|

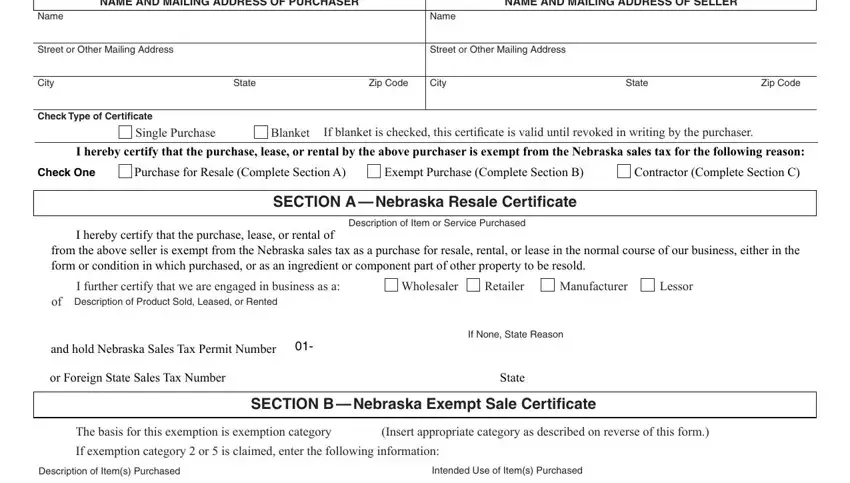

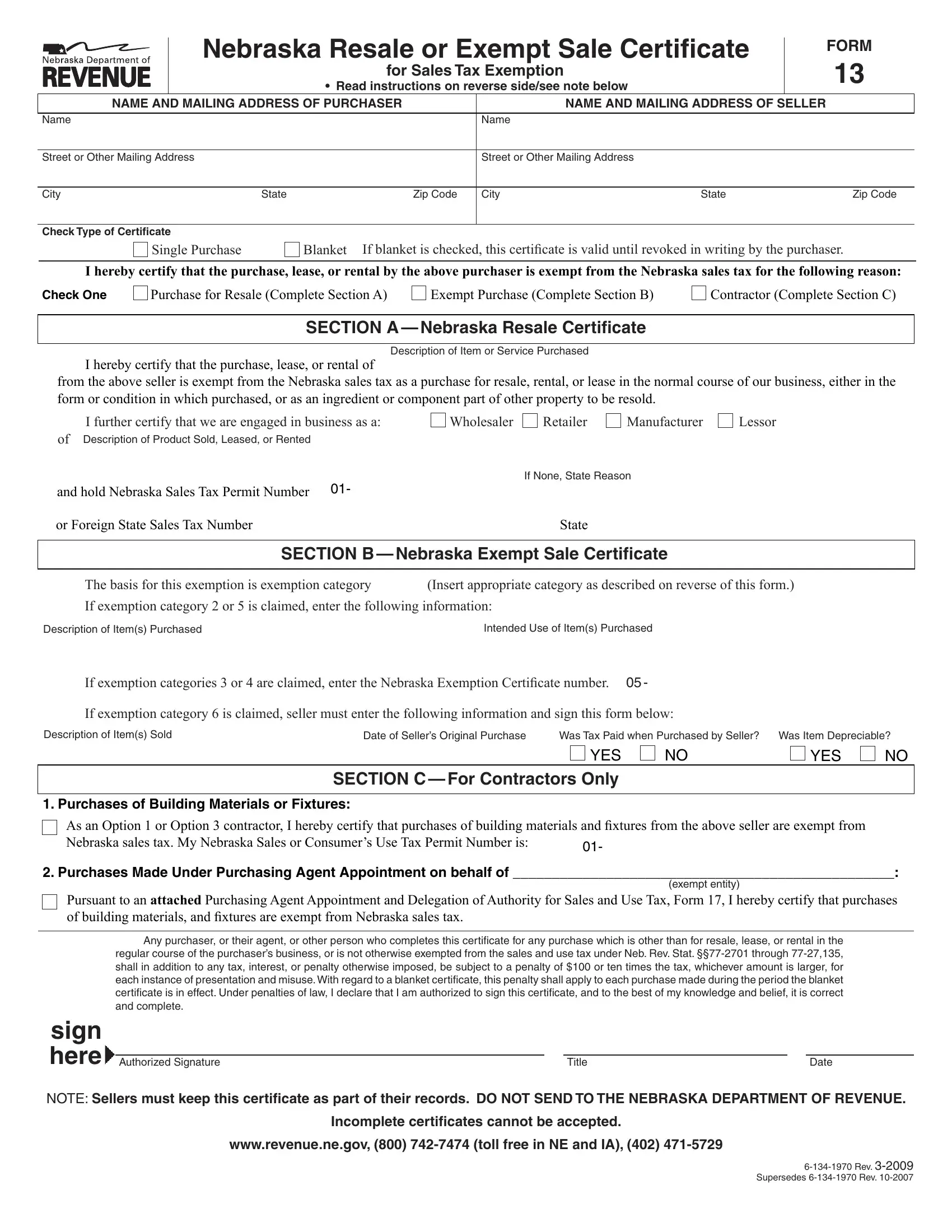

Who maY ISSue a ReSaLe CeRtIfICate. Form 13, |

(3) a statement of basis for exemption including completion of all |

|

Section A, is to be issued by persons or organizations making |

information for the basis chosen, (4) the signature of an authorized |

|

purchases of property or taxable services in the normal course of |

person, and (5) the date the certiicate was issued. |

|

their business for the purpose of resale either in the form or condition |

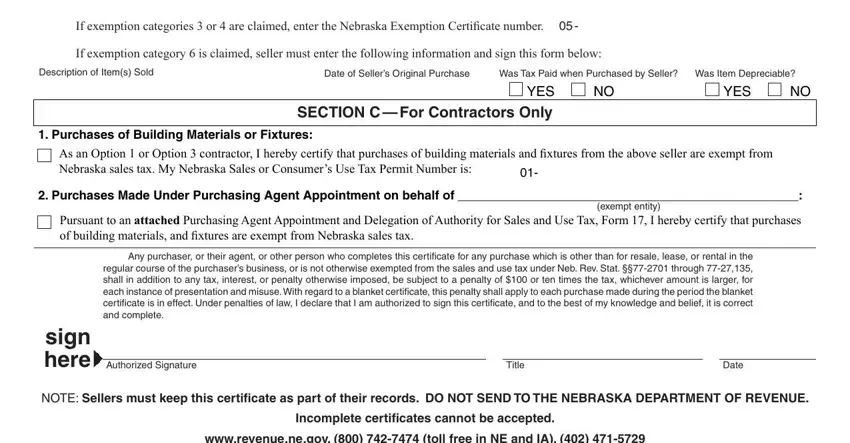

penaLtIeS.Any purchaser who gives a Form 13 to a seller for |

|

in which it was purchased, or as an ingredient or component part of |

|

any purchase which is other than for resale, lease, or rental in the |

|

other property. |

|

normal course of the purchaser’s business, or is not otherwise |

|

Who maY ISSue an eXempt SaLe CeRtIfICate. |

exempted from sales and use tax under the Nebraska Revenue Act, |

|

Form 13, Section B can only be issued by persons or organizations |

shall be subject to a penalty of $100 or ten times the tax, whichever |

|

exempt from payment of the Nebraska sales tax by qualifying for |

amount is larger, for each instance of presentation and misuse. |

|

one of the six enumerated Categories of Exemption (see below). |

Any purchaser, or their agent, who fraudulently signs a Form 13 |

|

Nonprofit organizations that have a 501(c) designation and are |

may be found guilty of a Class IV misdemeanor. |

|

exempt from federal and state income tax are not automatically |

|

CATEGORIES OF EXEMPTION |

|

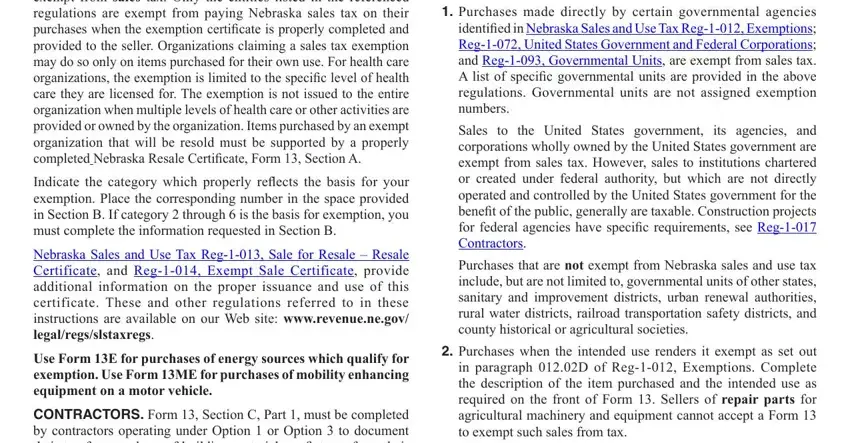

exempt from sales tax. Only the entities listed in the referenced |

|

|

1. Purchases made directly by certain governmental agencies |

|

regulations are exempt from paying Nebraska sales tax on their |

|

purchases when the exemption certiicate is properly completed and |

identiied in Nebraska Sales and Use Tax Reg-1-012, Exemptions; |

|

provided to the seller. Organizations claiming a sales tax exemption |

Reg-1-072, United States Government and Federal Corporations; |

|

may do so only on items purchased for their own use. For health care |

and Reg-1-093, Governmental Units, are exempt from sales tax. |

|

organizations, the exemption is limited to the speciic level of health |

A list of speciic governmental units are provided in the above |

|

care they are licensed for. The exemption is not issued to the entire |

regulations. Governmental units are not assigned exemption |

|

organization when multiple levels of health care or other activities are |

numbers. |

|

|

provided or owned by the organization. Items purchased by an exempt |

Sales to the United States government, its agencies, and |

|

organization that will be resold must be supported by a properly |

corporations wholly owned by the United States government are |

|

completed Nebraska Resale Certiicate, Form 13, Section A. |

exempt from sales tax. However, sales to institutions chartered |

|

Indicate the category which properly relects the basis for your |

or created under federal authority, but which are not directly |

|

exemption. Place the corresponding number in the space provided |

operated and controlled by the United States government for the |

|

in Section B. If category 2 through 6 is the basis for exemption, you |

beneit of the public, generally are taxable. Construction projects |

|

must complete the information requested in Section B. |

for federal agencies have speciic requirements, see Reg-1-017 |

|

Nebraska Sales and Use Tax Reg-1-013, Sale for Resale – Resale |

Contractors. |

|

Purchases that are not exempt from Nebraska sales and use tax |

|

Certificate, and Reg-1-014, Exempt Sale Certificate, provide |

|

include, but are not limited to, governmental units of other states, |

|

additional information on the proper issuance and use of this |

|

sanitary and improvement districts, urban renewal authorities, |

|

certificate. These and other regulations referred to in these |

|

rural water districts, railroad transportation safety districts, and |

|

instructions are available on our Web site: www.revenue.ne.gov/ |

|

county historical or agricultural societies. |

|

legal/regs/slstaxregs. |

|

2. Purchases when the intended use renders it exempt as set out |

|

Use Form 13E for purchases of energy sources which qualify for |

|

in paragraph 012.02D of Reg-1-012, Exemptions. Complete |

|

exemption. Use Form 13ME for purchases of mobility enhancing |

|

the description of the item purchased and the intended use as |

|

equipment on a motor vehicle. |

|

required on the front of Form 13. Sellers of repair parts for |

|

ContRaCtoRS.Form 13, Section C, Part 1, must be completed |

|

agricultural machinery and equipment cannot accept a Form 13 |

|

by contractors operating under Option 1 or Option 3 to document |

to exempt such sales from tax. |

|

their tax-free purchase of building materials or ixtures from their |

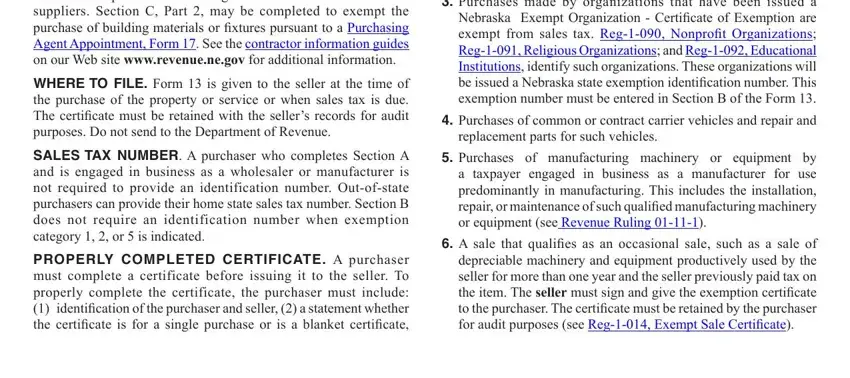

3. Purchases made by organizations that have been issued a |

|

suppliers. Section C, Part 2, may be completed to exempt the |

|

Nebraska |

Exempt Organization - Certiicate of Exemption are |

|

purchase of building materials or ixtures pursuant to a Purchasing |

|

exempt from sales tax. Reg-1-090, Nonproit Organizations; |

|

Agent Appointment, Form 17. See the contractor information guides |

|

Reg-1-091, Religious Organizations; and Reg-1-092, Educational |

|

on our Web site www.revenue.ne.gov for additional information. |

|

Institutions, identify such organizations. These organizations will |

|

|

|

WheReto fILe. Form 13 is given to the seller at the time of |

be issued a Nebraska state exemption identiication number. This |

|

the purchase of the property or service or when sales tax is due. |

exemption number must be entered in Section B of the Form 13. |

|

The certiicate must be retained with the seller’s records for audit |

4. Purchases of common or contract carrier vehicles and repair and |

|

purposes. Do not send to the Department of Revenue. |

replacement parts for such vehicles. |

|

SALES TAX NUMBER. A purchaser who completes Section A |

5. Purchases |

of manufacturing machinery or equipment by |

|

and is engaged in business as a wholesaler or manufacturer is |

a taxpayer engaged in business as a manufacturer for use |

|

not required to provide an identification number. Out-of-state |

predominantly in manufacturing. This includes the installation, |

|

purchasers can provide their home state sales tax number. Section B |

repair, or maintenance of such qualiied manufacturing machinery |

|

does not require an identification number when exemption |

or equipment (see Revenue Ruling 01-11-1). |

|

category 1, 2, or 5 is indicated. |

6. A sale that qualiies as an occasional sale, such as a sale of |

|

pRopeRLY CompLeteD CeRtIfICate. A purchaser |

|

depreciable machinery and equipment productively used by the |

|

must complete a certificate before issuing it to the seller. To |

seller for more than one year and the seller previously paid tax on |

|

properly complete the certificate, the purchaser must include: |

the item. The seller must sign and give the exemption certiicate |

|

(1) identiication of the purchaser and seller, (2) a statement whether |

to the purchaser. The certiicate must be retained by the purchaser |

|

the certiicate is for a single purchase or is a blanket certiicate, |

for audit purposes (see Reg-1-014, Exempt Sale Certiicate). |