Using PDF documents online is always a piece of cake with our PDF editor. You can fill in New York Form It 200 here painlessly. To maintain our tool on the cutting edge of efficiency, we aim to adopt user-driven capabilities and enhancements regularly. We are always happy to get feedback - help us with remolding PDF editing. To get the process started, take these easy steps:

Step 1: First, access the editor by clicking the "Get Form Button" at the top of this page.

Step 2: This tool will allow you to customize PDF files in a variety of ways. Change it by writing personalized text, adjust what's already in the file, and add a signature - all within the reach of a few mouse clicks!

This document will need specific details; to ensure correctness, take the time to heed the tips further on:

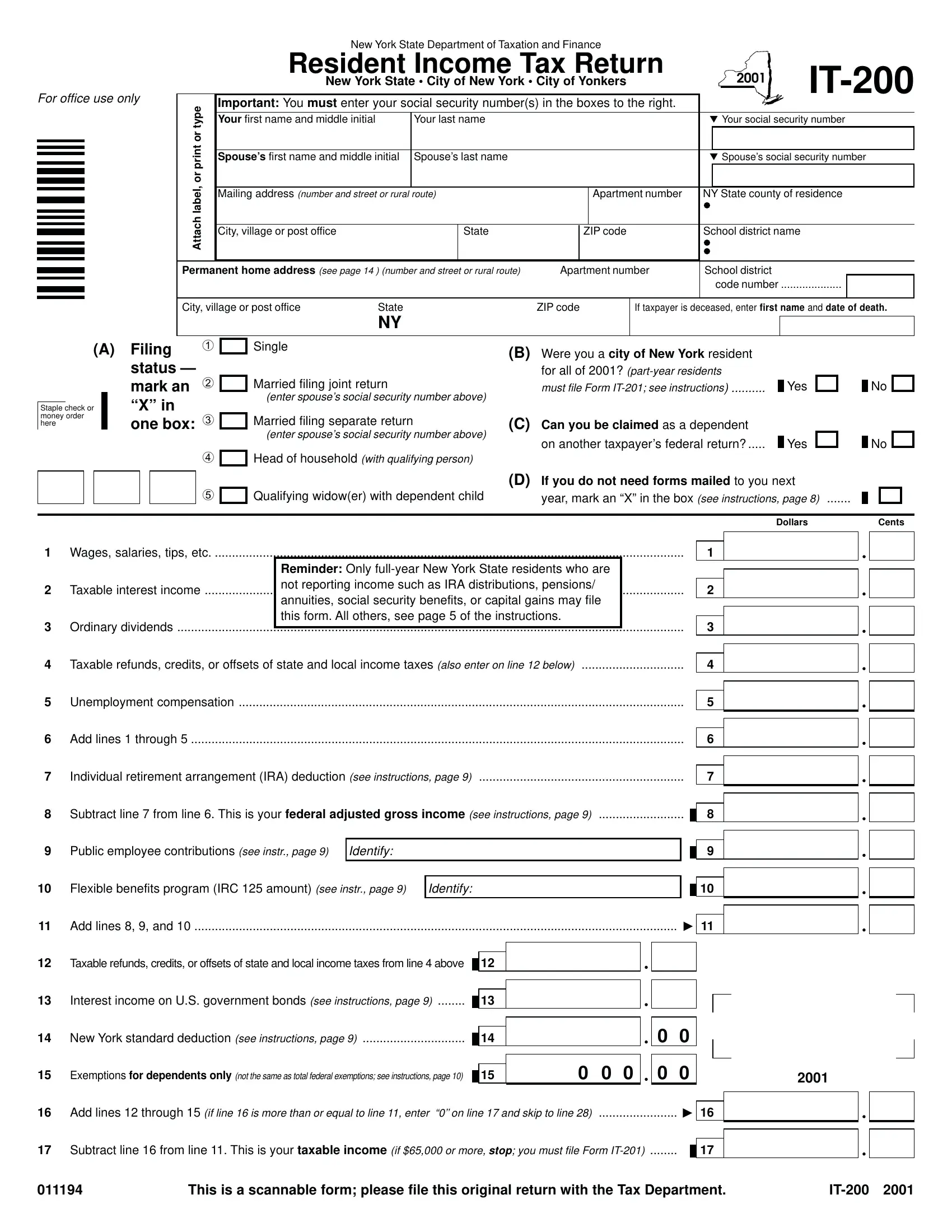

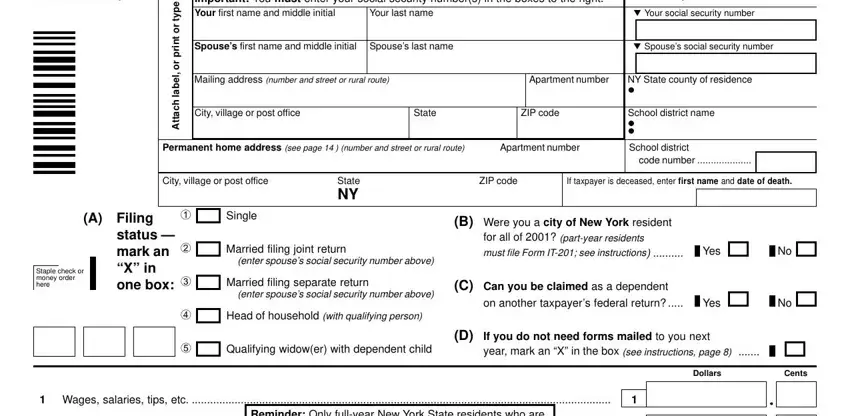

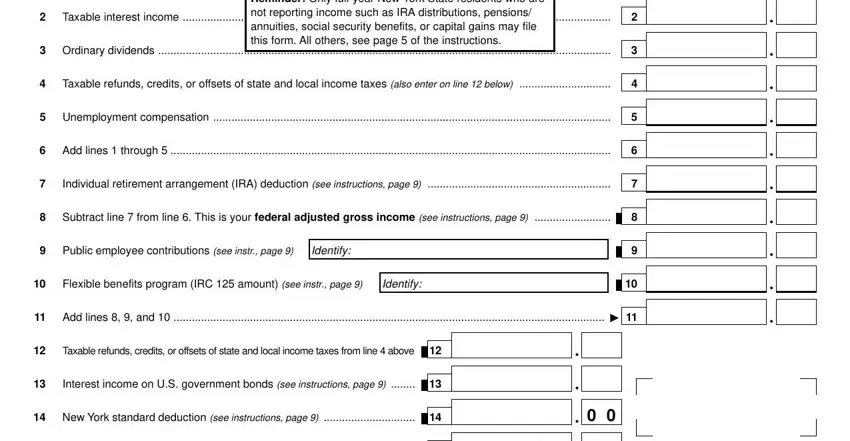

1. To get started, once completing the New York Form It 200, beging with the page that has the subsequent blanks:

2. The subsequent part is usually to submit the next few blanks: Taxable interest income, Reminder Only fullyear New York, Ordinary dividends, Taxable refunds credits or offsets, Unemployment compensation, Add lines through, Individual retirement arrangement, Subtract line from line This is, Public employee contributions see, Identify, Flexible benefits program IRC, Identify, Add lines and, Taxable refunds credits or offsets, and Interest income on US government.

Always be very attentive while filling out Add lines through and Unemployment compensation, since this is where many people make errors.

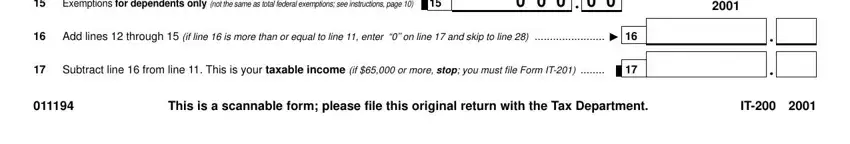

3. The following portion is focused on Exemptions for dependents only not, Add lines through if line is, Subtract line from line This is, and This is a scannable form please - fill out these blanks.

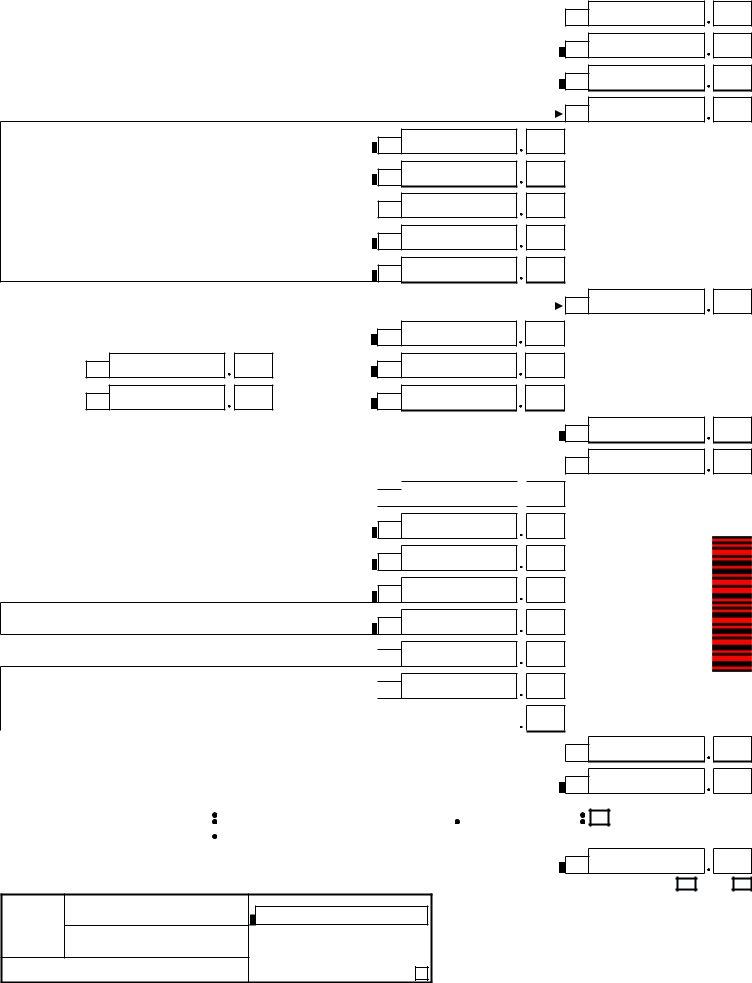

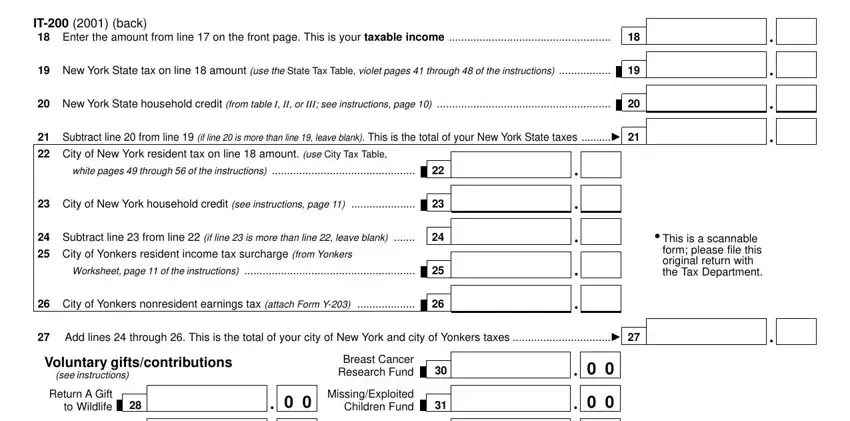

4. To move onward, this fourth form section involves filling in a few fields. Examples of these are IT back Enter the amount from, New York State tax on line, New York State household credit, Subtract line from line if line, City of New York resident tax on, white pages through of the, City of New York household credit, Subtract line from line if line, City of Yonkers resident income, Worksheet page of the, City of Yonkers nonresident, cid This is a scannable form, Add lines through This is the, Voluntary giftscontributions, and see instructions, which you'll find fundamental to continuing with this particular form.

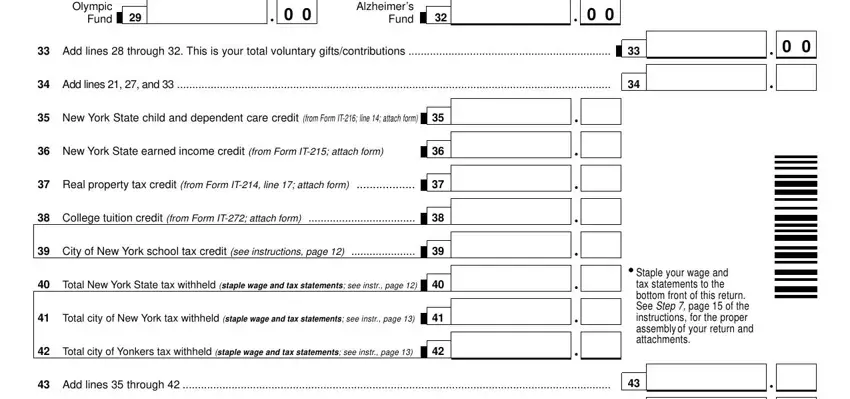

5. This last section to complete this PDF form is essential. Ensure that you fill out the required fields, including Olympic Fund, Alzheimers Fund, Add lines through This is your, Add lines and, New York State child and, New York State earned income, Real property tax credit from, College tuition credit from Form, City of New York school tax, Total New York State tax withheld, Total city of New York tax, Total city of Yonkers tax, Add lines through, and cid Staple your wage and tax, prior to using the document. Neglecting to do this might end up in an incomplete and probably nonvalid paper!

Step 3: Before addressing the next stage, make certain that blanks were filled out the right way. When you are satisfied with it, click “Done." After creating a7-day free trial account at FormsPal, you will be able to download New York Form It 200 or send it via email immediately. The document will also be easily accessible through your personal cabinet with your each and every edit. With FormsPal, you can fill out forms without needing to be concerned about personal information breaches or data entries getting shared. Our secure platform makes sure that your private data is kept safely.