In case you want to fill out new york life forms, you don't need to download any kind of software - simply use our PDF editor. The tool is constantly updated by our team, acquiring powerful features and growing to be greater. Here's what you would have to do to start:

Step 1: Access the PDF form in our editor by hitting the "Get Form Button" in the top part of this page.

Step 2: With our state-of-the-art PDF tool, you can actually accomplish more than merely complete blanks. Edit away and make your forms look great with custom textual content incorporated, or modify the original content to excellence - all that comes with the capability to insert your personal pictures and sign the PDF off.

It is actually an easy task to finish the form with our detailed guide! This is what you should do:

1. You have to fill out the new york life forms properly, therefore be attentive when working with the parts comprising these blank fields:

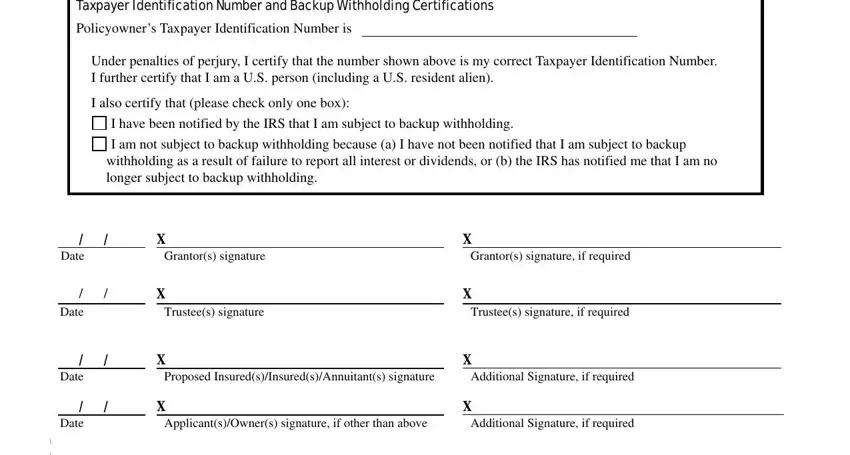

2. Given that the previous part is finished, you're ready add the needed particulars in Taxpayer Identification Number and, Policyowners Taxpayer, Under penalties of perjury I, I also certify that please check, I have been notified by the IRS, I am not subject to backup, Date, Date, Date, Date, X Grantors signature, Trustees signature, Grantors signature if required, Trustees signature if required, and X Proposed so you're able to progress to the third part.

Concerning Taxpayer Identification Number and and Grantors signature if required, be certain that you take a second look in this section. Those two are thought to be the key ones in the page.

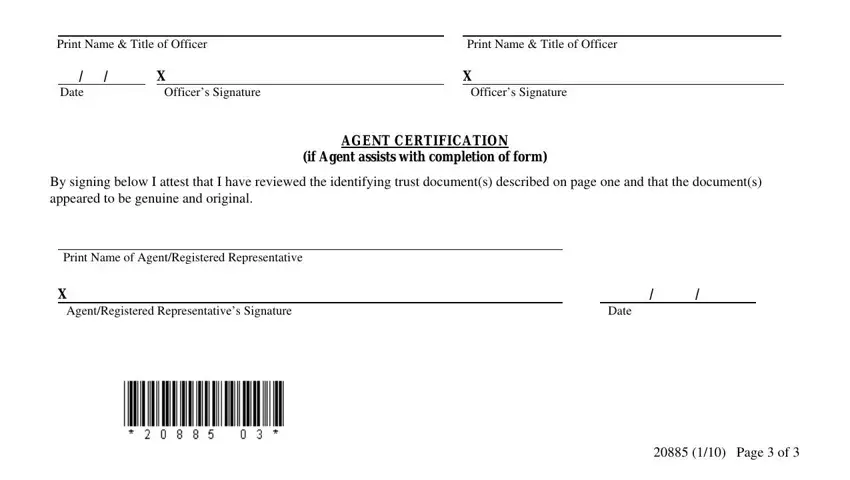

3. Within this part, check out Print Name Title of Officer, Date, X Officers Signature, Print Name Title of Officer, Officers Signature, AGENT CERTIFICATION, if Agent assists with completion, By signing below I attest that I, Print Name of AgentRegistered, X AgentRegistered Representatives, Date, and Page of. Each of these must be filled out with greatest focus on detail.

Step 3: Before finalizing this form, check that blanks have been filled in properly. Once you verify that it's fine, click “Done." Acquire the new york life forms after you sign up at FormsPal for a free trial. Instantly get access to the pdf form in your FormsPal account, together with any modifications and adjustments conveniently saved! When using FormsPal, you can fill out documents without worrying about personal data leaks or entries getting shared. Our protected platform helps to ensure that your personal data is kept safe.