Once you open the online editor for PDFs by FormsPal, you're able to complete or modify nebraska form right here. Our expert team is relentlessly working to expand the tool and ensure it is much faster for people with its handy features. Unlock an constantly progressive experience now - explore and find out new possibilities as you go! If you are looking to get started, this is what it will take:

Step 1: Hit the "Get Form" button in the top area of this page to get into our PDF editor.

Step 2: With our state-of-the-art PDF editor, you are able to do more than merely fill in blank form fields. Express yourself and make your docs seem high-quality with custom textual content added in, or tweak the file's original input to perfection - all that accompanied by the capability to insert stunning graphics and sign the PDF off.

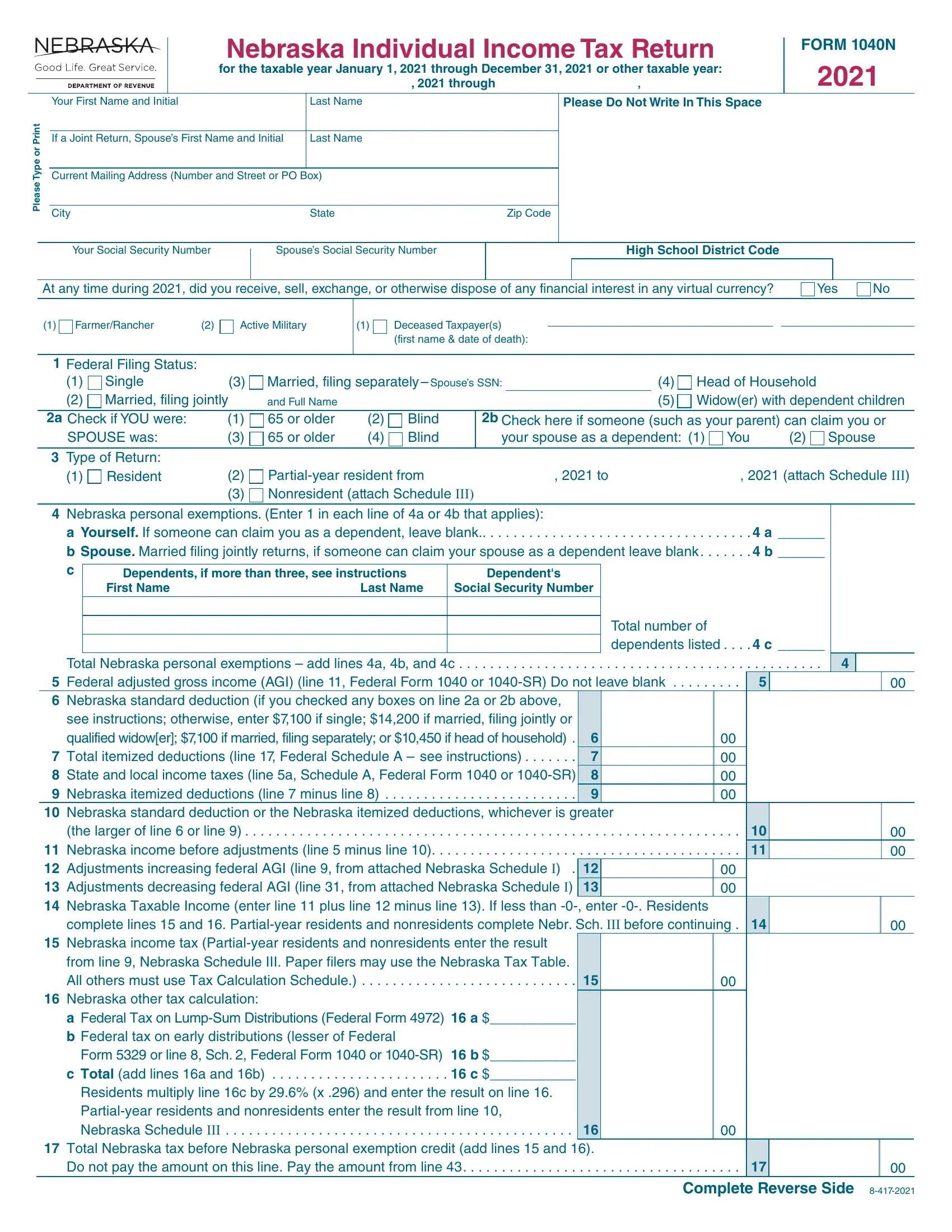

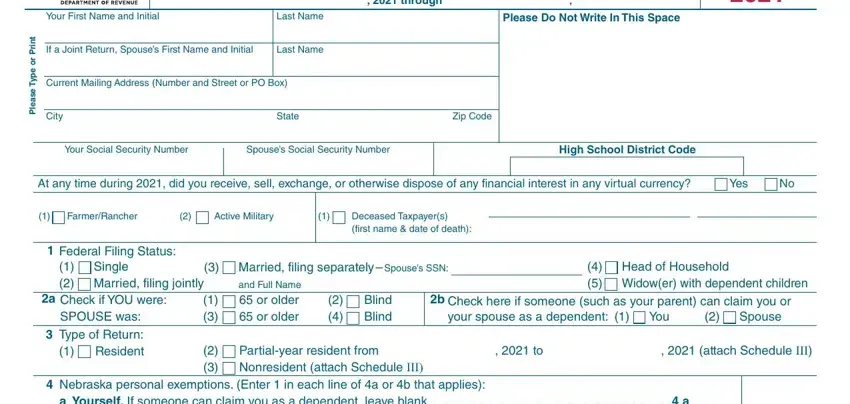

This PDF requires particular info to be filled out, so you need to take the time to fill in exactly what is asked:

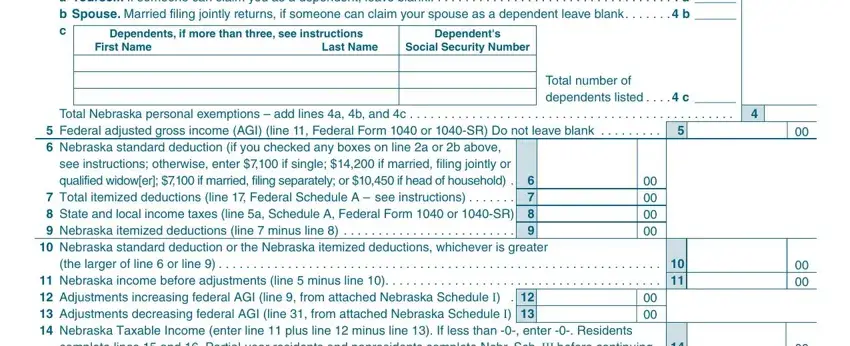

1. Start completing your nebraska form with a selection of essential fields. Gather all of the required information and ensure not a single thing overlooked!

2. Soon after this array of blank fields is completed, go to type in the applicable details in all these: a Yourself If someone can claim, Dependents if more than three see, Dependents, First Name, Last Name, Social Security Number, Total number of dependents listed, Total Nebraska personal exemptions, Federal adjusted gross income AGI, Nebraska standard deduction if, see instructions otherwise enter, Nebraska standard deduction or, the larger of line or line, and complete lines and Partialyear.

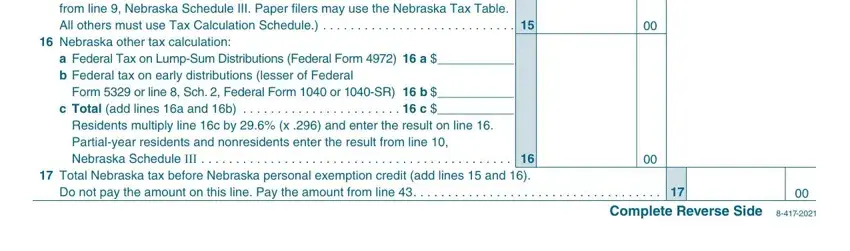

3. Completing from line Nebraska Schedule III, Nebraska other tax calculation, a Federal Tax on LumpSum, Form or line Sch Federal Form, Residents multiply line c by x, Do not pay the amount on this line, and Complete Reverse Side is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

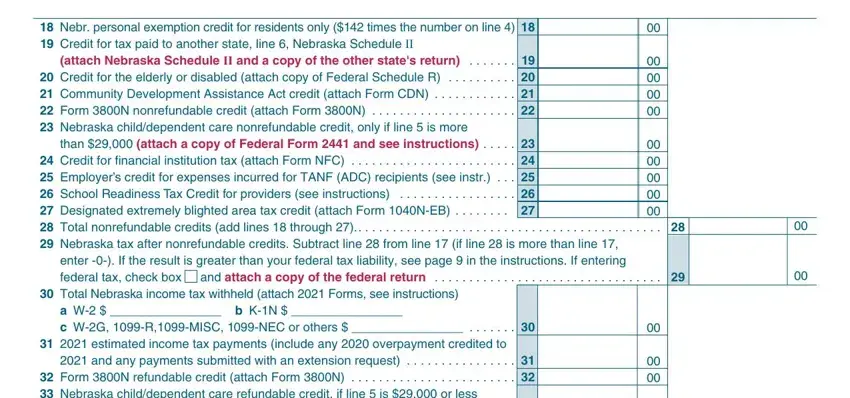

4. Filling out Nebr personal exemption credit, than attach a copy of Federal, enter If the result is greater, and attach a copy of the federal, Total Nebraska income tax, a W b KN c WG RMISC NEC or, estimated income tax payments, and and any payments submitted with is key in this fourth step - be certain to devote some time and fill in every blank area!

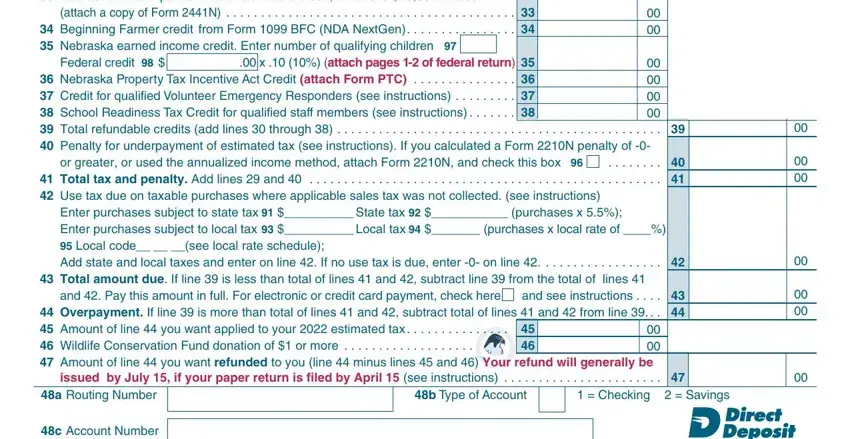

5. The last stage to submit this PDF form is crucial. Be sure you fill in the appropriate fields, such as and any payments submitted with, Federal credit, x attach pages of federal, or greater or used the annualized, Enter purchases subject to state, Total amount due If line is less, and Pay this amount in full For, and see instructions, issued by July if your paper, a Routing Number, c Account Number, b Type of Account, and Checking Savings, prior to using the document. If you don't, it might end up in an unfinished and potentially incorrect form!

It's very easy to make an error while filling in your Enter purchases subject to state, therefore be sure to reread it prior to deciding to submit it.

Step 3: Just after double-checking your fields, press "Done" and you're done and dusted! Find your nebraska form when you join for a 7-day free trial. Readily use the form in your FormsPal account page, along with any modifications and changes being conveniently saved! FormsPal guarantees risk-free document editing devoid of personal information record-keeping or sharing. Be assured that your details are secure here!