You can prepare nebraska form 6 instantly with the help of our online PDF tool. We at FormsPal are focused on providing you the ideal experience with our editor by continuously presenting new capabilities and improvements. Our tool is now much more helpful with the most recent updates! So now, editing documents is simpler and faster than before. With a few basic steps, you can start your PDF editing:

Step 1: Access the PDF doc inside our editor by hitting the "Get Form Button" at the top of this page.

Step 2: This tool provides the ability to modify nearly all PDF forms in various ways. Transform it by writing any text, adjust existing content, and include a signature - all at your disposal!

Completing this form demands focus on details. Make sure each field is filled out correctly.

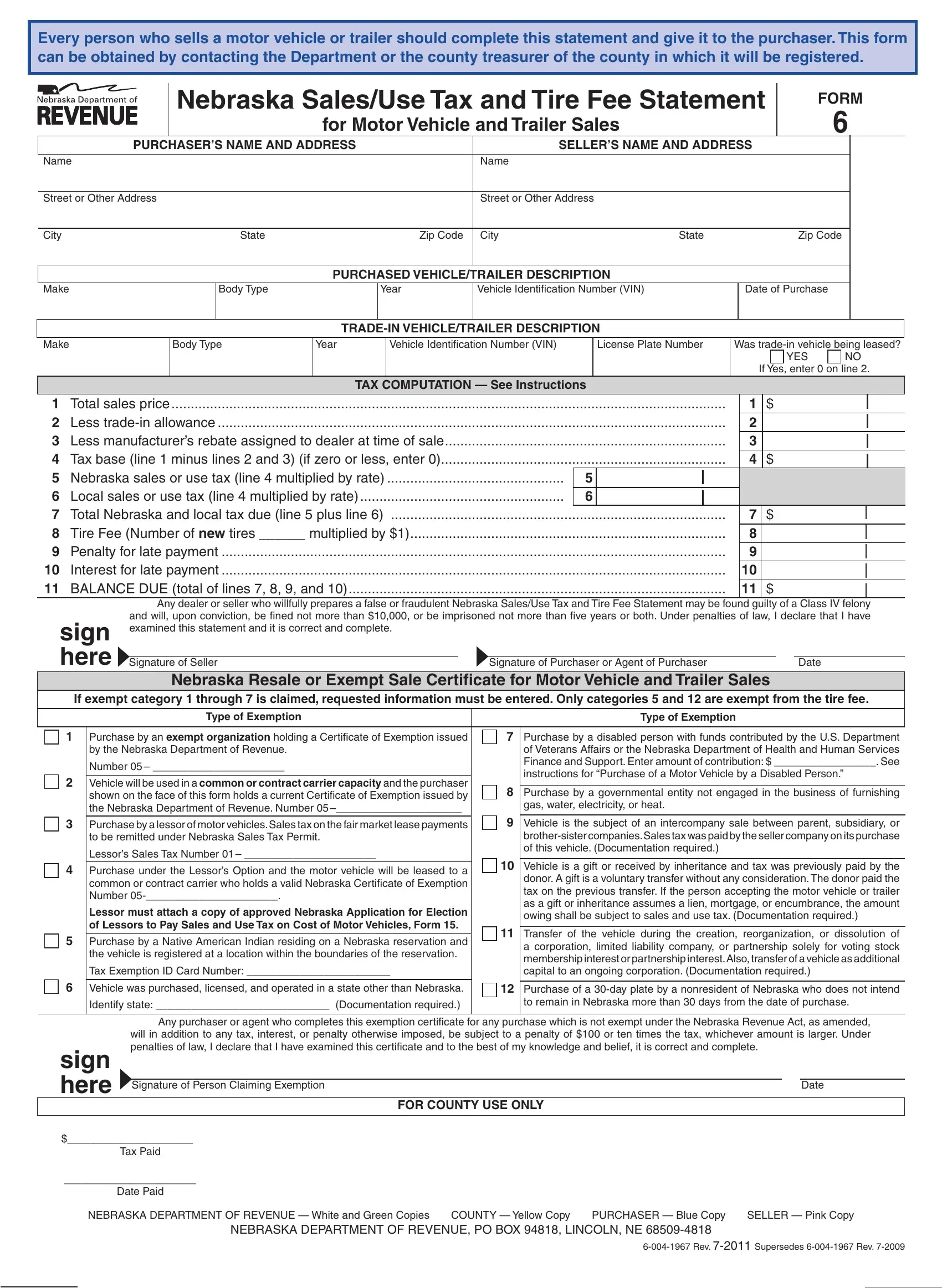

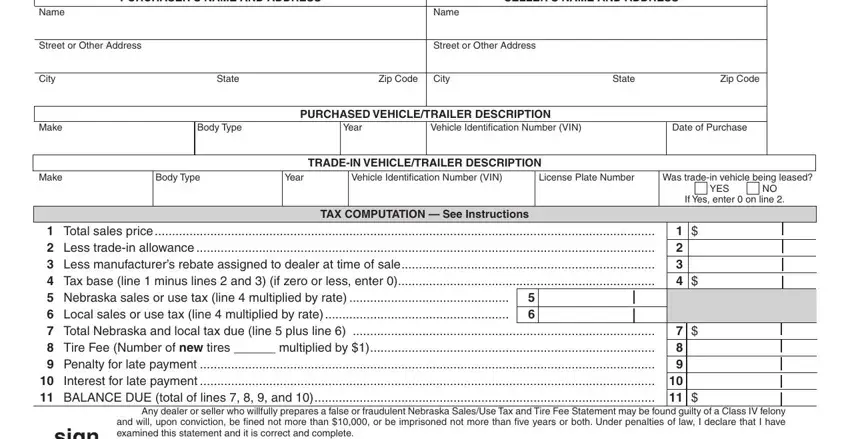

1. Fill out the nebraska form 6 with a selection of necessary fields. Consider all of the necessary information and ensure nothing is missed!

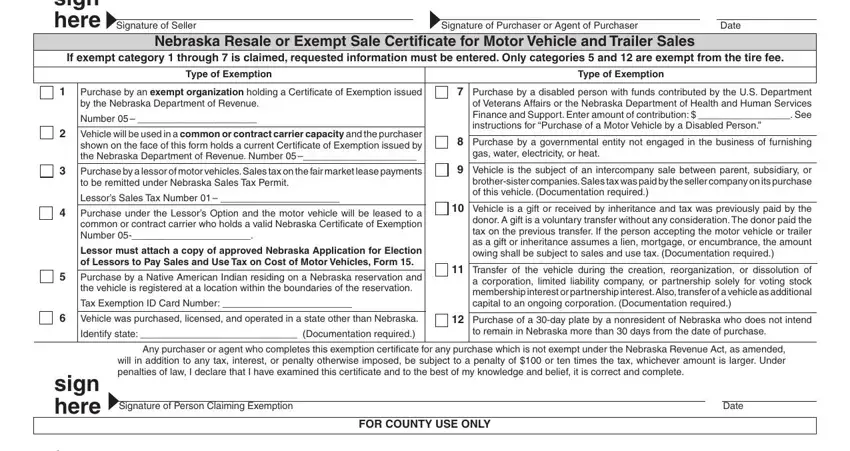

2. Just after filling out the last part, head on to the next step and enter the necessary details in these fields - sign here Signature of Seller, Signature of Purchaser or Agent of, Date, Nebraska Resale or Exempt Sale, If exempt category through is, Type of Exemption, Type of Exemption, Purchase by an exempt, by the Nebraska Department of, Number, Vehicle will be used in a common, Purchase by a lessor of motor, to be remitted under Nebraska, Lessors Sales Tax Number, and Purchase under the Lessors Option.

3. Within this stage, have a look at Tax Paid, Date Paid, NEBRASKA DEPARTMENT OF REVENUE, COUNTY Yellow Copy, PURCHASER Blue Copy, SELLER Pink Copy, NEBRASKA DEPARTMENT OF REVENUE PO, and Rev Supersedes Rev. Every one of these should be filled out with highest accuracy.

4. Your next paragraph will require your input in the following parts: PAYMENT OF TAX AND TIRE FEE The, The purchaser must present, INSTRUCTIONS FOR SELLER, LICENSED MOTOR VEHICLE DEALER OR, The pink copy must be retained, Sales and Use Tax Return Form and, The white yellow and blue copies, purchaser, The sales price on line shall, for every sale of a motor vehicle, purchaser, and An individual can only accept. It is important to fill in all needed info to move further.

It's simple to get it wrong while filling in your The sales price on line shall, and so ensure that you go through it again before you submit it.

Step 3: Go through everything you have entered into the blanks and then press the "Done" button. Get hold of the nebraska form 6 when you join for a 7-day free trial. Readily gain access to the form in your FormsPal account page, with any edits and changes automatically preserved! Whenever you work with FormsPal, you're able to complete forms without the need to worry about data incidents or data entries getting distributed. Our secure platform ensures that your private data is maintained safely.