person to sign this return, there must |

|

online instructions for cancelling your permit. The new owners must complete a |

|

be a power of attorney on file with DOR. Any person who is paid for preparing |

|

Form 20 to obtain their own sales tax permit. The new owners of the business |

|

should not use the previous owner’s preidentified sales and use tax returns. |

a taxpayer’s return must also sign the return as preparer. E-filers are required to |

|

Credit Returns. If line 11 is a credit amount, documentation must be sent |

identify the person completing the return during the filing process. |

|

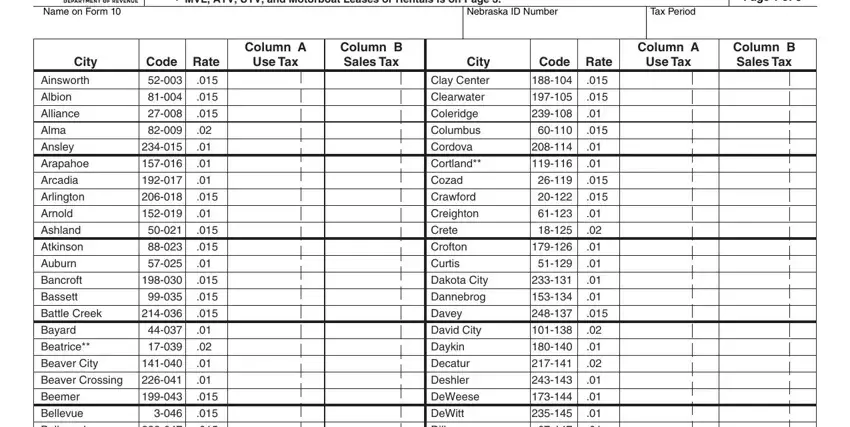

Nebraska Schedule I |

|

with the return to support the credit. This documentation must include a letter |

|

of explanation, invoices, or credit memos issued to customers. When e-filing, |

Line 1, Local Use Tax. Total the amounts reported in the use tax column and |

|

complete the explanation box with information on the credit. You will be |

enter the total from Nebraska Schedule I, on line 5, Form 10. |

|

contacted if additional documentation is required. If a credit is shown on |

Line 2, Local Sales Tax. Total the amounts reported in the sales tax column, |

|

line 11, it may be applied to a balance shown on line 12, if any, or used on future |

|

enter the total from Nebraska Schedule I, on line 6, Form 10. |

|

returns. If the credit cannot be used in a reasonable amount of time, a Claim for |

|

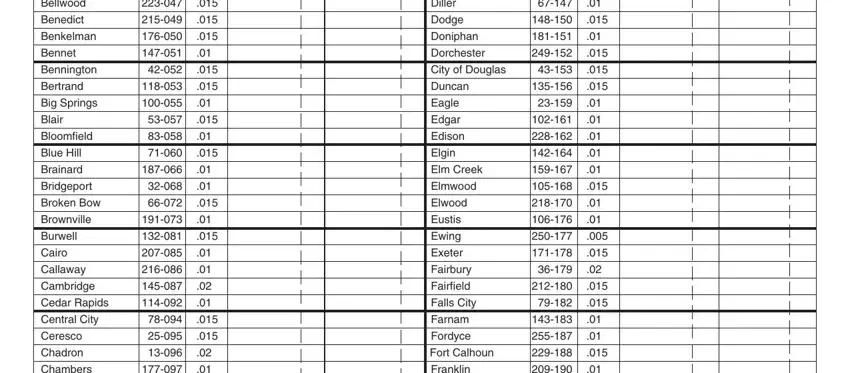

The Schedule I displays any city or county that has been reported in the |

|

Refund of Sales and Use Tax, Form 7, may be filed. The statute of limitations for |

|

last 12 months. A city or county may be added by writing the information |

|

filing the Form 7 is three years from the due date following the end of the period |

|

in the blank boxes on Schedule I. E-filers may add a city or county when |

|

for which the credit was created. |

|

completing Schedule I during filing. E-filers reporting to multiple localities |

|

Amended Returns. An amended Form 10 is available on our website. |

|

may upload a CSV file to ease this process. Any city or county that you write |

|

The only way to file an amended Form 10 is on paper, even if you are |

|

in or add during e-filing will be printed on your next return. You can find |

|

mandated to file electronically. However, if mandated, any payments should |

|

listings of the local city or county taxing jurisdictions and the sales tax rates at |

|

still be made electronically. If you e-file, you can make changes to your |

|

revenue.nebraska.gov. |

|

filed return any time on or before the return’s due date. This feature is for |

|

Multivendor Marketplace Platform (MMP) Users Only |

|

current tax period returns only. After the due date of the return, an amended |

|

Form 10 must be filed on a paper form. |

Retailers making sales into Nebraska using an MMP must enter the dollar |

|

Penalty and Interest. If the return is not filed and paid by the due date, a |

amount of Nebraska sales reported by MMPs that are collecting Nebraska |

|

sales tax on your behalf. Retain documentation from your MMPs that |

|

penalty will be assessed in the amount of 10% of the tax due or $25, whichever |

|

substantiates this amount. |

|

is greater. Interest on the unpaid tax will be assessed at the rate printed on |

|

MVL, ATV, UTV, and Motorboat Leases or Rentals |

|

line 12 from the due date until payment is received. |

|

Enter the portion of the state sales tax (reported on Form 10, line 3) that is from |

|

Retention of Records. Records to substantiate this return must be kept and |

|

all leases or rentals of: (1) automobiles, trucks, trailers, semitrailers, and truck |

|

be available to the DOR for a period of at least three years following the date |

|

tractors for periods of more than 31 days that are not classified as transportation |

|

of filing the return. |

|

equipment, see the Nebraska Sales Tax on Leased Motor Vehicles Information |

|

Additional information regarding sales and use taxes may be found in the |

|

Guide; (2) all-terrain and utility-type vehicles; or (3) motorboats and motorized |

|

“Information Guides” section of the DOR’s website. |

personal watercraft (for example, jet skis or wave runners). |