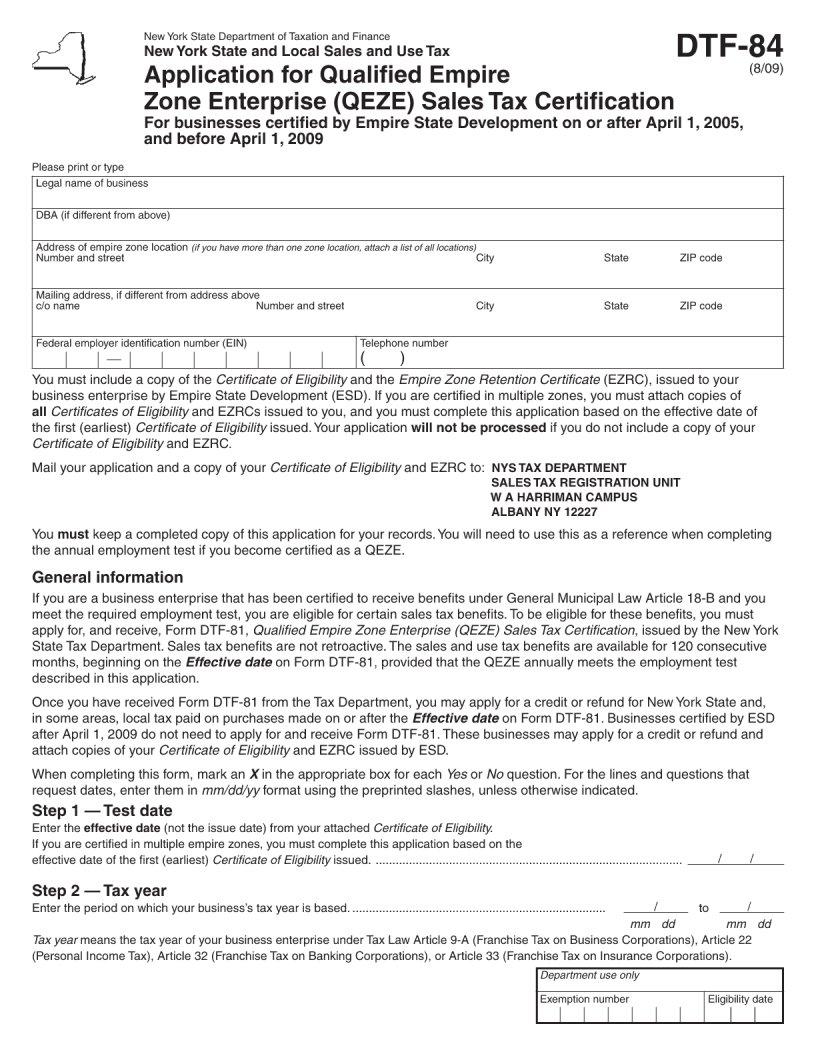

The intricacies of managing estates can often lead one into a labyrinth of legal and financial obligations, particularly in the bustling state of New York. Amidst this complexity lies the significance of the New York Dtf 84 form, an essential document for those navigating the nuances of estate transfers and taxes. This form serves as a critical tool in the process, ensuring that both the state and the individuals involved adhere to the requisite legal frameworks. It encapsulates vital information on the decedent, beneficiaries, and the estate itself, providing a structured way to declare assets and determine tax liabilities. Its role in streamlining the transfer of assets and in the calculation of any due taxes cannot be overstated, making it a cornerstone document for executors and estate administrators. Additionally, the form functions within the broader regulatory environment, aligning with New York State's commitment to maintaining fiscal order and compliance in matters of estate succession. Understanding its purpose, requirements, and the implications of its submissions is paramount for anyone involved in the complex yet unavoidable world of estate management.

| Question | Answer |

|---|---|

| Form Name | New York Form Dtf 84 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | EZ_IaT_ Form DTF84_09 dtf 84 form |