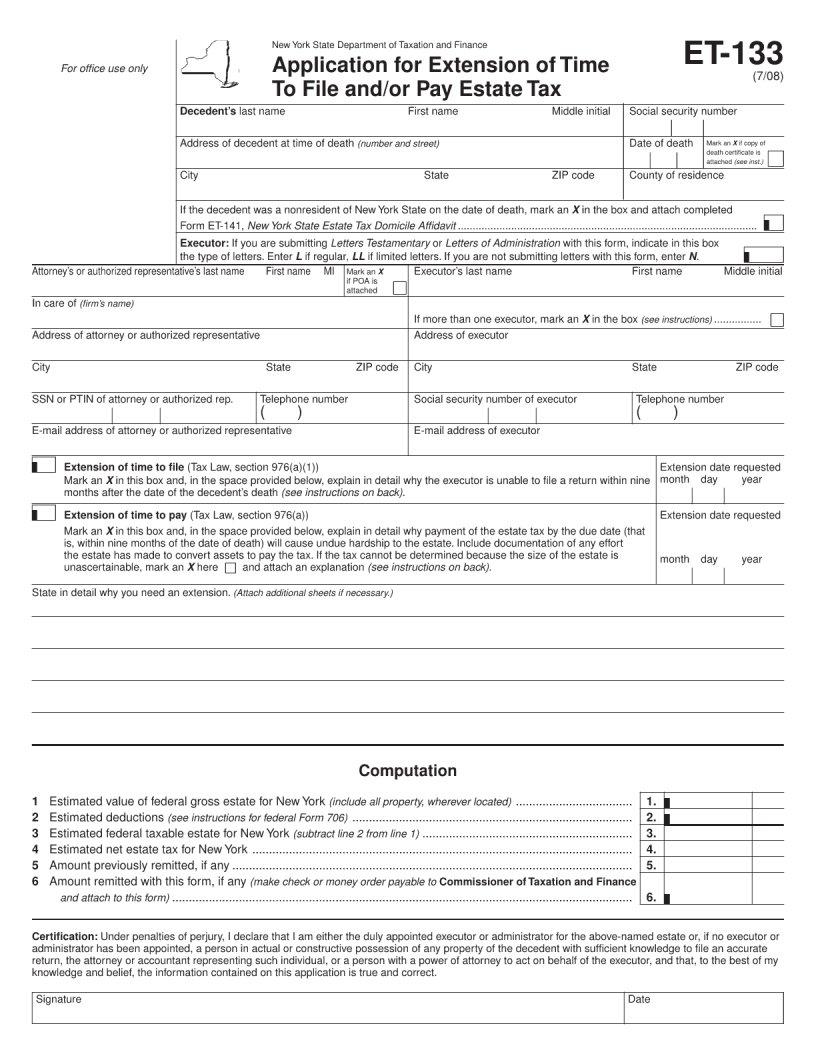

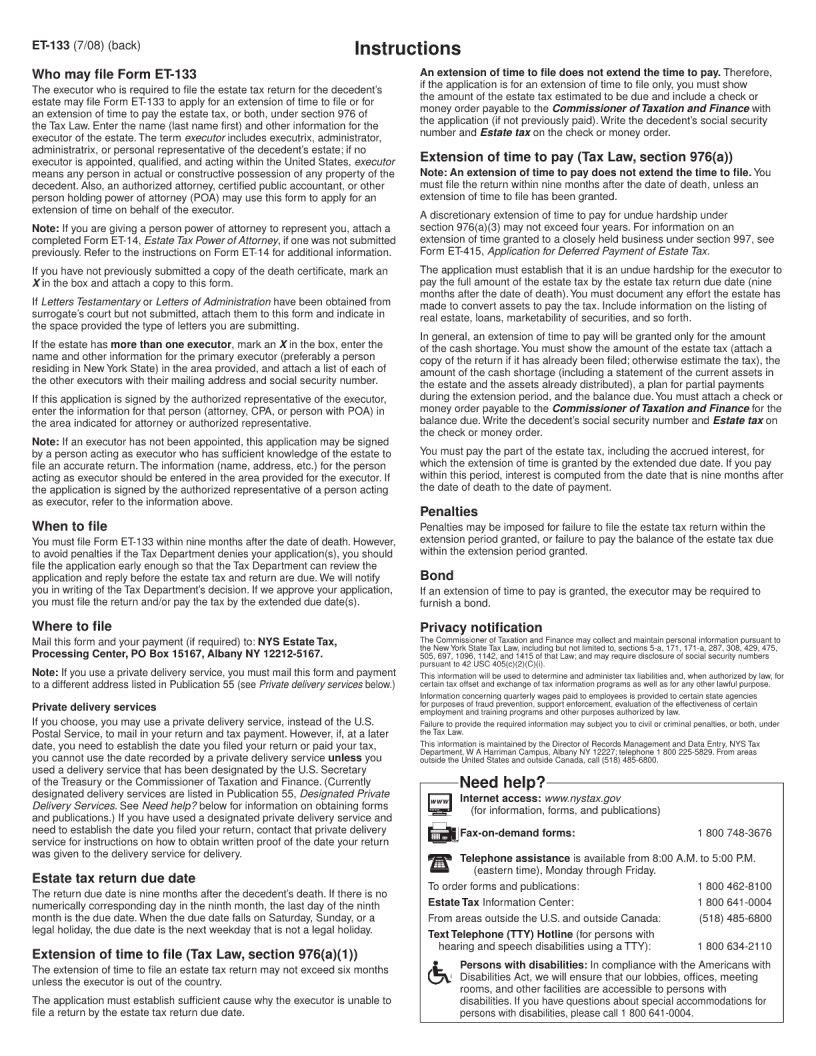

In the complex landscape of estate administration in New York, the role of the New York ET-133 form is pivotal. This document, instrumental for executors and administrators, serves as a request for the release of a lien on a decedent's New York State real property imposed due to unpaid estate taxes. Its completion is a critical step in ensuring the smooth transfer of real estate assets from the estate to the beneficiaries. Beyond just a mere formality, the ET-133 encapsulates the intersection of tax obligations and property rights, embodying the meticulous balance between the state's interest in securing tax revenues and the individual's right to transfer property according to the decedent's wishes. As executors navigate through the probate process, the intricacies embodied in the ET-133 demand a nuanced understanding of both estate law and tax implications. This document does not operate in isolation; it's part of a broader procedural tapestry, with its timely and accurate submission often marking the difference between the seamless fulfillment of a decedent's final wishes and potential legal entanglements that can delay or disrupt estate settlements.

| Question | Answer |

|---|---|

| Form Name | New York Form Et 133 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | administratrix, et 133 fillable form, FormET-14, CPA |